Highlights of This Issue

The statistical period covered by this issue of the bulletin is from January 9, 2026, to January 16, 2026.

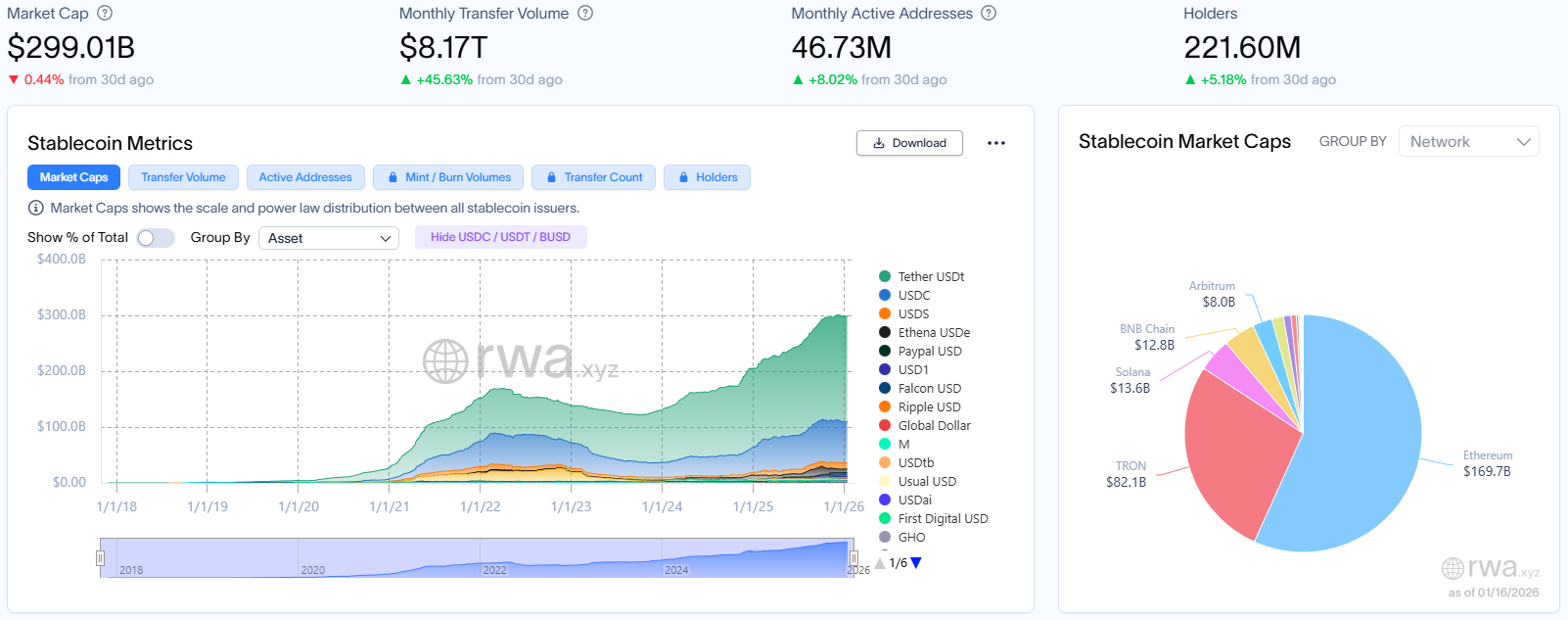

This week, the total market value of RWA (Real-World Assets) on-chain steadily increased to $21.22 billion, with the number of holders surpassing 630,000. This growth was primarily driven by the expansion of the investor base. Meanwhile, the total market value of stablecoins remained largely stable, but the monthly transaction volume surged by 45.63%, with a turnover rate reaching 27.3 times. This highlights the market's entry into a phase of "deepening existing asset competition," where institutional large-scale settlements and derivative collateral are driving high-speed turnover of existing capital, forming a unique pattern characterized by "high liquidity and low growth."

On the regulatory front, the U.S. is witnessing an intensifying "internal war" over stablecoin yields. Coinbase is actively lobbying against restrictions, but its stance has been challenged by executives from JPMorgan Chase and Bank of America. The CLARITY Act has become a focal point of the tug-of-war between traditional banks and the crypto industry, with its review hearing postponed to January 27. Meanwhile, Dubai is tightening stablecoin regulations, and South Korea has enacted legislation for security tokens, as global regulatory frameworks continue to evolve amid ongoing debates.

