Author | Sudheer Chava, Fred Hu, Nikhil Paradkar

Source | JFQA

Compile | Yan Zilin

I. Introduction

Since the introduction of Bitcoin in 2009, the cryptocurrency market has experienced explosive growth. During this time, thousands of crypto tokens—digital assets created on blockchains (decentralized, distributed digital ledgers)—have emerged. These tokens can represent a wide range of assets and utilities: well-known examples like Bitcoin and Ethereum are primarily used as mediums of exchange or stores of value, while other crypto tokens can be used to access specific products or services on blockchain platforms, or to represent ownership of physical and digital items. Along with the market's expansion, consumer interest has also grown significantly, with over 20% of U.S. adults having invested in, traded, or used crypto tokens (CNBC, 2022), and an estimated 580 million global crypto investors (Crypto.com, 2024).

Although the retail investor population in the cryptocurrency market has grown significantly, direct evidence on the characteristics of these investors is limited due to the anonymity of blockchain. Meanwhile, the surge in cryptocurrency investors has raised concerns among policymakers, especially considering the extreme volatility of the crypto market. For example, the total market capitalization of the crypto market reached nearly $2.8 trillion in November 2021, dropped to $1.2 trillion in June 2022, and then rebounded to $2.6 trillion in May 2024 (Forbes, 2024). This dramatic fluctuation raises concerns that retail investors may not fully understand the associated risks. Specifically, the returns of crypto tokens exhibit a highly right-skewed distribution, implying a small probability of achieving extremely high returns (Liu and Tsyvinski, 2021; Liu, Tsyvinski, and Wu, 2022). This return pattern is similar to that of lottery products, which are highly attractive to investors with strong gambling preferences (Kumar, 2009). Therefore, this paper investigates whether gambling preferences can predict retail investors' interest in the cryptocurrency market. Understanding whether retail investors view crypto tokens as lottery-like products can help policymakers determine appropriate disclosure standards and regulatory frameworks (e.g., legislative proposals such as those by Lummis and Gillibrand, 2023).

In the absence of direct data,This paper draws on the research of Da, Engelberg, and Gao (2011) and uses Google search interest as a proxy for retail investor attention. It focuses on two prominent types of crypto tokens: Initial Coin Offerings (ICOs) and Non-Fungible Token (NFT) series.Unlike tokens serving as general-purpose currencies, ICOs focus on project investment, while NFTs emphasize digital ownership and collectibles. Consistent with the view that gambling preferences predict interest in cryptocurrencies, this study finds that regions with higher per capita lottery sales show significantly greater attention to crypto tokens. This finding is robust to other gambling-related demographic characteristics identified by Kumar (2009) and Kumar, Page, and Spalt (2011). To address concerns that "attention does not equal investment," the paper documents that attention to crypto wallets also surges before and after token launches, with higher attention correlating with greater fundraising amounts and more participants. Furthermore, the study rules out alternative explanations such as advertising, risk preference, or distrust in institutions.

This article further explores the token-level factors that influence gambling-driven attention.First, ICO and NFT projects launched during the cryptocurrency market bubble tend to attract more attention from regions with a higher inclination toward gambling. Second, in the ICO market, tokens with lower initial offering prices (i.e., those with stronger "lottery-like" characteristics) and those lacking "Know Your Customer" (KYC) protocols (Li, Shin, and Wang, 2021) also generate greater interest from these regions. Furthermore, by using the gradual legalization of sports betting across U.S. states as a natural experiment, this study finds that in regions with a higher gambling tendency, the attention paid to token offerings relatively declines after legal sports betting is approved. This suggests that retail investors largely view cryptocurrency tokens as substitutes for traditional gambling products.

Finally, this paper examines the relationship between cryptocurrency attention and consumer credit outcomes.Using Equifax's data, this paper finds that in regions with a high propensity for gambling, credit card delinquency rates surge following periods of high attention to cryptocurrencies, and this phenomenon is concentrated among financially constrained subprime borrowers. Lag analysis shows that the rise in attention precedes the increase in delinquency rates.

