Original Title: Japan's Yield Surge Is the Hidden Driver Behind Gold and Bitcoin

Original Author: @that1618guy, Delphi Digital

Translated by SpecialistXBT, BlockBeats

Editor's Note: The simultaneous rise in gold and Japanese 10-year yields stands in sharp contrast to the weakness in Bitcoin. This article points out that this divergence reflects a market shift from "tightening trades" to "risk pricing," and that every move by the Bank of Japan could become a key variable in breaking the current market pattern.

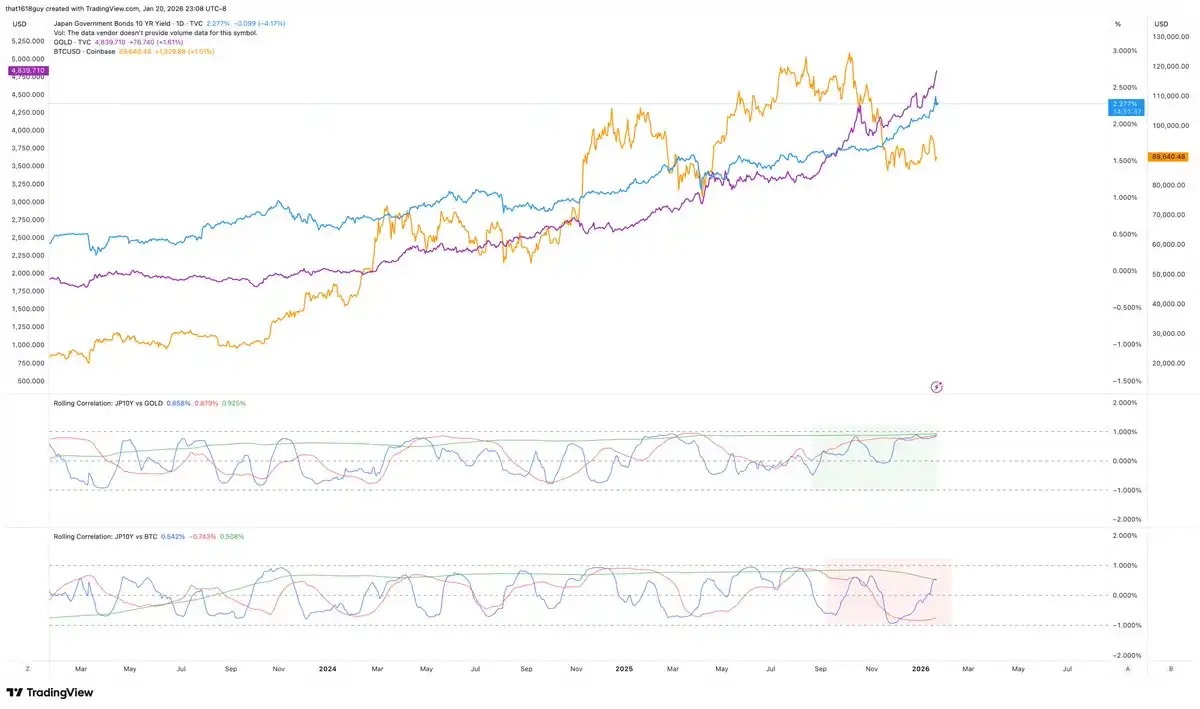

One of the most intriguing macroeconomic developments currently is the co-movement between gold and Japanese 10-year government bond yields. These two assets are fluctuating in sync, which contradicts the usual patterns observed during a typical monetary tightening cycle.

The following will analyze why gold follows Japan's yield trends, why Japan has become a key pressure point for markets, and what impact the Bank of Japan's potential intervention might have on Bitcoin.