Banking institutions are deepening their layouts in tokenization: major custodians such as BNY Mellon and State Street are launching tokenized deposit services. Swift, in collaboration with Chainlink and multiple banks, has successfully completed a pilot on the interoperability of tokenized assets, indicating that traditional financial infrastructure is accelerating its integration with blockchain systems.

Payment infrastructure continues to evolve: Visa integrates stablecoin payments with BVNK, South Korea's KB Company applies for a stablecoin credit card patent, and Ripple invests in LMAX to promote the use of RLUSD in institutional settlements. These developments indicate a deepening integration of stablecoins in cross-border payments and everyday consumer scenarios.

In addition, multiple stablecoin payment companies have secured significant funding, with capital continuing to bet on compliance and global expansion.

Pivot Table

Full View of the RWA Track

According to the latest data disclosed by RWA.xyz, as of January 16, 2026, the total market value of assets on the RWA chain reached $21.22 billion, representing a slight increase of 5.76% compared to the same period last month, with a steady growth rate maintained. The total number of asset holders has increased to approximately 632,700, rising by 9.08% compared to the same period last month.

The growth rate of asset holders is higher than the growth rate of asset size, indicating that the current market expansion is primarily driven by an expansion in the investor base, rather than a significant increase in average holdings per person.

Stablecoin Market

The total market capitalization of stablecoins reached $299.01 billion, representing a slight decrease of 0.44% compared to the same period last month, with the overall scale continuing to contract. Meanwhile, the monthly transaction volume surged to $8.17 trillion, a sharp increase of 45.63% compared to the previous month. The turnover ratio (transaction volume / market capitalization) reached 27.3 times, indicating a significant rise in the activity and utilization efficiency of existing funds.

The total number of active addresses has increased to 46.73 million, representing a month-on-month growth of 8.02%. The total number of holders has steadily risen to approximately 222 million, reflecting a month-on-month increase of 5.18%. The user base continues to expand.

The data indicates that the market has entered a phase of "deepening stock-based competition and structural adjustment." The contraction in market value reflects either a lack of inflows of new capital or even net outflows. However, demands from institutional large-scale settlements, derivative collateral, and similar activities are driving the rapid circulation of existing capital, forming a unique pattern characterized by "high liquidity and low growth."

The top stablecoins are USDT, USDC, and USDS. Among them, the market value of USDT increased slightly by 0.03% compared to the same period last month; the market value of USDC decreased by 2.36% compared to the same period last month; and the market value of USDS slightly declined by 0.78%.

Regulatory News

According to CoinDesk, the U.S. Senate Agriculture Committee plans to release its cryptocurrency market structure bill on January 21 and hold a key hearing on the bill's text on January 27. The hearing, originally scheduled for January 15 and postponed on Monday, will begin at 3:00 PM. The amendment hearing is a crucial step in the legislative process, during which senators will debate proposed amendments, vote on whether to include them in the base text, and then vote on whether to send the entire bill to the full Senate for consideration. The Senate Banking Committee will hold its own amendment hearing on its version of the bill this Thursday. Around midnight on Monday, a draft of the Banking Committee's version of the bill was released, though lawmakers are expected to propose amendments before the hearing.

Since the initial discussion draft was released, the Agriculture Committee has not yet published a bill text. Outstanding issues include provisions on ethics rules (pertaining to President Trump and his family's ties to multiple cryptocurrency companies) and quorum rules (requiring bipartisan leadership for regulatory agencies such as the SEC and CFTC). Currently, both agencies have only Republican members. According to informed sources, the bill text from the Banking Committee also does not include provisions on ethics or quorum, meaning the current version may not gain bipartisan support.

According to reporter Eleanor Terrett, after the U.S. Senate Banking Committee delayed the consideration of the crypto market structure bill for nearly 24 hours, stakeholders are now evaluating next steps. Multiple sources indicated that the bill could still "potentially" move forward if banks, Coinbase, and Democrats reach an agreement on the "revenue" provisions in the coming days.

