Organize & Compile:Deep Tide TechFlow

Key Points Summary

Tom Lee is the co-founder and head of research at Fundstrat Global Advisors, chairman of the Ethereum-focused fiscal company Bitmine Immersion, and chief investment officer of Fundstrat Capital, which manages the rapidly growing Granny Shots ETF series (with AUM currently reaching $4.7 billion).

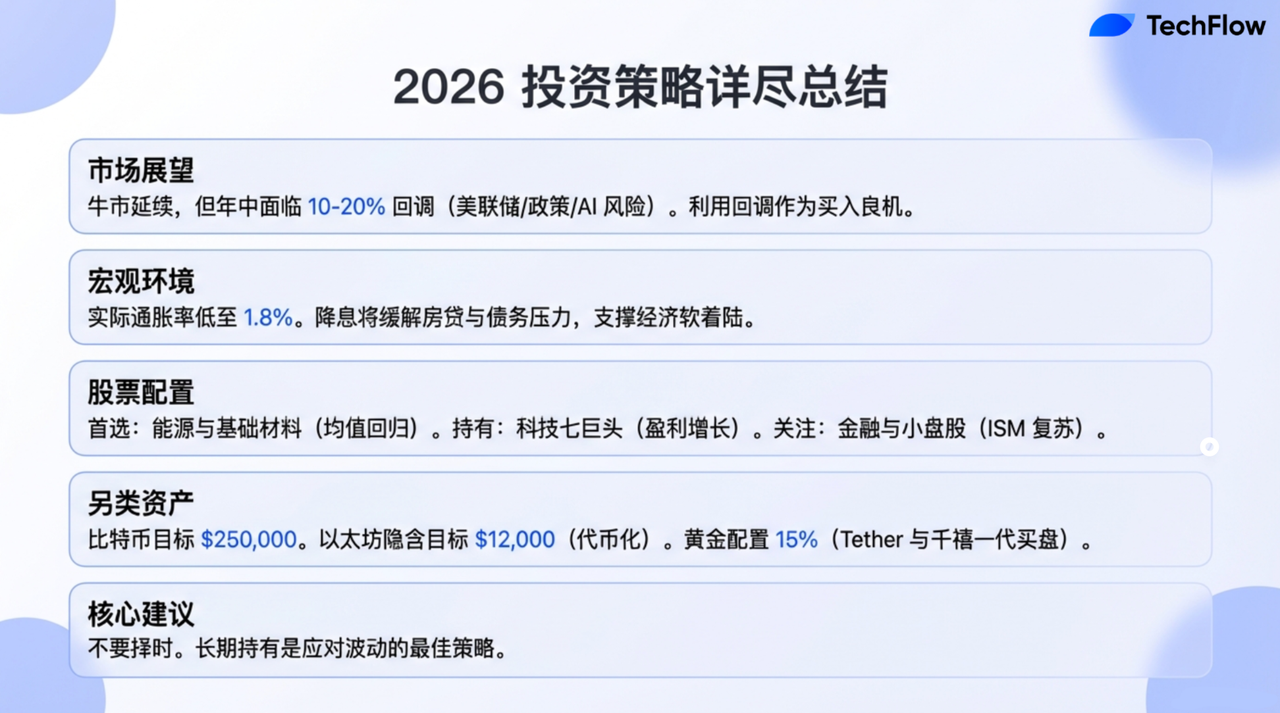

In this episode, Tom shared his market insights. He believes the bull market that began in 2022 is still in its early stages. Although the market may experience a sharp correction this year that feels like a bear market, he expects a strong rebound in the stock market by 2026. He pointed out that investors need to address three major changes this year: the new Federal Reserve policy, a more interventionist White House, and the ongoing repricing of the artificial intelligence (AI) boom. At the same time, he noted that while he remains optimistic about the "Magnificent Seven" tech giants, cyclical sectors, energy, basic materials, financials, and small-cap stocks may become more attractive investment areas.

The program also explored topics such as gold, cryptocurrencies, and demographic trends. Tom believes gold is currently undervalued and revealed that Tether may be one of the largest private buyers of gold at this stage. He also pointed out that millennials are rediscovering the value of gold, while younger generations tend to favor cryptocurrencies. He argued that Bitcoin remains "digital gold," while Ethereum is the cryptocurrency he is most optimistic about. He also analyzed how the deleveraging event in October last year caused cryptocurrencies to deviate from the price trajectory of gold, and predicted that Bitcoin and Ethereum will experience significant price increases as banks and asset management companies accelerate their adoption of blockchain technology.

In addition, Tom also mentioned Bitmine's $200 million investment in MrBeast's Beast Industries. He believes that MrBeast is one of the most influential media assets of this generation and stated that financial education and Ethereum are expected to become core components of future products, reaching billions of users worldwide.

