Written by: Artemis Analytics

Compiled by Web3 Legal Counsel

We are often misled by the exaggerated stablecoin transaction volumes in article titles, getting excited about how they surpass Visa/Mastercard's volumes, and indulging in dreams of "canceling plans and preparing to win," replacing SWIFT. When we compare stablecoin transaction volumes with those of Visa/Mastercard, it's like comparing the settlement volume of securities with that of Visa/Mastercard—they are fundamentally incomparable.

Although blockchain data shows huge trading volumes for stablecoins, most of them are not real-world payments.

Currently, the majority of stablecoin trading volume comes from: 1) funding balance adjustments by exchanges and custodians; 2) trading, arbitrage, and liquidity cycles; 3) smart contract mechanisms; and 4) financial adjustments.

Blockchain only shows the transfer of value, not the reasons behind the transfers. Therefore, we need to clarify the actual flow of funds behind stablecoin payments and the underlying statistical logic. To this end, we have compiled the article "Stablecoins in Payments: What the Raw Transaction Numbers Miss" by McKinsey & Artemis Analytics, aiming to help us cut through the stablecoin payment haze and reveal the underlying reality.

The provided link is a LinkedIn article in Chinese (zh_CN). Here's the English (en_US) translation of the title and the first paragraph to give you an idea of the content: **Title:** Stablecoins for Payments: What Do the Raw Transaction Numbers Say? **First Paragraph (Translated):** Stablecoins are increasingly being used as a medium of exchange in the digital economy. As a type of cryptocurrency designed to maintain a stable value relative to a fiat currency (such as the US dollar), stablecoins are seen as a bridge between traditional finance and the blockchain world. In this article, we will explore the transaction data of stablecoins to understand their role in the payments ecosystem. If you'd like a full translation of the article or a summary of the key points, let me know!

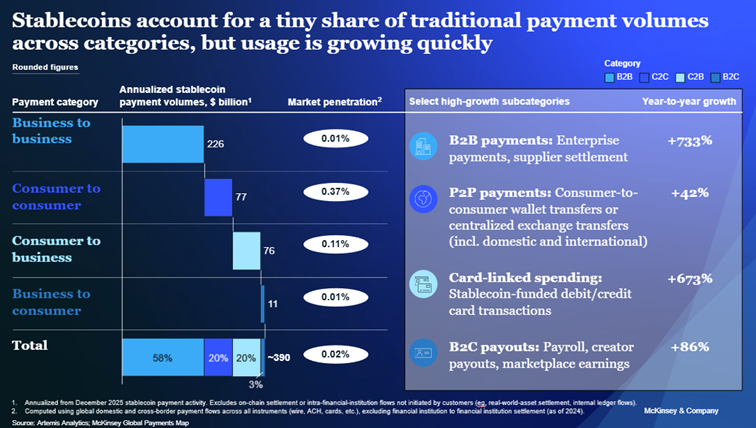

According to the analysis by Artemis Analytics, the actual scale of stablecoin payments in 2025 is approximately $390 billion, representing a doubling compared to 2024.

It is important to note that actual stablecoin payments are significantly lower than conventional estimates, but this does not diminish the long-term potential of stablecoins as a payment channel. On the contrary, it provides a clearer benchmark for assessing the current market situation and the conditions required for stablecoin scaling. At the same time, it is also evident that stablecoins are real, growing, and in an early stage within the payments sector. The opportunities are substantial, but the figures need to be properly measured.

I. Overall Trading Volume of Stablecoins

Stablecoins are gaining increasing attention as a faster, cheaper, and programmable payment solution, with annual transaction volumes reaching up to $35 trillion, according to reports from Artemis Analytics, Allium, RWA.xyz, and Dune Analytics.

