Original Title: "Just Spent 250 Million to Buy a Company, Then Laid Off 30% of Staff—Polygon Tries a New Approach"

Original Author: David, DeepTide TechFlow

I saw a message today: Polygon laid off about 30% of its employees.

Although the official Polygon team has not issued a formal announcement, CEO Marc Boiron acknowledged the layoffs in an interview, while stating that the total number of employees will remain stable due to the addition of newly acquired teams.

There are also posts from laid-off employees on social media, indirectly confirming this fact.

But in the same week, Polygon announced spending $250 million to acquire two companies. Is it a bit strange to lay off employees while spending such a large amount of money?

If it were merely a contraction, they wouldn't spend 250 million at the same time on acquisitions. If it were expansion, they wouldn't cut 30% of their staff. Taken together, these two actions look more like a restructuring or a change in leadership.

The people laid off were from the existing business lines, and the vacated positions were filled by the acquired team.

250 million yuan was spent to buy a license and payment channel.

The two acquired companies are called Coinme and Sequence.

Coinme is an established company founded in 2014, specializing in the exchange between fiat currency and cryptocurrencies. It operates over 50,000 retail locations for cryptocurrency ATMs in the United States. Its most valuable asset is its licenses; it holds money transmission licenses in 48 states. These licenses are very difficult to obtain in the U.S., and companies like PayPal and Stripe have taken many years to acquire them all.

Sequence provides wallet infrastructure and cross-chain routing. Simply put, it allows users to perform cross-chain transfers with one click, without having to deal with complicated tasks like bridging or switching gas tokens. Its clients include chains such as Polygon, Immutable, and Arbitrum, and it also has a distribution partnership with Google Cloud.

The two acquisitions amount to a total of $250 million. Polygon has given this set of tools a name: "Open Money Stack," positioning it as middleware for stablecoin payments, aiming to sell it to B-end clients such as banks, payment companies, and remittance providers.

The logic I understand is as follows:

Coinme provides compliant fiat on-ramps and off-ramps, Sequence provides a user-friendly wallet and cross-chain capabilities, and Polygon's own chain provides the settlement layer. Putting these three pieces together forms a complete solution.Complete stablecoin payment infrastructure.

The question is, why is Polygon doing this?

This path for L2, Polygon has already become very difficult to proceed with.

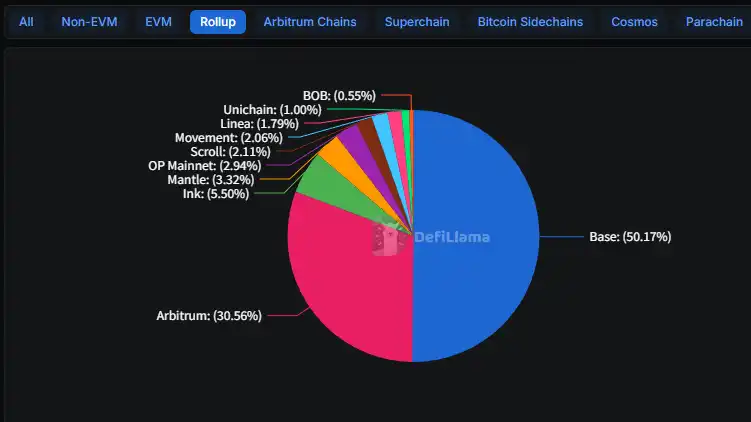

The situation in 2025 is clear: Base has won.

Coinbase's L2 solution has grown from a TVL of $3.1 billion at the beginning of last year to $5.6 billion, accounting for 50% of the entire L2 market. Arbitrum has maintained 30% but has seen almost no growth. The remaining dozens of L2 solutions are mostly unused after their airdrops were distributed.

Where does Base win? Coinbase has hundreds of millions of registered users, so users naturally come whenever any product feature is launched.

For example, Morpho, a lending and borrowing protocol, has seen its deposits on Base grow from $354 million at the beginning of last year to $2 billion now. The core reason is that it was integrated into the Coinbase app. Users can simply use it by opening the app, without needing to know what an L2 is or what Morpho is.

Polygon doesn't have such an entry. It also laid off staff in 2024, cutting 20% of its workforce at that time. That was a bear market contraction, and everyone was cutting staff.

This time is different; even with funds in the account, they are still cutting, which indicates an active decision to change direction.