Regarding the section of the bill dealing with tokenized securities, some tokenization companies believe that Coinbase's objections are taken out of context. Stakeholders, including Brian Armstrong, have expressed their desire to significantly amend or completely remove the provision. In addition, the ethical controversies surrounding the bill are still under discussion, and it is reportedly ongoing between the White House and the Senate. Sources indicated that the delay by the Banking Committee does not necessarily affect the proceedings of the Agriculture Committee. If the Agriculture Committee can reach a strong bipartisan agreement, it could make the review process by the Senate Banking Committee smoother.

Dubai Bans Privacy Coins and Tightens Regulations on Stablecoins

According to a report by CoinDesk, the Dubai Financial Services Authority (DFSA) has banned privacy coin transactions, promotions, and derivative activities within the Dubai International Financial Centre (DIFC) since January 12, citing the difficulty in meeting anti-money laundering (AML) and sanctions compliance requirements. The new regulations also redefine stablecoins, recognizing only "fiat-backed crypto tokens" supported by fiat currency and high-quality assets as legitimate stablecoins; algorithmic stablecoins like Ethena are not considered stablecoins under the new rules. Additionally, the DFSA has transferred the responsibility of assessing token suitability to licensed institutions, shifting regulatory focus toward ensuring compliance.

According to Digital Asset, the South Korean National Assembly has passed amendments to the Capital Markets Act and the Electronic Securities Act. This marks the country's formal establishment of a framework for the issuance and circulation of security tokens (STOs), about three years after the relevant guidelines were issued by the financial regulatory authorities.

The core content of the amendment includes introducing the concept of distributed ledgers, allowing issuers who meet certain conditions to directly issue and manage tokenized securities in an electronic registration format. It also establishes a new category of "issuance account management institutions." In addition, non-typical securities such as investment contract securities will be brought under the regulatory scope of the Capital Markets Act. Their circulation in the over-the-counter (OTC) market will be enabled through the newly established OTC brokerage business. The amendment to the Capital Markets Act will take effect from the date of its announcement. However, provisions related to investment solicitation guidelines will become effective six months after the announcement, and OTC-related provisions will take effect one year after the announcement.

Project Progress

Bank of New York Mellon Launches Tokenized Deposits to Expand Digital Asset Business

According to Bloomberg, Bank of New York Mellon (BNY Mellon) has launched a tokenized deposit service, allowing clients to transfer funds through blockchain channels, making it the latest major global bank to deeply engage in the digital asset space. The company stated that this form of digital cash represents on-chain deposits held in BNY Mellon accounts by its clients. As the bank moves toward 24/7 operations, the service can be used for collateral and margin trading, and it can also accelerate payment speeds. Clients participating in this new service include exchange operator Intercontinental Exchange (ICE), trading firms Citadel Securities and DRW Holdings, Ripple Prime under Ripple Labs Inc., asset management firm Baillie Gifford, and stablecoin company Circle.

Bank of New York (BNY), the world's largest custodian bank, will launch a platform allowing institutional clients to settle deposits on a blockchain. This functionality will operate on BNY's private, permissioned blockchain and will be subject to the company's established risk, compliance, and control framework.

According to Bloomberg, global custodian giant State Street has announced the launch of a digital asset platform, planning to introduce tokenized money market funds, ETFs, stablecoins, and deposit products. The initiative will be jointly advanced by its asset management division and partner institutions, marking a shift from its traditional back-office services to direct participation in asset issuance. Previously, State Street had partnered with Galaxy Digital to launch a tokenized fund, and it is also considering offering cryptocurrency custody services in the future.

Société Générale is collaborating with SWIFT to test stablecoin settlement for tokenized bonds.

According to CoinDesk, the digital assets division of Société Générale, SG-FORGE, in collaboration with SWIFT, successfully completed the issuance, delivery versus payment (DvP) settlement, interest payment, and redemption of a tokenized bond using its MiCA-compliant stablecoin, EUR CoinVertible (EURCV). This test demonstrated the potential synergy between traditional payment systems and blockchain platforms. By enabling cross-platform asset transaction coordination, SWIFT aims to accelerate the digitization of capital markets. This project is part of a larger-scale digital asset experiment led by SWIFT and involving more than 30 global banks.

