Key Insights

- Polygon price has rebounded by over 67% from its lowest level in December.

- The network activity, including users and transactions, has soared in the past few weeks.

- The Polygon burn rate has continued rising.

Polygon price rebounded this month, ending a strong sell-off that had pushed it to a record low of $0.0983. POL was trading at $0.1600, up by nearly 60% from its lowest level in December. This article explores some of the top reasons why the POL token has rebounded.

Polygon Price Has Jumped as Its Network Activity Soars

One of the main reasons why the Polygon price has rebounded is that activity in its network has jumped in the past few months. This growth has helped it to bridge the gap with other layer-2 networks like Base, Optimism, and Arbitrum.

For example, data compiled by Nansen shows that Polygon is one of the fastest-growing chains in the crypto industry. Its transaction count rose by 12% in the last 3 days to over 177 million.

In contrast, Optimism handled 58 million transactions. On the other hand, Arbitrum processed 61 million transactions in the same period.

Its active addresses rose by 15% in the last 30 days to over 14 million. It is also higher than other popular layer-2 chains.

Polygon has seen active addresses surge in recent months. More users are actively joining its network.

This growth has led to a surge in network fees. Its fees rose by 242% to over $2.5 million. This means that it is collecting more fees than other networks like Ton and Optimism.

Polygon is Becoming a Major Chain in Payments

Polygon price has also soared as the network became a major player in the payments industry. Analysts believe that this will continue accelerating in the next few years.

Polygon has been selected by some of the biggest companies in the payments industry, like Revolut, Shift4 Payments, Stripe, and Mastercard.

Data compiled by Artemis shows that the network’s stablecoin supply has jumped to over $3 billion. Most of them are USD Coin (USDC).

The network processed stablecoin transactions worth $28.3 billion in the past 30 days. Of this, $450 million came specifically from the payments segment.

For example, while Base Blockchain handled $3.1 trillion in the last 30 days, only $22 million of this was in the payment segment.

This growth will likely accelerate after Polygon made two acquisitions as part of its Open Money Stack. It bought Coinme and Sequence, entering the US-regulated market. The acquisitions will help it to have a substantial market share in the payment industry.

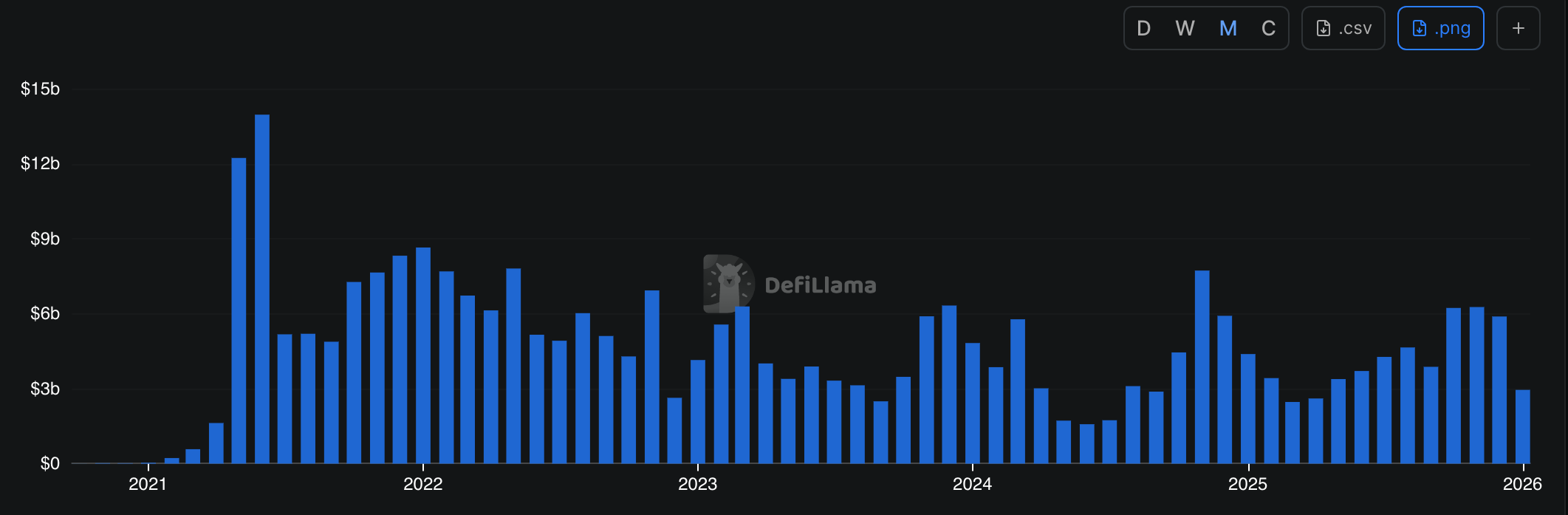

Polygon DEX Volume is Soaring Because of Polymarket

The other notable catalyst for the ongoing Polygon price surge is that its Polymarket is helping it to grow its volume.

