Key Insights

- Ripple’s Brad Garlinghouse outlined the company’s plan for 2026. It focuses on the long-term growth and utility of XRP and RLUSD.

- The CEO says 2025 was extremely successful for Ripple, but 2026 will be better.

- XRP is still trading above $2 as XRP ETFs have their first outflow in over 50 days.

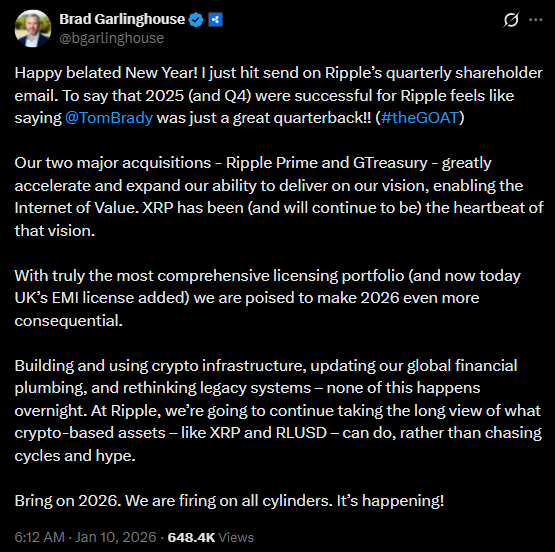

Ripple CEO Brad Garlinghouse has announced the firm’s plan for 2026. He stated that it will focus on the growth of RLUSD and Ripple XRP. Garlinghouse shared his vision on X, noting that the company remains committed to long-term performance.

Garlinghouse’s comments come a day after the firm secured an Electronic Money Institution (EMI) license in the UK.

Garlinghouse Says the Firm is Focused on Utility and Adoption of its Digital Assets

According to Garlinghouse, 2025 was an impressive year for Ripple. He described it as the “Tom Brady year” for the company. He noted that the company’s two major acquisitions last year, Ripple Prime and GTreasury, significantly expanded its capabilities.

However, the firm plans to outdo that in 2026. Garlinghouse said the company will use its crypto-based assets actively. He highlighted Ripple XRP and the RLUSD stablecoin as key priorities.

He also highlighted the compliance portfolio, including the recent approval in the United Kingdom. According to him, the firm is poised to make 2026 a more consequential year.

He said:

The statement shows the fintech company’s priority this year. It aims to become a major player in the payments industry.

BNY Mellon recently chose the company as one of its partners for its tokenized deposits capabilities. Interestingly, XRP and RLUSD are already leading assets, with XRP ranking as a top-three cryptocurrency.

However, adoption is still relatively low compared to the leaders in their sector, something Ripple hopes to change this year. The CEO particularly noted that the Ripple XRP is at the core of its vision. It is to enable the Internet of Value.

Ripple XRP Stays Above $2 as ETFs See First Outflows

Meanwhile, the Ripple XRP was recently trading above $2, a price level it has maintained since January 2. Although the token has fallen significantly from its year peak of $2.4, it is still in the green year-to-date.

The pullback for XRP after its early-year gains is mostly due to some holders taking profits. This has increased selling pressure. The selloffs were enough for spot XRP exchange funds (ETFs) to have their first-ever outflow.

Before now, the ETFs launched on November 13, 2025, have maintained inflows for more than 50 consecutive days.

Still, the $40 million outflows on January 7 appear to be an anomaly rather than the norm. The products have already recovered with inflows in the following two days and still have over $1.47 billion.

The post Ripple CEO Garlinghouse Sets 2026 Focus on Ripple XRP, RLUSD Growth appeared first on The Market Periodical.