This paper contributes to multiple strands of literature. First, it provides a new perspective on the characteristics and motivations of retail investors in the ICO market (e.g., Li and Mann (2025), Lee and Parlour (2021), Cong, Li, and Wang (2021, 2022)). Second, it enriches the NFT literature by revealing the relationship between retail investor attention and primary market performance (e.g., Kong and Lin (2021), Borri, Liu, and Tsyvinski (2022), Oh, Rosen, and Zhang (2023)). Third, it extends the literature on how gambling preferences affect financial product prices and trading volumes (e.g., Barberis and Huang (2008), Bali, Cakici, and Whitelaw (2011), Kumar (2009), Green and Hwang (2012)). Fourth, it connects to the literature on retail investor behavior (e.g., Barber and Odean (2000, 2008), Welch (2022), Fedyk (2022), Barber et al. (2022)). Finally, it complements the emerging literature on the characteristics of cryptocurrency investors (e.g., Dhawan and Putniņš (2023), Hackethal et al. (2022), Kogan et al. (2024), Aiello et al. (2023), Divakaruni and Zimmerman (2024), Sun (2023)), demonstrating that gambling preferences are an important factor in predicting retail investors' interest in the cryptocurrency market.

II. Data and Descriptive Statistics

This section introduces the data sources used in the study and the descriptive statistics of the variables in the regression analysis.

A. Data Source

1. Retail Investor Attention This paper follows the approach of Da et al. (2011) by using online search attention obtained from Google Trends as a proxy for investment behavior. Its advantage lies in capturing investors' search intentions in private settings. The study employs the Google Search Volume Index (SVI), which ranges from 0 to 100. This paper collects data at a more granular level, specifically within designated market areas (DMAs), covering 209 DMAs in the United States. For each token project, the region with the highest attention (SVI=100) represents the area where the project is relatively most popular.

2. Initial Coin Offering (ICO) ICO (Initial Coin OfferingIt is a way for blockchain startups to raise funds. Unlike IPOs, these tokens do not represent equity but usually represent some kind of usage rights (Utility) within the project's ecosystem.

(1) Sample Screening: Integrated from ICOBenchmark.io, excluding projects that did not meet their funding minimum (soft cap) and those that were not accessible to U.S. investors.

(2) Data volume: A total of 937 completed ICOs from January 2016 to December 2018 were finally selected.

(3) Contributor Identification: Obtain wallet addresses through the white paper, and use Etherscan.io to track the number of unique wallet addresses, thereby estimating the actual number of contributors.

3. Non-Fungible Token (NFT) NFT Represent ownership of unique items on the blockchain, such as artworks.

(1) Sample Selection: The data is sourced from the largest trading platform, OpenSea. Due to Google Trends often displaying 0 for low-volume search terms, this study focuses on the top 100 NFT series by trading volume between 2017 and 2022.

(2) Screening criteria: Projects with a total supply exceeding 10,000 or an average minting price of 0 were excluded. The final sample includes 46 NFT series.

4. Regional Demographic Characteristics This paper uses per capita lottery sales as a proxy variable for regional gambling propensity. The data were manually collected from state gaming authorities and aggregated to the DMA level. To avoid "look-ahead bias," all demographic data are set at the 2015 baseline to capture static cross-sectional differences.

5. Features of Consumer Credit Default data is obtained from Equifax, with default defined as being 90 days or more delinquent. This paper calculates default rates at the DMA-year-month level and conducts a comparative study by dividing the population into subprime borrowers (credit score < 620) and non-subprime borrowers (credit score ≥ 620) based on credit scores.

B. Descriptive Statistics

1. Regional Characteristics:Among the 197 DMAs with lottery data, adults spent an average of $199 per year on lotteries, but there were significant regional differences (ranging from less than $1 to over $800).

2. Features of ICO:The average amount of funds raised in an ICO is 26.3 million USD (approximately 40% of the hard cap). 36% of the projects require KYC (Know Your Customer verification), and 57% of the projects make their code public on GitHub.

3. NFT Features:The median issuance of NFT series in the sample is approximately 9,200. The vast majority (about 90%) are active on Twitter and Discord, and 85% of the projects promote items labeled as "rare."

