Prediction markets posted a record-breaking week, generating more than $2.7 million in fees. Opinion and Polymarket led activity as volumes and open interest climbed across major platforms.

Opinion and Polymarket Drive Record Week for Prediction Markets

Prediction markets reached a new milestone last week, generating more than $2.7 million in fees, the highest weekly total on record. The surge reflects rising engagement across leading platforms, with opinion-based markets and short-term price bets driving much of the activity.

Opinion emerged as the top fee generator, accounting for 54.3% of total fees and bringing in over $1.5 million during the week. Trading volumes on the platform averaged $115.6 million over the past seven days, up 2.5% week over week and more than 33% month over month. Opinion’s open interest stood at $151.6 million, with a relatively high volume-to-open-interest ratio of 76%, pointing to active turnover rather than passive positioning.

Polymarket also posted a strong performance, particularly through its 15-minute up/down markets, which alone generated $787,000 in fees. That figure represented 28.4% of total weekly fees across the sector. Polymarket’s average seven-day trading volume reached $112.4 million, rising more than 15% week over week and nearly 200% compared with the previous quarter. Open interest on the platform totaled $335.7 million, the highest among prediction market protocols, although its lower volume-to-open-interest ratio suggests a greater share of longer-dated positions.

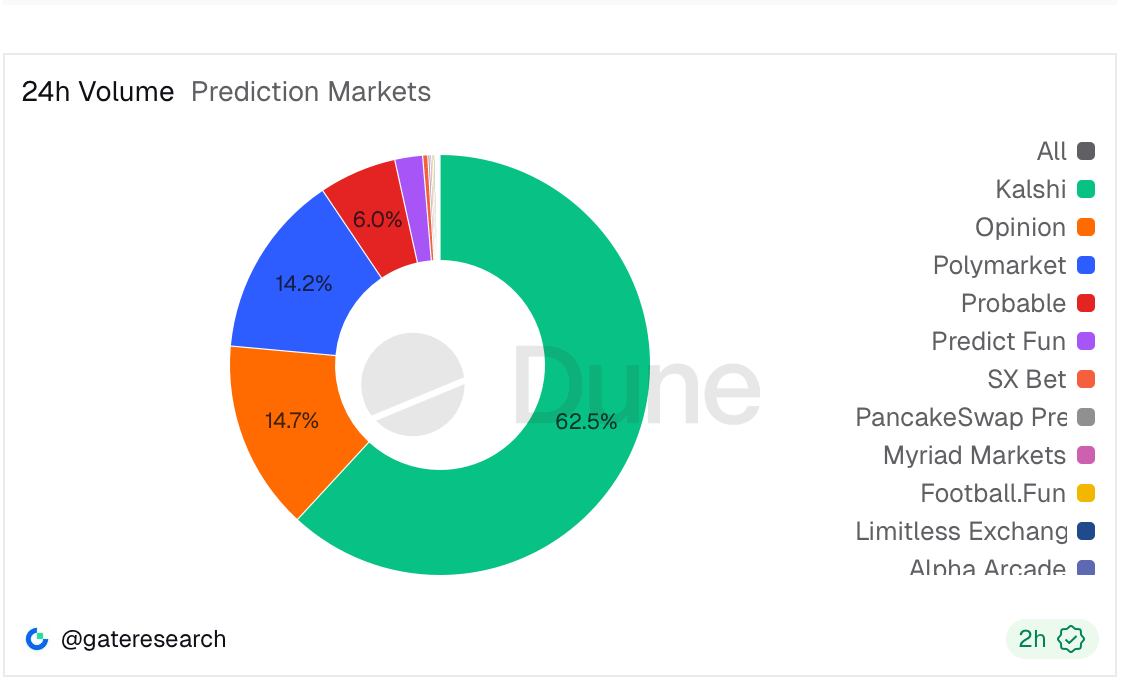

Kalshi remained the largest platform by overall market share, capturing 52.6% of seven-day volume and more than half of activity across longer time frames. Kalshi’s average weekly volume stood at $307.6 million, with growth of 7% week over week and nearly 177% quarter over quarter. Open interest reached $334.6 million, closely matching Polymarket at the top of the sector.

Smaller platforms also showed signs of rapid growth. Probable recorded the fastest expansion, with weekly volume jumping more than 93% and quarter-over-quarter growth exceeding 2,300%, albeit from a smaller base. Predict Fun averaged $14.6 million in weekly volume, while Football.Fun held just over $5 million in open interest.

Read more: CNBC Partners With Kalshi to Integrate Prediction Market Data

Overall, the data points to a maturing prediction market landscape, where liquidity, fees, and open interest are rising together. Short-term trading formats and opinion-driven markets appear to be playing an increasingly important role in driving engagement and revenue across the sector.

FAQ📈

- Why did prediction markets see a record week?

Rising participation in opinion-based and short-term markets pushed weekly fees above $2.7 million. - Which platforms led prediction market activity?

Opinion and Polymarket drove most fees and volume, with Kalshi remaining the largest by market share. - What types of markets are attracting traders most?

Short-term up/down bets and opinion-driven contracts generated the highest turnover and engagement. - What does this mean for the prediction market sector?

Growing fees, volumes, and open interest signal a more liquid and maturing prediction market ecosystem.