Original Title: Digital Asset OTC Market 2025

Original Source: Wintermute

Translated from Chinese (Simplified) to English (US): Azuma, Odaily Planet Daily

Editor's Note: On January 13, Wintermute released its analysis report on the 2025 cryptocurrency over-the-counter (OTC) market. As one of the leading market makers in the industry, Wintermute is undoubtedly highly sensitive to market liquidity trends. In this 28-page report, the firm reviews the changes in liquidity in the cryptocurrency market in 2025 and draws conclusions accordingly.The market is shifting from clear, narrative-driven cyclical fluctuations toward a mechanism characterized by stronger structural constraints and execution-driven dynamics.Based on this conclusion, Wintermute has also outlined three key scenarios that the market must go through to achieve a recovery by 2026.

The following is the original report from Wintermute, compiled and translated by Odaily Planet Daily (with some content omitted).

Report Abstract

2025 marks a fundamental shift in the liquidity mechanisms of the cryptocurrency market.Capital is no longer widely dispersed across the market; liquidity has become more concentrated and unevenly distributed, leading to increased divergence in returns and market activities.As a result, a large trading volume is concentrated in a few tokens.The duration of market upswings is shorter, and price performance is more dependent on the channels and methods through which liquidity enters the market, compared to previous years.

The following report summarizes the key changes in liquidity and trading dynamics observed by Wintermute in 2025:

· Trading activities are concentrated in a few large tokens.BTC, ETH, and some selected altcoins accounted for the majority of trading activity. This reflects the gradual expansion of ETFs and Digital Asset Treasury (DAT) products into a broader range of altcoins, as well as the waning of the Meme coin cycle by early 2025.

· The fading speed of narrative beliefs has accelerated, and the exhaustion speed of altcoin market conditions has doubled.Investors no longer consistently follow narratives with sustained conviction, instead engaging in opportunistic trading around themes such as meme coin launch platforms, perpetual contract trading platforms, emerging payment systems, and API infrastructure (e.g., x402), with limited follow-through.

As the influence of professional counterparties increases, trade execution tends to become more cautious.This is specifically manifested in more cautious cyclical trade execution (breaking away from the previous fixed four-year cycle), broader use of leveraged over-the-counter products, and diversified applications of options as a core asset allocation tool.

How capital enters the crypto market is as important as the overall liquidity environment.Capital is increasingly flowing into the market through structured channels such as ETFs and DATs, influencing the direction and final concentration of liquidity within the market.

This report primarily interprets the aforementioned market developments based on Wintermute's proprietary over-the-counter (OTC) data. As one of the largest OTC trading platforms in the industry, Wintermute provides liquidity services across regions, products, and diverse counterparties, enabling a unique and comprehensive view of off-chain crypto OTC activity. While price trends reflect market outcomes, OTC activity reveals how risk is deployed, how participant behaviors evolve, and which market segments remain active. From this perspective, the market structure and liquidity dynamics in 2025 have undergone significant changes compared to earlier cycles.

Part 1: Spot

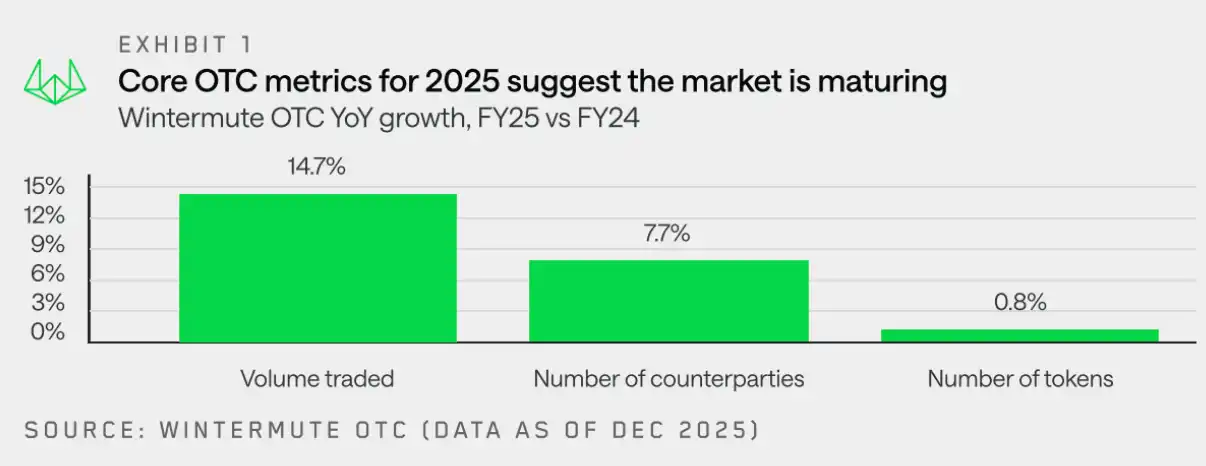

Wintermute's OTC data shows that,Trading activities in 2025 have shifted from being purely volume-driven to a more mature and strategic trading environment.Trading volume continues to grow, but trade execution is becoming more planned. Off-exchange trading is increasingly favored for its capacity to handle large orders, privacy, and controllability.

The deployment of market positions has also evolved from simple directional trading to more customized execution strategies and a broader use of derivatives and structured products. This indicates that market participants are becoming more experienced and disciplined.

In Wintermute's spot over-the-counter (OTC) activities, the aforementioned structural transformation is mainly reflected in the following three aspects:

· Trading Volume Growth:The continued growth in off-exchange trading volume highlights the market's enduring demand for efficient execution of large orders and access to off-chain liquidity, while simultaneously limiting market impact.

· Counterparty Growth:The scope of participants has further expanded, driven by factors such as venture capital funds shifting from purely private allocations to liquid markets; corporations and institutions executing block trades through over-the-counter channels; and individual investors seeking alternatives to traditional venues beyond centralized and decentralized trading platforms.

· Token Landscape:The overall token activity has surpassed BTC and ETH, with capital flowing into a broader range of altcoins through DAT and ETF. Nevertheless, position data throughout the year indicates that after the major liquidation event on October 11, 2025, both institutional and retail investors shifted back to major tokens. Altcoin rallies have become shorter in duration and more selective, reflecting the fading of the Meme coin cycle and an overall contraction in market breadth as liquidity and risk capital have become more selective.

Next, Wintermute will provide a more detailed analysis of these three aspects.