Key Points Summary

- Bitcoin will reach a new high this year, hitting $250,000.

- Tether has become the largest private buyer of gold.

- The magnitude of this pullback could be around 10%, but even a 10% correction can feel like a bear market.

- Every market correction is a great opportunity to buy.

- The sectors we are most optimistic about this year are energy and basic raw materials.

- The banking industry has started to embrace the efficiency improvements brought by blockchain technology.

- Silver and copper may perform well this year. As an industrial metal, copper is closely related to the ISM index. If copper prices rise, I believe it will drive the performance of basic materials and raw material stocks.

- When we look back at the performance in 2026, we will find that it represents a continuation of the bull market that began in 2022.

- There are several particularly critical shifts in the market. The first is the new leadership at the Federal Reserve; the second is the policy direction from the White House; and the third is the market's ongoing attempt to assess the value of artificial intelligence (AI). Taken together, these three factors could lead to a "bear market"-style correction.

- Last year, investors often overreacted in the face of escalating tariff negotiations and uncertainty. This year, the market's response is expected to be more rational, with the anticipated reaction magnitude reduced by half.

- The Federal Reserve's interest rate cut can actually alleviate the economic pressure for many Americans.

- If the Federal Reserve Chair is replaced or if several more interest rate cuts occur this year, it would be positive for the stock market.

- Oil prices may remain weak or fluctuate in the short term, but factors such as the development of data centers and the shift away from alternative energy sources will drive oil prices higher in the future. Therefore, energy stocks can perform strongly.

- Bitcoin is digital gold, but the group of people who believe in this theory does not overlap with the group of people who own gold.

- The adoption curve of cryptocurrencies is still higher than that of gold, because more people own gold than own cryptocurrencies.

- I think the most important advice I can give to investors is not to try to time the market. The people who truly make money are those who invest for the long term.

- Cryptocurrency is being embraced by the younger generation—it has already become a part of their lives.

2026 Market Outlook: A Correction in a Bull Market

Wilfred Frost:Welcome to the *Master Investor* podcast. I'm Wilfred Frost. Today's guest is someone you all know very well—Tom Lee. Tom is a co-founder and head of research at Fundstrap Global Advisors, as well as chairman of the Ethereum asset management company Bitmine Immersion. He also oversees the Granny Shots ETF, a fund focused on technology and innovation investments. It's a great honor to have you here in London for our show.

It is early 2026, Tom. I see that you have made very accurate predictions about this year's market trends:The market will experience an initial rise at the beginning of the year, followed by a significant pullback, and then a new round of rebound toward the end of the year. Does this description accurately reflect your outlook for the market in 2026?

Tom Lee:

I thinkWhen we look back on the performance in 2026, we will find that it is a continuation of the bull market that began in 2022.It also demonstrates stronger economic resilience. However, I believe the market needs to face several important transitions, two of which are particularly critical.The first is the new leadership of the Federal Reserve.The market usually tests the policies of a new Federal Reserve Chair. This process, which includes identifying and confirming the policies and the market's response, could trigger a correction.The second factor is the policy orientation of the White House.In 2025, the White House's policies have had a significant impact on the technology consulting and healthcare sectors. In 2026, more industries, sectors, and even countries may become the focus of policy attention. This shift has introduced greater uncertainty, as evidenced by the recent rise in gold prices, which reflects market concerns over risk. These two factors could potentially lead to a market correction.

Wilfred Frost:You mentioned two factors. Are there any other possible influences?

Tom Lee:

Yes, and alsoThe third factor is that the market is still trying to assess the value of artificial intelligence (AI).Although we believe AI remains a strong market driver, there are still many questions in the market regarding its long-term potential, energy demands, and the capacity of data centers. Before these issues are clarified, the market may need other strong supporting factors, such as the recent rebound in the ISM manufacturing index and a potential recovery in the real estate market as interest rates decline. However, these shifts also bring uncertainties. Therefore, I believe the combination of these three factors could lead to a "bear-market-style" correction.

Wilfred Frost:So, do you think the magnitude of this pullback will be a 20% correction from peak to trough, or a bit smaller?

Tom Lee:

It might be around 10%. But even a 10% pullback can feel like a bear market.Of course, it may also be achieved.15% or 20%This could cause the market to pull back to its initial levels at the beginning of the year. Although we had a very strong start to the year, I expect the market may experience a pullback at some point, but I still believe that...The final market performance this year will be very strong.

Wilfred Frost:We spoke in August last year, and at that time you mentioned that we were at the beginning or very close to the beginning of a 10-year bull market. Do you still hold that view? In other words, once the market has gone through this correction, would you consider it an excellent buying opportunity?

