Trove once had a perfect narrative.

As a Perp DEX targeting collectibles and RWA (Real World Assets), Trove claims to be able to convert illiquid "cultural assets"—such as Pokémon cards, CSGO skins, and luxury watches—into tradable financial assets, providing collectors with a hedging platform.

However, within just ten days, the Trove team staged a farce through a series of astonishing moves, incidentally emptying the pockets of onlookers.

Bait

At the end of last October, Trove founder @unwisecap talked extensively about "Everything Can Be a Perpetual Future" in several posts, and announced that Trove would be built upon HIP-3, greatly exciting the community.

In the following month, Trove announced partnerships with Kalshi and CARDS (Collector_Crypt) in succession, and received official endorsements in the form of replies from these two well-known projects. (P.S. As of the time of writing this article, Kalshi had already severed ties, removing its reply from Trove's official Twitter post.)

In mid-December, Trove announced an investment of over 20 million USD to acquire 500,000 HYPE tokens to meet the integration requirements of HIP-3. Shortly after, the testnet points program launched, and the platform's trading volume exceeded 1 million USD within two weeks. Everything was moving in the expected direction—until...

Textbook on Insider Trading

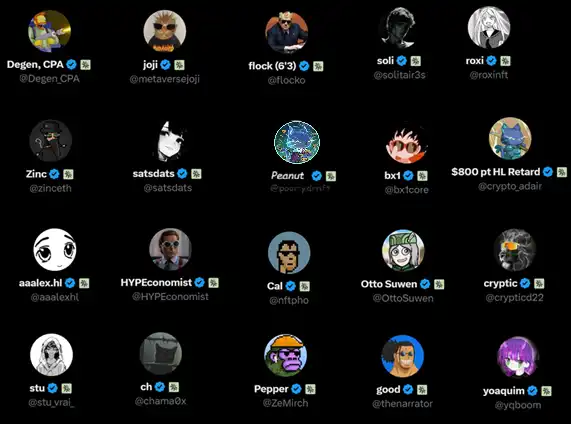

On January 6, Trove suddenly announced an ICO with a 20 million dollar FDV (Fully Diluted Valuation), using a "oversubscription" model for the public sale and offering priority allocation to token holders. With a concentrated promotional effort led by a group of KOLs (Key Opinion Leaders) wearing Trove badges, Trove successfully raised 11.5 million dollars, achieving 4.6 times oversubscription.

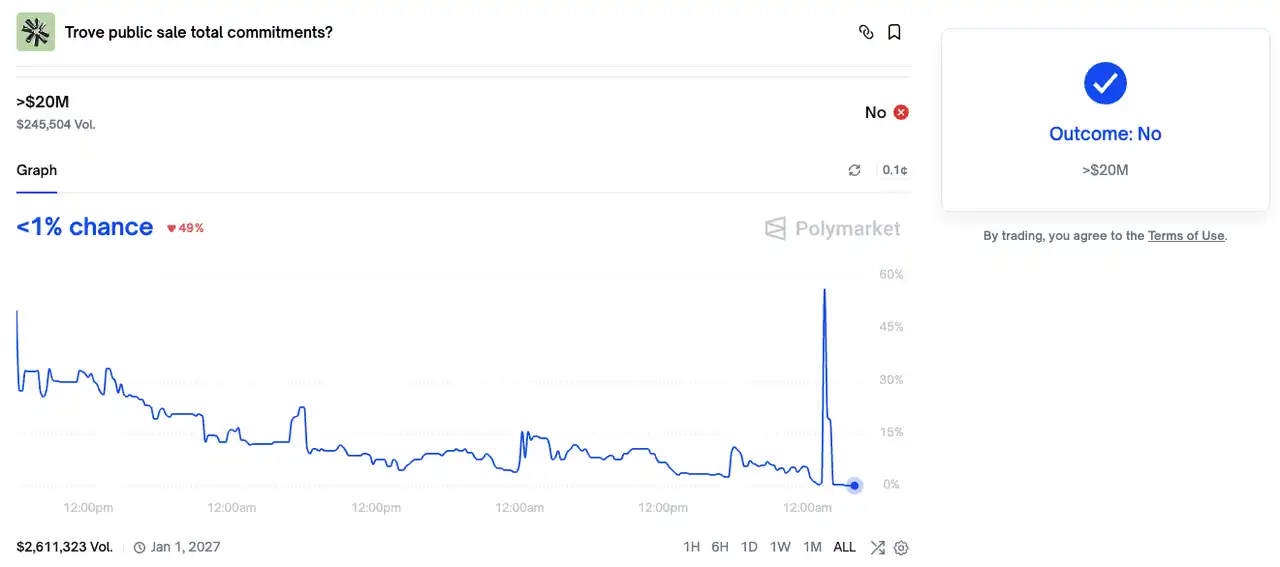

At this point, with less than two hours remaining until the ICO deadline, the probability on Polymarket for the prediction market on "Trove ICO total fundraising exceeding $20 million" has nearly dropped to zero.

