The XRP ETFs have now officially recovered the $40 million worth of capital outflow they recorded earlier this year.

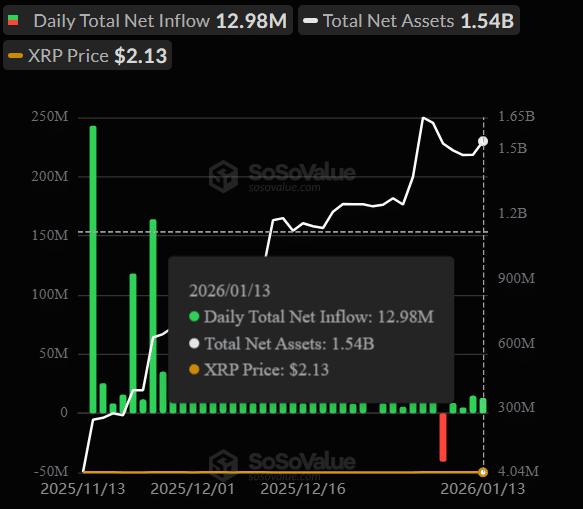

This comes on the back of the latest inflow data, as the products attracted $12.98 million worth of capital influx on Jan. 13, according to data provided by market analytics resource Sosovalue. From here, the XRP ETFs are now on track to augment their cumulative inflow after rebounding from the setback.

For context, following an impressive start, which saw the XRP ETFs record 35 trading days of consecutive inflows, the highest for any crypto-related ETF, the products witnessed their first outflow on Jan. 7, 2026, with $40.8 million worth of capital exit. However, after four trading days, the ETFs have now recovered this lost capital.

Key Data Points

- The first XRP ETF, a product from Canary Capital, launched on Nov. 13, 2025, and brought in $245 million on its debut.

- This product continued to see inflows until ETFs from Bitwise, Grayscale, Franklin Templeton, and 21Shares emerged, also in late 2024.

- All five ETFs crossed the $1 billion cumulative inflow milestone on Dec. 15, after 21 days of consistent inflows.

- The funds ended 2025 with a $5.58 million inflow on Dec. 31, boasting $1.17 billion in cumulative netflows at the time and maintaining its positive flow streak.

- This positive momentum spilled into the new year, as the ETFs recorded inflows worth $13.59 million, $46.1 million, and $19.12 million in the first three trading days.

XRP ETFs Recoup Lost Capital

However, following the impressive run of form during their first trading days this year, the XRP ETFs recorded their first outflow on Jan. 7, worth $40.8 million.

Interestingly, while some suggested that the Jan. 7 figure would mark the first of multiple outflows to come in the following days, the ETFs quickly flipped the trend, resuming their positive momentum from Jan. 8. With the latest inflow, they have now recorded four consecutive days of capital influx since the Jan. 7 outflow.

Notably, the XRP ETFs saw $12.98 million worth of inflow on Jan. 13. This brought the cumulative inflows since Jan. 8 to $41.67 million, allowing the products to recover the $40.8 million outflow. As a result, their total inflow since launch now stands at $1.25 billion.

How Do XRP ETFs Compare to Other Crypto ETFs?

With $1.25 billion in total cumulative netflows, XRP ETFs rank third among the largest ETFs by inflows, only behind Bitcoin (BTC) and Ethereum (ETH). For context, Bitcoin ETFs, which launched in January 2024, boast cumulative inflows worth $57.27 billion. Meanwhile, ETH ETFs, launched in July 2024, have recorded $12.57 billion in inflows.

Despite Solana ETFs launching more than two weeks before their XRP counterparts, they have not yet crossed the $1 billion inflow milestone, with netflows now sitting at $833.51 million. Notably, Solana ETFs have only witnessed three days of capital outflows.

Meanwhile, ETFs linked to other crypto assets besides BTC, ETH, XRP, and SOL have all seen negligible figures. Specifically, DOGE ETFs have recorded $6.58 million worth of inflows since November 2025. Chainlink ETFs hold a record of $63.78 million in netflows, while the Litecoin product from Canary Capital has only witnessed $8.07 million.

DisClamier: This content is informational and should not be considered financial advice. The views expressed in this article may include the author's personal opinions and do not reflect The Crypto Basic opinion. Readers are encouraged to do thorough research before making any investment decisions. The Crypto Basic is not responsible for any financial losses.