Tom Lee:

I have always believed that,Every market correction is a great opportunity to buy.Last year, the market declined on April 7th due to tariff issues, and it turned out to be one of the best times to buy stocks over the past five years. At that time, many stocks hit new all-time highs and experienced a very strong rebound. Therefore, I believe that if the market does indeed correct as we anticipate this year, it will present a very good buying opportunity.

Drivers of a Long-Term Bull Market

Wilfred Frost:Last August, you mentioned that we might be at the beginning of a new 10-year bull market, and at that time, you believed the reasons behind it included:A surge in the working-age population, the younger generation inheriting substantial wealth, and the United States leading in many innovative fields (especially artificial intelligence and blockchain)In a central positionAre you still confident about these three long-term factors?

Tom Lee:

Yes, in fact, I think these factors are now becoming clearer.

First, the United States does have a favorable demographic trend,This stands in sharp contrast to the declining labor force in many countries.

Secondly, in terms of wealth inheritance,There is an increasing amount of discussion indicating that Generation Z, Millennials, and Generation Alpha will inherit significant wealth during their lifetimes. While this phenomenon may exacerbate wealth inequality, it also means that the future will see a number of very wealthy young individuals, while others gradually build up their personal wealth through their own efforts.

About Artificial IntelligenceI believe the evidence that we are moving toward superintelligence is growing. Progress in this area is happening at a very rapid pace, especially in robotics and the integration of robots with other technologies, all of which will continue to drive the United States' advantages. As for blockchain, its impact has already extended beyond companies like BlackRock and Robinhood. For example, Jamie Dimon (CEO of JPMorgan) recently publicly stated that he believes blockchain can indeed solve many problems in financial services. I think...The banking industry has started to embrace the efficiency improvements brought by blockchain technology.

Wilfred Frost:You still firmly believe in the long-term bull market outlook and think that the market will recover after a pullback.Then, how can we better determine when this initial pullback will occur?I recently listened to your interview on CNBC, where you mentioned that markets often peak on good news, which sounds somewhat counterintuitive.Do we now have such good news indicating that the short-term market may have reached its peak?

Tom Lee:

This question is difficult to answer, and currently, some signs are based on experience. At present, our institutional clients have not shown a very optimistic market outlook. Before both the public and institutional investors have adjusted their positions to the point where good news no longer drives the market upward, I believe...The stock market still has room to rise.This is also why a strong performance in the first week of January is a positive signal, and it appears we may end the month with positive returns, indicating a strong start for the market this year.

Margin debt is one indicator we can pay attention to. We have been tracking margin debt on the New York Stock Exchange, which is currently at a historical high, but the year-over-year growth rate is only 39%. Typically, to reach a partial market peak, the year-over-year increase in margin debt needs to reach 60%. Therefore,There may also be a further acceleration in the use of leverage, which could signal a local peak in the market.

Macro: Trade War and the Federal Reserve

Wilfred Frost:Let's talk about some macro-level factors.First, let's talk about trade issues,I remember that you mentioned last year the impact of the trade war wasn't as bad as expected. However, more tariff-related threats emerged over the past weekend, this time involving Greenland and targeting both the UK and the EU. It seems the UK might compromise, while the EU may take retaliatory measures.Would this worry you in the short term?

Tom Lee:

There are some concerns, but they are not particularly serious. I think...Last year, investors often overreacted in the face of escalating tariff negotiations and uncertainty, leading to significant market declines.HoweverThe market's response this year is expected to be more rational, with the anticipated magnitude of reaction halved.However, uncertainties still remain, such as how the Supreme Court will rule on the tariff issue. If the ruling is unfavorable to Trump, it might weaken the United States' negotiating position, and the White House could take more extreme measures, which could lead to even greater uncertainty. Nevertheless, I recently read some news suggesting that some people believe the Supreme Court might support Trump's policies. Therefore, the final outcome is still uncertain at this point.

Wilfred Frost:Another important macroeconomic issue is the Federal Reserve.When we talked in August last year, your view at that time was that a Fed rate cut would be good for the market, but you questioned whether the Fed's independence would be bad for the market.However, I feel that you didn't pay particular attention to the seriousness of the intervention at that time. How do you view this issue today?

Tom Lee:

I think the situation remains similar.The Federal Reserve does face some implicit threats, including investigations by the Department of Justice.However, I believe there are still some voices within the White House emphasizing...Do not completely undermine the independence of the Federal Reserve.Market history tells us that,The Federal Reserve remains one of the most important institutions globally, and undermining its credibility and independence could bring significant uncertainty.