III. Regional Gambling Tendencies and Retail Investor Attention to Cryptocurrencies

This study examines how regional differences in gambling tendencies affect the attention received by cryptocurrency tokens by estimating the following general regression model:

Among these, SVL represents the attention toward an ICO or NFT series $ i $ within a designated market area (DMA) $ d $ during the issuance period. The core coefficient measures the impact of gambling propensity at the DMA level on attention to cryptocurrencies. This paper uses per capita lottery sales as a proxy for gambling propensity, while controlling for regional demographic characteristics and project fixed effects.

Key Conclusions:

1. ICO Attention Analysis: Research has found a significant positive correlation between per capita lottery sales and the level of attention received by ICOs (Initial Coin Offerings). Specifically, for every one standard deviation increase in the tendency to gamble, the average level of attention received by an ICO increases by approximately 12.8%. This conclusion remains valid even after robustness checks that include regional demographic variables or project fixed effects. This suggests that in regions with a higher tendency to gamble, retail investors show greater interest in ICOs.

2. NFT Series Analysis: Studies on NFTs show even more significant associations. For every one standard deviation increase in gambling tendency, the attention received by an NFT collection increases by approximately 20%. Although the attention received by NFTs is more geographically concentrated than that of ICOs, the predictive power of gambling preferences on interest remains very strong.

A. Robustness Check: Alternative Measures of Competitive Preferences

This paper, drawing on existing research (Kumar, 2009), uses various socioeconomic characteristics as proxy indicators for gambling preferences. The findings show that regions with a higher proportion of Catholics, greater income inequality, higher unemployment rates, and larger minority populations exhibit significantly higher interest in cryptocurrency tokens. Conversely, areas with higher levels of education, higher marriage rates, or higher income levels show lower interest in cryptocurrency tokens. This further confirms the strong alignment between interest in crypto assets and traditional gambling-related psychological traits.

B. External Validation: Is Attention Equivalent to Investment?

To verify that "attention" can effectively reflect "investment behavior," this paper conducts two tests:

1. Encrypted Wallet Attention:Research has found that during token offerings, search volumes for cryptocurrency wallets such as MetaMask and Coinbase Wallet surge simultaneously in regions with a high tendency for gambling. Since participation in ICOs/NFTs must be conducted through such wallets, this provides strong evidence that attention is being converted into actual investment intent.

2. Primary Market Performance:By introducing "anchor tokens" to compare the absolute search popularity across different projects, the study found that ICO projects with higher attention levels tend to raise more funds, achieve their funding targets at a higher rate, and experience a significant increase in the number of contributors on the first day. For NFT series, higher attention levels result in raising more funds, having more wallet addresses that have minted NFTs, and significantly reducing the time required to complete the minting process (an increase in search popularity by one standard deviation can shorten the minting time by approximately 71 days).

C. Exclude other explanatory paths

This article examines other channels that might interfere with the conclusions, and the results show that:

1. Anti-establishment sentiment and distrust toward institutions:Using the Libertarian Party's vote share and the CFPB complaint rate as measures of regional distrust, we found that these factors could not explain the association between gaming tendencies and interest in cryptocurrencies.

2. General Risk Appetite:Introducing survey data to measure regional risk preferences, we find that it cannot replace the explanatory power of gambling propensity regarding interest in cryptocurrencies.

3. Regional Advertising Placement:For NFT samples, controlling for regional advertising expenditures of cryptocurrency exchanges, it was found that regional gaming tendencies remain a core variable in predicting cryptocurrency attention, even after accounting for the impact of advertising and marketing.

Summary of Conclusions:The empirical results consistently indicate that regional gambling preferences are a core driver of retail investors' attention to crypto tokens, and this attention directly translates into fundraising performance in the primary market. It is not driven merely by distrust in institutions, general risk preferences, or marketing efforts.

Four, Factors Influencing the Attention to Utility Token Games

In this section, this paper explores various factors that regulate retail investors' gamified attention toward crypto tokens, including the characteristics of the tokens themselves and changes in the external gaming environment.