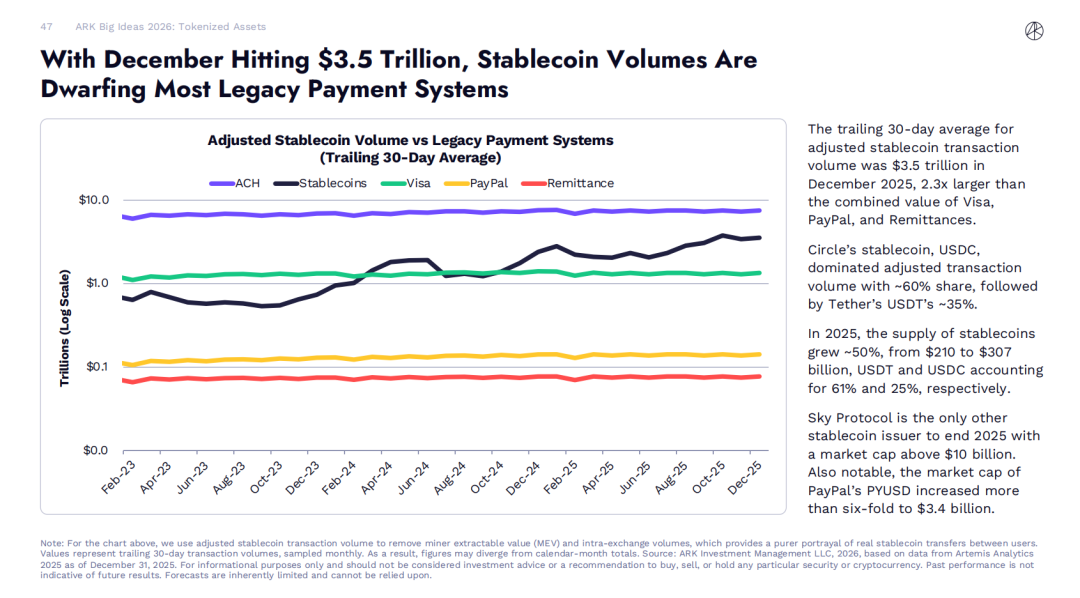

According to ARK Invest's 2026 Big Ideas data: In December 2025, the 30-day moving average of adjusted stablecoin transaction volume reached $3.5 trillion, which is 2.3 times the combined total of Visa, PayPal, and remittance services.

However, most of these transactional activities are not actual end-user payments, such as payments to suppliers or remittances. They mainly include transactions, internal fund transfers, and automated blockchain activities.

To eliminate confounding factors and more accurately assess stablecoin transaction volumes, McKinsey partnered with leading blockchain analytics provider Artemis Analytics. The analysis results indicate:

According to the current transaction speed (annualized figures are based on stablecoin payment activities in December 2025), the actual annual volume of stablecoin payments is approximately $390 billion, accounting for about 0.02% of the total global payment volume.

This highlights the necessity of more in-depth interpretation of data recorded on the blockchain, as well as the need for financial institutions to make scenario-driven strategic investments in order to realize the long-term potential of stablecoins.

II. Strong Growth Expectations for Stablecoins

In recent years, the stablecoin market has expanded rapidly, with its circulating supply exceeding $300 billion, compared to less than $30 billion in 2020 (DeFillma data).

Public market forecasts consistently indicate strong expectations for continued growth in the stablecoin market. On November 12 of last year, U.S. Treasury Secretary Scott Bessent stated during a speech at a U.S. Treasury market conference that the supply of stablecoins could reach up to $3 trillion by 2030.

Major financial institutions have also made similar forecasts, expecting stablecoin supply during the same period to range between $2 trillion and $4 trillion. This growth projection has significantly increased the attention financial institutions are paying to stablecoins, with many organizations actively exploring their applications across various payment and settlement scenarios.

When you filter out behaviors similar to payments, a completely different picture emerges. The adoption is not evenly distributed, with typical scenarios as follows:

- Global Salaries and Cross-Border Remittances: Stablecoins offer an attractive alternative to traditional remittance channels, enabling near-instant cross-border fund transfers at very low costs. According to the McKinsey Global Payments Landscape data, the annualized payment volume of stablecoins in the global salaries and cross-border remittances sector is approximately $9 billion. The overall transaction volume in this sector is $1.2 trillion, meaning stablecoins currently account for less than 1%.

- B2B payments between enterprises: In the field of cross-border payments and international trade, there have long been efficiency challenges such as high transaction fees and long settlement cycles. Stablecoins can precisely address these issues. Enterprises that have taken early action are leveraging stablecoins to optimize their supply chain payment processes and improve liquidity management, with particularly significant benefits for small, medium, and micro-sized businesses. According to McKinsey's global payment landscape data, the annualized volume of stablecoin-based B2B payments is approximately $22.6 trillion, while the total global B2B payment volume is about $16 trillion, meaning stablecoins account for only about 0.01%.