Volume Growth: Cyclical Patterns Replaced by Short-Term Volatility

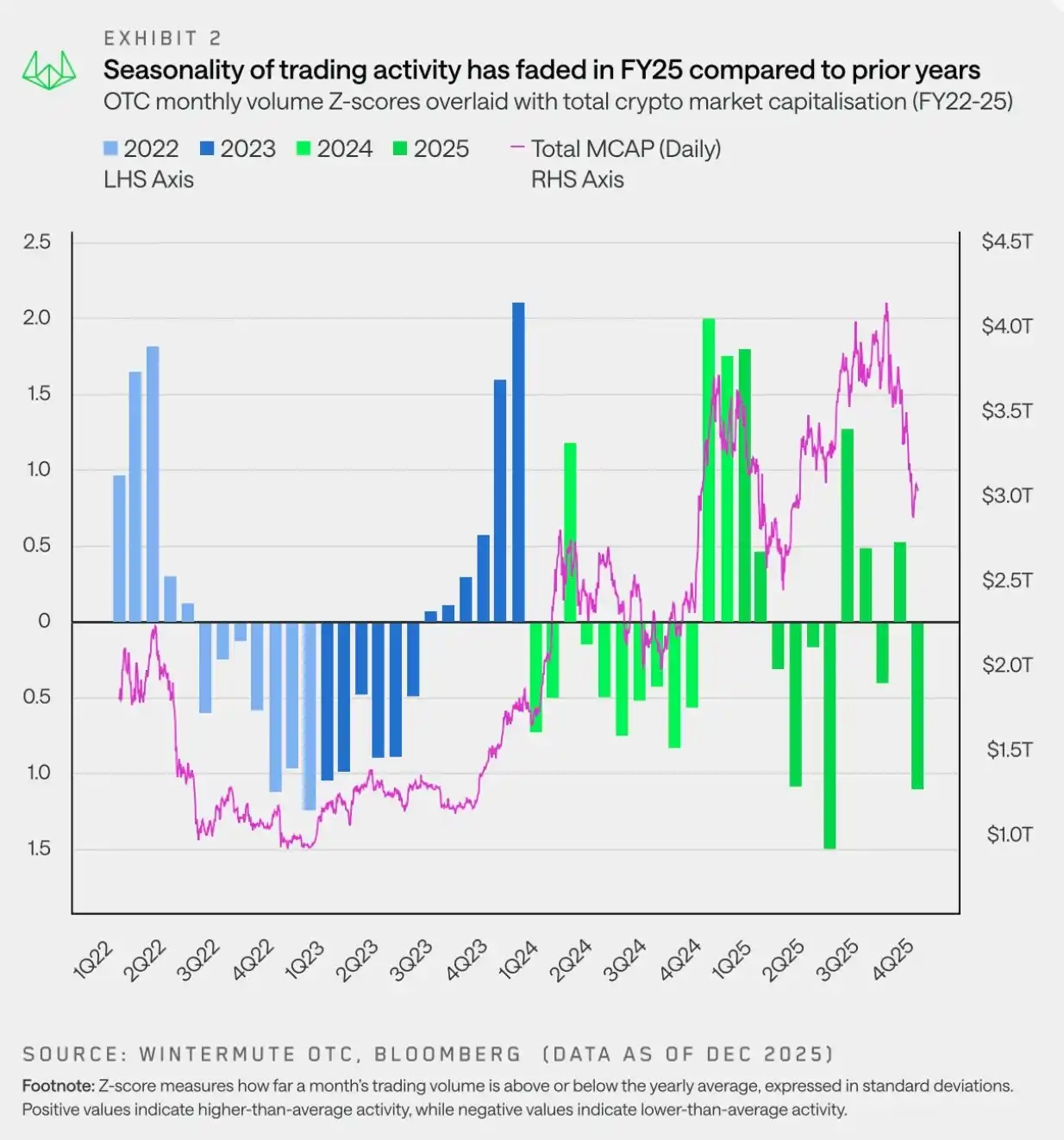

"The 2025 market is characterized by volatile movements, with price fluctuations primarily driven by short-term trends rather than longer-term seasonal changes."

Wintermute's over-the-counter (OTC) data shows that trading activity in 2025 has exhibited a notably different seasonal pattern, significantly diverging from previous years. Market optimism toward the newly appointed U.S. pro-cryptocurrency administration quickly faded, and risk sentiment deteriorated sharply by the end of the first quarter as Meme coins and AI Agent narratives cooled down toward the end of the quarter. On April 2, 2025, further downward pressure on the market was exerted by top-down negative news, such as Trump's announcement of increased tariffs.

As a result, market activity in 2025 will be concentrated in the first half of the year, with a strong start at the beginning of the year followed by a broad weakening during spring and early summer. The year-end rebounds seen in 2023 and 2024 did not reoccur, breaking what had previously appeared to be an established seasonal pattern—often reinforced by narratives such as the "October Rally." In fact, this was never a true seasonal pattern, but rather a year-end rally driven by specific catalysts, such as the ETF approvals in 2023 and the formation of the new U.S. government in 2024.

After entering the first quarter of 2025, the upward momentum from the fourth quarter of 2024 failed to fully recover. Market fluctuations intensified, with increased volatility. As macroeconomic factors dominated market direction, price movements became more characterized by short-term swings rather than sustained trends.

In short, the flow of capital has become passive and intermittent, with pulse-like fluctuations around macroeconomic headlines but without showing any sustained momentum. In this volatile environment,Despite thinner market liquidity and the increasing importance of execution certainty, over-the-counter trading continues to maintain its position as the preferred execution method.

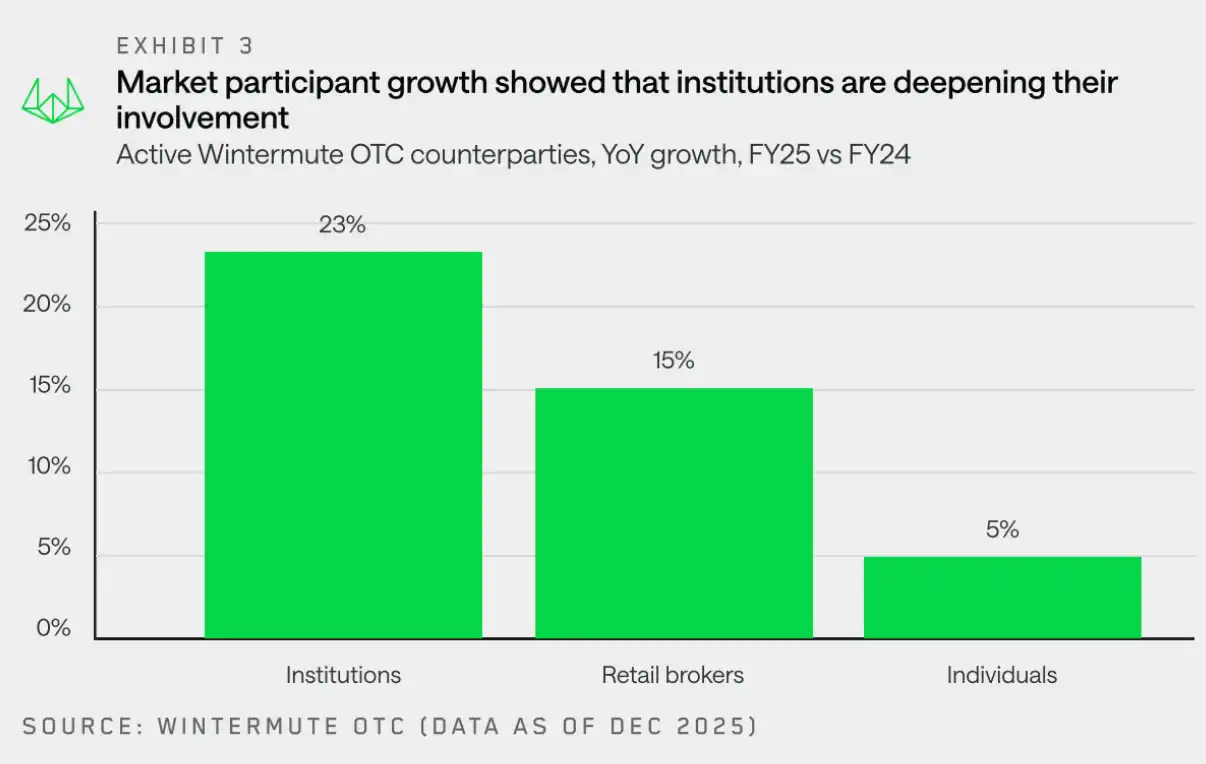

Counterparty: Institutional Foundations Becoming Increasingly Solid

"Although the price trend for 2025 has been flat, institutional counterparties have already taken root here."

Wintermute observed strong growth across most counterparty types, with the most significant increases coming from institutional and retail brokers. Within the institutional category, while the growth of traditional financial institutions and enterprises remained moderate, their engagement deepened significantly—activities became more consistent, and there was an increasing focus on prudent execution strategies.

Although the market performance in 2025 has been lackluster, institutions have clearly established a presence. Compared to last year's more tentative and fragmented participation,The year 2025 is characterized by deeper integration, higher trading volumes, and more frequent activities. These factors all provide constructive and positive signals for the long-term future of the industry.

Token Landscape: The Top Markets Are Becoming Increasingly Diversified

"Trading volume is increasingly flowing into large tokens beyond BTC and ETH, a trend driven jointly by DAT and ETF."

