Original Title: VanEck Q1 2026 Outlook: Risk On

Original Source: VanEck

Translated by Felix, PANews

Heading into 2026, clearer fiscal and monetary signals will support a more positive risk appetite, and investment opportunities in areas such as artificial intelligence, private credit, gold, India, and cryptocurrencies will become more attractive.

Key points:

By the end of 2025, AI-related stocks experienced a significant correction, resetting their valuations and making investments in AI and related themes more attractive.

Gold is once again emerging as a global currency asset, and the recent pullback provides a better opportunity to enter the market.

After a difficult 2025, business development companies (BDCs) now offer more attractive yields and valuations.

India remains an investment market with high growth potential, and cryptocurrencies are bullish in the long term, although short-term signals are complex.

As we move into 2026, the market is in a rare environment: clear and well-defined. While selectivity remains crucial, this clarity surrounding fiscal policy, the direction of monetary policy, and key investment themes supports a more proactive risk-on strategy.

After some AI-related stocks experienced sharp declines toward the end of last year, AI trading now appears more attractive compared to the "suffocating" highs seen in October. Notably, this pullback has occurred alongside continued strong underlying demand for computing power, tokens, and productivity enhancements.

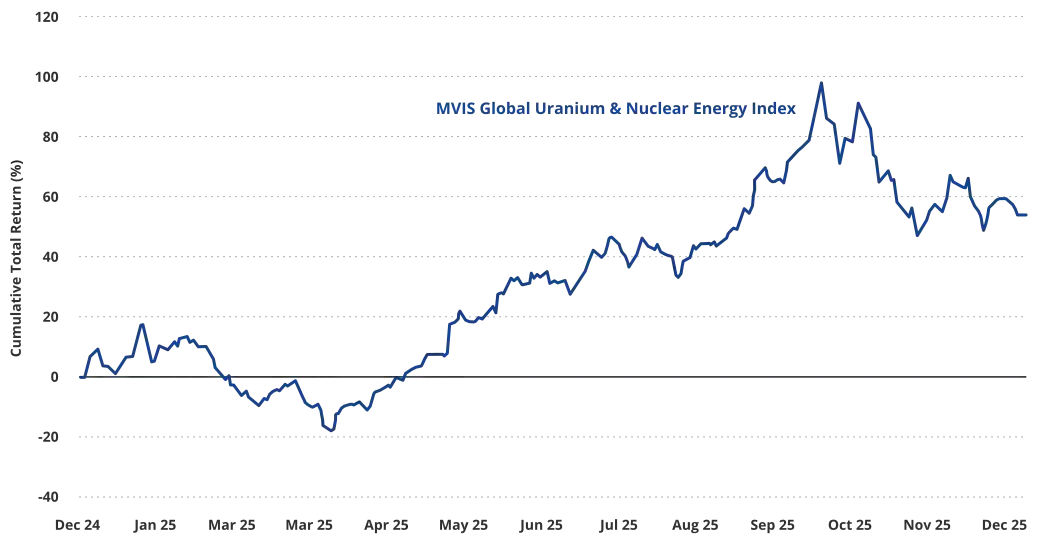

Related topics, such as nuclear energy linked to AI-driven electricity demand, have also experienced significant price adjustments. These adjustments have improved the risk-return profiles for investors with a medium- to long-term perspective.

Future fiscal and monetary policy surprises will decrease.

One of the most important developments for the market is the gradual improvement in the U.S. fiscal position. Although the deficit remains high, its share of GDP has declined from the historic highs seen during the pandemic. This fiscal stabilization helps anchor long-term interest rates and reduces tail risks.

Regarding interest rates, U.S. Treasury Secretary Scott Bessent's characterization of the current rate level as "normal" is significant. Markets should not expect aggressive or destabilizing short-term rate cuts by 2026. Instead, the outlook points toward policy stability, moderate adjustments, and fewer shocks. This is also one of the reasons why market expectations have become clearer.

Nuclear energy stocks experienced a pullback in the fourth quarter:

Source: Bloomberg Data as of December 31, 2025

The business development company is regaining attention.

Business Development Companies (BDCs) had a tough year in 2025, but this correction has created opportunities. With yields still attractive and credit concerns largely priced into the market, BDCs are more appealing now than they were a year ago.

The same applies to the managing companies behind them, such as Ares. The valuations of these companies are currently becoming more reasonable in comparison to their long-term profitability and past performance.

Gold as a Global Monetary Asset

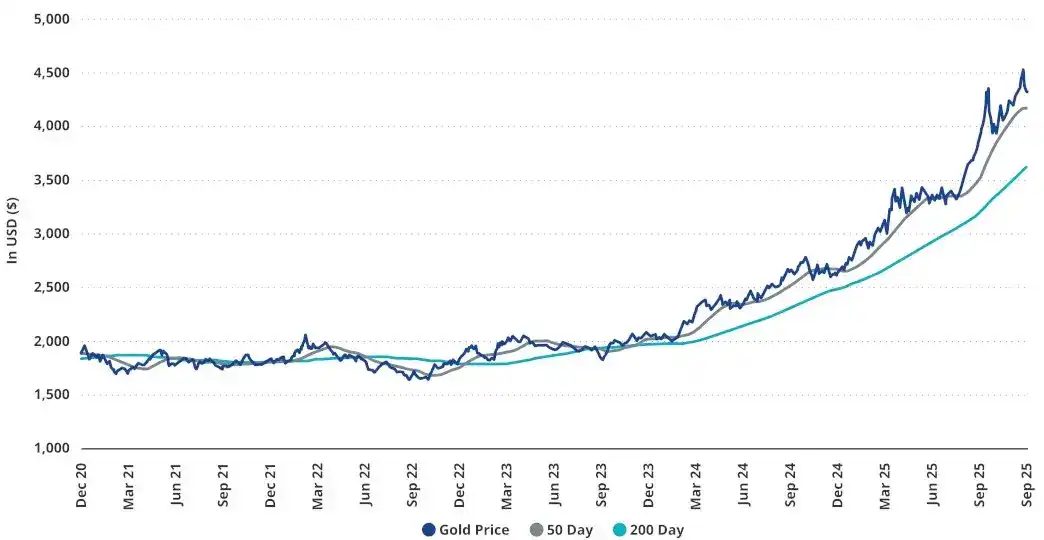

Driven by the demand from central banks and the global economy's gradual move away from U.S. dollar dominance, gold is continuing to re-emerge as a leading global currency. Although from a technical perspective, gold prices appear to be overextended, VanEck views this pullback as a good opportunity to accumulate more. Its structural advantages remain intact.

Gold prices are above the support level, but demand remains strong:

Source: Bloomberg Data as of December 31, 2025

Investment Opportunities in India and Cryptocurrency

In addition to the U.S. market, India remains a highly potential long-term investment destination, driven by its structural reforms and sustained growth momentum.

In the cryptocurrency space, Bitcoin's traditional four-year cycle was disrupted in 2025, complicating short-term signals. This divergence supports a more cautious short-term outlook for the next 3 to 6 months. However, this view is not universally shared within VanEck, as Matthew Sigel and David Schassler hold a more positive outlook on the recent cycle.

Click to learn about BlockBeats' job openings.

Welcome to join the official Lulin BlockBeats community:

Telegram Subscription Group:https://t.me/theblockbeats

Telegram discussion group:https://t.me/BlockBeats_App

Official Twitter account:https://twitter.com/BlockBeatsAsia