A. Token Feature Analysis

This article examines specific token attributes that may trigger retail investors' gambling mentality.

1. Low-price feature (lottery-like attribute):According to existing literature (Kumar, 2009), low price is a core characteristic of lottery-like stocks. Empirical findings show that ICO projects with lower opening prices on their first day receive significantly more attention from regions with a high tendency for gambling compared to high-priced projects. The interaction term coefficients indicate that the attention given to low-priced tokens is further increased by approximately 5% in these regions.

2. Identity Verification Protocol (KYC) and Risk Preference:Price manipulation behaviors such as "pump and dump" (P&D) schemes are common in the cryptocurrency market, and such projects often have weak KYC (Know Your Customer) reviews. Research has found that ICOs (Initial Coin Offerings) lacking KYC protocols attract extremely high attention from retail investors in regions with a high tendency for gambling, indicating that these investors are more inclined to participate in high-risk, poorly regulated projects.

3. Market Bubble/Boom Period Effect:This article defines the period from the second half of 2017 to early 2018 as the "boom period" of the ICO market, and the price surge phase of the NFT market between 2021 and 2022 as the "explosion period." Regression results show that token projects launched during these two periods received significantly more attention from regions with high gambling tendencies compared to non-bubble periods. For NFTs, the attention given to tokens in high gambling tendency regions during the bubble period was about 23% higher than during non-bubble periods.

B. The Impact of Legalizing Sports Betting

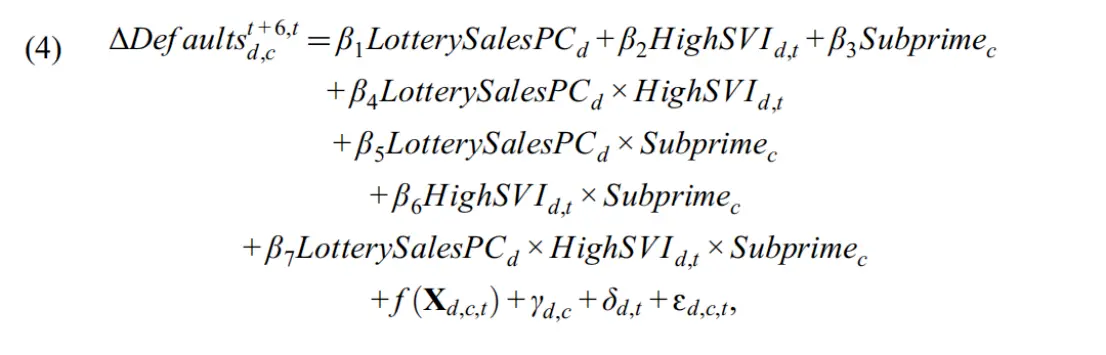

To further confirm that the interest in cryptocurrencies is driven by gambling preferences, this paper utilizes the phased legalization of sports gambling across U.S. states as a natural experiment. If cryptocurrencies are viewed as substitutes for gambling, then the attention toward these tokens should decrease when legal gambling channels become available. This paper estimates the following regression model:

Among them, PostSG is a dummy variable that takes the value of 1 when the state where DMA d is located has legalized sports betting and the ICO occurs after the legalization date.

Main Conclusion:

1. Significant substitution effect:The empirical results show that after the legalization of sports betting, the attention to ICOs in the relevant regions significantly decreased.

2. Stronger responses in areas with high gambling tendencies:After introducing the interaction term between "legalization of gambling" and "per capita lottery sales by region," the coefficient was found to be significantly negatively correlated. This suggests that in regions where the tendency to gamble was already high, the introduction of sports betting has the most pronounced "crowding-out effect" on the attention paid to cryptocurrency tokens.

3. Conclusion Summary:This finding strongly suggests that retail investors view cryptocurrency tokens as traditional gambling products.Substitute.When residents have legal sports betting channels to satisfy their gambling desires, their interest in the cryptocurrency market diminishes accordingly.

