"My approach is actually very simple," said Vitalik Buterin last week when asked how he earned seven million dollars within a year. "I look for markets that have already gone into 'crazy mode' and then bet that these crazy things won't happen."

When the world goes mad, rationality is the best arbitrage.

At the end of January 2026, during an interview in Chiang Mai, Ethereum founder Vitalik Buterin publicly discussed his trading experience on the prediction market Polymarket: in 2025, he earned a profit of about $70,000 using a principal of approximately $440,000.

Although this amount of money is trivial for Vitalik, who is worth hundreds of millions of dollars, the trading strategies he mentioned in the interview and his understanding of Polymarket's settlement mechanism indicate that he is not "just messing around." Instead, he has developed a well-structured trading logic after thoroughly exploring the entire prediction market system.

To help the audience better understand, he also actively provided several specific examples. For instance, the Nobel Peace Prize laureate who was widely discussed last year—Trump had repeatedly publicly stated that he himself was the most qualified person to receive the award.

After extensive media coverage, Trump's probability of winning the award once exceeded 15%. Many traders believed that, given Trump's style, he would use various forms of pressure and persuasion to eventually force the Norwegian Nobel Committee to compromise and award him the prize.

Vitalik's assessment of this matter is straightforward: this 15% does not reflect actual probability, but rather sentiment. What I need to do is stand opposite to the sentiment and use rationality to profit from the overestimated probability gap.

Starting from the premise that "Trump will not win the Nobel Prize," reverse-engineer Vitalik's Polymarket account.

Based on clues revealed by Vitalik in the interview and Polymarket's mechanism that allows traders' records to be verified, we can actually attempt to outline his account profile: $440,000 in principal, $70,000 in annual profit, and he earned money by betting that Trump would not receive the 2025 Nobel Peace Prize.

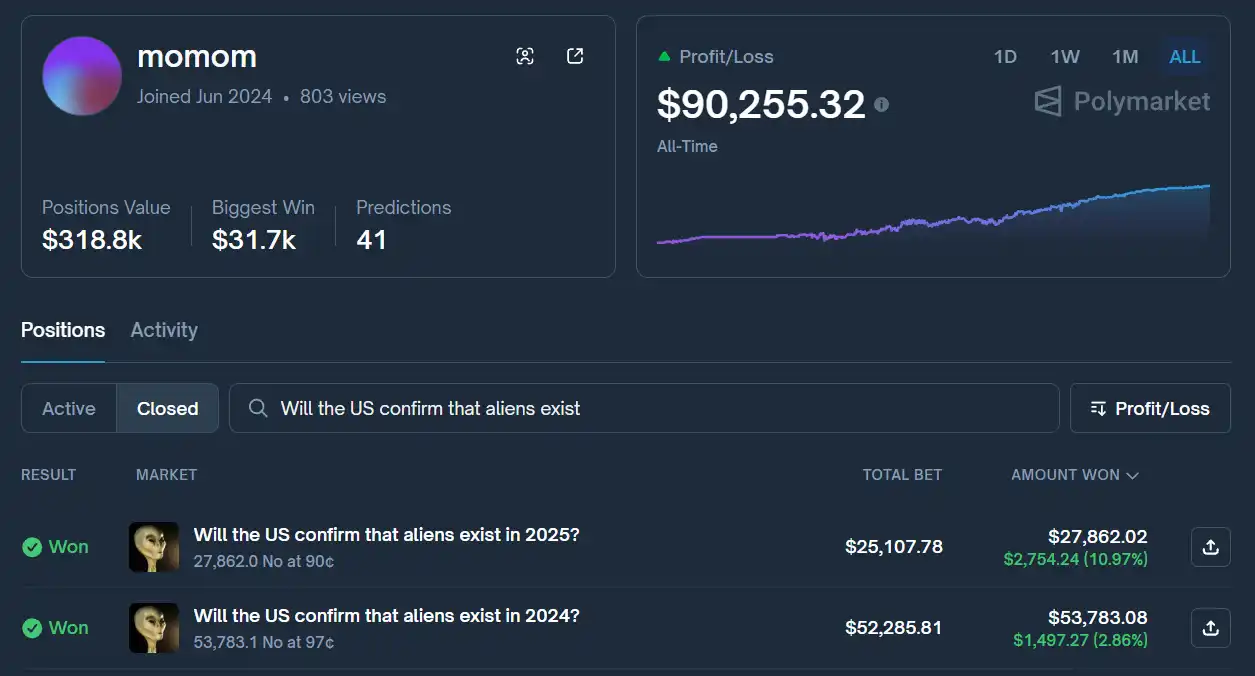

After going through a screening process, two accounts emerged: momom and terremoto.

