Author: Jae, PANews

In the long journey of Ethereum's scalability, Polygon was once remembered by the name "sidechain." But now, it is quietly shedding its old skin, striving for a rebirth.

Recently, Polygon co-founder Sandeep Nailwal positioned 2026 as the "rebirth year" for POL. In the week following his post, the price of the POL token surged by over 30%.

With the completion of the acquisitions of Coinme and Sequence, as well as the disclosure of its technical roadmap, Polygon aims to evolve from an Ethereum scaling solution into the "foundation for payments and tokenization" of global markets.

Spending over 250 million USD to make major acquisitions, bridging the final mile for cash to go on-chain

Polygon has begun adopting an extremely aggressive strategy, directly penetrating into the financial gateways of the physical world.

On January 13, Polygon Labs announced the completion of its acquisition of two cryptocurrency companies, Coinme and Sequence, in a deal valued at over $250 million. Coinme specializes in cash-to-cryptocurrency exchange services and operates a cryptocurrency ATM network in the United States. Sequence provides on-chain infrastructure services, including products such as cryptocurrency wallets.

Polygon Labs CEO Marc Boiron and Sandeep Nailwal stated that this acquisition is a key component of their stablecoin and payment strategy, aiming to strengthen Polygon's infrastructure presence.This move also marks Polygon's expansion from "smart contracts" to "physical infrastructure."

It is worth noting that Coinme is one of the earliest licensed Bitcoin ATM operators in the United States. This acquisition not only secured its ATM network covering 49 states across the U.S. and tens of thousands of retail locations (such as major supermarkets like Kroger), but more importantly, it acquired a complete set of essential licenses for payment institutions operating within the U.S.—specifically, a Money Transmitter License (MTL).

The underlying logic behind this acquisition is to establish a physical network for fund deposits and withdrawals.For users without traditional bank accounts or for general users of CEX (centralized exchanges), Polygon provides a way to directly convert cash into on-chain assets (such as stablecoins or POL) at supermarket checkout counters through Coinme's ATMs.

This is a shortcut for "cash on-chain," yet it also presents a substantial compliance barrier.Acquiring an entity that has operated for over a decade and has a mature compliance framework would provide Polygon with a very high barrier to entry. Although Coinme is currently facing some regulatory challenges (such as the refund directive from Washington State's DFI), for Polygon, this remains the optimal solution for connecting physical-world liquidity.

In short, this major acquisition is not just about buying equipment, but also about buying access, licenses, and trust.

Sandeep Nailwal bluntly stated that this move will put Polygon Labs in direct competition with Stripe. In the past year, Stripe has also acquired stablecoin and crypto wallet startups in succession, and developed its own public blockchain tailored for payment scenarios, aiming to build a full technology stack ranging from payment processing to user asset storage.

Overall, in the new round of stablecoin arms race, Polygon Labs is trying to stand on the same starting line as traditional fintech giants through acquisitions.

A Performance Sprint from 5,000 to 100,000 TPS

The war involving stablecoin payments cannot do without strong support from the technical layer.

According to Sandeep Nailwal's disclosed TPS (transactions per second) roadmap, Polygon aims to elevate the execution efficiency of the blockchain to the level of traditional internet.

The recent Madhugiri hard fork upgrade completed by Polygon has already shown initial results, increasing the on-chain TPS by 40% to reach 1,400 TPS.

The team's first-phase plan is to achieve 5,000 TPS within six months. The goal of this phase is to address the congestion issues currently experienced by the PoS chain during peak transaction times, enabling Polygon to handle the throughput required for global retail payments.

The more aggressive second-phase upgrade plan aims to increase the entire ecosystem's TPS to 100,000 within 12 to 24 months, which means Polygon is expected to handle transaction volumes comparable to Visa.

Achieving this goal relies on two major technological breakthroughs:

Rio Upgrade: Introducing stateless validation and recursive proofs, reducing transaction finality from minutes to approximately 5 seconds, and eliminating the risk of chain reorganization.