Five, Retail Investor Attention to Cryptocurrency and Its Impact on Consumer Credit Outcomes

Existing research (Barber and Odean (2000); Barber et al. (2022)) indicates that individual investors often perform poorly in traditional stock markets. If their performance is similarly poor in the cryptocurrency market, they may fall into financial difficulties. Therefore,This section examines the relationship between retail investors' cryptocurrency attention and subsequent consumer credit outcomes, and investigates how this relationship varies with consumers' credit constraints.This paper measures credit constraints through credit scores and divides them into subprime loan groups (scores < 620) and non-subprime loan groups (≥ 620). Since the ICO sample is more comprehensive than the NFT sample, this section focuses on the relationship between retail investors' attention to ICOs and their consumption delinquency rates.

Key Conclusions:

1. The association between the encryption craze and the default rate:The study found that the interaction term between per capita lottery sales (a measure of gambling propensity) and the ICO attention index is significantly positive. This suggests that in regions with high gambling propensity and high ICO attention, subsequent consumer credit default rates will significantly increase.

2. Vulnerability of the Subprime Borrower Group:Further analysis revealed that the surge in delinquency rates was entirely driven by the subprime borrower group. In regions where both high gambling tendencies and high attention levels coexisted, the delinquency rate among subprime borrowers increased by an average of approximately 2.3% within six months. In contrast, there was no significant change in delinquency rates among non-subprime borrowers (those with better financial conditions).

3. Leading-Lag Relationship and Preceding Trend Test:To rule out the possibility that the rise in attention was directly caused by the default behavior itself, this paper conducts a pre-trend analysis of changes in default rates. The findings show that in the period before the surge in attention (from t-6 to t), there were no significant differences in default rates across regions (no pre-trend). However, in the period after the attention surge (from t+1 to t+6), the default rates of subprime loans in regions with a high tendency for speculation began to rise significantly. This lead-lag relationship in timing suggests that it was the surge in attention from the cryptocurrency market that foreshadowed the subsequent credit deterioration, rather than the other way around.

Summary of Conclusions:

This chapter's research demonstrates that...Investment tendencies in cryptocurrency assets driven by gaming dynamics can have negative economic consequences for socially vulnerable financial groups. For subprime borrowers who already face financial constraints, participating in such high-risk, lottery-like cryptocurrency investments often comes with subsequent real risks of financial default.

Six. Conclusion

This article thoroughly explores the fundamental motivations behind individual investors' participation in the cryptocurrency market. The study finds that...Gambling preferences are a core factor in explaining this phenomenon.By analyzing search data from Google Trends, this paper confirms that in regions with higher per capita lottery sales and a more speculative atmosphere,Retail investors show significantly higher interest in Initial Coin Offerings (ICOs) and Non-Fungible Token (NFT) projects compared to other regions.This attention is not artificial hype; it is not only highly synchronized with the download and usage of crypto wallets, but it also directly and positively influences the fundraising amount and the number of participants for tokens in the primary market.

Further analysis of the moderating effects shows that,This gambling-driven investment motivation is particularly pronounced during market "bubble periods" and when tokens exhibit "lottery-like characteristics," such as extremely low unit prices, lack of identity verification protocols/KYC, and susceptibility to price manipulation.The study also found through a natural experiment on the legalization of sports betting across U.S. states that when legal betting channels become available, the attention given to previously active cryptocurrency tokens significantly decreases.This strongly suggests that retail investors view cryptocurrency tokens as an alternative to traditional gambling products.

Most importantly,This speculative behavior based on gambling preferences poses a significant threat to both individual and societal financial well-being.Using microdata from Equifax, the study finds that in regions with high gambling propensities, a surge in interest in cryptocurrencies often precedes an increase in consumer delinquency rates in the following months. This credit deterioration is entirely concentrated among the most financially vulnerable subprime borrowers. These findings challenge the simplistic notion that "cryptocurrencies are tools for financial inclusion," revealing instead their potential as speculative instruments that may exploit the wealth of the economically disadvantaged. In summary, this paper provides important academic evidence for regulators around the world:Cryptocurrencies are largely treated by retail investors as a new form of gambling tool. Regulation of such assets should not be limited to financial risks but should also establish stricter disclosure standards and entry requirements from the perspectives of public health and consumer protection.