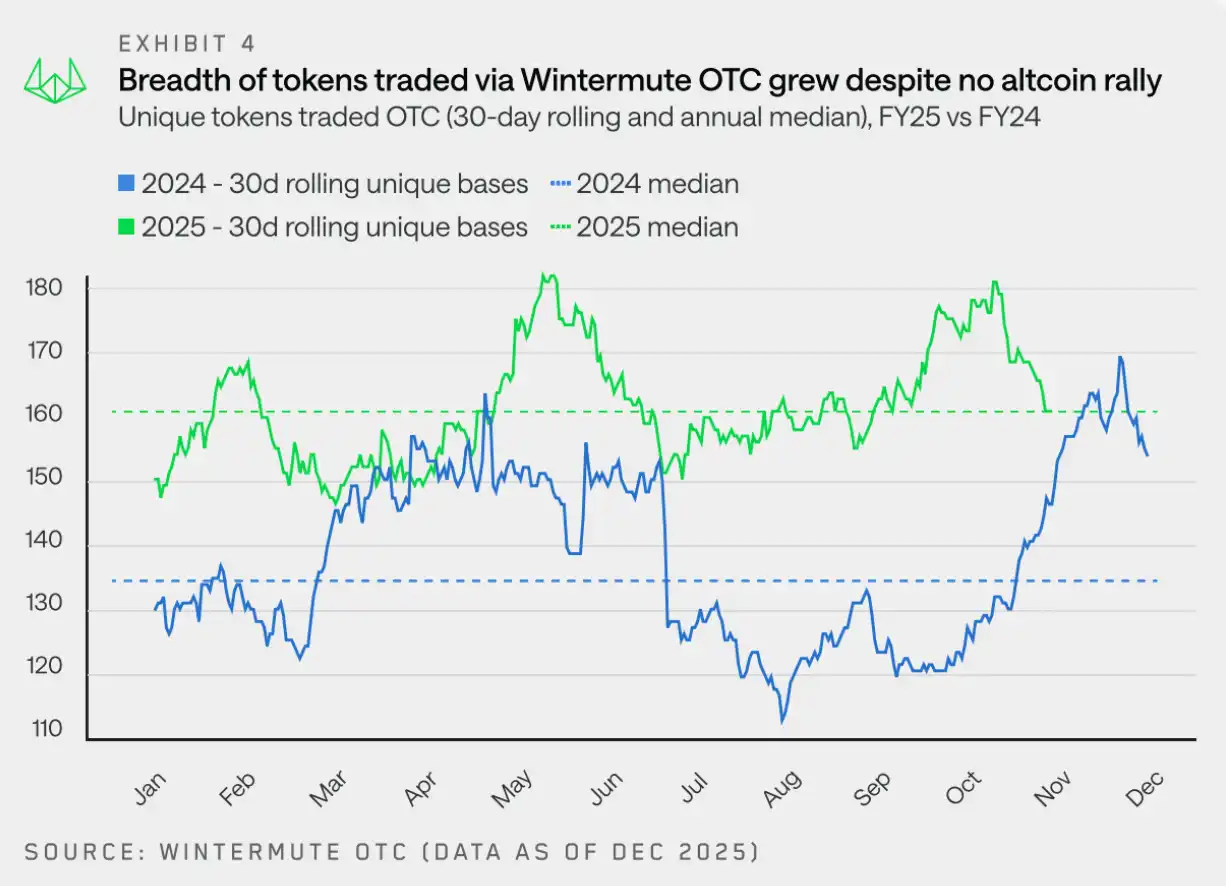

In 2025, the total number of tokens traded remained generally stable. However, based on 30-day rolling data, Wintermute traded an average of 160 different tokens, up from 133 in 2024. This indicates that over-the-counter trading activities have expanded into a broader and more stable range of tokens.

The key difference from 2024 is:The hype cycle driving token activity in the 2020s has weakened— the breadth of token trading has remained relatively stable throughout the year, rather than experiencing sharp surges in token diversity around specific themes or narratives.

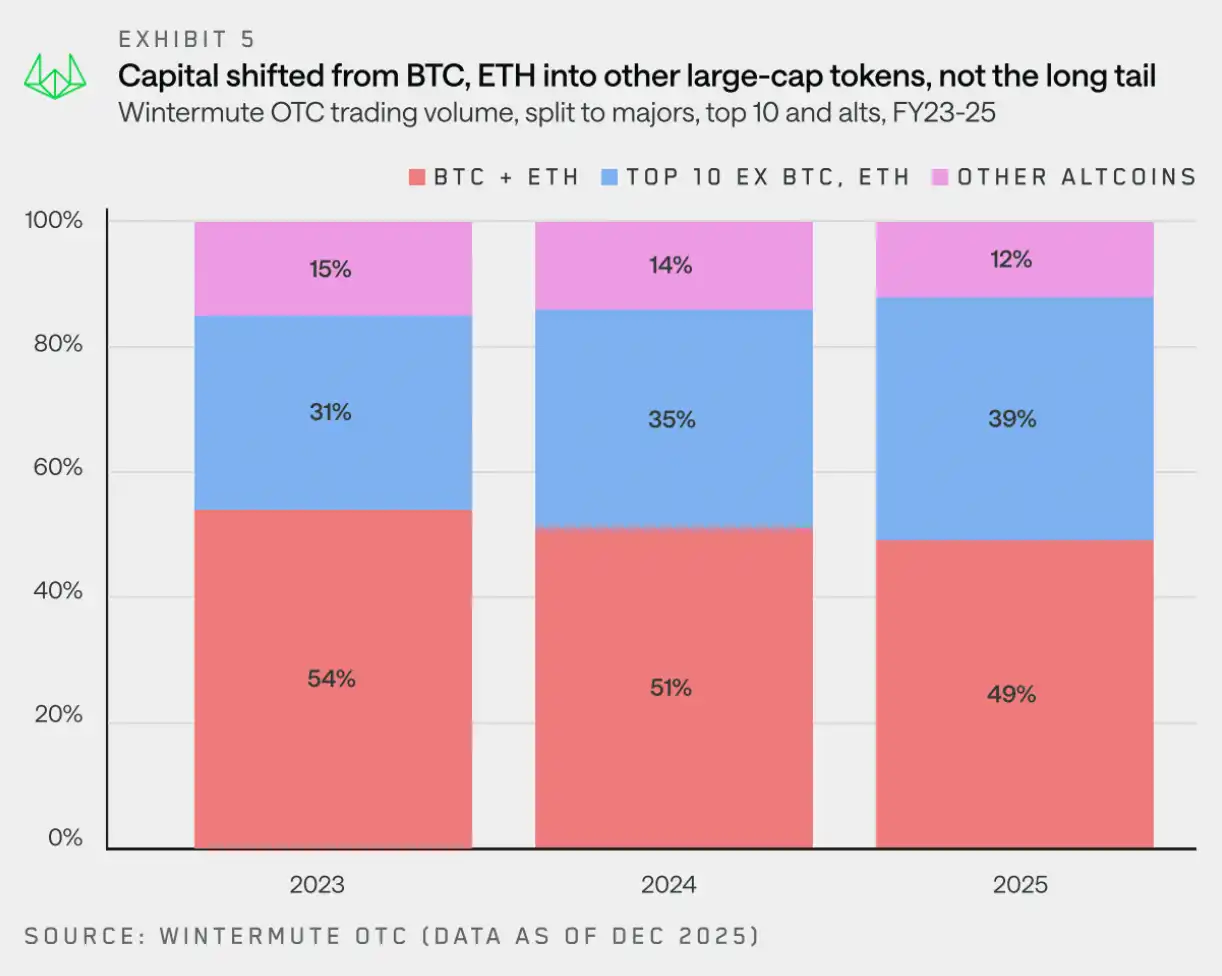

Since 2023, Wintermute's total notional trading volume has become increasingly diversified, with trading volume from other asset categories surpassing the combined trading volume of BTC and ETH. Although BTC and ETH remain significant components of the trading flow, their combined share of total trading volume has decreased from 54% in 2023 to 49% in 2025.

It is worth noting where these funds have flowed—Although long-tail tokens continue to see a decline in their share of trading volume, blue-chip assets (the top 10 assets by market capitalization, excluding BTC, ETH, wrapped assets, and stablecoins) have increased their share of total nominal trading volume by 8 percentage points over the past two years.

Although some funds and individuals have concentrated their investments in large-cap tokens this year, the growth in trading volume has also been driven by ETFs and DATs expanding their investment scope beyond mainstream assets. DATs have been granted authorization to invest in these assets, while ETFs are also broadening their investment range, including the launch of staking ETFs (such as for SOL) and index funds.

These investment instruments continue to favor over-the-counter (OTC) trading rather than exchange trading, especially when the required liquidity is not available on exchanges.

Spot Funding Flow Analysis for Various Types of Tokens

Mainstream coins: Capital is gradually flowing back at the end of the year.

"By the end of 2025, both institutional and retail investors will be reallocating back into major cryptocurrencies, indicating that they all expect major coins to rebound before altcoins recover."