AggLayer (Aggregation Layer): Achieve seamless liquidity sharing across multiple chains through ZK proof aggregation, making 100,000 TPS not the burden of a single chain, but the distributed synergy of the entire Polygon network.

It can be said that Polygon is not reforming a single chain, but building a federation.

Payment services penetrate retail scenarios, integrating three major fintech giants.

Once the fund inflow and outflow channels as well as the processing capacity are both in place, payment processing will naturally fall into place.

Polygon is positioning itself as the technological foundation of a global payment network by forming deep partnerships with fintech giants.

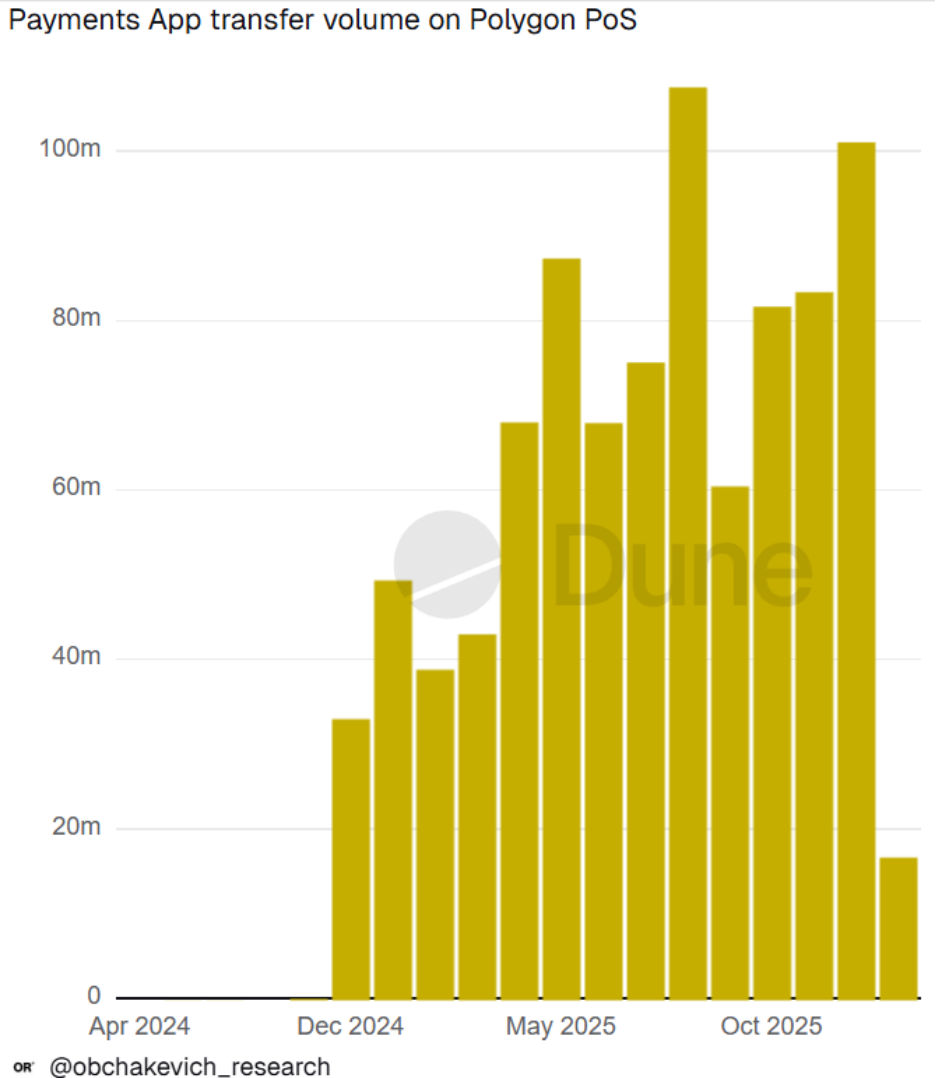

Full Integration with Revolut: As Europe's largest digital bank with 65 million users, Revolut has integrated Polygon as its primary infrastructure for crypto payments, staking, and trading. Revolut users can now send low-cost stablecoin transfers and stake POL tokens directly on the Polygon network. As of the end of 2025, the total transaction volume on Polygon by Revolut users has shown a steady upward trend, with cumulative transactions approaching $900 million.

