Key Insights

- Crypto ETFs are struggling. Spot XRP ETFs launched in late 2025. They have already attracted $1.22 billion in cumulative net inflows.

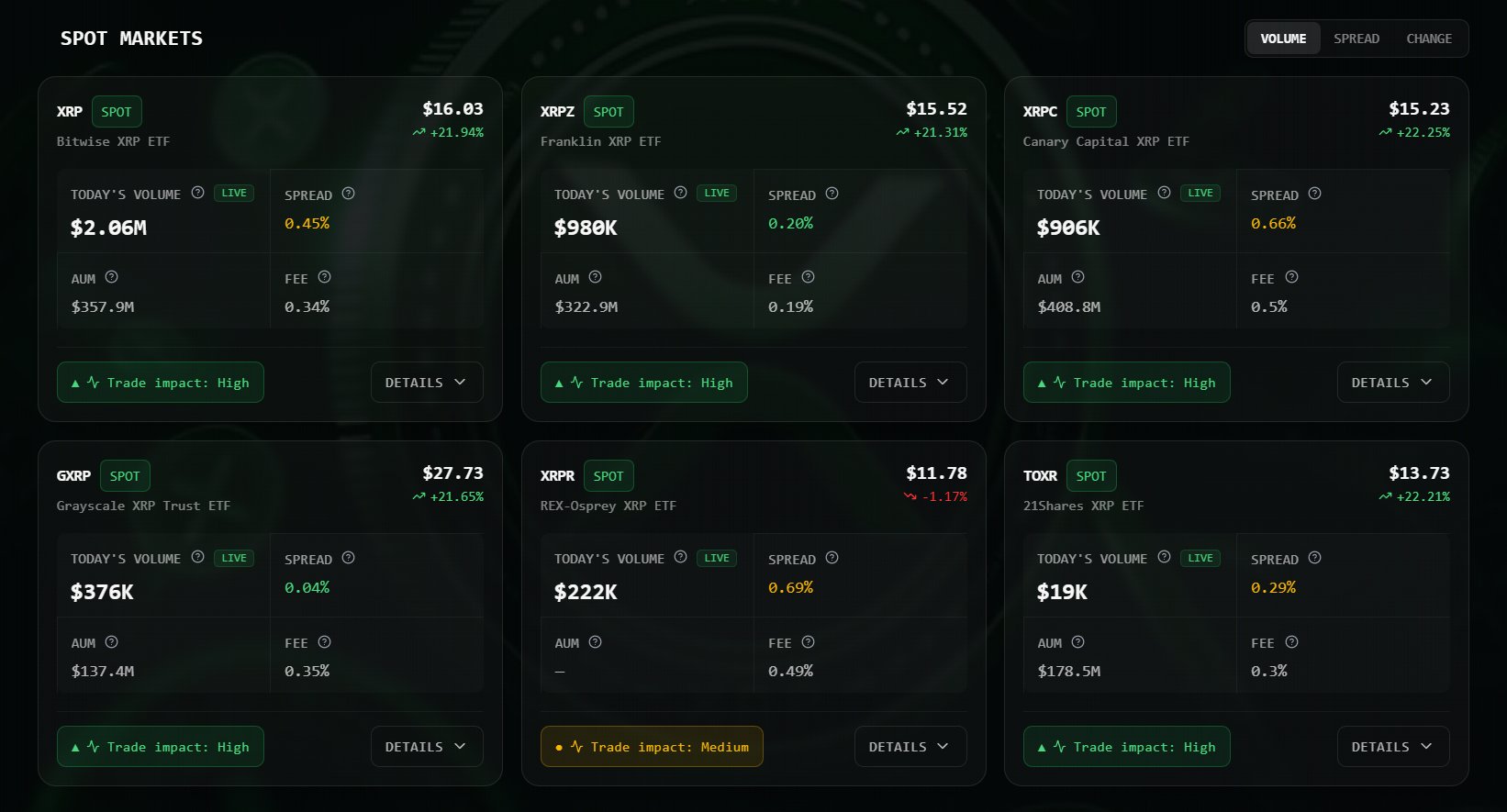

- After the first 30 minutes, the volume of the XRP ETFs reached about $5 million. Bitwise XRP already saw a single-minute spike worth around $1,921,850.