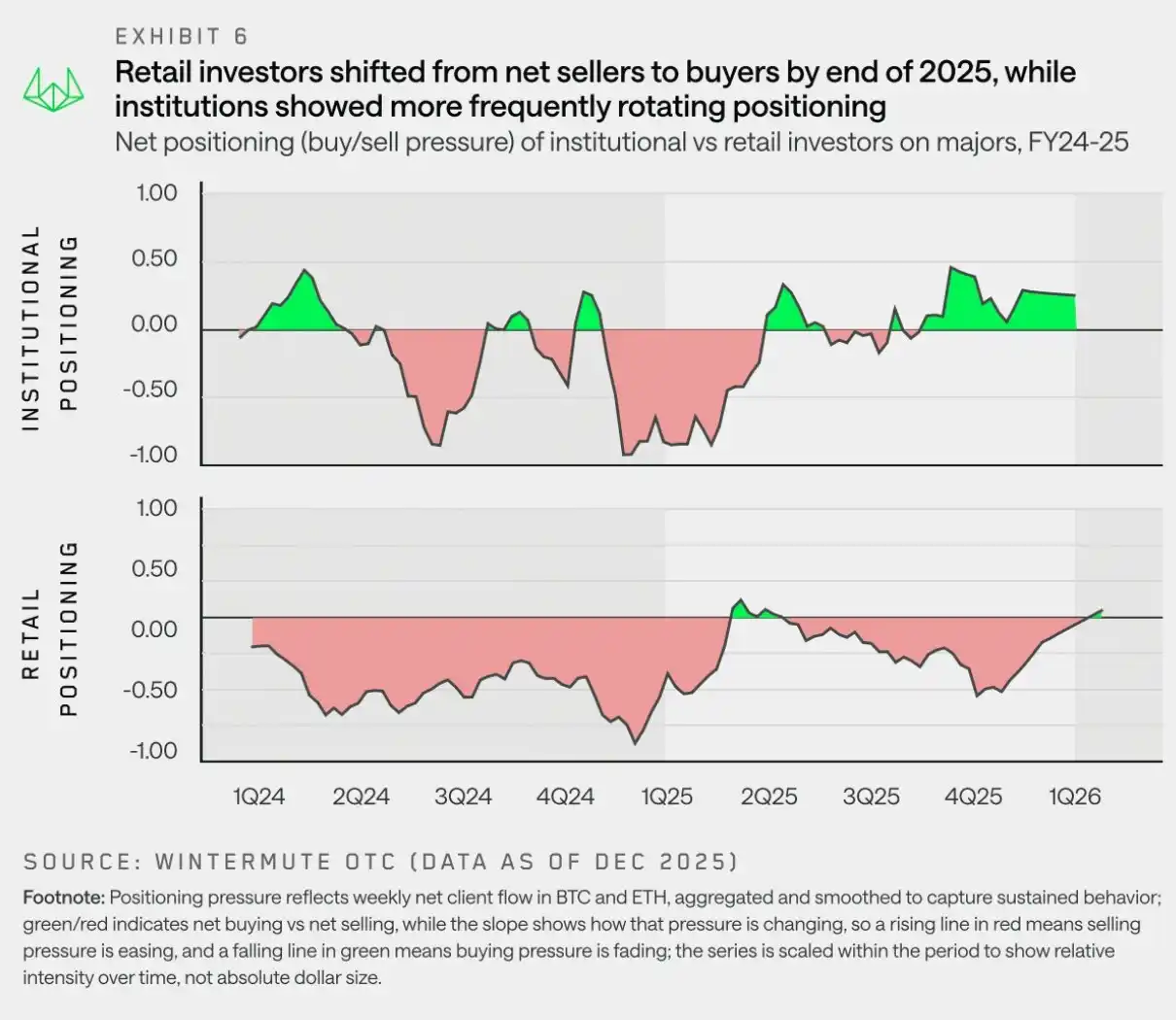

As the narrative around altcoins gradually fades and macroeconomic uncertainties resurface in early 2025, capital allocation is shifting back to BTC and ETH.Wintermute's OTC liquidity data shows that institutional investors have consistently maintained an overweight position in major cryptocurrencies since Q2 2025. However, retail investors shifted toward altcoins in Q2 and Q3 of 2025, hoping for a market rebound in altcoins. Yet, after the deleveraging event on October 11, they quickly returned to major cryptocurrencies.

The trend of capital shifting toward major cryptocurrencies is driven by a weak market, as the so-called "altcoin season" has yet to truly kick off, gradually leading the market into a state of disappointment. This trend was initially led by institutions (which have long been net buyers of major cryptocurrencies), but by the end of the year, retail investors also became net buyers.

This position layout is consistent with the prevailing market view at present:BTC (and ETH) need to lead the market first before risk appetite returns to altcoins. Retail investors now seem to increasingly agree with this view.

Altcoins: Bullish Trends Becoming Shorter-Lived

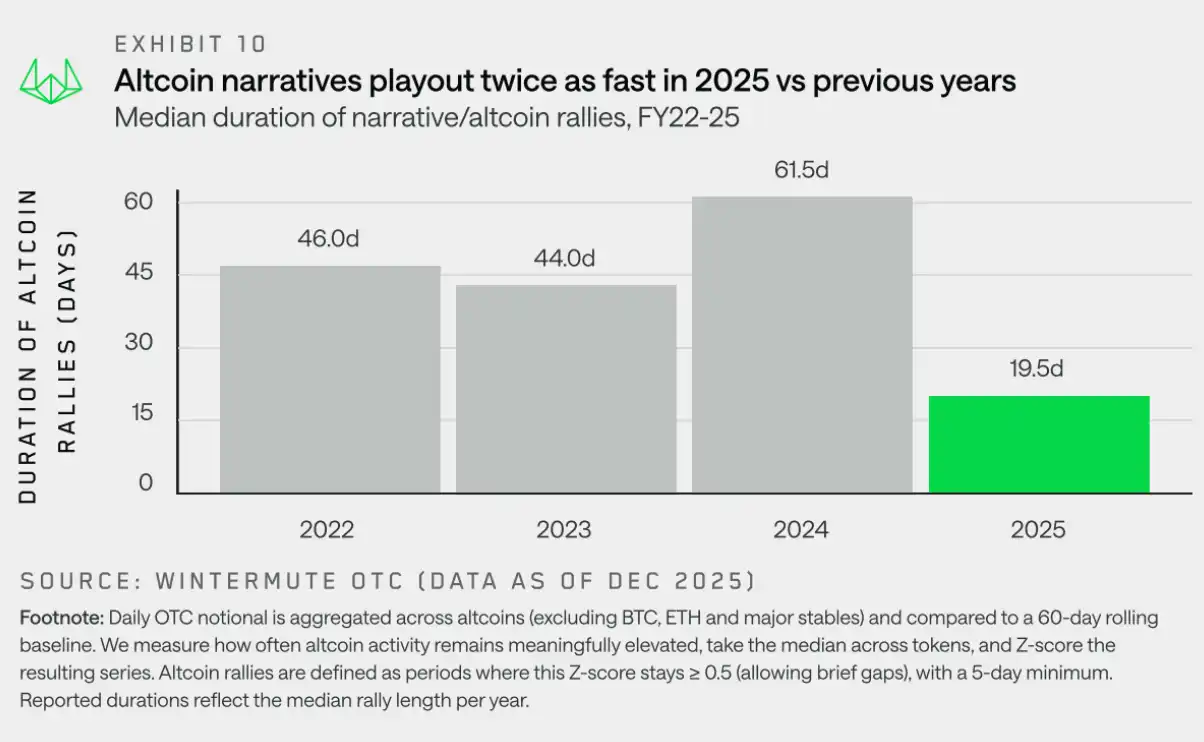

"In 2025, the average bullish trend driven by altcoin narratives lasted about 19 days, a significant decrease from 61 days in the previous year, indicating that the market has shown some degree of fatigue following last year's excessive rally."

In 2025, altcoins as a whole performed poorly, with annual aggregate returns declining significantly. Apart from brief rebounds, there was no meaningful or sustained recovery. Although individual themes occasionally attracted attention, these themes consistently struggled to gain momentum or translate into broader market participation.From the perspective of capital flow, this is not due to a lack of narrative, but rather the market has already shown clear signs of exhaustion—the bullish momentum has repeatedly been tested, yet it quickly fades due to the inability to consolidate conviction.

To understand this dynamic, we go beyond price appearances and focus on persistence analysis. Here, "persistence" is defined as the duration for which a meme coin maintains participation levels in off-exchange trading flows above recent normal levels. In practice, the persistence indicator measures whether an upward movement can attract sustained follow-through from participants, or whether market activity quickly dissipates after initial volatility. This perspective enables us to distinguish between meme coin movements with genuine persistence and intermittent, rotational bursts that fail to evolve into broader trends.