Data compiled by DeFi Llama shows that Polygon has handled transactions worth over $2.95 billion this month. Its transactions stood at $5.89 billion in December.

That’s a slight decrease from the previous month’s $6.25 billion. Most of the volume is from Polymarket, Uniswap, QuickSwap, and Dodo.

Polymarket has become one of the biggest players in the prediction market. It handles transactions worth millions a month, and its valuation has hit over $11 billion.

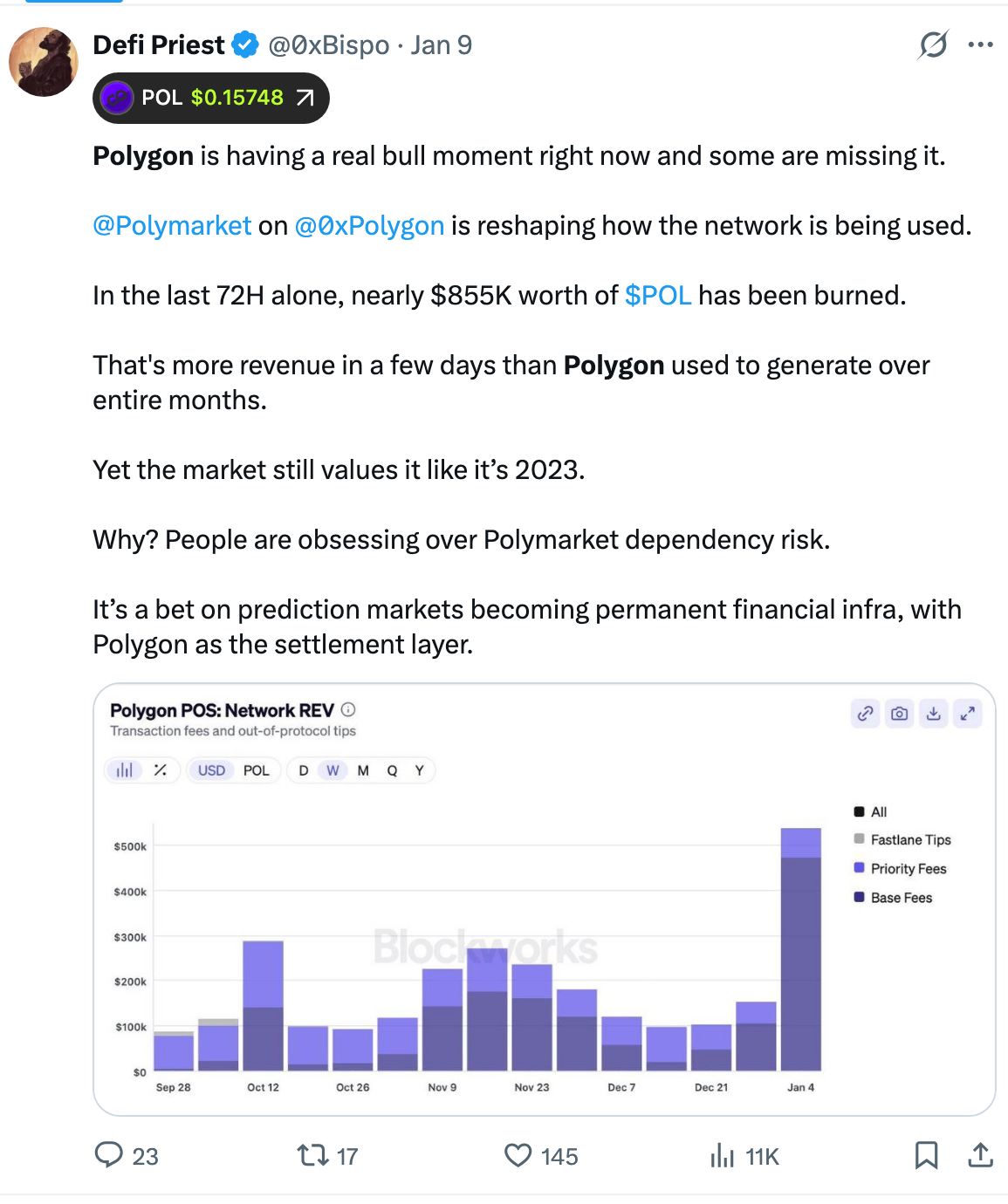

Polygon Tokenomics and Rising Burn Rate

Meanwhile, Polygon has some of the best tokenomics in the crypto industry. Data shows that it has a circulating supply of 10.56 billion tokens, which is also its maximum supply. This means that the network will never have token unlocks, which increase the supply.

At the same time, Polygon reduces the circulating supply through its daily token burns. It removes tokens permanently. Its token burn has accelerated now that its fees have jumped.

For example, data shows that POL tokens worth thousands of dollars are being burned each day.

To sum it up, the Polygon price is soaring due to strong fundamentals. Rising fees and growing payment industry usage fuel demand. Daily token burns strengthen its tokenomics and support momentum.

The post Here’s Why Polygon’s Price Is Soaring and What’s Driving the Surge appeared first on The Market Periodical.