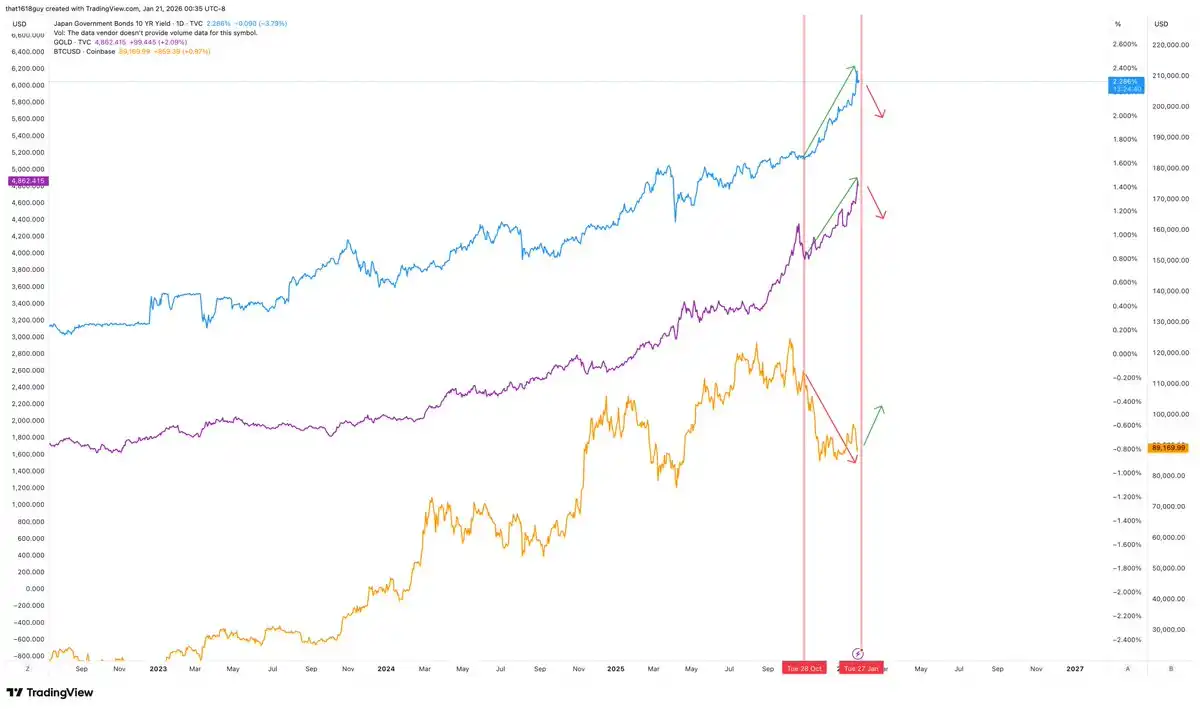

Gold and Japanese government bonds rise in tandem... while Bitcoin moves in the opposite direction.

In normal market environments, rising long-term interest rates suppress gold prices by increasing the opportunity cost of holding non-yielding assets. This negative correlation only breaks down when interest rates deviate from their normal market trends and instead signal policy pressures. Now, Japan's 10-year yield has surged sharply, while gold prices are rising in tandem—an occurrence that precisely illustrates this latter scenario.

