Key Insights

- Coinbase stock price has crashed by 45% from its highest point in 2025.

- The average estimate among Wall Street analysts is that its stock will jump to $375.

- COIN faces major headwinds that may prevent this from happening.

Coinbase stock has fallen by over 45% from its peak in 2025 as the company confronts numerous challenges, including the cryptocurrency bear market and slow growth. This article explains why the COIN stock plunged and whether it will rebound by 55% and hit $375 as Wall Street pros predict.

Wall Street Analysts are Bullish on the Coinbase Stock

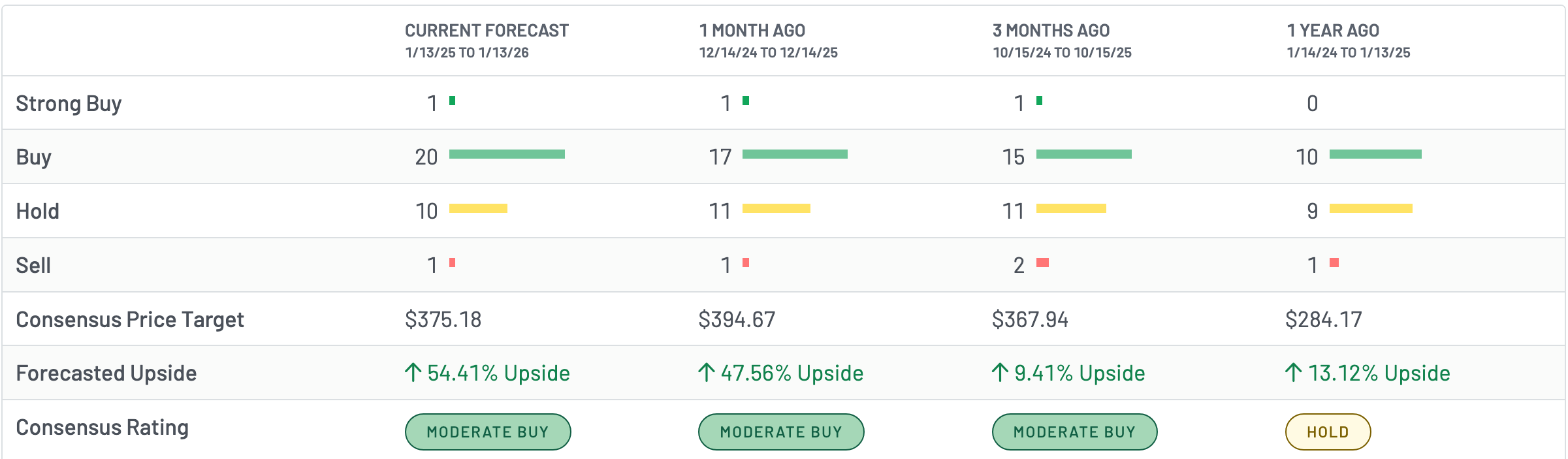

Most analysts in Wall Street are maintaining their bullish bias on the Coinbase stock price this year. In a recent note, Bank of America’s Jason Kupferberg upgraded his rating from neutral to buy and set a target of $340.

Bernstein’s Gautam Chhugani reiterated his bullish view and set a target of $440. Goldman Sachs has a target of $303, while BTIG predicts it will soar to $420.

Data compiled by MarketBeat shows that the average target price for the stock is $375, representing a 54% increase from the current level. This target is lower than the $394 it had a month ago.

The bullish case for Coinbase among analysts is based on its market share in the United States and its valuation. Analysts also cite the recently announced products like its prediction market and its tokenized stocks service.

Coinbase is Facing Major Headwinds

Still, the Coinbase stock price is facing major risks that may impact its performance in the coming months. The first one is that the crypto market weakness is continuing this year, with Bitcoin and most altcoins being in a tight range.

Historically, cryptocurrency exchanges underperform when there is a bear market as participants stay away. Low activity affects its transaction revenue, which remains its largest revenue earner.

The other major risk is that competition in the United States continues to rise. Top companies like Vanguard, Charles Schwab, and SoFi have made plans to offer the service. This entry may attract some customers from Coinbase or prompt it to lower transaction fees to stay competitive.