According to a Chainlink announcement, Swift, in collaboration with Chainlink and UBS Asset Management, successfully completed key interoperability tests with BNP Paribas, Intesa Sanpaolo, and Société Générale, enabling seamless settlement of tokenized assets between traditional payment systems and blockchain platforms. This pilot project covered DvP (Delivery versus Payment) settlement, interest payments, and redemption processes, marking significant progress for Swift in harmonizing on-chain and off-chain financial systems.

This initiative focuses on key processes such as DvP (Delivery versus Payment) settlement, interest payments, and redemption of tokenized bonds, covering roles including payment agents, custodians, and registrars. The project is built upon a recent pilot completed by SWIFT and Chainlink under the Monetary Authority of Singapore's (MAS) "Project Guardian," demonstrating how financial institutions can leverage existing SWIFT infrastructure to facilitate off-chain cash settlement for tokenized funds.

South Korean financial giant KB Company applies for a patent for a stablecoin credit card.

According to The Block, KB Kookmin Card, part of KB Financial Group—the largest financial group in South Korea—has filed a patent application for stablecoin payment technology. The patent covers a hybrid payment system that allows users to make payments using stablecoins through their existing credit cards. According to the design, users can bind a blockchain wallet address to their existing credit card. When making a payment, the system will first deduct the amount from the stablecoin balance in the linked digital wallet. If the balance is insufficient, the remaining amount will be charged to the credit card. KB stated that this design aims to lower the barrier for digital asset payments while preserving the existing card payment infrastructure, familiar user experience, and associated benefits (such as rewards and protections), helping stablecoins transition from niche platforms to mainstream finance.

Visa partners with BVNK to launch stablecoin payment service

According to CoinDesk, Visa has announced a partnership with stablecoin payment infrastructure company BVNK to integrate stablecoin capabilities into its Visa Direct real-time payment network. This collaboration will allow businesses in specific markets to pre-fund payments in stablecoins and directly disburse funds to recipients' digital wallets. BVNK will provide the underlying infrastructure to process and settle these stablecoin transactions. The company currently processes over $30 billion in stablecoin payments annually. Visa invested in BVNK through its venture capital division in May 2025, followed by a strategic investment from Citigroup.

Bakkt Agrees to Acquire Stablecoin Payment Infrastructure DTR

According to an official announcement, Bakkt Holdings (NYSE: BKKT) has reached an agreement to acquire Distributed Technologies Research Ltd. (DTR), a global stablecoin payment infrastructure company, in exchange for approximately 9,128,682 shares of Class A common stock, advancing the integration of its stablecoin settlement and digital banking operations. The transaction is expected to be completed upon receiving regulatory and shareholder approvals, with ICE voting in favor of the deal. The company will rebrand to "Bakkt, Inc." on January 22 and host an investor day at the New York Stock Exchange on March 17.

Galaxy Digital Completes First Tokenized Securitized Loan Notes Issuance with a Size of $75 Million

According to Alternativeswatch, NASDAQ-listed Galaxy Digital announced that it has successfully issued its first tokenized collateralized loan obligation (CLO), "Galaxy CLO 2025-1," on the Avalanche blockchain, with a total size of $75 million. The funds will be used to support Galaxy's lending business, including financing for an unfunded credit facility provided by Arch Lending. Galaxy's lending team and digital infrastructure team were responsible for the structuring and tokenization of this collateralized loan obligation (CLO), respectively, while Galaxy Asset Management was responsible for the issuance and management of the CLO.

Figure Launches the OPEN Platform to Enable Direct Stock Lending and Trading on the Blockchain

According to Bloomberg, Figure Technology has launched a new platform called "OPEN" (On-Chain Public Equity Network), which allows companies to issue real equity tokens on its Provenance blockchain. Shareholders can directly lend their stocks without going through traditional brokers or custodians. Figure will begin by issuing its own equity tokens and will support trading on its decentralized platform, aiming to rebuild the infrastructure of equity markets.

