Key Insights:

- Uniswap’s Head & Shoulders broke the Neckline at the $7.6 area, and it had the first conviction candle above it.

- UNI was up 26%; What caused this huge pump, as others were up 16%?

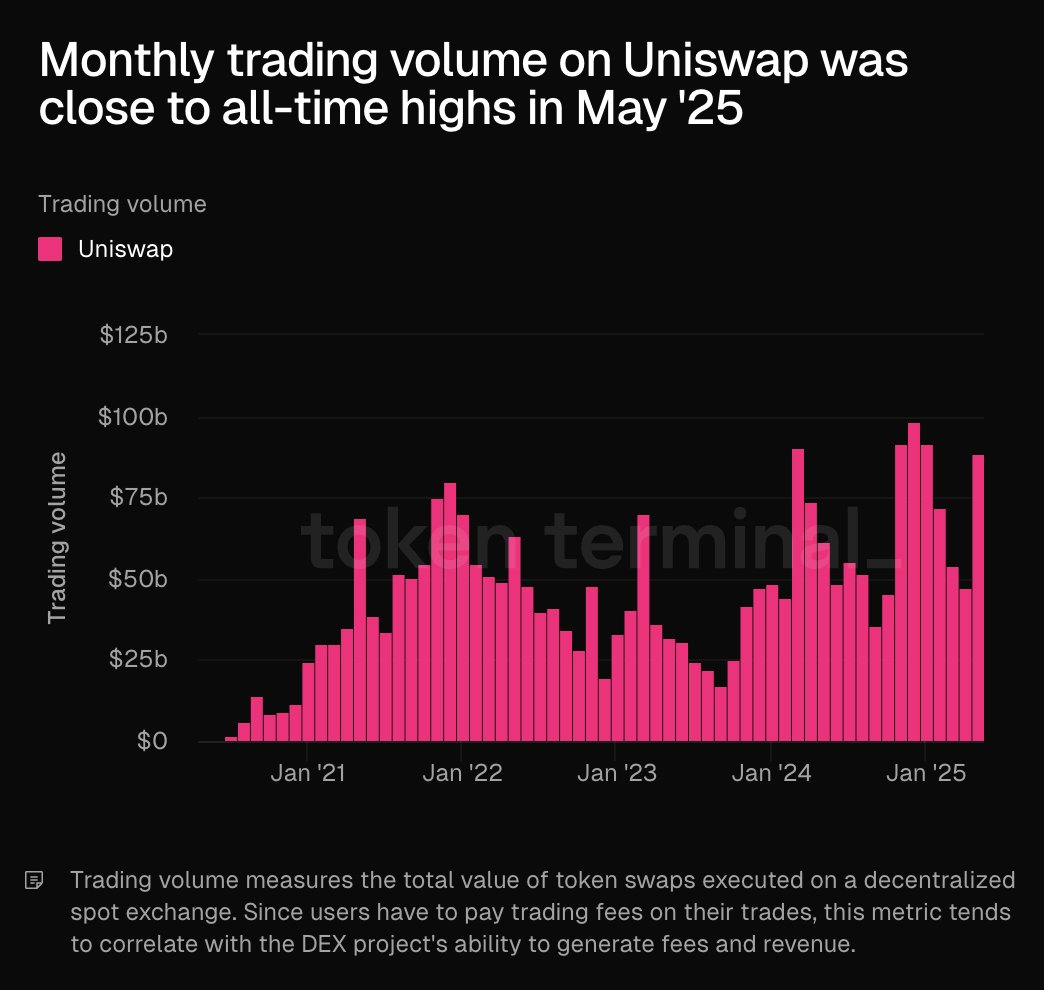

- Monthly trading volume on Uniswap was close to all-time highs as May closed.

After a successful U.S. SEC roundtable on decentralized finance, DeFi tokens exploded following a softer spot on DeFi platforms. Following their massive daily gains, this elicited the feeling “DeFi summer 2.0 loading?” for Uniswap crypto, AAVE, among others.

The SEC Governor announced that DeFi platforms will be exempt from regulatory restrictions. This news drew significant trader interest in UNI and AAVE.

Why Was Uniswap Crypto Price Up 26%?

Following the SEC’s decision, Uniswap crypto price rose by 26%. This showed that other DeFi projects would not be tightly regulated.

As a result, investors became more hopeful. This prompted immediate changes in the market because clear regulations tend to increase investors’ confidence.

Softer regulations could create new opportunities in the DeFi sector. This may attract fresh investment and broader interest in UNI and other tokens. As more people engage, their values could experience significant growth.

With positive regulations, there will be more involvement in the market and better liquidity, and Uniswap may perform more stably. Investor confidence could rise, which could help DeFi start a new revival phase called “DeFi summer 2.0.”

UNI Price Prediction Analysis

Technically, UNI price rose above a key inverse Head & Shoulders neckline at $7.6, indicated by a conviction candle.

This was a bullish signal after Uniswap crypto had accumulated over the past 100 days in this pattern. After the decisive move above the neckline, UNI may reach the first resistance level at $10.

If the level is pushed through, the price may exceed the key resistance at $12. If Uniswap price falls below $7.6, it could signal weakness. This may lead to a retest of the key neckline. The price could then shift back into the accumulation zone.

Uniswap crypto price was confirmed to be in a bullish trend by the Ichimoku indicator’s criteria. The price surged due to strong bullish trends.

It remained above the Kumo cloud and the Conversion and Base price lines. Also, the cloud was thick and green, meaning the market would stay stable and move higher.

Ultimately, the Lagging Span was hanging above the cloud, indicating that the trend was positive for UNI. However, traders must be wary of pullbacks, especially after massive rallies.

However, if these Ichimoku parts were broken and UNI fell below the $7.6 level, this could signal weaker power from the bulls. This would shift the market to bearishness and lower the Uniswap crypto price toward the recent lows.

Uniswap Monthly Trading Volume

Additionally, in May 2025, Uniswap trading volume shot past $100 Billion. This revealed that the market was active and investors were more engaged on the platform.

More people using the platform led to a rise in fees and could help UNI’s value rise. As more people joined, which caused higher trading volume, the demand for UNI could rise and lift its prices.

If the trading stays active and at high levels for a long while, it may increase the chances of quick price drops. Significant increases in trading volume mean speculative trading is happening, which can lead to sharp changes in the market.

A steady rise in Uniswap trading volume could signal bullish strength. This trend suggests growing investor confidence in the market. However, a steep decline in deal activity could likely reduce investors’ confidence and cause the Uniswap crypto price to fall.

The post Uniswap Crypto Pumps 26% In A Day: Will UNI Reclaim $10 Now? appeared first on The Market Periodical.