XRP ETFs extend the current inflow streak with $10.63 million in daily net flow, as their total traded value reaches a five-day high.

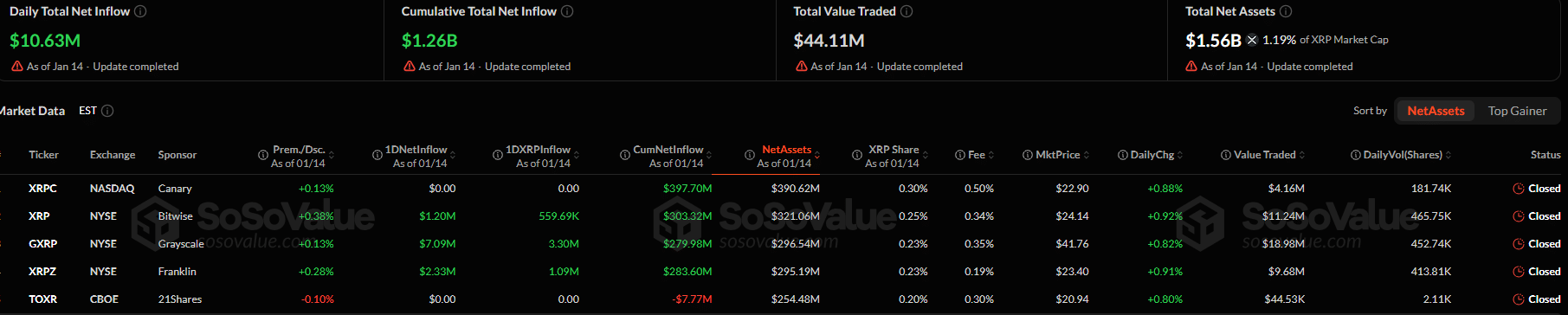

Specifically, data from SosoValue shows that the five US XRP spot ETFs recorded a daily trading volume of $44.11 million on January 14. Notably, this was the highest level of market participation in the last five market days. Such volume was last seen on January 6, when the funds brought in $19.12 million.

The increasing volume matters, as it shows strong interest among institutional and retail investors. As volume grows, liquidity rises too.

Key Data Points

- Data from SosoValue shows that the five US XRP spot ETFs recorded a daily trading volume of $44.11 million on January 14, the highest in the past five trading days.

- The US investment vehicle attracted a net inflow of $10.63 million on Wednesday and is currently on a five-day streak of inflows.

- The Grayscale XRP Trust ETF (GXRP) led the inflows, pulling in $7.09 million.

- The XRP spot ETFs’ cumulative total net inflows stand at $1.2 billion, and the total net assets at $1.56 billion.

- As ETF inflows increase, XRP becomes scarcer in the open market.

XRP ETFs Extend Inflow Streak to Five Days

The notable volume spike ticked in favor of accumulation rather than distribution, as market users bought more XRP ETFs than they sold on Wednesday. Data shows the investment vehicles attracted a net inflow of $10.63 million.

Leading these inflows was the Grayscale XRP Trust ETF (GXRP). The fund brought in $7.09 million yesterday, translating to an accumulation of 3.3 million XRP tokens.

Two other ETFs, the Franklin XRP ETF (XRPZ) and the Bitwise XRP ETF (XRP), recorded net inflows of $7.09 million and $1.20 million, respectively. This resulted in the funds purchasing 1.09 million XRP and 559,690 XRP, respectively. Canary XRP ETF and 21Shares XRP ETF saw zero flows.

The Wednesday inflows extended the funds’ daily net inflow streak to five days, attracting $52.3 million in the process. Their cumulative total net inflows stand at $1.2 billion, and the total net assets at $1.56 billion.

Market Implications for XRP

Remarkably, inflows into an ETF show strong traction for its underlying asset. Here, it suggests that XRP is an asset of interest to investors looking to meddle with cryptocurrencies.

Remarkably, these funds actually hold XRP, implying that they are consistently accumulating the token, impacting supply. Currently, they hold 1.19% of XRP’s market cap, adding pressure to the asset’s supply. If this trend persists, then XRP may eventually react to the tightening supply.

Important Caveat

However, while these inflows have shown consistency, there is no guarantee that this trend will persist. As a result, the concept of supply shock as demand increases remains speculative.

Moreover, inflows into ETFs do not directly imply a price increase. Unless the conditions that drive price increase, which are demand outpacing supply, are met, these inflows would not impact the price of XRP.

Also, XRP has barely reacted to these inflows, falling short of the price surge several enthusiasts predicted would occur once ETFs debut. There are no guarantees this will change soon, either.

DisClamier: This content is informational and should not be considered financial advice. The views expressed in this article may include the author's personal opinions and do not reflect The Crypto Basic opinion. Readers are encouraged to do thorough research before making any investment decisions. The Crypto Basic is not responsible for any financial losses.