We also know that the current term of Federal Reserve Chair Jerome Powell will end this year. So the current situation is a bit like "waiting for time to pass," since we know a new Federal Reserve Chair will be appointed.Once the new chairman is in place, I think the White House may feel satisfied.As for the next Federal Reserve Chair, current predictions are constantly changing. Now it seems that Hasset's chances have decreased, while WH and Rick Reer are becoming more likely candidates. In addition, many people generally expect this year's interest rate cuts to be somewhat more aggressive than what the economic data suggest.

Wilfred Frost:So, once the Federal Reserve Chair is replaced or if several more interest rate cuts are made this year, would this ultimately be good for the stock market?

Tom Lee:

Yes, I think so.Good news for the stock marketSince 2022, inflation has been the focus of market attention, partly because the Federal Reserve has been actively combating inflation and aims to maintain its credibility through tightening policies. However, based on economic data, I believe that...The actual inflation level is lower than the published data.For example, the "real inflation" is shown as 1.8%, and the median inflation is also 1.8%. Currently, the main factor keeping inflation high is housing costs, but home prices are actually declining. However, the calculation of housing costs in the Consumer Price Index (CPI) is lagging. Therefore, I believe the Federal Reserve has room to cut interest rates. If housing affordability becomes an issue, we need to address mortgage rates, and rate cuts can help alleviate this problem. In addition, burdens such as consumer installment debt can also be reduced through rate cuts. So I think,The Federal Reserve's interest rate cut can actually alleviate the economic pressure for many Americans.

Sector Configuration: Energy, Raw Materials, and Technology

Wilfred Frost: Let's talk about how investors should allocate their portfolios across sectors. Have the largest stocks, such as the "MAG 7" or "MAG 10," become overvalued? Are they no longer suitable investment choices for 2026?

Tom Lee:

We remain bullish on the "MAG 7" because we are confident in their earnings growth.As long as these companies maintain their growth, their performance should outperform the market. However,The sectors we are most optimistic about this year are energy and basic raw materials.At the beginning of last December, we identified these two sectors as our preferred investment areas. This was partly based on the mean reversion investment logic—energy and basic materials had performed very poorly over the past five years, and historical data from the past 75 years suggests that such a significant downturn often signals a turning point. Additionally, some current geopolitical factors are favorable to these two sectors.

I believe the ISM index may rise back above 50 this year. Combined with the Federal Reserve's interest rate cuts, this suggests that the industrial sector, financial sector, and small-cap stocks could perform well. Therefore, although we like the "MAG 7," cyclical sectors might be more interesting investment choices this year.

Wilfred Frost: Let's start by talking about the energy sector. I remember you once said that you are not optimistic about short-term oil prices, but you are bullish on energy stocks.

Tom Lee:

You're right. I understand that,The movements of oil prices and energy sector stocks are not always correlated.Part of the reason is that the prices of energy stocks reflect expectations of future oil prices. I think...Oil prices may remain weak or fluctuate in the short term, but factors such as the development of data centers and the shift away from alternative energy sources will drive oil prices higher in the future. Therefore, energy stocks can perform strongly.

Wilfred Frost:As for the basic raw materials sector, especially the parts related to metals, their commodity prices have already experienced an incredible surge. Perhaps we can discuss this further in conjunction with cryptocurrencies later.

If metal prices adjust, will these stocks perform poorly? Does your forecast depend on the stability of metal prices such as gold, silver, and copper?

Tom Lee:

Yes,If the prices of gold, silver, and copper experience negative growth this year, the investment logic for the basic raw materials sector may not work.However, we believe that although gold has already experienced a significant price increase,Silver and copper may perform well this year. As an industrial metal, copper is closely related to the ISM index. If copper prices rise, I believe it will drive the performance of basic materials and raw material stocks.

Wilfred Frost: The financial sector was one you were very bullish on last August, and your prediction proved to be extremely accurate. These stocks have performed exceptionally strongly, and looking at their charts now, it's almost hard to believe how much they've risen. Do you still maintain a positive outlook on these stocks? Their price-to-book ratios are no longer cheap.

Tom Lee:

Yes, they are indeed not cheap anymore, but I believe the business models of these companies are being redefined in a positive way. Banks are investing heavily in technology and artificial intelligence (AI), so they will be the main beneficiaries in the era of super intelligence. The biggest expense for banks is employee salaries, and I think in the future banks can reduce their reliance on employees, which will improve their profit margins while also reducing the volatility of their earnings. I think...Banks will be revalued, becoming more like technology companies.When I began studying banks in the 1990s, banks were typically valued at a price-to-book ratio of 1 times or a price-to-earnings ratio of 10 times. Now, I believe they should command a valuation with a premium to the market.

Wilfred Frost: I'd like to talk more specifically about tech stocks and AI-related stocks. You still have a positive outlook on this sector, and your predictions over the past 15 years have been very accurate. However, you mentioned that only 10% of AI stocks will be good investment choices over the next decade, which surprised me a bit. But you're still optimistic about the field, right?