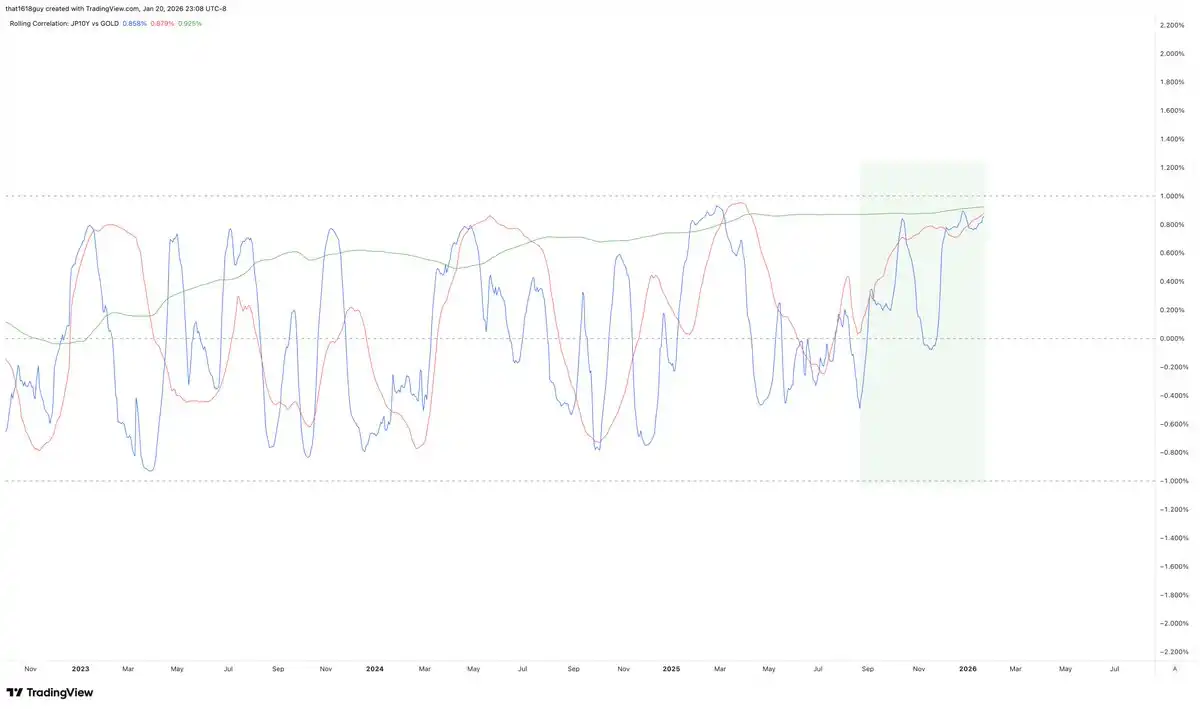

This correlation chart clearly reveals this transition.

The 30-day correlation between Japan's 10-year yield, shown by the blue line in the chart, and gold remains volatile, but it has clearly spent more time in positive territory rather than quickly dropping into negative territory. This alone indicates that the traditional inverse relationship is weakening.

More importantly, the 90-day correlation represented by the red line has also increased, indicating that this is not just short-term noise. Most compelling is the one-year correlation shown by the green line: it has steadily risen and remains stably in the positive range.

When long-term correlations turn positive and remain at high levels, it often indicates a fundamental change in market logic. The rise in Japanese government bond yields no longer hinders gold, but is instead interpreted by the market as a signal of pressure being absorbed by gold. This suggests that the market now views rising yields as a risk signal, rather than merely a tightening signal.

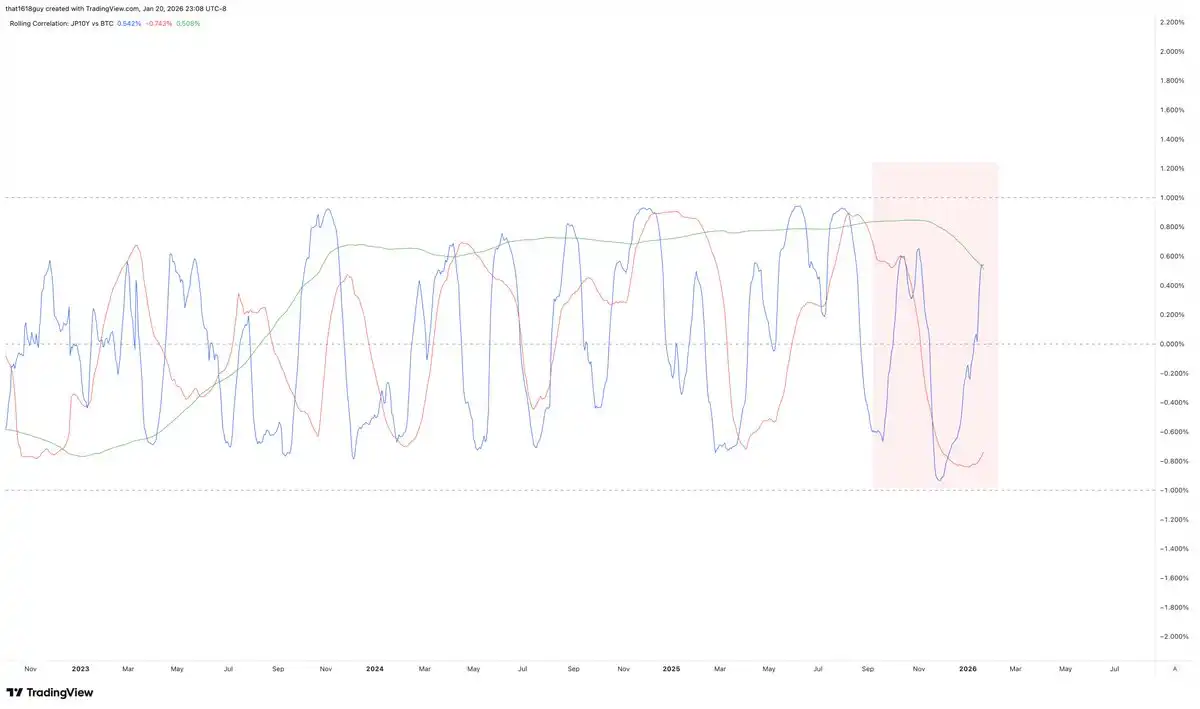

More interestingly, other markets did not exhibit similar phenomena. During the same period, Bitcoin maintained a negative correlation with Japanese 10-year yields.