Wall Street analysts expect the company’s profitability to remain on edge as it continues to spend. The average estimate among 15 analysts is that its earnings per share (EPS) for 2025 will be $7.84, down from $9.48 in 2024. Similarly, the average of 17 analysts is that its EPS in 2026 will drop to $6.77.

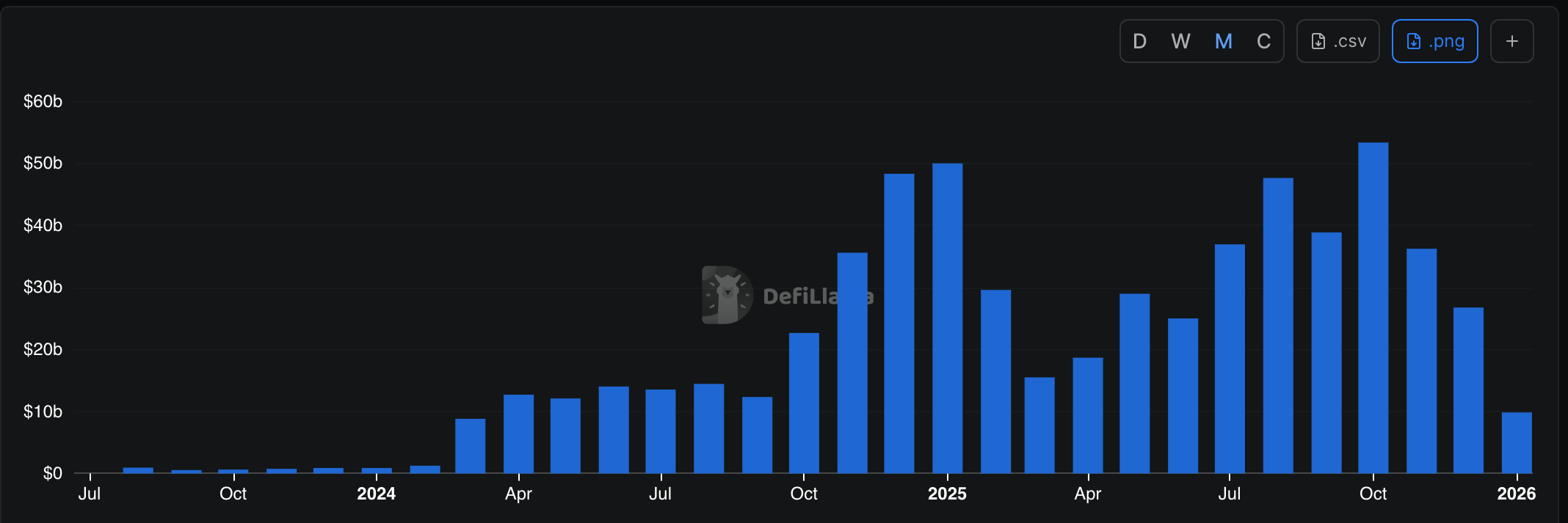

Meanwhile, data compiled by DeFi Llama shows that Base, its layer-2 network, is not doing well. For example, stablecoin supply in the network has dropped from $4.88 billion in December to $4.86 billion today.

As the chart below shows, the monthly DEX volume on Base has been in a downward trend since October, when it peaked at $53 billion. It slipped to $36 billion in November and $26 billion in December.

More data shows that the number of Base users and transactions has been in a freefall. Therefore, these numbers suggest that the BASE token may not receive a significant valuation when it launches.

Additionally, it is still too early to predict how much money the company will generate from its prediction market.

COIN Stock Price Technical Analysis

The daily chart shows that the Coinbase stock price has plummeted from last year’s high of $445 to the current $242. It has tumbled below the 61.8% Fibonacci Retracement level at $258. Moving below that level often confirms a bearish outlook.

The stock also formed a death cross pattern on December 16, as the 50-day moving average dropped below the 200-day moving average. This pattern is one of the riskiest ones in technical analysis.

Coinbase stock has remained below the Supertrend indicator. It has also formed a bearish flag-like chart pattern.

Therefore, the most likely Coinbase stock forecast is bearish, with the main target being at $200. As such, it is highly unlikely that it will reach the target of $375 anytime soon, as analysts estimate.

The post Can Coinbase Stock Jump to $375 as Wall Street Experts Predict? appeared first on The Market Periodical.