Tom Lee:

Yes, I think this is a common phenomenon in any rapidly growing field. For example, looking back at the internet industry, if we examine the stock pool in 2000, which was 25 years ago, only 2% of the companies ultimately survived. However, the returns generated by these 2% of companies far exceeded the losses from the other 98%, and the overall performance still significantly outperformed the S&P 500 index. Therefore, I believe that in the AI sector, although more than 90% of stocks may ultimately underperform, the successful investments will compensate for—and even surpass—the losses from the rest.

Companies going public today are often in more mature, later stages, but this seems to be changing. I believe this is the first time we are seeing an increasing number of companies showing interest in going public, not only through IPOs but also through SPACs (special purpose acquisition companies). In addition, in the alternative investment space—such as venture capital, private equity, and private credit—investors (limited partners, or LPs) have not been receiving significant returns. As a result, capital is shifting from alternative investments to public markets, which is driving more companies to enter the public market. However, in the past 12 months, I have seen many public company stocks perform very strongly, so I believe there are still many opportunities in the market.

Wilfred Frost:Regarding mega-cap companies and large-market-cap stocks, the valuations of these companies are very interesting. In most cases, their valuations are justified because of their high growth rates. I heard you mention a point in another podcast that impressed me, which is thatThese companies may gradually evolve into consumer goods-like companies.thus achieving a premium valuation. This perspective makes me wonder if Warren Buffett noticed this earlier than we did, for example, in the case of Apple.Is this your view of these mega-cap companies? For example, even if Nvidia's growth slows, its valuation could still remain stable?

Tom Lee:

Yes, the audience can look back at Apple's example. Apple's analysts have consistently regarded it as a hardware company since its IPO in the 1980s. For many years, they believed Apple's valuation should not exceed a 10 times price-to-earnings ratio. However, Apple gradually built a complete service business ecosystem and a user retention model, proving that it is more than just a hardware company. I remember during 2015 to 2017, when I met with some institutional investors, they still insisted that Apple was a hardware company, but today Apple's valuation has completely changed.

I believe people are now viewing Nvidia in a similar way, seeing it as a cyclical hardware company, and thus only giving it a meager valuation of 26 times earnings. In reality, however, Nvidia is a company with high visibility into future profits, yet its valuation is only half that of Costco. I think these stocks have significant potential for further valuation increases.

Wilfred Frost: If the macroeconomic outlook turns out to be worse than expected, then when the market experiences the pullback you predict—such as a 20% decline in the S&P 500—will these stocks decline less, like consumer staples companies, or will they still behave as high-volatility growth stocks and fall more than the market?

Tom Lee:

This is a good question. During a market correction,Usually, the ones affected first are the crowded trades.(TechFlow Note: Crowded trades usually refer to certain assets or stocks that are heavily concentrated in the holdings of a large number of investors. This situation can make these assets more sensitive to market fluctuations, especially during market corrections. When market sentiment turns pessimistic, investors often rush to reduce their positions, thereby exacerbating the price declines of these assets.) Because investors need to reduce risk, the "MAG 7" as a heavily held asset could be impacted. On the other hand, when investors feel anxious, they may turn to the "MAG 7" for safety. Therefore, I believe non-U.S. stocks may be the part that experiences a larger decline during a correction, as non-U.S. stocks significantly outperformed U.S. stocks last year. If trade tensions escalate or global economic outlooks become uncertain, the correction in non-U.S. stocks could be more pronounced.

ETF Product: Granny Shots

Wilfred Frost: Let's talk about some of your recent success stories, such as "Granny Shots," which, as I mentioned earlier, is your ETF or a series of ETF products. When we discussed this last August, the AUM of these ETFs was between $200 million and $250 million, and it has now grown to $450 million.

Tom Lee:

Yes, the total size has already reached $4.7 billion, distributed across three ETF products. Granny GRNY is the largest one. Granny J is a small- and mid-cap stock ETF launched in November last year, with an asset size of approximately $355 million currently. The Granny ETF for income-oriented investors, which is the income-generating version, paid its first dividend in December last year. This usually drives asset growth because it provides a clear yield. The target yield is about 10%, and the product's current asset size is approximately $55 million.

Wilfred Frost: Is now a good time to invest in small-cap stocks or income-generating products rather than traditional products for the coming year?

Tom Lee:

I'm not the type of person who likes to try "market timing." For example, in January last year, Mark Newton warned of a potential market pullback, but the market actually dropped far more than expected, by 20%. Nevertheless, we still advised investors to remain fully invested, and in the end, they recovered their losses by July.