The second chart highlighting the relevance underscores this contrast.

The 10-year Japanese yield's 30-day and 90-day correlations with Bitcoin have indeed fluctuated sharply as expected, but the main activity has remained below the zero line, reflecting Bitcoin's sensitivity to short-term macroeconomic pressures. Most importantly, the 1-year correlation (green line) has turned downward and remains negative, indicating that over a longer time horizon, Bitcoin consistently faces downward pressure when Japanese yields rise.

In other words, to see signs of a sustainable rebound, we need the 10-year Japanese yield to start cooling down— which, in theory, would also be reflected in gold prices.

How to interpret the current market logic

When gold and sovereign bond yields rise in tandem, what the market is pricing in is not stronger economic growth or tighter monetary policy discipline, but rather credit risk and balance sheet vulnerabilities.

This pattern typically emerges in the following scenarios: hedging demands outweigh arbitrage logic, policy control capabilities are questioned, and rising yields expose duration mismatches rather than suppressing economic activity. In such an environment, gold no longer functions primarily as an inflation hedge, but rather as a balance sheet hedge.

The inverse relationship between Bitcoin and Japanese yields reinforces this interpretation. Markets view rising Japanese yields as a tightening shock, benefiting gold but not Bitcoin. The current divergence is precisely a key signal.

Why Japan Has Become a Key Pressure Point Japan has become a key pressure point in the complex geopolitical and economic landscape of the 21st century due to a combination of