The chart above illustrates a clear shift in altcoin bullish trends. Between 2022 and 2024, altcoin bull runs typically lasted about 45 to 60 days. In 2024, a strong year for Bitcoin (BTC), wealth effects drove momentum to altcoins and sustained the popularity of narratives such as Meme coins and AI. In 2025, although new narratives emerged, including Meme coin launch platforms, Perp DEX, and the x402 concept, the median duration of these trends dropped sharply to around 20 days.

Although these narratives can trigger short-term market activity, they have failed to develop into sustained, market-wide bullish trends.This reflects the volatility of the macro environment, market fatigue after excessive gains last year, and the insufficient liquidity in altcoins to support narrative-driven breakthroughs in the early stages.As a result, the altcoin market resembles more tactical trading rather than high-confidence trend-based trading.

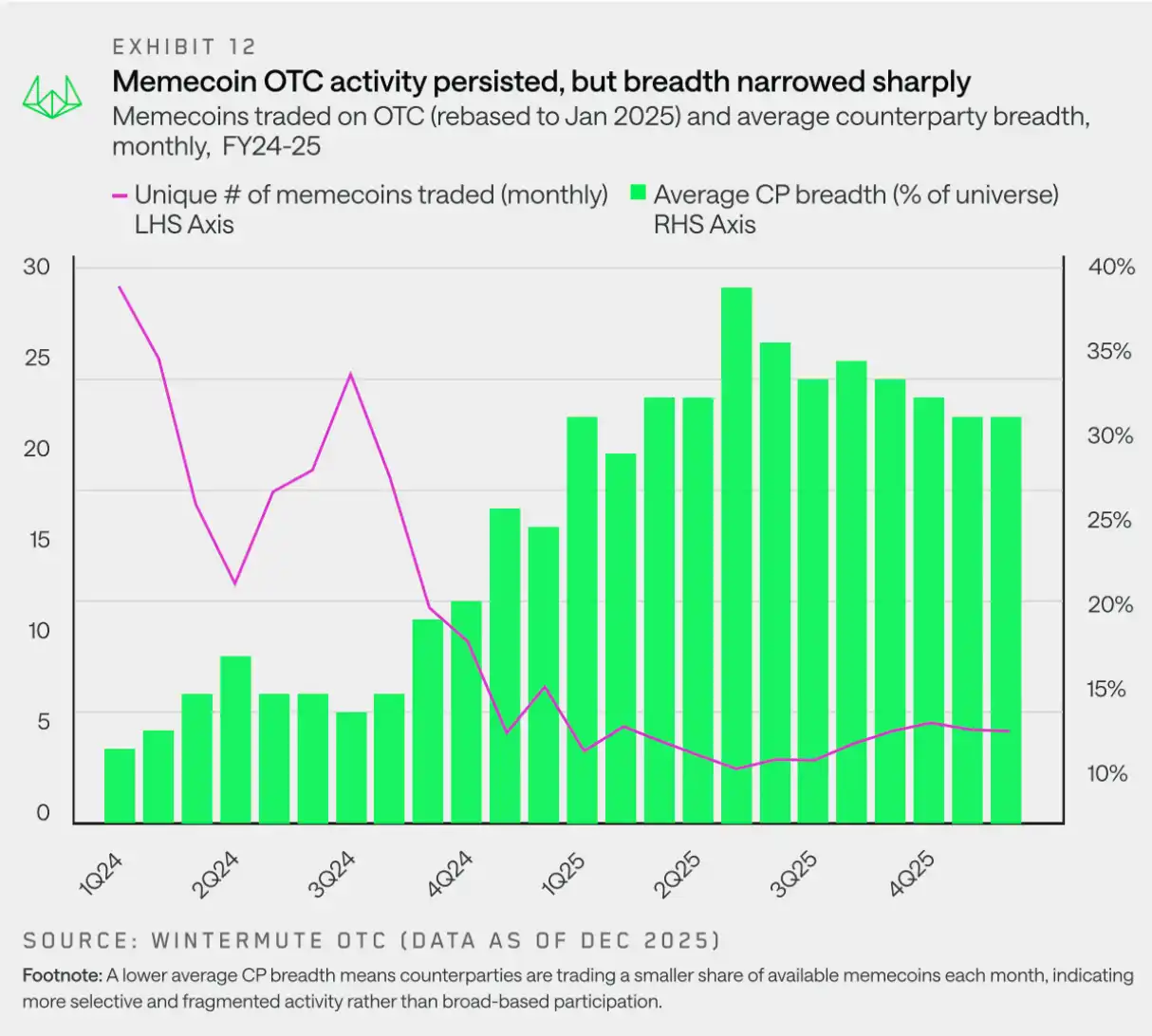

Meme Coins: Active Range Narrows

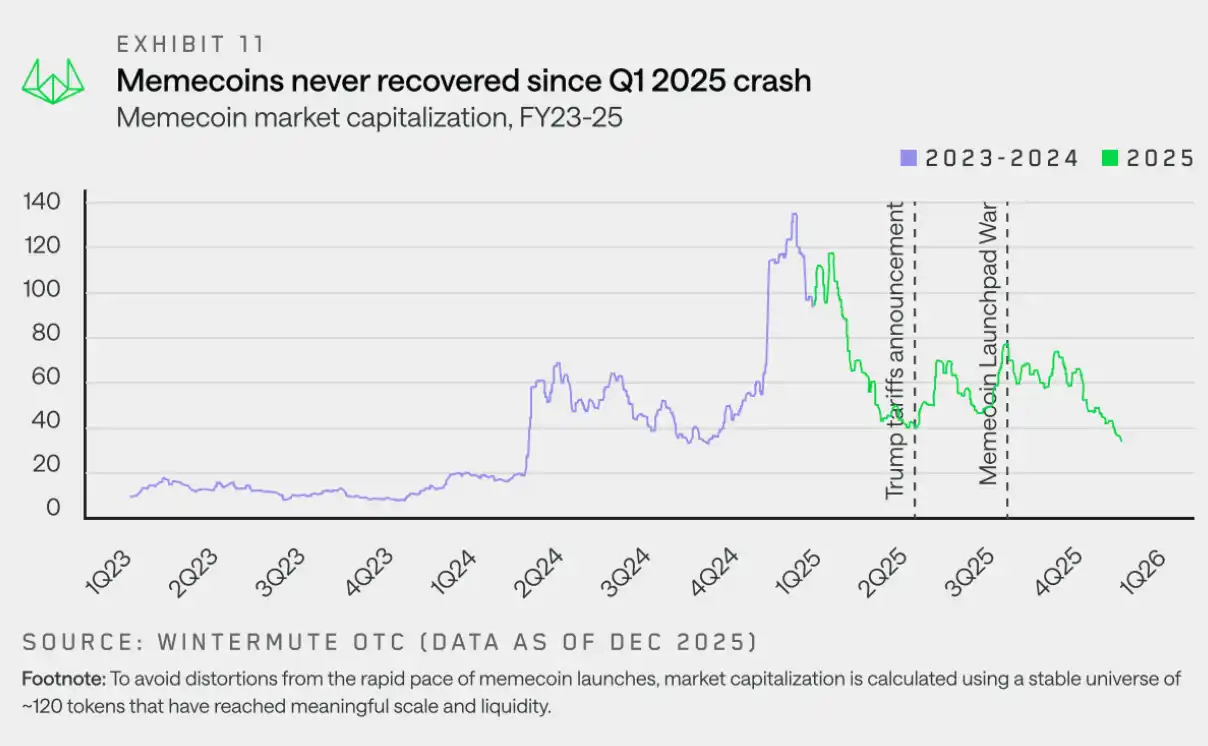

"Meme coins failed to recover after peaking in the first quarter of 2025, as trades became more fragmented and concentrated, preventing them from regaining support."

Meme coins entered 2025 in the most crowded market conditions, characterized by a high frequency of new launches, sustained bullish sentiment, and price movements that reinforced narratives. However, this state abruptly came to a halt. Unlike other sectors with higher beta coefficients, meme coins turned downward earlier and more decisively, and have consistently failed to rebuild upward momentum.

While prices have significantly corrected, the absolute number of Meme coins traded over-the-counter remains at a healthy level at any given time. Even by the end of 2025, the number of monthly traded tokens remains above 20, indicating that trading interest has not disappeared. The change lies in how the activity is expressed. In practice, this means that the number of coins involved in each counterparty's monthly transactions has significantly decreased, with activity becoming concentrated in specific tokens rather than being broadly spread across the entire Meme coin space.