I believe that small- and mid-cap stocks have been weak for a long time, and even if there is a pullback, it won't change the fact that they could experience a strong performance cycle over the next five to six years. Therefore, I still choose to hold these stocks.

Of course, if the overall market declines, the Granny ETF won't rise. Therefore, I believe investors who purchase these ETFs need to be aware of this. However, these ETFs have selected the strongest companies related to the most important themes, so they should perform better during market corrections and potentially stronger during market recoveries.

Gold and Cryptocurrency

Wilfred Frost: Let's first talk about gold, and then we'll discuss cryptocurrencies. What do you think are the reasons for gold's outstanding performance last year?

Tom Lee:

I believe there are some obvious reasons and some less obvious reasons why gold performs well. The obvious reasons include:First, the current investment environment features greater political and geo-political uncertainties.Wars around the world, as well as the U.S. president, who has performed well economically but has exacerbated global trade uncertainty and fragmentation.Second, central banks around the world have generally adopted accommodative policies, and the United States has finally entered an easing cycle, including ending quantitative tightening (QT). These factors have all provided support for gold.

As for less obvious reasons,Firstly, Tether (the largest stablecoin provider in the U.S.) has become the largest private buyer of gold.To the best of my knowledge, each Tether stablecoin unit is fully collateralized by government bonds. They generate returns through these assets and use the additional gains to purchase gold. I believe Tether has become one of the largest net buyers since last July.

Wilfred Frost: When you say "believe," is this based on solid data? How does Tether's purchase volume compare to the large amount of gold recently purchased by various central banks?

Tom Lee:

Yes, we have indeed seen the relevant data. I can't specify the exact scale, but I believe only one central bank's purchases might exceed those of Tether. If you simply look at the issuance of Tether's USDT and the trend in gold prices since July last year, you'll notice a strong correlation between them.

Another factor is a study we conducted in 2018, which found that investment preferences often span generations. For example, the baby boomer generation prefers gold, Generation X favors hedge funds, and now millennials, who are entering their prime working years, are rediscovering an interest in gold—something their grandparents favored. This has also contributed to a resurgence in the demand for gold.

Wilfred Frost:I'm a millennial, and I also like gold, but I sold too early.Regarding gold, do you think it is the ultimate form of money, or merely a commodity like other industrial metals such as copper and silver?This would change our perspective on last year's returns. For example, both JPMorgan and Nvidia performed well, with their stock prices rising by about 20%.But if we view gold as the ultimate currency, then they might actually be declining. What's your opinion?

Tom Lee:

Yes, we at Fundstrat haven't explicitly recommended gold, but I think we might want to consider doing so. You described it very accurately.Gold is not meaningful as a commodity metal, because last year the total industrial and retail jewelry sales of gold were approximately 120 billion U.S. dollars, while its net value reached 30 trillion U.S. dollars.Therefore, from the price-to-sales ratio perspective, it is unreasonable. Moreover, we know that gold is not scarce because there are large gold reserves underground, and all the gold is extraterrestrial material. For example, SpaceX might discover a gold-rich meteorite in the future, which could lead to a sudden and significant increase in the gold supply.

However, gold has been used as a store of value for centuries. As you mentioned, it serves as an alternative to the U.S. dollar. Therefore,We might consider gold as an alternative to the U.S. dollar. From this perspective, all other assets have depreciated relative to gold.

Wilfred Frost: If viewed from this perspective, do you think more people would accept this viewpoint? What would be its impact?

Tom Lee:

Yes, I think this means that gold should have a place in a portfolio. I see things likeRay Dalio recommends a gold allocation as high as 10%.And in this podcast, you mentioned it could be around 15%. Assuming it is 15%, yet the proportion of gold in most people's investment portfolios is almost zero. Therefore, gold is still an under-allocated asset today.

Wilfred Frost: Why Didn't Cryptocurrency Perform as Well as Gold Last Year?

Tom Lee:

I think the reason is that...Related to timeCryptocurrencies performed similarly to gold before October 10 of last year. For example, Bitcoin rose by 36% at that time, Ethereum increased by 45%, even outperforming silver. However, on October 10, cryptocurrencies experienced the largest-ever deleveraging event in history, surpassing the impact of the FTX incident in November 2022. After that, the value of Bitcoin fell by more than 35%, and Ethereum dropped nearly 50%.

The cryptocurrency market is experiencing deleveraging.This disrupted market liquidity providers, who in cryptocurrency markets are essentially equivalent to central banks. As a result, approximately half of the market's liquidity providers were eliminated during the October 10th incident. Until cryptocurrencies gain widespread support from mainstream institutional investors, such internal deleveraging events will continue to have significant impacts on the market.

Wilfred Frost: Does this mean you admit that Bitcoin is not digital gold?

