Original | Odaily Planet Daily (@OdailyChina)

Author | Dingdong (@XiaMiPP)

On January 13, Polygon Labs announced that it has completed the acquisition of cryptocurrency startups Coinme and Sequence, with the total acquisition price exceeding 250 million US dollarsHowever, Polygon Labs has refused to disclose the specific acquisition price for each company, nor has it clarified whether the transactions were conducted in cash, equity, or a combination of both. Based on the currently disclosed information, the transactions will proceed in a phased manner: the acquisition related to Sequence is expected to be completed within this month, while the acquisition of Coinme will require regulatory approval and is not expected to finalize until as late as the second quarter of 2026 at the earliest.

"Countercyclical Actions" During Downturns

Polygon Labs CEO Marc Boiron and Polygon Foundation founder Sandeep Nailwal stated that the acquisition aims to support the network's stablecoin strategy. Specifically, Polygon has been actively promoting the adoption of stablecoins but has lacked localized regulatory infrastructure. The acquisition of Coinme is intended to address this gap. As a U.S.-based cryptocurrency financial company,Coinme holds money transmitter licenses covering multiple states and also operates a Bitcoin ATM network.This means that Polygon can leverage Coinme's existing compliance framework to bypass lengthy approval cycles and directly enter the most strictly regulated U.S. market. Coinme will continue to operate its existing business, including the cryptocurrency exchange, wallet, and Crypto-as-a-Service offerings, as a wholly-owned subsidiary of Polygon Labs.

The value of Sequence is more reflected inBlockchain Wallets and Developer InfrastructureLayer. In the context of Web3, a wallet is not merely a tool for asset storage but also the gateway through which users enter the entire blockchain ecosystem. Its security, usability, and scalability directly determine whether the network can support a larger scale of users and funds. Polygon's acquisition of Sequence, in a way, is proactively building "user-side" infrastructure in preparation for its stablecoin strategy.

From this perspective, Polygon's two acquisitions are centered around the same goal.Upstream and downstream layout: One end is the compliant channel, and the other end is the user entry point.

Shifting the perspective back to the industry as a whole, while the L2 ecosystem continues to shrink and market conditions remain weak, Polygon has instead chosen to boldly advance and actively take measures to save itself, continuously investing resources in integration and expansion. Behind these countercyclical moves is a core principle of "compliance first," aiming to proactively complete preparations in the tightening global regulatory environment.The Transition from "Cryptographic Infrastructure" to "Financial Infrastructure"thereby attracting more traditional capital and institutional users, and strengthening its moat.

On-chain data: Not all L2s are declining.