In addition to the principal and profits matching up, the two systems perfectly align in terms of trading logic. Vitalik's profit-making system for "short sentiment" involves over 70% of transactions betting on something not happening, with no transactions related to guessing cryptocurrency prices or sports events.

Further on-chain fund tracing revealed that although the amount deposited into terremoto's account matched the $440,000, this sum was split into dozens of small deposits, each in the thousands of dollars. Additionally, there were no activities other than fund transfers between multiple on-chain wallets.

Meanwhile, momom's on-chain deposits included several large transactions exceeding $100,000. Combined with the fact that momom's account only made one "Yes" bet, and considering that terremoto's transaction frequency is so high that it resembles a full-time trader actively participating in prediction markets every day, we ultimately believe that momom better matches Vitalik's profile.

If momom is Vitalik, what is his strategy?

Imagine this: today is March 3, 2025. As a die-hard Trump supporter, you are firmly convinced that he is unlike previous presidents who were puppets controlled by the deep state. Within a year of Trump's presidency, he has fulfilled various campaign promises (such as ICE officers patrolling the streets to apprehend undocumented immigrants, imposing tariffs to "protect domestic businesses," etc.).

You also clearly remember that he said during the campaign that he would push for the release of documents related to UFOs and extraterrestrials.

Just yesterday, you saw in the news report that U.S. legislators are pushing for new legislation to establish a "UFO task force." In the comments section, someone mentioned another related news story:

A former U.S. Air Force officer and intelligence official, David Grusch, revealed that the U.S. government has operated a "decades-long UAP crash recovery and reverse engineering program," recovering "non-human origin" aircraft and "non-human biological remains."

Putting these clues together, you discover something amazing: Trump is likely to release alien files!

At this moment, you see in the prediction market that the probability of the event "Will the United States announce the existence of aliens in this world by 2025?" is only 10%. This means that Trump has nearly 11 months to release relevant documents.

"This probability is seriously underestimated!" You came to this conclusion after just now checking the news, comments, and even searching for related information on your own, and then you placed a bet on "Yes."

This is a bet with a potential return of nearly ten times, and you believe it to be your most successful investment since the beginning of 2025. What you don't know is that the counterparty on the other side of the order book is none other than Vitalik.

This is exactly what the account did in March last year: Amidst numerous market noises and widespread media coverage, he bet that the U.S. would not announce the existence of extraterrestrials within the following ten months, when the probability was 10%. This trade ultimately earned him a 10% profit.

Interestingly, the exact same betting line has appeared again, and he once again bet that the event would not happen this year. Even as of the time of writing, this trade is still in a loss. You can even copy his trade at a price lower than Vitalik's cost.

Conclusion

It's only been a month into 2026, yet various events that once seemed impossible have repeatedly dominated headlines in major media outlets: Venezuela's president, Maduro, was captured by the U.S. like a chicken and flown back to America by helicopter; Trump went as far as targeting NATO allies to acquire Greenland; the Epstein files have implicated nearly every major American political and business figure.

There is no denying that we are living in an era overwhelmed by uncertainty. Against this backdrop, "it seems like anything could happen."

Predictive markets emerge, directly translating this illusion into probabilities: every breaking news story, every tweet, and every exaggerated media interpretation briefly boosts the "Yes" price in a particular market.

Many star traders, such as Vitalik, bet that an extreme event will not occur by overestimating the probability of such an event. After being optimized through well-established trading systems based on mathematics and statistics—such as the Kelly criterion—this strategy has become one of the most robust investment approaches in prediction markets today.

Click to learn about BlockBeats' job openings.

Welcome to join the official Lulin BlockBeats community:

Telegram Subscription Group:https://t.me/theblockbeats

Telegram discussion group:https://t.me/BlockBeats_App

Official Twitter account:https://twitter.com/BlockBeatsAsia