Tom Lee:

Bitcoin is digital gold, but the group of people who believe in this theory does not overlap with the group of people who own gold.Therefore,The adoption curve of cryptocurrencies is still higher than that of gold, because more people own gold than own cryptocurrencies.The adoption path of future cryptocurrencies may be quite bumpy. I believe 2026 will be a very important test. If Bitcoin can reach a new all-time high, then we can be certain that the deleveraging event has passed.

Wilfred Frost: You're predicting a price target of $250,000 for Bitcoin this year, right? What's driving this forecast?

Tom Lee:

Yes, we believe that Bitcoin will reach a new high this year.I believe the driving force lies in the increasing practicality of cryptocurrencies. For example, banks are beginning to recognize the value of blockchain technology, as settlement and final clearance processes operate very efficiently on blockchain. Additionally, cryptocurrency banks like Tether demonstrate that blockchain-native banks can actually outperform traditional banks. For instance, Tether is projected to generate nearly $20 billion in profits by 2026, making it one of the top five most profitable banks globally. In terms of valuation, it could rank just behind JPMorgan, and potentially be worth twice as much as Goldman Sachs or Morgan Stanley.

Tether has only 300 full-time employees, while JPMorgan Chase has 300,000 employees. By using blockchain technology, Tether's profitability is nearly on par with any bank, and even exceeds that of most banks. At the same time, its M1 money supply accounts for less than 1%, and its balance sheet size is also very small. Nevertheless, it remains one of the most profitable banks in the world.

Wilfred Frost: Let's talk about Ethereum again. Last August, you told us that you were bullish on both Bitcoin and Ethereum, and in the long run, you believe Ethereum will outperform. Why did Ethereum drop so sharply in the last quarter of last year?

Tom Lee:

Ethereum is the second-largest blockchain network. I believe it will always be more volatile than Bitcoin until its scale approaches that of Bitcoin. The cryptocurrency market often views the price of Ethereum in terms of its ratio to Bitcoin. If we simply take the ETH-to-BTC ratio as a price benchmark in the crypto world, the price ratio of Ethereum to Bitcoin is still below the levels seen in 2021. Compared to four years ago, Ethereum has already become a more superior blockchain.

For example, tokenization, including the tokenization of the U.S. dollar, is a major trend that Wall Street is betting on. Larry Fink has called it the biggest innovation since double-entry bookkeeping. Robinhood's Vlad Tenev wants to tokenize everything. We've already seen not only U.S. dollars (stablecoins) but also credit funds striving to be tokenized. JPMorgan is launching a money market fund on Ethereum, and BlackRock has already tokenized a credit fund on Ethereum. Therefore, Ethereum is actually the blockchain that Wall Street is beginning to adopt. If the Ethereum-to-bitcoin price ratio returns to its 2021 high, and Bitcoin reaches $250,000, then Ethereum's price could reach approximately $12,000. Currently, Ethereum's price is about $3,000.

Bitmine Immersion and Mr. Beast Investment

Wilfred Frost: Last week you announced a $200 million investment in Beast Industries (the company behind Mr. Beast). Mr. Beast is one of the biggest YouTube influencers in the world. As far as I understand, his influence in the media is truly amazing, right?

Tom Lee:

Yes, I think most people on Wall Street don't realize the influence of Mr. Beast, for several reasons. First,This is a private company.Therefore, it is necessary to evaluate his influence through media data. Secondly,He is highly iconic among Generation Z, Generation Alpha, and Millennials.

He currently has over 100 million followers. The only person with more followers than him on platforms like TikTok, Instagram, and Meta is Cristiano Ronaldo. His YouTube videos receive more monthly viewing hours than Disney and Netflix combined. Each episode of Mr. Beast's YouTube videos is watched by over 250 million viewers monthly, and he releases two episodes each month, which is equivalent to the viewership of two Super Bowls per month. In addition, his show Beast Games, launched on Amazon Prime, is the number one program on the platform, with viewership surpassing that of almost all movies.

Wilfred Frost: These data are indeed shocking. But why didn't companies like Disney, Amazon Prime, Comcast, or Netflix invest in Beast Industries, but instead an Ethereum treasury company did?

Tom Lee:

Well, they are very selective about who can enter their capital structure. Mr. Beast himself (Jimmy Donaldson) is the largest shareholder, and other shareholders include Chamath Palihapitiya from Social Capital, while Bitmine is their largest corporate investor on the balance sheet. As you can imagine, many companies are eager to invest in Beast Industries, and we are very fortunate to have been invited to participate in their capital structure.

Wilfred Frost: At last week's Bitmine annual shareholders meeting, you mentioned that Beast Industries will launch financial products or services. Has this plan been finalized? Will you be involved in it?