Part 2: Derivatives

Wintermute's over-the-counter (OTC) derivatives data shows strong growth. As market volatility intensifies and large orders increase, the OTC market has become the preferred venue for executing complex, capital-efficient structured products, due to its ability to provide price certainty and operational privacy.

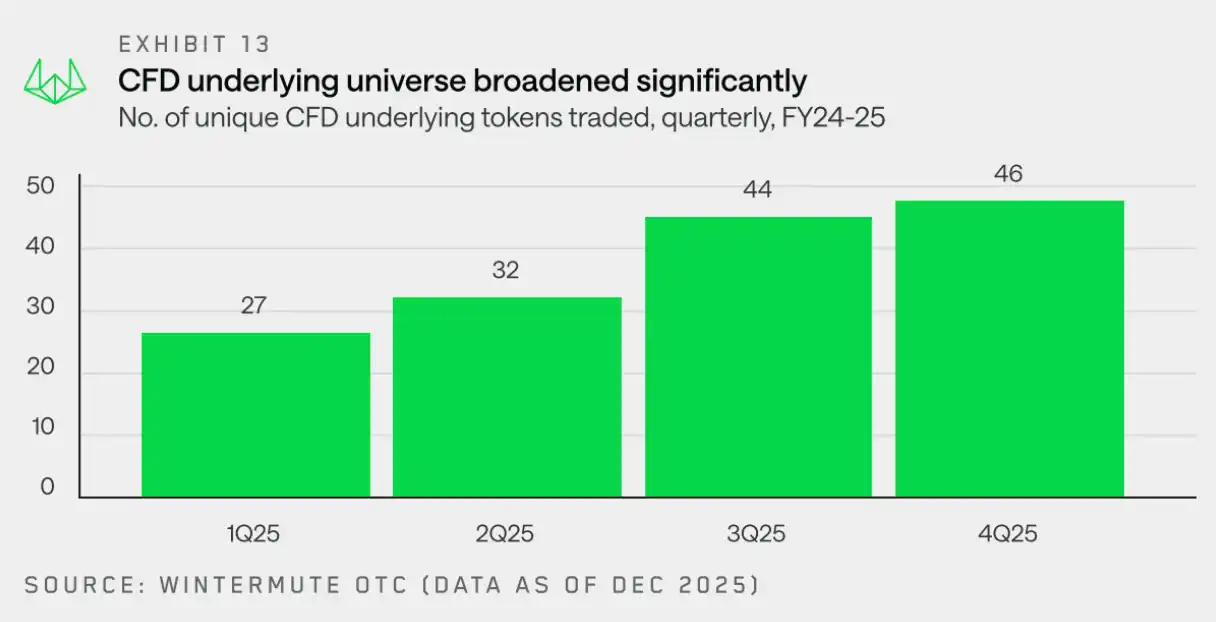

Contracts for Difference (CFDs): Expanded Range of Underlying Assets

"In 2025, the underlying assets of contracts for difference (CFDs) have further expanded, and futures, as a capital-efficient way to gain market exposure, are increasingly favored."

The number of tokens used as underlying assets on the Wintermute OTC desk for CFDs (Contracts for Difference) has tripled year-over-year, increasing from 15 in Q4 2024 to 46 in Q4 2025. This continued growth reflects the market's increasing adoption of CFDs as a capital-efficient way to access a broader range of assets, including long-tail tokens.

The growing demand for contracts for difference reflects a broader market trend toward capital-efficient exposure via futures.The open positions in perpetual contracts increased from $120 billion at the beginning of the year to $24.5 billion in October, after which market risk appetite sharply declined following a liquidation event on October 11.

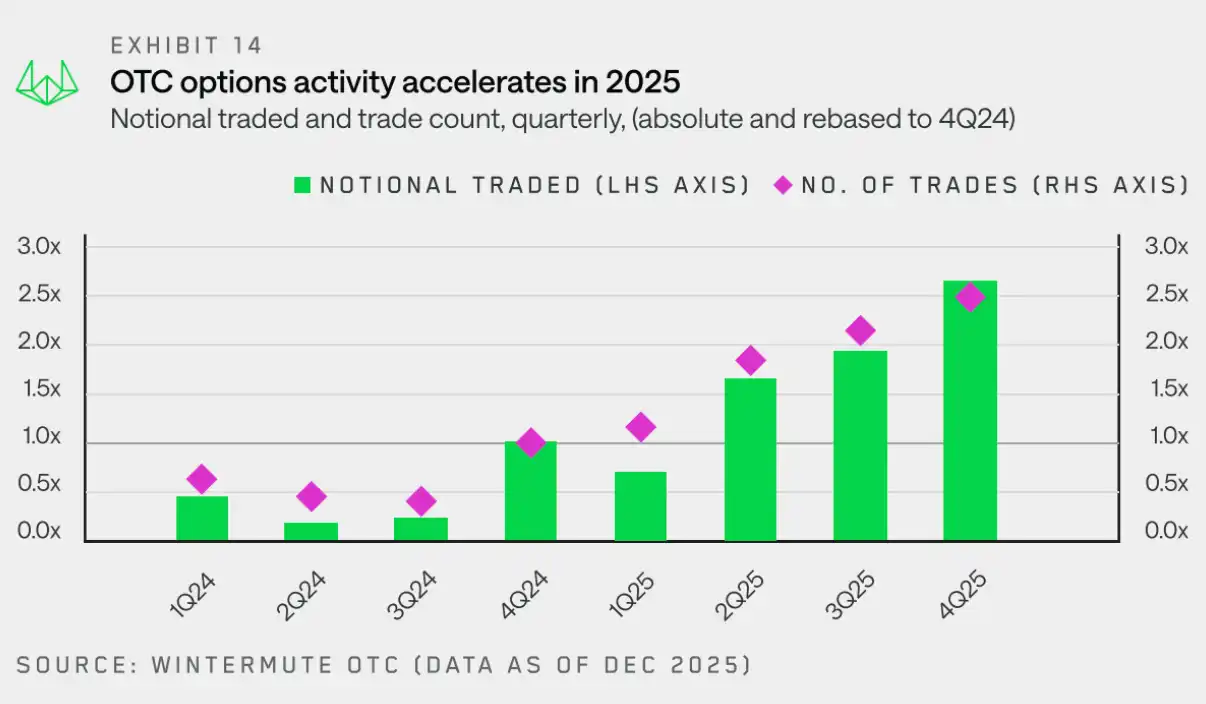

Options: Strategy Complexity Continues to Rise

"As systematic strategies and return generation become the primary drivers of trading volume growth, the options market is rapidly maturing."

Building on the previous surge in CFD and futures activity, Wintermute's OTC data shows thatCounterparties are increasingly turning to options to construct more customized and complex cryptocurrency exposures.

This shift has driven a sharp increase in options market activity: both notional trading volume and the number of transactions grew by approximately 2.5 times year-over-year from Q4 2024 to Q4 2025. This growth is primarily attributed to the adoption of options strategies by more market participants—especially crypto funds and digital asset treasuries—to generate passive income.

The chart below tracks quarterly over-the-counter (OTC) options activity relative to the first quarter of 2025, clearly illustrating the growth trend throughout the year. By the fourth quarter, the notional trading volume reached 3.8 times that of the first quarter, while the number of transactions reached 2.1 times, highlighting the continued increase in both the size and frequency of individual trades.

Part of the increase in notional volume stems from the rise of systematic options strategies, which involve maintaining continuous exposure and rolling positions over time.This marks a significant shift compared to previous years, when options were more commonly used to express purely directional views.