- Capital Markets: Stablecoins are reshaping settlement processes in capital markets by reducing counterparty risk and shortening settlement cycles. Some asset management institutions have issued tokenized funds that can automatically distribute dividends to investors via stablecoins, or directly reinvest dividends back into the fund, without requiring bank-initiated fund transfers. This early application demonstrates how on-chain cash flows can effectively streamline fund operations. Data shows that the annualized settlement transaction volume of stablecoins in capital markets is approximately $8 billion, while the total global capital market settlement volume is about $200 trillion, meaning stablecoins account for less than 0.01%.

Currently, the basis cited by various parties to support the rapid adoption of stablecoins is largely based on publicly available stablecoin transaction volume data, and people often assume that these data reflect actual payment activities. However, to determine whether these transactions are related to payment behaviors, a deeper analysis of the actual nature of on-chain transactions is required.

The provided link appears to be a direct link to a Twitter/X status, but it does not contain any text to translate. If you'd like, you can copy and paste the text from the tweet, and I'll be happy to translate it for you from Chinese (zh_CN) to English (en_US).

Currently, the majority of real stablecoin payment transaction volumes are highly concentrated in Asia, with regions such as Singapore, Hong Kong, and Japan serving as at least one transaction channel. Global saturation has not yet been achieved.

Although the aforementioned market forecasts and early application scenarios confirm the significant growth potential of stablecoins, they also reveal a reality: there remains a considerable gap between market expectations and the actual situation that can be derived solely from surface-level transaction data.

McKinsey & Company, Global Payments Map

https://www.mckinsey.com/industries/financial-services/how-we-help-clients/gci-analytics/our-offerings/global-payments-map

III. Cautiously Interpreting Stablecoin Trading Volume

Public blockchains provide unprecedented transparency for transactional activities: every fund transfer is recorded on a shared ledger, allowing people to almost instantly track the flow of funds between wallets and various applications.

Theoretically, compared to traditional payment systems, this characteristic of blockchain makes it easier for the market to assess the popularity of stablecoins—transaction data in traditional payment systems is fragmented across various private networks, only aggregated data is disclosed, and some transactions are not disclosed at all.

However, in practice, the total trading volume of stablecoins cannot be directly equated with the actual payment volume.

The transaction data on a public blockchain can only reflect the amount of fund transfers, but cannot reveal the underlying economic purposes. Therefore, the original stablecoin transaction volume on the blockchain actually includes various types of transaction behaviors, specifically including:

- Cryptocurrency exchanges and custodians hold substantial stablecoin reserves and transfer funds between their own wallets;

- Smart contracts automatically interact, causing the same funds to be repeatedly transferred;

- Liquidity management, arbitrage, and transaction-related fund flows;

- The technical mechanisms at the protocol layer break down a single operation into multiple on-chain steps, resulting in multiple blockchain transactions and increasing the total transaction volume.

These activities are essential components of the on-chain ecosystem and are likely to grow further with the widespread adoption of stablecoins. However, from a traditional perspective, most of these activities do not fall within the category of payments. If directly aggregated without adjustment, they can obscure the true scale of actual payment activities involving stablecoins.

The implications are clear for financial institutions assessing stablecoins:

Publicly available raw transaction volume data can only serve as a starting point for analysis. It should not be equated with the popularity of stablecoin payments, nor should it be regarded as the actual revenue potential of stablecoin business operations.

IV. The Landscape of Stablecoin Payment Volumes

In the analysis conducted in collaboration with Artemis Analytics, a detailed breakdown of stablecoin transaction data was performed. The study focused on identifying transaction patterns that align with payment characteristics, including business fund transfers, settlements, salary disbursements, and cross-border remittances. At the same time, transaction data primarily involving trading activities, institutional internal fund rebalancing, and automated stablecoin cycling through smart contracts were excluded.

The analysis shows that the actual scale of stablecoin payments in 2025 will reach approximately $390 billion, doubling compared to 2024. Although the share of stablecoin transactions in overall on-chain transactions and global payment volumes remains relatively low, this data is sufficient to confirm that stablecoins have already generated genuine and continuously growing application demand in specific scenarios (see chart).