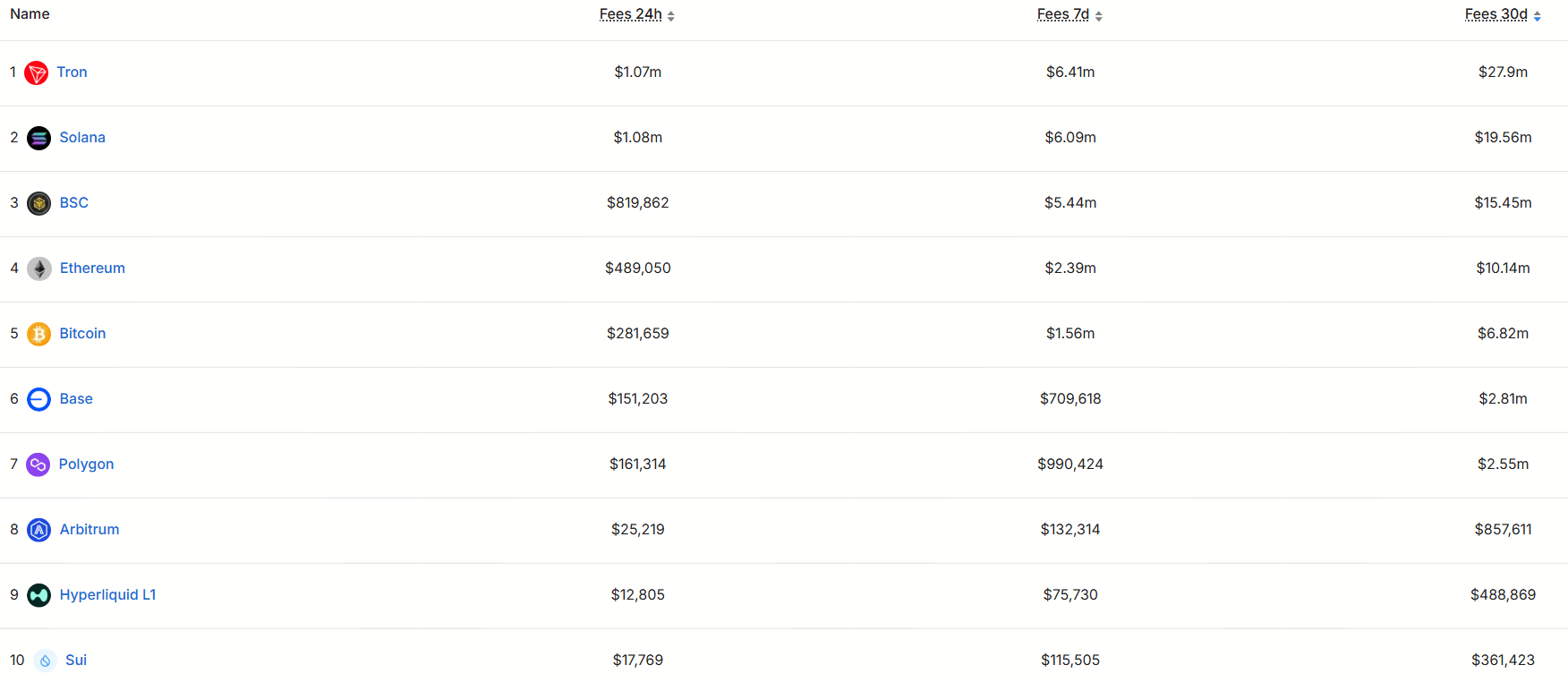

In addition to its strategic-level positioning, Polygon also performs impressively in on-chain data. According to... defillama.com is a website that provides data and analytics on decentralized finance (DeFi) protocols The public chain revenue data for the past 30 days shows that Polygon ranks seventh, still maintaining a certain level of resilience in the highly competitive public chain market.

Of course, the overall gap remains very significant. The top-ranked Tron generates as much as $27.9 million in monthly revenue, while the tenth-ranked Sui only earns $360,000, a difference of over 77 timesThe reality is rapidly eliminating public chain projects that "tell stories but lack real demand." Even Zero Network, a Layer-2 network incubated by Zerion—a Web3 wallet company that once raised $22.5 million—has stopped producing blocks for over three weeks.

In such a comparison, Polygon is at least still "at the table actively."

The Truth Behind the Revenue Surge: A Short-Term Boost for Polymarket

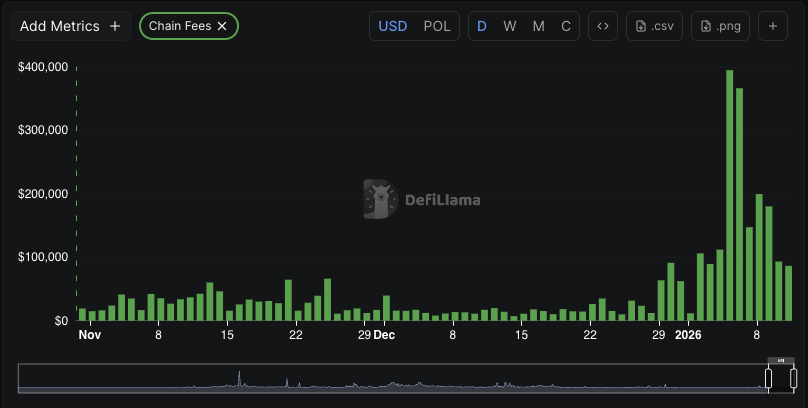

However, it is worth noting that the significant increase in Polygon's transaction fee revenue only began to show from early 2026. According to data disclosed by Castle Labs on January 13, Polygon's current monthly revenue has approached $1.7 million.

The main driver of this round of revenue growth comes from Polymarket.After Polygon introduced a paid model for its 15-minute price prediction market (where users bet on whether major cryptocurrencies like BTC, ETH, SOL, and XRP will rise or fall in price over the next 15 minutes, with settlements occurring every 15 minutes), the network's daily revenue once reached as high as $100,000.

More importantly, Polygon adopts a fee-burning mechanism for its PoS network, where higher transaction volumes result in more token burnings, thus creating a deflationary effect. So far this year, Polygon has cumulatively burned approximately 12.5 million POL tokens, worth approximately $1.5 million, representing about 0.12% of the total supply..

According to the current pace, if this trend continues, the burn rate could reach approximately 3.5% by 2026, significantly higher than the annual issuance rate of staking rewards, which is around 1.5%. The amount burned has already exceeded twice the amount of staking rewards distributed, resulting in a net reduction in supply.

Although Polymarket confirmed via the Discord community in late December 2025 that it will migrate to its self-built Ethereum Layer 2 (named POLY), the migration will not be completed immediately.In the short term, Polygon will continue to benefit from the high activity on Polymarket, accelerating the deflationary effects and thus positively impacting the price of POL.

For more analysis on their correlation, see:The Economics Behind Polymarket's Migration from Polygon》.

Conclusion

Overall, the current surge in Polygon's transaction fees and token burning largely depends on the phased prosperity driven by Polymarket. At the same time, its long-term strategy focused on stablecoin payments and real-world financial infrastructure is also gradually taking shape.

This might be exactly where Polygon is most worth watching right now:Short-term data provides confidence to the market, while long-term strategies determine whether it can remain in the next round of competition..