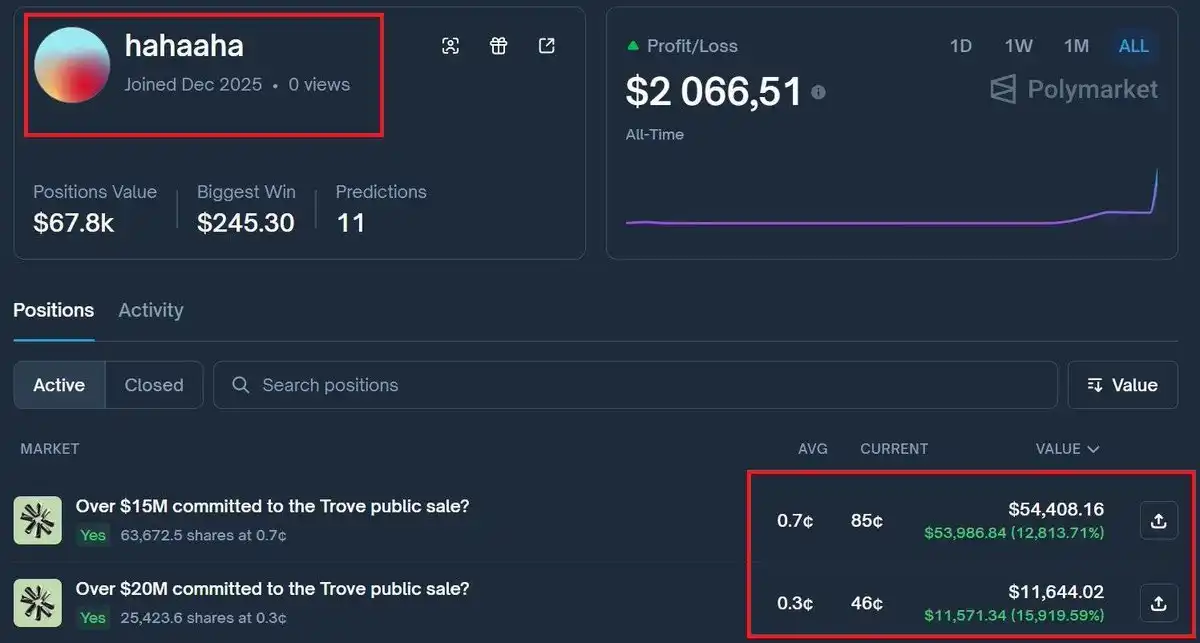

The real drama then began. The team suddenly broke the rules and announced that the ICO period would be extended by five days to ensure fair distribution. The "YES" option on Polymarket instantly surged from a low to nearly 60%. Clearly, insider capital had moved ahead of time; on-chain data showed that specific wallets had placed precise bets before the announcement and quickly exited after the price skyrocketed.

Perhaps believing that the liquidity of the prediction market was insufficient to satisfy their appetite, amid community doubts and criticism, the Trove team seized the opportunity to stage a "beacon fire trick on the feudal lords"—they announced the withdrawal of the extension decision and proceeded to end the ICO according to the original plan.

Along with this announcement, the corresponding betting market was immediately settled at zero. Data from Polymarket shows that certain wallets accurately placed bets before the news was released and continued to profit from subsequent reversals.

The Great Retreat

On January 17, Trove suddenly announced that it would abandon Hyperliquid and instead launch a token on Solana. For a project that had consistently raised funds under the banner of the Hyperliquid ecosystem, this move was akin to pulling the rug out from under the project.

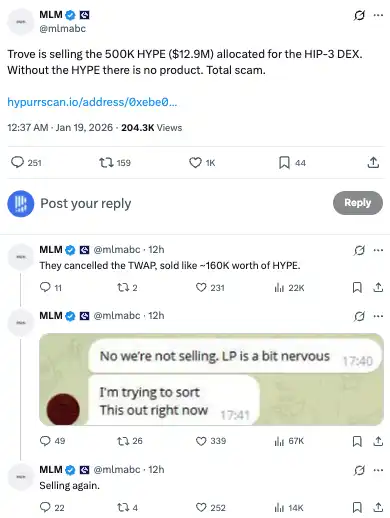

At the same time, on-chain detective MLM caught the Trove team using the timed sell function to attempt selling half of their HYPE tokens within 40 minutes.

Choosing to sell ten million worth of tokens in 40 minutes during the most illiquid weekend— the Trove team is really desperate.

Faced with doubts, the Trove team's explanation seemed weak and unconvincing: "The investors felt nervous and decided to exit." However, on-chain transaction records showed that these selling activities were happening at the same time the team publicly denied "selling tokens."

This hypocrisy has completely shattered the trust foundation of the community. As trust collapses, more secrets are being exposed.

