Key Insights:

- Trump disclosed $57.4 million in crypto income tied to World Liberty Financial.

- He holds 15.75 billion governance tokens, granting him voting rights.

- WLFI raised $550 million; investors include Justin Sun and Web3Port.

Trump’s 2025 ethics filing reveals $57.4 million in crypto income from World Liberty Financial. The former president holds 15.75 billion WLFI tokens, raising fresh questions about political ties to emerging digital finance ventures.

Trump Crypto Earnings Lead Ethics Disclosure Headlines

U.S. President Donald Trump disclosed $57.4 million in income tied to his involvement with World Liberty Financial (WLFI), a crypto-focused company he backs with sons Donald Jr. and Eric.

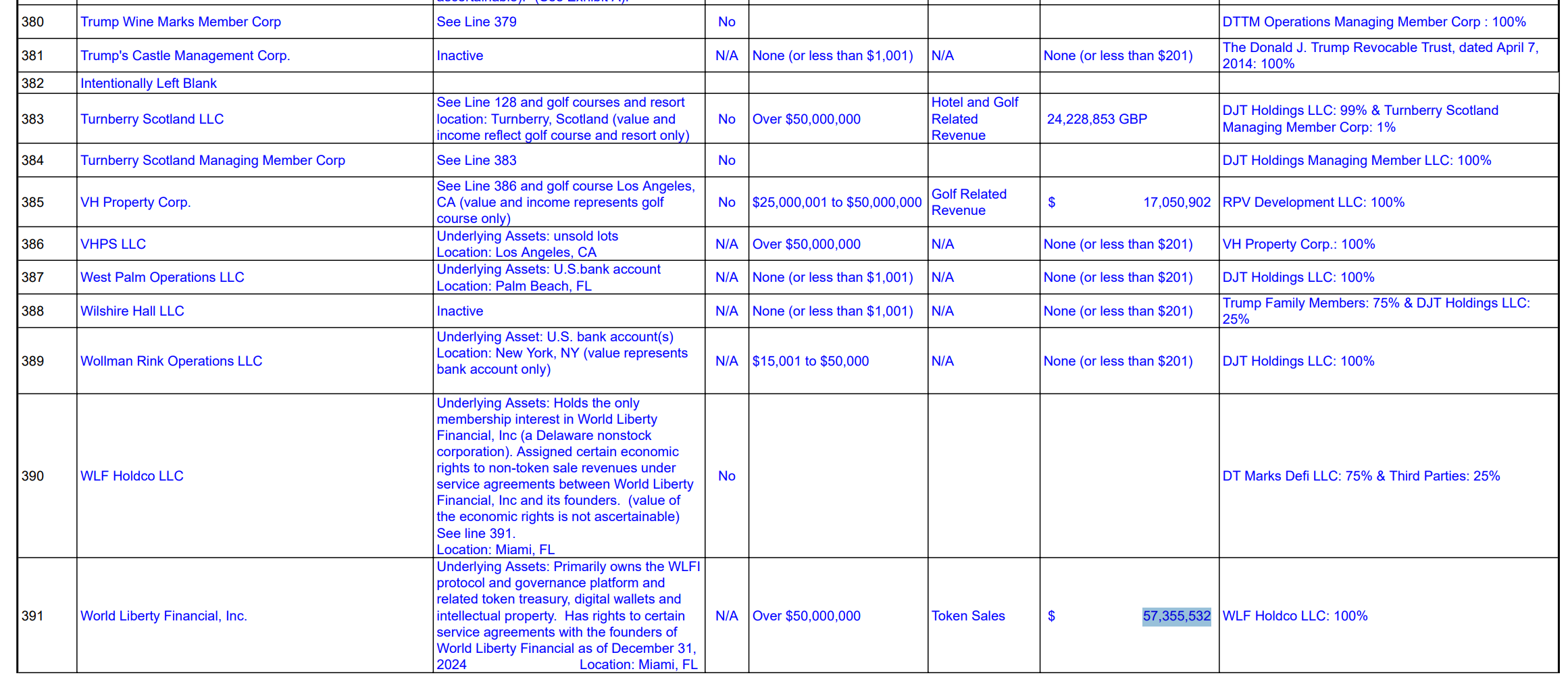

The figure appeared in Trump’s 2025 annual public financial disclosure, filed with the U.S. Office of Government Ethics on June 13. The filing identifies the income simply as “$57,437,927” and links it to WLFI, a digital asset venture launched in Sept. 2024. The document lists governance tokens as part of his holdings, reportedly totaling 15.75 billion units, although it does not clarify how the earnings were realized.

The income could reflect token sales, staking proceeds, or internal accounting valuations. The disclosure form does not provide that level of detail, leaving open the mechanism by which the tokens generated that sum.

Trump Holds Billions of WLFI Governance Tokens

The governance tokens listed in the filing give Trump voting rights within WLFI’s ecosystem. The exact valuation method remains undisclosed. However, the $57 million income line indicates either partial monetization of these tokens or an internal estimate based on their early-round pricing.

World Liberty Financial positioned itself as a DeFi and stablecoin project aiming to disrupt traditional finance. The firm raised $550 million across two public token sales by March 2025. The first brought in $200 million, while the second secured another $250 million.

Justin Sun, the founder of TRON, joined early with a $30 million investment in Nov. 2024. He received 2 billion WLFI tokens at $0.015 each. Web3Port followed in Jan. 2025 with a $10 million contribution. Oddiyana Ventures also invested, though it did not disclose the amount.

At a $0.015 rate, Trump’s 15.75 billion tokens could imply a valuation of over $236 million, though market liquidity and sellability remain uncertain. The filing, however, includes no guidance on current WLFI token price or circulating supply.