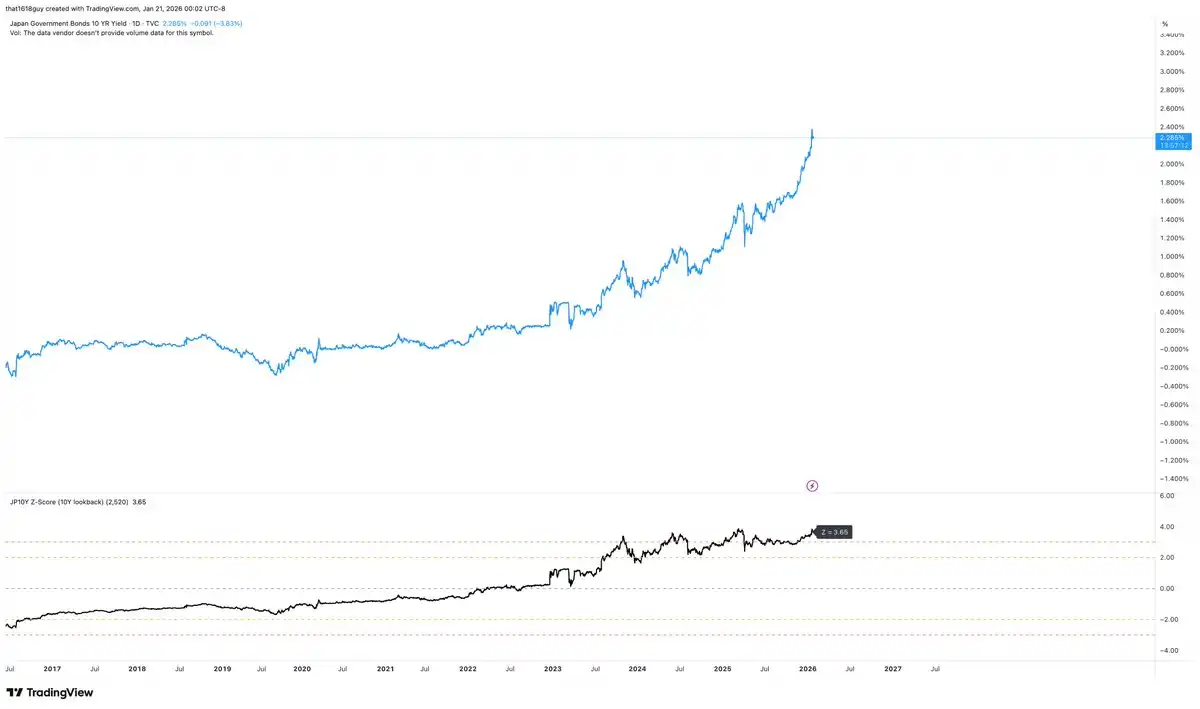

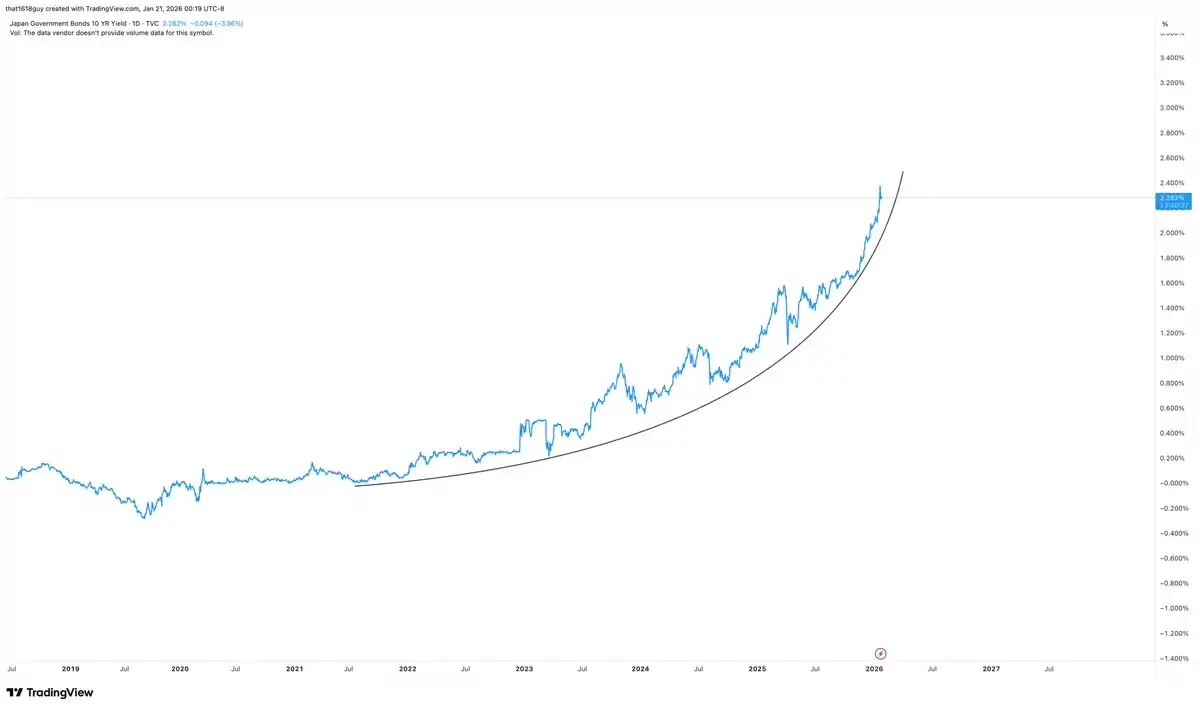

Japan has a unique sensitivity to this dynamic. The sharp upward surge in the yield of Japan's 10-year government bonds, as shown in the chart above, is by no means a neutral event for its domestic financial system. The key issue lies not only in the rise in yields, but also in the fact that the magnitude of the increase has reached statistically extreme levels relative to Japan's own policy framework.

Using a rolling 10-year window, the current 10-year Japanese yield is about 3.65 standard deviations above its long-term average. This is equivalent to flipping a coin 13 times in a row and getting heads every time.

This is worth noting in any market. However, in Japan, where long-term yields have been tightly controlled over the past decade, such a significant fluctuation clearly signals that policy anchors are beginning to loosen. This is precisely a typical characteristic of the disintegration of the old order.

Equally important as the absolute level is the rate of increase.

The recent steep rise in yield levels has transformed a single interest rate adjustment into a balance sheet event. Japan can gradually absorb higher yields, but it would struggle to cope smoothly with a sudden rapid repricing of duration that occurs within a financial system designed around yield suppression.

When yields surge sharply, the market is not only seeking a new equilibrium but also conducting a stress test on all participants who have bet on the status quo of the "Japanese model."

Japanese financial institutions are structured to hold long-duration Japanese government bonds (JGBs) deeply as both assets and collateral. This makes rapid increases in yields inherently destabilizing, rather than merely restrictive. As yields rise sharply, the market value of bond portfolios declines, and the value of collateral deteriorates. Within a system explicitly designed around suppressing yields, financing conditions become increasingly tight.