According to Reuters, sources revealed on Wednesday that Pakistan has reached an agreement with World Liberty Financial, a cryptocurrency company associated with the family of U.S. President Donald Trump, to explore the use of its dollar-pegged stablecoin, USD1, for cross-border payments. Under the agreement, World Liberty will collaborate with Pakistan's central bank to integrate the USD1 stablecoin into the country's regulated digital payment framework, allowing it to operate in parallel with Pakistan's domestic digital currency infrastructure. The announcement is expected to be formally made during a visit to Islamabad by World Liberty's CEO, Zach Witkoff.

Ripple Invests $150 Million in LMAX to Promote RLUSD Stablecoin for Institutional Market Settlement

According to an announcement by Ripple and LMAX Group, the two companies have entered into a multi-year strategic partnership. Ripple will provide $150 million in funding to support the widespread adoption of RLUSD stablecoin as collateral and settlement asset within LMAX's global institutional trading platform. RLUSD will support crypto assets, perpetual contracts, CFDs, and certain fiat cross products, aiming to enhance cross-asset collateral efficiency and enable 24/7 on-chain settlement. The collaboration also includes the custody of RLUSD through LMAX Custody's segregated wallets, as well as integration with Ripple Prime to expand institutional liquidity and reduce market fragmentation.

STBL Releases Q1 Roadmap: USST Mainnet Deployment and Launch of Lending and RWA Expansion

The stablecoin protocol STBL has released its Q1 2026 roadmap. The core objective is to shift focus from infrastructure development to application deployment, activating USST as a productive asset that can be used for lending and yield generation. The main components include:

January will see the deployment of USST on the mainnet, integration of Hypernative to automate the pegging mechanism, and the launch of DeFi lending and borrowing features.

February will involve liquidity injections and RWA collateral expansion, along with the deployment of an ecosystem-specific stablecoin (ESS) structure on the testnet;

In March, we plan to expand the native USST minting feature to other high-performance blockchains such as Solana and Stellar, and release a simplified interface for the STBL DApp.

MANTRA Announces Staff Reductions and Restructuring to Address Market Challenges

John Patrick Mullin, co-founder of MANTRA, issued a statement announcing that the company will undergo restructuring and reduce its team size, affecting multiple support departments including business development, marketing, and human resources. Mullin stated that adverse events in April 2025, combined with downward market pressures, have made the cost structure unsustainable. The restructuring aims to focus on the core strategy in the RWA (Real-World Assets) domain, enhancing capital efficiency and maintaining a leading position.

According to BeInCrypto, informed sources said that Polygon recently carried out a large-scale internal layoff, with approximately 30% of its staff being let go this week. On social media, multiple Polygon employees and ecosystem members have posted about their departures or team changes. The layoffs occurred after Polygon shifted its strategy toward stablecoin payments and completed a $250 million acquisition of Coinme and Sequence. Kurt Patat, communications lead at Polygon Labs, confirmed that the layoffs were part of post-acquisition team integration measures, and the company's total headcount is expected to remain stable.

Related Reading:Polygon Completes the Puzzle with $250 Million Investment, POL Token Deflation Marks the "Year of Rebirth"

According to Russian media reports, Tether, the issuer of the USDT stablecoin, has registered the trademark for its asset tokenization platform, Hadron, in Russia. The company submitted the application in October 2025, and the Russian Federal Service for Intellectual Property (Rospatent) decided to register the trademark in January 2026. The company has obtained exclusive rights to the trademark, which will remain valid until October 3, 2035. The trademark can be used for blockchain financial services, cryptocurrency trading and exchange, cryptocurrency payment processing, and related consulting services.

According to The Block, Oobit, a mobile wallet supported by Tether, has announced a native integration with Phantom, a Solana ecosystem wallet. Users can now make one-click stablecoin payments at Visa-accepting merchants worldwide through Oobit's DePay system. Funds are deducted in real-time from the wallet and automatically converted into fiat currency, eliminating the need for pre-transfers or intermediaries. Solana co-founder Anatoly Yakovenko participated in Oobit's $25 million Series A funding round.

According to CoinDesk, last November, when stablecoin issuer Tether announced a "strategic investment" in Ledn, it kept the investment details confidential. However, sources revealed that Tether actually paid between $40 million and $50 million for the investment. Ledn is a company that provides fiat and stablecoin loans secured by Bitcoin collateral. This investment valued Ledn at approximately $500 million.