- The price of these XRP ETFs closed at 21% gains, but the price of XRP crypto was down 3%. As attention in XRP rises, will the price of the crypto also start recovering?

The crypto ETFs market continues to trend but not for the good reasons. Most of these products have been in a downward spiral the same way as their underlying native tokens. However, Ripple’s XRP ETFs have been an exception in this struggle.

Hence, we will discuss the specifics of this outperformance by XRP ETFs. Also, a look into why the price of XRP crypto is not following the same trend.

Crypto ETFs: XRP ETF Inflows Since Launch and Volume

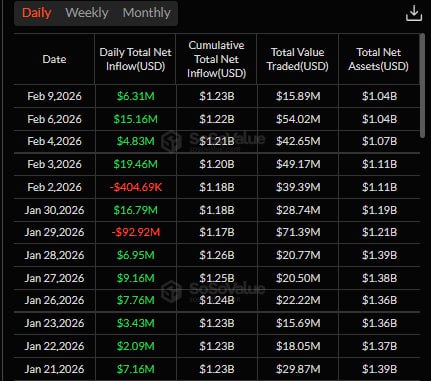

According to SoSoValue data, Spot XRP ETFs, launched in late 2025, now have a total of $1.23 billion in net inflows. This was a big increase compared to what was happening in the crypto world.

Since launch, most days its daily inflows have been positive. On February 9, XRP brought in $6.31 million, while on February 6 made $5.16 million.

February 4th brought in $4.83 million, enforcing the continuous net inflows. There were only a few dips, like the one on January 29 that lost $92.92 million.

These inflows have not gone unnoticed. Institutions continue to explore the future of XRP’s ETF and ETP products. Grayscale, Bitwise, and Bitnomial held a meeting to discuss the way forward for these products.

Volume has also been key in these products. The volume shot up when the day’s trading opened. In the first half hour, the total hit $5 million. Bitwise XRP went up $1.92 million in just one minute.

At the same time, other crypto ETFs were losing money every week. But last week alone, XRP ETFs brought in $39 million. This strength showed that there was a clear demand.

Other Crypto ETFs Lag Behind XRP ETFs

While XRP ETFs were doing well, other crypto ETFs have had a hard time. In one recent session, Bitcoin ETFs lost $272 million, and last week they lost $689 million. Ethereum did the same thing, losing $149 million.

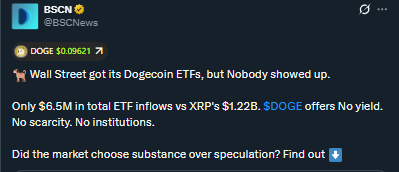

The situation was worse for Dogecoin ETFs, which didn’t move much. Since they started, they have only brought in $6.5 million. And in total, Dogecoin ETFs hold less than $9 million in capital. This was an indication of real struggle.

Solana ETFs made only $2.94 million a week. But last week alone, XRP made $39 million. This was more than 10x less than that of XRP. It’s easy to see this difference. Money was moving to XRP while other coins lost value.

Comparison of Market Performance: XRP ETF vs. XRP Crypto Prices

The charts were, however, different. XRP ETFs ended the day up 21%. The value of XRP crypto dropped by 3%. This gap is very noticeable. This meant that ETFs were attracting more money than the native cryptocurrency.

ETF demand remained strong, but crypto faced selling pressure. Hope was growing the same way as interest. The momentum of ETFs may help the recovery, but it is not guaranteed.

However, the weakness could last if crypto continues to lose capital. It was still possible to keep selling, as the top 100 coins were, on average, in the bear market zone. Both results were real. Getting better or getting worse was the market’s choice.

The post Crypto ETFs: How XRP ETF Inflows Are Outperforming The Market appeared first on The Market Periodical.