This is precisely why the Bank of Japan has historically intervened when pressures emerge in the data, rather than waiting until markets have completed their normalization. The BOJ does not need to wait for yields to reach an absolute threshold; often, a significant acceleration in volatility across multiple standard deviations is sufficient to trigger action.

Therefore, the normalization of Japan's yields is not merely a market adjustment, but a balance sheet shift that could pose real transmission risks to the banking system, especially in cases of disorderly or one-sided market volatility.

The recent movements in Japan's 10-year government bond yields have significantly increased the Bank of Japan's incentive to intervene. Such intervention does not necessarily have to take the form of a clear restoration of strict yield curve control. Verbal guidance, targeted yield-smoothing operations, or relatively mild control over the long-term bond market could be sufficient to dampen fluctuations in the yield curve and stabilize market conditions.

The Impact of the Bank of Japan's Intervention on Gold

If the Bank of Japan conducts credible intervention and reasserts control over long-end yields, this specific pressure signal should diminish. This does not mean that gold will suddenly turn bearish, but it is likely to remove one of the key catalysts for the current upward trend.

Combined with the analysis in the article "Commodities First, Bitcoin Follows" published by Delphi Digital last week, the gold chart has already indicated this dynamic.

Although the overall uptrend remains intact, the upward momentum is no longer expanding at the same rate. Recent gains have pushed prices to the upper boundary of the ascending channel, but without the kind of momentum confirmation seen in earlier stages of the rally. Even as prices slowly rise, the RSI indicator still struggles to break above previous highs, indicating that marginal buyers are becoming more cautious.

This aligns with the current market structure that is bullish, yet increasingly reliant on policy pressures rather than broad participation. Gold has benefited from the sharp rise in Japanese 10-year government bond yields, but this benefit is more evident in price persistence than in accelerated gains. When the primary catalysts are expected to be resolved, price movements tend to shift from impulsive to consolidative.

The BOJ's decisive intervention is likely to break the link between gold and Japanese yields, reduce the pricing of policy pressures, and perfectly align with the signals already indicated by the charts—that the market is forming a partial top or entering a consolidation phase, rather than experiencing a trend reversal. This outcome would allow gold to dissipate its excess momentum through time rather than price, thereby slowing the upward momentum while maintaining the overall bullish trend.

Gold is not structurally reliant on Japanese yen pressure to provide support, but it clearly benefits from it on the margin. If this pressure is contained, the chart suggests the market is prepared to pause commodity trading.

The Impact of the Bank of Japan's Intervention on Bitcoin

Since Bitcoin's movement is opposite to that of Japanese yields and gold, this relationship should also become evident when the Bank of Japan eventually decides to intervene.

The chart has already suggested this asymmetry: even as gold and Japanese yields continue to rise, Bitcoin, although weaker, shows signs of stabilization rather than accelerating downward. This pattern is consistent with the characteristics of an asset finding a bottom under macroeconomic pressure, and it remains highly sensitive to any credible containment measures.

If the Bank of Japan intervenes, Bitcoin's response is likely to differ from that of gold. As global liquidity conditions stabilize and the tightening impact from the decline in Japan's long-term yields weakens, Bitcoin may experience a recovery rather than a decline. In this sense, Bitcoin is not competing with gold under this scenario, but rather functioning as "digital gold," waiting for the easing of pressure signals.

Conclusion

The key insight is not that yields have peaked or that Japan is about to intervene, but rather that markets now view Japanese yields as a signal of global pressure, and asset price behavior is adjusting accordingly.

Gold is absorbing this pressure, while Bitcoin is reacting to it, and the divergence between the two is telling. As long as Japanese 10-year yields continue to rise unimpeded, a stronger performance from gold is logical. However, if the Bank of Japan intervenes and regains control, the pressure premium in gold should ease, and its price trend could shift from accelerated gains to consolidation.

In any case, Japan's government bond market has now become the clearest window for observing how the market prices policy risks and balance sheet vulnerabilities. Before the 10-year Japanese yield begins to ease, gold may continue its upward trend, while Bitcoin's price performance is likely to remain weak.

"Hello, I amOriginal article link"」" is a

Click to learn about BlockBeats' job openings.

Welcome to join the official Lulin BlockBeats community:

Telegram Subscription Group:https://t.me/theblockbeats

Telegram discussion group:https://t.me/BlockBeats_App

Official Twitter account:https://twitter.com/BlockBeatsAsia