According to Crowdfund Insider, stablecoin payment infrastructure provider PhotonPay has announced the completion of a multi-million-dollar Series B funding round. The round was led by IDG Capital, with participation from Hillhouse Investment, Enlight Capital, Lightspeed Faction, and Shoplazza. Blacksheep Technology served as the exclusive financial advisor. The company did not disclose its valuation. The new funding will be used to accelerate the expansion of its stablecoin financial payment channels, recruit key talent, and broaden its global regulatory compliance presence, with a particular focus on the United States and certain emerging markets.

Founded in 2015, PhotonPay currently operates 11 centers globally and employs more than 300 staff. The company claims that its annualized payment processing volume based on its "stablecoin-native" clearing and settlement infrastructure has exceeded $30 billion. It has established partnerships with financial institutions such as JPMorgan Chase, Circle, Standard Chartered Bank, DBS Bank, and Mastercard, and plans to enhance its capabilities in account issuance, acquiring, and foreign exchange services. Starting from 2026, PhotonPay also plans to launch enterprise value-added services, including cash yield-based treasury products and flexible credit tools.

According to Bloomberg, stablecoin payment company Rain has announced the completion of a new round of funding totaling $250 million, valuing the company at $1.95 billion post-investment. The round was led by ICONIQ, with participation from institutions including Sapphire Ventures, Dragonfly, Bessemer, Lightspeed, and Galaxy Ventures. This funding brings Rain's total capital raised to over $338 million.

Farooq Malik, co-founder and CEO of the company, stated that the funding will be used to expand operations in North America, South America, Europe, Asia, and Africa, as well as to help the company adapt to the rapidly evolving global regulatory environment. Rain currently issues stablecoin payment cards in over 150 countries through a partnership with Visa, allowing cardholders to make purchases at local merchants or withdraw cash from ATMs. The company also plans to access payment systems such as the U.S. ACH and the European SEPA through its partner financial institutions. Malik noted that the company may pursue strategic acquisitions in the future, having already acquired the rewards platform Uptop and the currency conversion platform Fern in the past year.

Latin American stablecoin payment company VelaFi completes $20 million Series B round.

Latin American stablecoin payment infrastructure company VelaFi has announced the completion of a $20 million Series B funding round, led by XVC and Ikuyo, with participation from Alibaba Investment, Planetree, and BAI Capital, bringing the company's total funding to over $40 million. The funds will be used to expand compliance, banking connections, and operations in the United States and Asia. VelaFi has processed billions of dollars in transactions for hundreds of enterprise clients, offering stablecoin solutions including cross-border payments, multi-currency accounts, and asset management.

Stablecoin service provider Meld completes $7 million financing, led by Lightspeed Faction

According to Fortune, stablecoin service provider Meld has announced the completion of a $7 million funding round, led by Lightspeed Faction, with participation from F-Prime, Yolo Investments, and Scytale Digital. The total funding raised to date has reached $15 million, with the valuation details not disclosed. Meld aims to become a one-stop platform for businesses and individuals to access and convert digital assets globally. Its goal is to build a "Visa of cryptocurrency," enabling users to purchase or settle stablecoins, Bitcoin, Ethereum, or any other type of digital assets worldwide.

According to official news, the stablecoin protocol USDat's developer, Saturn, announced the completion of an 800,000 USD funding round. This round was led by YZi Labs and Sora Ventures, along with several angel investors from the cryptocurrency industry.

The revenue sources of the USDat protocol mainly combine the Strategy perpetual preferred stock (STRC) with U.S. Treasury bonds. The project team stated that the protocol aims to introduce institutional-grade credit into DeFi, enabling Strategy's credit to be utilized on-chain and providing a new model for corporate treasuries within decentralized finance.

RWA project TBook announces cumulative fundraising exceeding $10 million.

According to Chainwire, embedded RWA liquidity layer TBook has announced the completion of a new funding round led by SevenX Ventures, achieving a valuation exceeding $100 million. This round also attracted participation from Mask Network, prominent family offices, and existing investors, bringing TBook's total funding to over $10 million. Following this latest round of financing, TBook's investor list now includes SevenX Ventures, Sui Foundation, KuCoin Ventures, Mask Network, HT Capital, VistaLabs, Blofin, Bonfire Union, LYVC, and GoPlus.