Remember back when Polygon's story was about enterprise adoption, such as the accelerator with Disney, Starbucks' NFT membership program, Meta's Instagram minting, Reddit avatars, and so on.

Four years have passed, and most of those collaborations have fallen silent. Starbucks' Odyssey program was also shut down last year.

Continuing to directly compete with Base on the L2 track, Polygon has almost no chance of winning. While the technological gap can be caught up, user entry points cannot be. Instead of exhausting resources on a battlefield where victory is unlikely, it's better to seek new opportunities.

Stablecoin payments are a good direction, but it's very crowded.

Stablecoin payments are indeed a growing market.

In 2025, the total market value of stablecoins exceeded $300 billion, a 45% increase compared to the previous year. Their usage is also evolving, expanding from primarily arbitrage between trading platforms to include scenarios such as cross-border payments, corporate finance, and salary disbursements.

But this market is already very crowded.

Stripe spent $1.1 billion last year to acquire Bridge, a stablecoin infrastructure company, and recently secured the issuance rights for the USDH stablecoin on Hyperliquid. PayPal's PYUSD has already captured a 7% share of the stablecoin market on Solana.

Circle is promoting its own payments network. Major banks like JPMorgan, Wells Fargo, and Bank of America are forming alliances to issue their own stablecoins.

Polygon co-founder Sandeep Nailwal told Fortune that this acquisition positions Polygon as a competitor to Stripe.

To be honest, that statement is a bit too strong.

Stripe spent $1.1 billion, and Polygon spent $250 million. Stripe has millions of merchants, while Polygon's clients are mainly developers. Most importantly, Stripe has accumulated payment licenses and banking relationships over more than a decade.

In a direct confrontation, this is not an opponent of the same caliber.

But Polygon might be betting on a different approach. Stripe wants to incorporate stablecoins into its own closed-loop system, keeping merchants to still use Stripe, but replacing the settlement layer with stablecoins, making transactions faster and cheaper.

What Polygon aims to do is to build open infrastructure, allowing any bank or payment company to build their own services on top of it.

One is vertical integration, and the other is horizontal entry. These two models may not directly compete, but they are vying for the attention of the same group of customers.

Live a different life; the road ahead is uncertain.

In the end, though, layoffs in the crypto industry over the past two years aren't uncommon.

OpenSea has cut 50%, and Yuga Labs and Chainalysis are also scaling back. ConsenSys laid off 20% of its workforce last year and did so again this year. Most of these are passive contractions due to running out of funds, so the priority is just to survive first.

Polygon is a bit different. They have money in the bank and were even able to set aside 250 million for acquisitions, yet they still chose to lay off 30% of their staff.

A blood transfusion can be a way to save a life, but it also carries risks.

The Coinme acquired by Polygon primarily operates crypto ATMs, with over 50,000 machines deployed at retail locations across the United States, allowing users to buy cryptocurrency with cash or exchange cryptocurrency for cash.

The problem is that this business ran into trouble last year.

California regulators fined Coinme $300,000 for allowing users to withdraw more than the daily $1,000 limit through ATMs. Washington State was even stricter, imposing a complete ban, which was lifted only in December last year.

Polygon's CEO once said that Coinme's compliance was "beyond requirements." However, regulatory penalties are clear and documented; empty flattery cannot change that fact.

When these matters are tied to the token, the narrative around the $POL token changes as well.

Previously, the more the chain was used, the more valuable POL became. After the acquisition, Coinme takes a fee for each transaction, which is real cash revenue, not a token narrative. The official statement estimates that it could generate over $100 million in revenue annually.

If it can truly achieve this, Polygon could potentially evolve from a "protocol" into a "company," generating revenue, profits, and valuation benchmarks. Such entities are rare in the crypto industry.

However, the pace at which traditional finance is entering the space has clearly accelerated, and the window of opportunity for crypto-native companies is narrowing.

There's a saying in the industry: build in a bear market, harvest in a bull market.

The current issue with Polygon is that it is still under development, but the harvesters of the bull market may no longer be it.

Click to learn about BlockBeats' job openings.

Welcome to join the official Lulin BlockBeats community:

Telegram Subscription Group:https://t.me/theblockbeats

Telegram discussion group:https://t.me/BlockBeats_App

Official Twitter account:https://twitter.com/BlockBeatsAsia