(Stablecoins in payments: What the raw transaction numbers miss)

Our analysis has yielded three key observations:

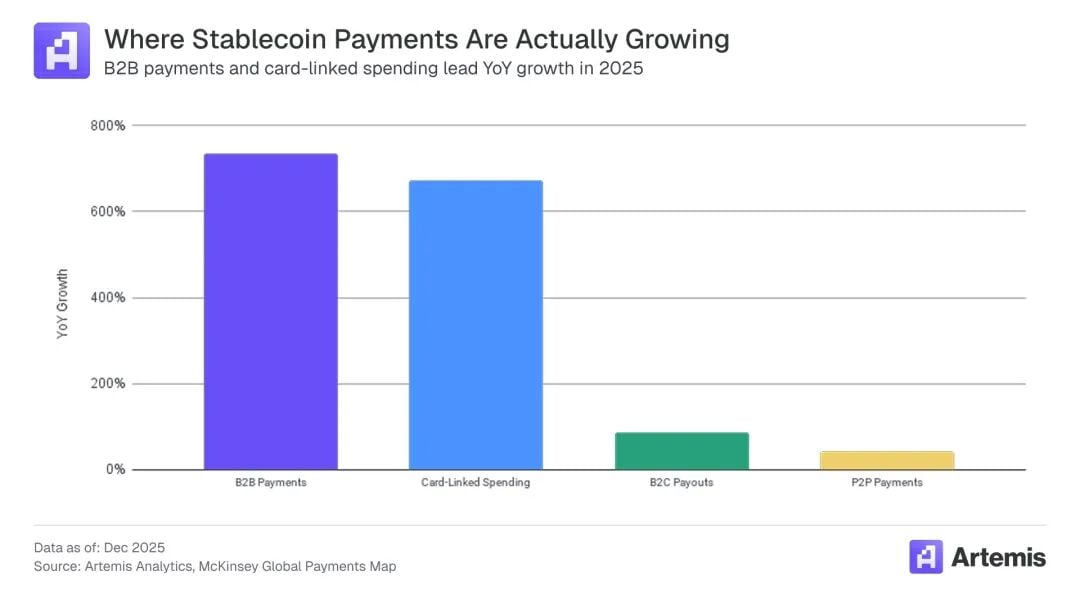

- Clear value proposition. Stablecoins are becoming increasingly popular because they offer clear advantages over existing payment channels, such as faster settlement speeds, better liquidity management, and reduced user experience friction. For example, we estimate that stablecoin-linked bank card transaction volumes will grow to $4.5 billion by 2026, representing a 673% increase from 2024.

- B2B drives growth. B2B payments dominate, with a volume of approximately $226 billion, accounting for about 60% of the total stablecoin payments globally. B2B payments grew by 733% year-over-year, indicating a rapid growth phase expected to arrive by 2026.

- Transaction activities are most active in the Asia region. Transaction activities vary across different regions and cross-border payment channels, indicating that the transaction volume will depend on local market structures and constraints. Stablecoin payments from Asia represent the largest source of transactions, with a transaction value of approximately $245 billion, accounting for 60% of the total. North America follows closely with $95 billion in transaction value, while Europe ranks third with $500 billion. Transaction values in Latin America and Africa are both less than $10 billion. Currently, transaction activities are almost entirely driven by payments originating from Singapore, Hong Kong, and Japan.

From the above trends, it is evident that the practical applications of stablecoins are gradually taking root in a few verified scenarios. Whether stablecoins can achieve broader and more extensive development hinges on whether the models of these mature scenarios can be successfully replicated and extended to other regions.

Stablecoins have substantial potential to reshape the payment system, and realizing this potential depends on the continuous advancement of technological research and development, regulatory improvements, and market implementation. For large-scale adoption, it is essential to have clearer data analysis, more rational investment strategies, and the ability to identify effective signals and filter out irrelevant noise from public trading data. For financial institutions, only by maintaining ambitious development goals while objectively recognizing the current scale of stablecoin transactions, and steadily planning for future opportunities, can they seize the initiative and lead industry development in the next phase of stablecoin applications.