Key Insights

- Sharplink stock plunged 67% after misunderstood SEC resale filing.

- Lubin denies any share sales by him or Consensys.

- $1B ETH treasury plan triggered initial stock surge, then panic.

Shares of Sharplink Gaming (SBET) crashed over 67% in after-hours trading on Thursday after the sports betting firm filed an S-3 registration with the U.S. Securities and Exchange Commission. The move triggered widespread investor panic as many interpreted the filing as a major stock dump—just days after the company revealed plans to build a $1 billion Ethereum treasury.

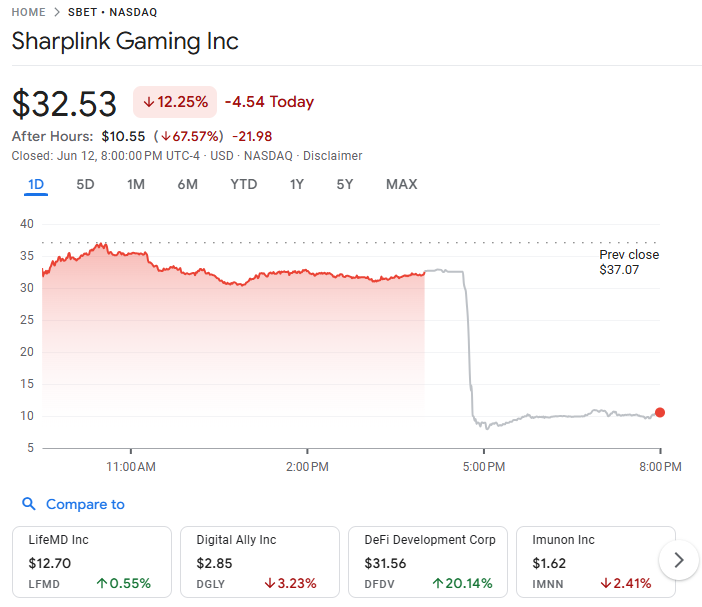

The Minneapolis-based gambling platform had closed regular trading at $32.53, down 12.25% on the day. But within hours, the stock plunged as low as $8 before slightly recovering to $10.55 by press time. That marked a 67.6% drop from the day’s close, according to Google Finance.

Ethereum Bet Meets Shareholder Panic

Sharplink’s collapse comes after its May 30 announcement that it would raise up to $1 billion in a private investment in public equity (PIPE) round, with plans to use most of the proceeds to purchase Ethereum (ETH). That plan briefly sent SBET stock skyrocketing to $124, up from $6 on May 23, as investors rushed to front-run the anticipated ETH acquisition.

However, the new SEC filing—registering the potential resale of nearly 58.7 million shares—spooked the market. Many interpreted it as insiders or early investors looking to offload stock, reversing the hype around the firm’s Ethereum pivot.

BTCS Inc. CEO Charles Allen explained the fear dynamic in blunt terms: “This creates a prisoner’s dilemma: everyone rushes to sell before the others do—a classic race to the bottom.”

Allen added that if the company announces the actual ETH purchase soon, it could reverse the selloff. “If they played cards right, I’d expect a surprise PR tomorrow with $1B of ETH purchases,” he said, calling it a potential spark to “reignite the stock.”

Lubin and Consensys Push Back on Speculation

Joseph Lubin, Chairman of Sharplink Gaming and CEO of Ethereum software firm Consensys, denied that the filing reflects any actual sale. In a post on Wednesday, Lubin wrote that “some are misinterpreting” the filing. He clarified that it merely registers shares for “potential resale” by prior PIPE investors.

“This is standard post-PIPE procedure in tradfi, not an indication of actual sales,” Lubin added. He stressed that neither he nor Consensys had sold any shares.

Consensys’ general counsel Matt Corva echoed the same position, stating: “The filing doesn’t reflect anyone’s sales, which may or may not ever happen. But it’s a basic filing.” Corva noted the deal had already closed weeks earlier, and the S-3 merely formalized it.

Despite reassurances, investors appeared unconvinced. A page in the filing listed a “Shares Owned After the Offering” column showing zero, which many wrongly read as confirmation of a selloff. Lubin explained that figure was hypothetical, based on a full resale assumption.

From Crypto Hype to Classic Correction

Sharplink’s Ethereum treasury move had initially aligned with a broader trend among public companies seeking to emulate the crypto treasury strategy pioneered by Michael Saylor’s firm, Strategy (formerly MicroStrategy). That company famously shifted its business model to hold over 582,000 Bitcoin—worth more than $61 billion at current prices.

Sharplink’s $425 million PIPE raise to kickstart its ETH reserves was one of the largest crypto treasury pledges to date. Its price spike after the announcement reflected excitement over the firm becoming a major Ethereum holder.

But the dramatic reversal highlights the volatile nature of retail sentiment around crypto-linked stocks, especially when legal filings are poorly understood. Ethereum was trading around $2,640 at the time of publication, down 4% in the last 24 hours, according to CoinGecko.

At its peak, Sharplink stock rose more than 1,900% in a single week. The 67% drop following Thursday’s filing erased most of those gains. Whether the company can rebound now depends on how quickly it executes its Ethereum purchase—and how clearly it communicates next steps.

The post Sharplink Stock Tanks 67% After SEC Filing Sparks Ethereum Panic appeared first on The Market Periodical.