Broader Web3 Activity Mirrors Trump’s Crypto Strategy

The WLFI income was not the only crypto-related entry in Trump’s disclosure. The president listed continued involvement in CIC Digital LLC and CIC Ventures LLC, companies tied to previous digital ventures. While income from those entities remained low or inactive, Trump’s digital footprint extends beyond a single initiative.

In previous filings, Trump recorded revenues from NFT collectibles, particularly the Trump Digital Trading Cards collection. The 2025 filing does not show fresh NFT income but confirms that holding companies remain in place.

His earnings also suggest continued monetization from speaking engagements and business partnerships unrelated to WLFI. Still, the crypto venture produced the highest reported single source of income in the entire disclosure.

SEC Filing Adds Context to Trump’s Digital Holdings

Earlier this year, Trump Media’s Bitcoin treasury registration received the green light from the U.S. Securities and Exchange Commission. The SEC declared the Bitcoin holding registration “effective,” setting a legal framework for storing BTC within the Trump Media ecosystem.

This coincides with a broader narrative around Trump’s digital asset strategy heading into the 2025 campaign cycle. His sons, Donald Jr. and Eric Trump, have also actively supported the WLFI initiative, further entrenching the Trump family’s stake in the crypto market.

According to the OGE form, Trump certified that all information in the document was “true, complete, and correct” to the best of his knowledge. The form will now undergo review by the Office of Government Ethics and remains available to the public through DocumentCloud.

What’s Next for WLFI and Trump Crypto Ventures?

While the ethics filing puts a spotlight on WLFI’s early-stage wealth generation, the company has yet to release detailed whitepapers, smart contract audits, or governance frameworks publicly.

With Trump’s earnings now tied directly to the crypto asset’s future performance, market participants may view the venture through a more political lens. Investors and regulators will likely scrutinize further developments—especially if WLFI pushes for wider adoption or token listing.

As the election cycle intensifies and the crypto market matures, Trump’s financial and ideological ties to blockchain ventures will continue drawing attention.

The post Trump Crypto Holdings Yield $57M, Ethics Filing Confirms appeared first on The Market Periodical.