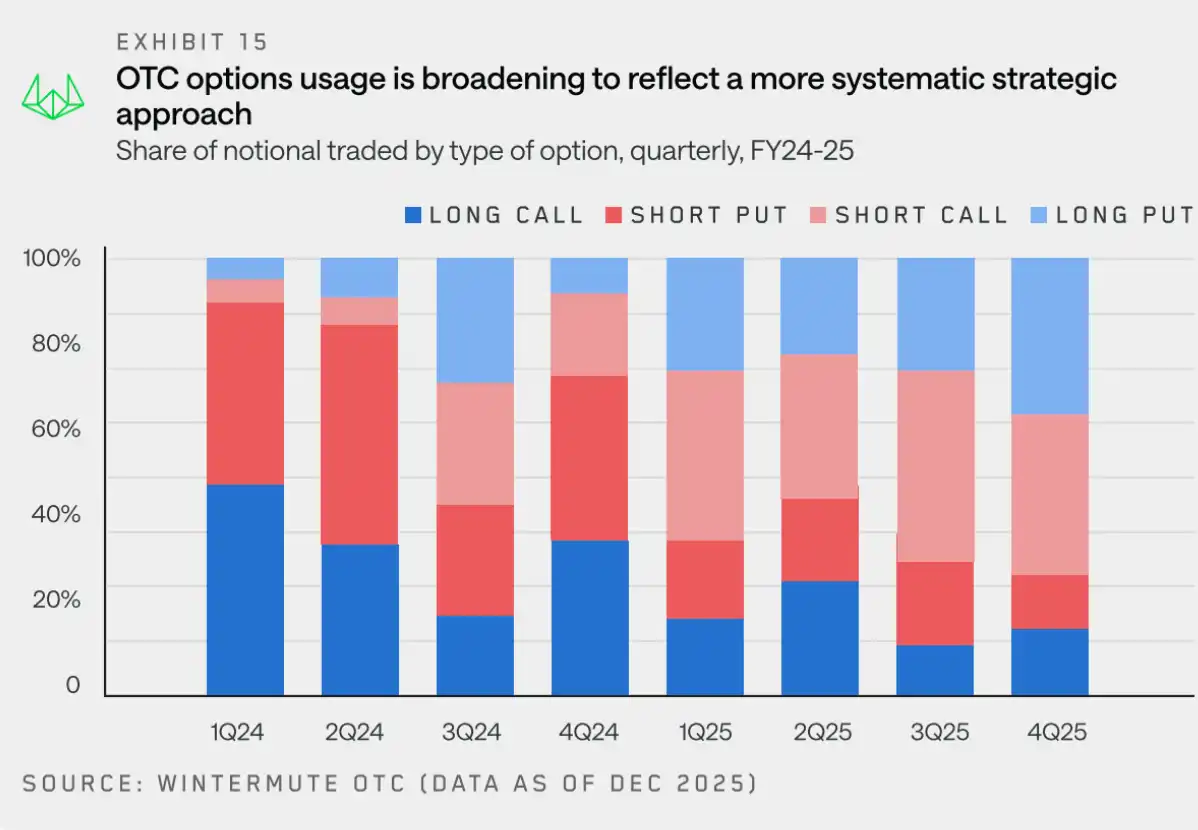

To understand the evolution of options cash flows, we further examined BTC (which still accounts for a significant portion of the notional trading volume in 2025). The following chart shows the quarterly distribution of long and short positions in call/put options.

The composition of BTC options flow in 2025 reflects a clear shift: from a focus on buying bullish call options, toward a more balanced use of both calls and puts, with increasing emphasis on income generation and structured, repeatable strategies. Income strategies have become more widespread, as investors generate returns by selling put options and covered call options, increasing stable option supply and suppressing volatility. At the same time, due to BTC's failure to break previous highs, demand for downside protection remains strong, and long put positions continue to be actively used. Overall, the market is placing greater emphasis on earning income and managing risk, rather than betting on further price increases.

The reduction in long call options purchases further confirms that options are being used less for directional bullish exposure and more for systematic strategy execution. These dynamics collectively indicate that, compared to previous years,The options market is becoming more mature in 2025, with a more professional user base.

Part 3: Liquidity

Cryptocurrencies have historically served as an outlet for excess risk appetite.Cryptocurrencies are highly sensitive to changes in the global financial environment due to their weak valuation anchors, built-in leverage, and high dependence on marginal capital flows.When liquidity is loose, risk tolerance rises, and capital naturally flows into the crypto space. However, when the environment tightens, the issue of a lack of structural buying power is quickly exposed.Therefore, cryptocurrencies have always fundamentally relied on global liquidity and will continue to do so in the future.

In 2025, the macroeconomic environment will be a key driver of cryptocurrency prices.Although the current backdrop features slowing interest rates, improved liquidity, and a strengthening economy—factors typically supportive of risk asset prices—the cryptocurrency market has remained weak. We believe there are two key reasons behind this disconnection: retail investor attention and new sources of liquidity.

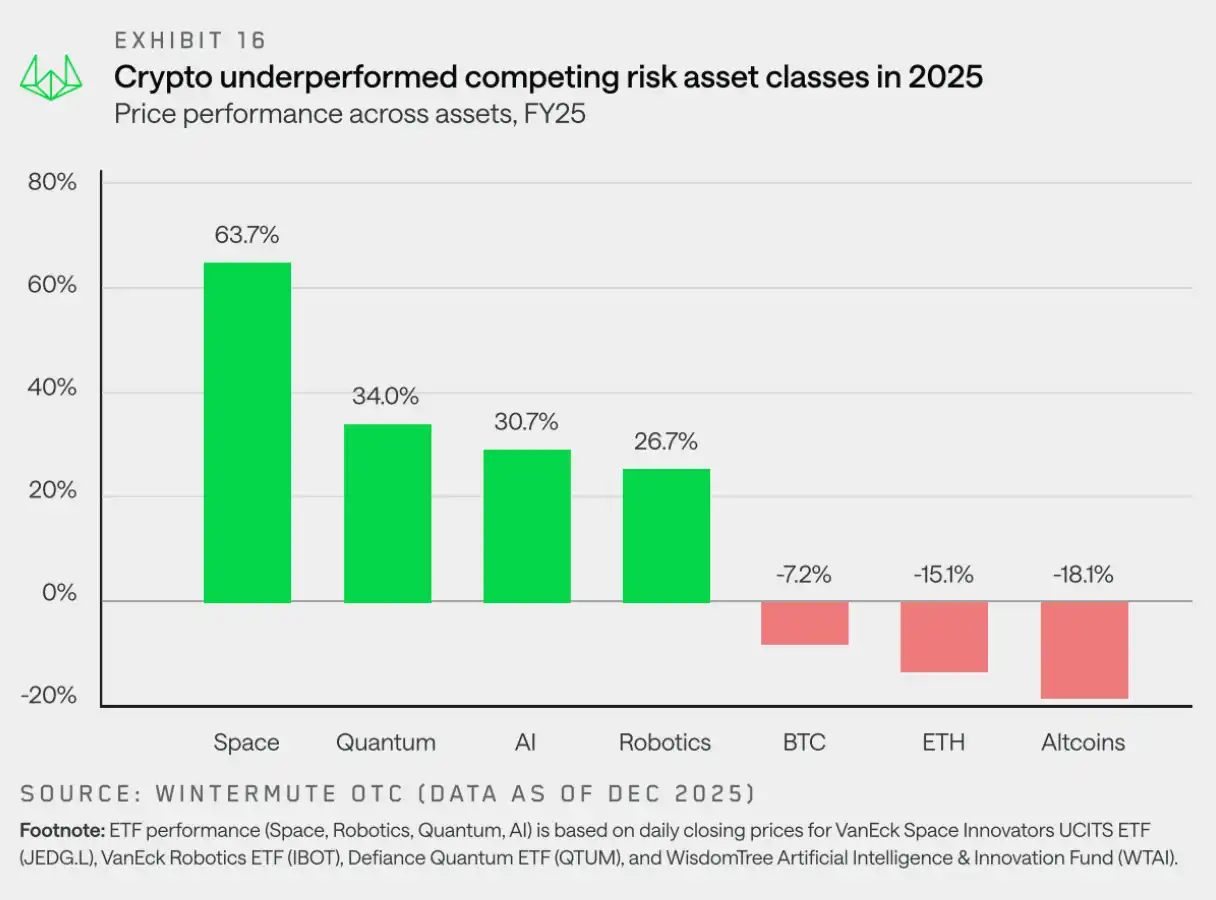

Retail Investor Interest: Cryptocurrency Is No Longer the "Top Choice" Risky Asset

"In 2025, cryptocurrency has lost its position as the preferred risk asset among retail investors."

Although institutional participation has increased, retail investors remain the cornerstone of the cryptocurrency market. A key reason for the poor market performance in 2025 lies in the dispersion of retail attention and the diminished rotation effect of crypto assets as the preferred risk-on asset.

Although there are many influencing factors, the following two are the most prominent: tech...Technological advancements have lowered barriers to market entry, making other investment opportunities—particularly in areas like AI—more accessible. These assets offer similar risk profiles, narrative logic, and return potential, thereby diverting attention away from the crypto space.At the same time, we are experiencing a return to normalcy after 2024—when retail investor participation was extremely high, initially flocking to Meme coins and then shifting toward AI agents by year-end. The market's return to a normal level of enthusiasm is an inevitable trend.