Flutterwave's Settlement Bridge: African payment giant Flutterwave has also chosen Polygon as its default public blockchain for cross-border payments, focusing on stablecoin settlements. Considering the high costs of traditional remittances in Africa, Polygon's low fees and fast settlement offer a superior option for local driver payments and trade on platforms like Uber.

Mastercard's Identity Solution: Mastercard has adopted Polygon to power its "Mastercard Crypto Credential" identity solution, introducing verified usernames for self-custody wallets. This significantly lowers the barrier to entry for users and reduces the risk of address misidentification during transactions, while enhancing the overall payment experience.

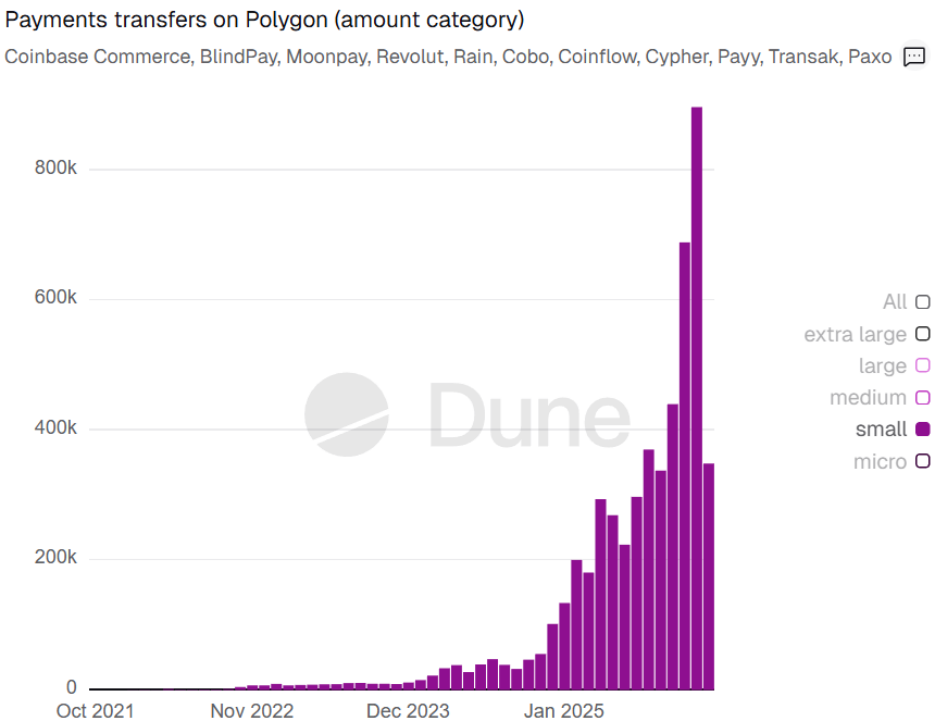

Polygon is also significantly penetrating everyday consumption scenarios.According to Dune's data, as of the end of 2025, the number of microtransactions on Polygon (with individual amounts between $10 and $100) has approached 900,000, setting a new record and increasing by over 30% compared to November.

Leon Waidmann, the head of Onchain research, emphasized thatThis transaction range overlaps significantly with daily credit card spending, indicating that Polygon is gradually becoming a primary channel for payment gateways and PayFi (Payment Finance).