Tom Lee:

Yes, CEO Jeff Henbold has mentioned Beast Financial Services' future plans. I think Beast Industries might reveal more details in the coming weeks. They are indeed very smart and have already commercialized Mr. Beast's brand in various ways, such as Feastables chocolate, healthy lunches, beverages, and collaborations with other creators. Therefore, for a company with a billion fans, further commercialization is a very natural step.

Wilfred Frost: Do you think this is good news for Ethereum? Is there a possibility that Mr. Beast, who has 100 million followers, might promote Ethereum in the future?

Tom Lee:

I think this is very likely. Today, there is a significant gap in financial literacy around the world, especially among young people, because schools do not truly teach this subject.Financial literacy is very important,Because we know that many baby boomers and Generation X individuals have insufficient savings for retirement, and Social Security cannot be fully relied upon, financial education is one of the biggest gaps in today's society.

Mr. Beast is likely to become a leader in promoting financial education, which will bring great benefits to society. This is also one of the reasons we are interested in Beast Industries, as our corporate values and social values align closely with theirs. Mr. Beast represents kindness and integrity.

As for the future of finance, right now...The bank has clearly stated that blockchain is the direction for financial development.For example, JPMorgan Chase wants to build its business on blockchain, and Jamie Dimon has stated that blockchain is a better way to build banks. However, the place where banks today choose to build smart contracts is precisely Ethereum. Therefore, if the goal is to educate the public about finance, Ethereum should certainly have a place in that education.

Wilfred Frost:Last question: I still feel that such an investment seems somewhat off-track for a financial management company.Have you previously mentioned the "Lunar Investment Program" similar to Orbs, which implies that you acknowledge it as a high-risk investment? Or do you believe it is actually a strategic investment?

Tom Lee:

I understand that for people who are not familiar with our investment logic, this may seem entirely high-risk. However, in reality, it makes sense. Bitmine has clearly stated since its inception that approximately 5% of the balance sheet would be allocated for "Moonshot Program Investments." Given today's asset size, this amounts to an investment budget of about $700 million, and we have already invested approximately $220 million in these initiatives.

I believe Beast Industries is a very promising investment because it gives us access to the world's largest content creator, potentially the "Mr. Beast" of our generation. He is unprecedented, and it's possible that no one else will surpass him for a long time in the future. As a financial management company, our goal is not only to strengthen the Ethereum ecosystem but also to ensure its future sustainability. By establishing a potential organic partnership with Mr. Beast, I believe this will further solidify Ethereum's future. Therefore, I think this is an excellent strategic move.

Final Recommendations

Wilfred Frost: The last two questions. The first one is, what is your most important advice for investors in the stock market this year?

Tom Lee:

Yes,The most important advice I can give to investors is not to try to time the market.because doing so will become an enemy to your future performance. Many investors always hope to buy at the market's lowest point and sell at its highest. However, historically, whether in the stock market or the cryptocurrency market,People who truly make money are those who make long-term investments.Although I have warned that there may be a lot of volatility in 2026, investors should view market corrections as an opportunity to buy, not as a reason to exit. Too many people sell out of emotion and then miss the chance to buy back in, losing the compounding benefits of their investments. I believe this is a very important distinction.

Wilfred Frost: The second question is, what is your long-term advice for cryptocurrency investors? I believe this may be related to the points just mentioned, but what do you think they should do in terms of investing?

Tom Lee:

Yes, I believe many listeners are still skeptical about cryptocurrencies, or have never even been exposed to them, because they may feel they cannot truly understand them. We need to recognize that,Cryptocurrency is being embraced by the younger generation—it has already become a part of their lives., because they are digital natives.In the future, the boundaries between services and money will become blurred.This is not much different from when Bill Gates talked about the Internet on the David Letterman Show in 1995. At that time, David Letterman expressed great skepticism about the concept of the Internet because he belonged to a generation that had difficulty accepting it easily. If Bill Gates had explained the future of the Internet to a 20-year-old, the young person would have understood it immediately. Today, cryptocurrencies are going through a similar situation.

Wilfred Frost: So, how do you think people should invest in cryptocurrencies? You recommend Bitmine, but should they hold a basket of cryptocurrencies? Or should they invest in financial firms? Or should they allocate Bitcoin and Ethereum in a 2:1 ratio?

Tom Lee:

I believe a dual strategy can be adopted. First, there is a theory called the "Lindy Effect," and I suggest purchasing only those cryptocurrencies that have existed for a long time, such as Bitcoin and Ethereum. Second, I believe cryptocurrencies may become a "settlement layer" in the future, even if it remains invisible. Bitmine not only serves as a settlement layer for the industry, but through our investments, we are actually becoming a financial services company. Therefore, investing in Bitmine is not just investing in Ethereum; you are also investing in a company that is driving the future of finance.