As a result, retail investors are favoring stock market themes such as AI, robotics, and quantum technology, while BTC, ETH, and most altcoins have lagged as major risk assets. Cryptocurrencies are no longer the default outlet for excess risk-taking.

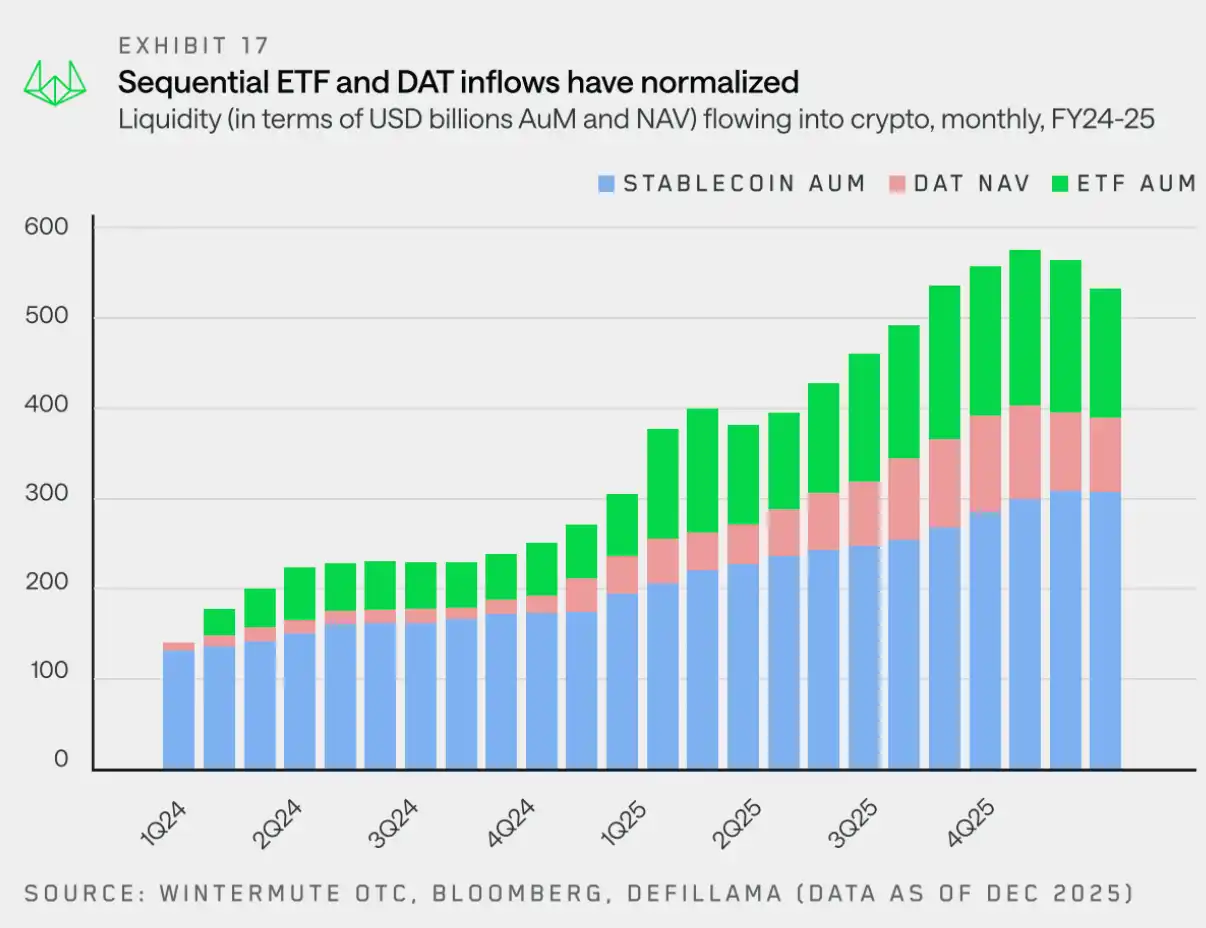

Liquidity Channels: ETFs and DAT Become New Pathways

"Today, ETFs and DATs, along with stablecoins, are becoming significant channels driving capital inflows into the cryptocurrency market."

BTC and ETH prices have slightly declined, but the most significant relative weakness has appeared in the altcoin sector. In addition to weak retail participation, a key factor lies in the shift in liquidity and how capital is entering the market.

Until two years ago, stablecoins and direct investments were still the primary channels for capital entering the crypto market. However, ETFs and DATs have structurally altered the pathways through which liquidity is injected into the ecosystem.

Earlier this year, we categorized encrypted liquidity into three core pillars: stablecoins, ETFs, and DAT. Together, they form the primary channels for capital inflows into the crypto market.

· Stablecoins have become one of many entry points: they remain crucial for settlement and collateral, but now only play a role in capital inflow rather than holding a dominant position.

· ETF channels liquidity toward the two largest assets: inflows constrained by investment scope enhance the depth and resilience of major assets, but have limited spillover effects beyond BTC and ETH.

· DAT introduces stable and non-cyclical demand: Treasury fund allocation has further concentrated on core assets, absorbing liquidity without naturally expanding risk appetite.

Liquidity is not only flowing in through ETFs and DAT, but the chart above demonstrates how significant these channels have become. As mentioned earlier, their investment scope is expanding and beginning to allow exposure beyond BTC and ETH, primarily involving other blue-chip tokens. However, this process is gradual, so the benefits for altcoin markets will take time to become apparent.

In 2025, cryptocurrencies are no longer driven by broad market cycles. Instead, the bull market is limited to a small number of assets with concentrated liquidity, while the majority of the market underperforms.Looking ahead to 2026, the market's performance will depend on whether liquidity spreads to more tokens or remains concentrated in a few large tokens.

2026 Market Outlook: Moving Beyond Pure Cyclical Patterns

"The market failed to achieve the anticipated upward trend in 2025, but this may signal that cryptocurrencies are beginning to transition from speculative assets to a mature asset class."

The market performance in 2025 has demonstrated that the traditional four-year cycle model is gradually becoming obsolete.Our observations indicate that market performance is no longer dominated by self-fulfilling four-year narratives, but rather depends on the flow of liquidity and investor focus.

Historically, native cryptocurrency wealth functioned like a single, interchangeable liquidity pool, where Bitcoin gains naturally spilled over into major altcoins and then further into smaller cryptocurrencies. However, Wintermute OTC data shows that this spillover effect has significantly weakened.New capital instruments—especially ETFs and DATs—have evolved into "closed ecosystems." While they provide ongoing demand for a few blue-chip assets, capital does not naturally rotate into the broader market. As retail interest has significantly shifted toward stocks and prediction markets, 2025 has become an extremely concentrated year—where a small number of mainstream assets have absorbed the vast majority of new capital, while the rest of the market struggles to sustain upward momentum.

Three Possible Paths to 2026

2025 is a year of significantly narrowed market breadth. As previously mentioned, the average duration of altcoin rallies has shortened from about 60 days last year to around 20 days. Only a few select tokens have shown outstanding performance, while the broader market has continued to decline gradually under the impact of unlocking selling pressure.

To reverse this trend, at least one of the following three conditions must occur:

· ETF and DAT expand their investment scope:Currently, most of the new liquidity remains confined to institutional channels such as ETFs and DAT. A broader market recovery will require these institutions to expand their investable scope. Preliminary signs are already emerging, with more ETF applications for SOL and XRP being submitted sequentially.

· Leading Coins Drive the Market:Similar to 2024, if Bitcoin (and/or ETH) experiences a strong price increase, it could generate a wealth effect and spill over into broader markets. However, how much capital will ultimately flow back into the digital asset sector remains to be seen.

Market Attention Returns:Another, less likely scenario is that retail investors' attention significantly shifts back from the stock market (including themes such as AI and rare earth elements) to the cryptocurrency sector, bringing new capital inflows and increased issuance of stablecoins.

The market trends in 2026 will depend on:It describes whether at least one catalyst can effectively promote liquidity to spread beyond a few major assets; otherwise, the market's concentration will continue.

Click to learn about BlockBeats' job openings.

Welcome to join the official Lulin BlockBeats community:

Telegram Subscription Group:https://t.me/theblockbeats

Telegram discussion group:https://t.me/BlockBeats_App

Official Twitter account:https://twitter.com/BlockBeatsAsia