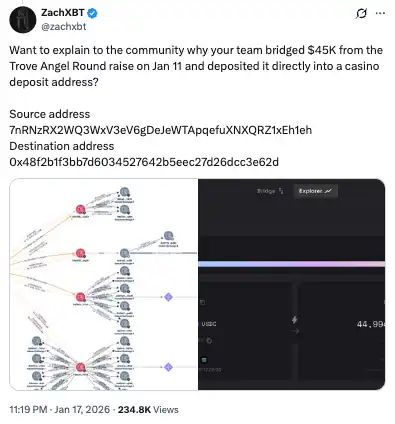

Well-known on-chain detective ZachXBT revealed that the Trove team paid up to $45,000 in marketing fees to @TJRTrades, directly transferring the funds to the KOL's菠菜 (gambling) website recharge address.

KOL @hrithikk stated that the Trove team not only provided KOLs with generous marketing funds, but also privately offered ICO quotas at a valuation as low as $8.5 million, with discounts of up to 60%, along with substantial airdrop rewards. Currently, Trove is still selling shares at low prices and has asked him more than five times if he could invest in Trove.

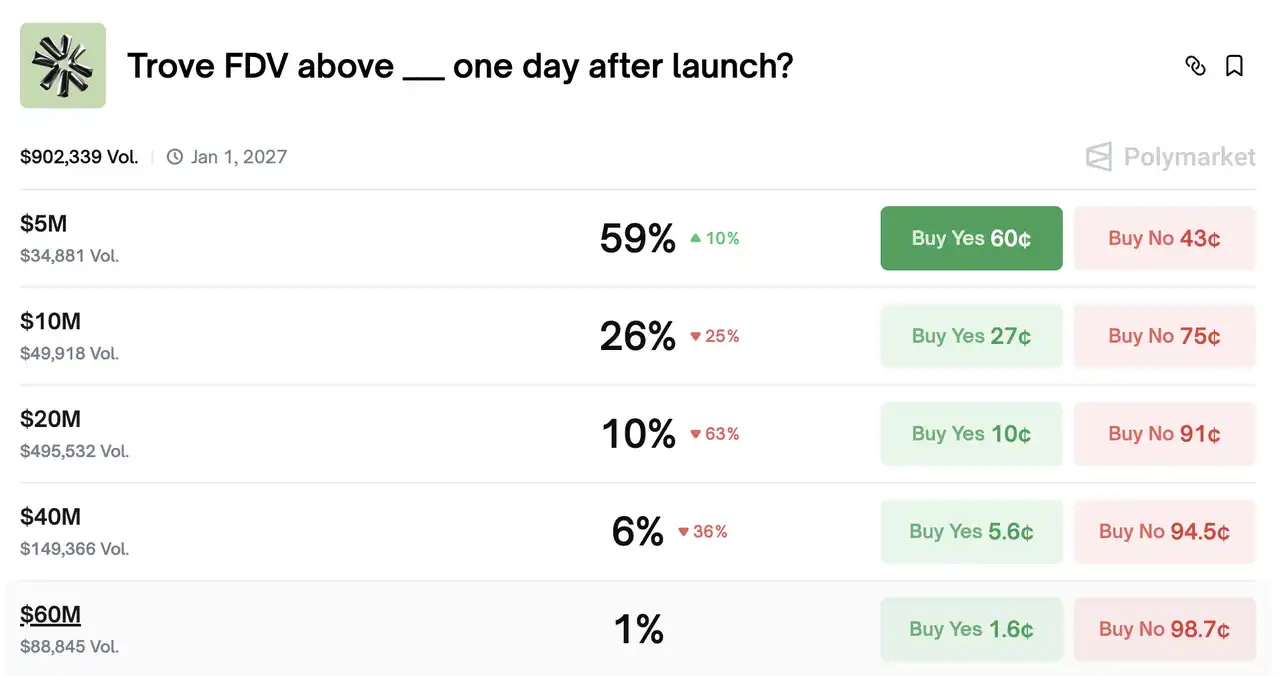

Trove will have its Token Generation Event (TGE) at 1 AM Beijing Time on January 20th. According to the market data on Polymarket, the TROVE token has a 90% probability of trading below its presale valuation.

The good news is that this farce may not end with a simple "soft rug." Trove once claimed on its official website to comply with the EU's MiCA regulations. Now, facing allegations of false advertising and potential fraud, angry investors have every reason to file civil lawsuits based on MiCA provisions.

The bad news is that chat screenshots disclosed by KOLs show that team members appear to be from Iran.

The Hyperliquid ecosystem is known for its strong community cohesion, but the atmosphere of excessive trust also provides fertile ground for scammers.

Click to learn about BlockBeats' job openings.

Welcome to join the official Lulin BlockBeats community:

Telegram Subscription Group:https://t.me/theblockbeats

Telegram discussion group:https://t.me/BlockBeats_App

Official Twitter account:https://twitter.com/BlockBeatsAsia