The protocol plans to conduct a Token Generation Event (TGE) in the first quarter of 2026. TBook is building an embedded RWA liquidity layer that smartly connects asset issuers with qualified users through an on-chain reputation infrastructure. TBook's infrastructure is built upon a proprietary three-layer architecture: the Identity Layer (Incentivized Passport and vSBT), the Intelligence Layer (WISE credit scoring), and the Settlement Layer (TBook Vault).

The U.S. stock token trading platform Metex MSX (msx.com) announced today that it will change the fee structure for RWA spot trading, effective immediately. After the adjustment, the RWA spot trading section will shift from the previous "two-way fee" model to a "one-sided fee" model. Specifically, the buy side will continue to charge a 0.3% trading fee, while the sell side will now have a 0% fee. This means that when users complete a full trading cycle of "buy + sell," their overall trading cost will effectively be reduced by 50%. The new fee policy is now in effect across the entire MSX platform, covering all RWA spot trading pairs currently listed.

Insight Highlights

The "Civil War" of U.S. Stablecoins Erupts: Banks Blockade Yields, Crypto Industry Strikes Back

PANews Summary: A heated debate is currently taking place in the U.S. over stablecoins, with the core conflict centered on whether stablecoins should be further restricted from providing users with any form of yield. Traditional financial institutions, represented by community banks, argue that even if stablecoin issuers do not directly pay interest, the indirect returns such as rewards and points offered through third parties like exchanges still attract capital away from the banking system, threatening their survival. As a result, they advocate for amending the "GENIUS Act" to completely close this "loophole." However, the crypto industry strongly opposes this, arguing that such "containment" is protectionism disguised as regulation. They claim it not only stifles innovation but also weakens the competitiveness of U.S. dollar stablecoins globally, potentially leading capital to flow into digital currency systems of other countries and creating a "national security trap." At its core, this debate is about how stablecoins should be legally defined — whether as a form of bank deposit or a new asset class — and reflects a deeper struggle in the U.S. over how to balance financial stability, traditional banking interests, technological innovation, and global monetary competitiveness in the digital era.

Golden RWA Trend Insights — Rapid Growth, From "Hedge Assets" to "On-Chain Financial Infrastructure"

PANews Overview: Gold RWA (real-world asset tokenization) has achieved nearly triple its market capitalization in 2025, surpassing $3 billion, and is evolving from a traditional passive safe-haven asset into an active, programmable foundational component of on-chain finance. Its rapid growth is driven by macroeconomic hedging demand, the stablecoin ecosystem's need for diversified underlying assets, and the maturation of regulatory frameworks (such as the U.S. GENIUS Act). The market landscape has evolved from a "duopoly" between XAUT (liquidity-focused) and PAXG (compliance-focused) to a multi-polar ecosystem encompassing specialized functions such as payments, yield generation, and cross-chain capabilities. In the future, gold RWA is expected to play key roles in the next-generation financial system, including serving as a neutral bridge for cross-border payments, a core collateral asset in DeFi, and a "transition asset" connecting traditional finance with the on-chain world. However, its development still faces core risks such as centralized custody, technical complexity, and inconsistent global regulations.

From Concept to Scale: RWA Becoming the "Long-Term Bullish Trend" in the Crypto Market

PANews Overview: Real-world asset tokenization (RWA) is moving from the hype of a concept to a substantive, scalable "slow bull market" growth track, becoming one of the few areas in the crypto market with clear potential and sustainability. Its core logic lies in growth driven by real asset demand (such as on-chain U.S. Treasury bonds and commodities in a high-interest-rate environment) and the strategic involvement of traditional financial institutions (such as BlackRock and Franklin Templeton), rather than market sentiment. As regulatory frameworks become clearer and cash flows are genuinely tied to tokens, RWA has transitioned from an experiment to a scalable stage. Its development resembles a "slow bull market" driven by fundamentals and long-term capital inflows, and it is expected to continuously reshape the market structure of DeFi.