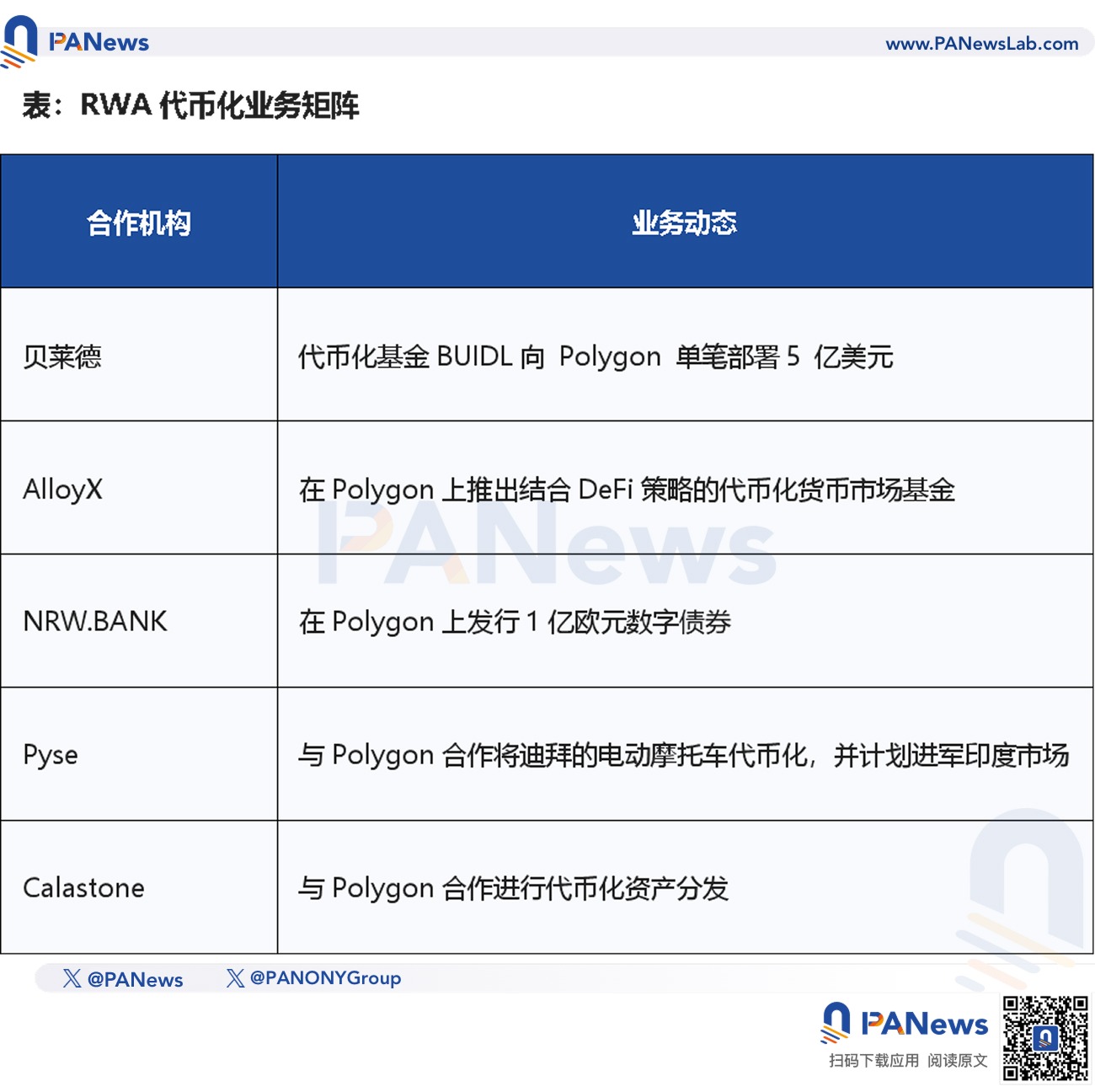

Tokenized business focuses on institutional markets, BlackRock bets $500 million

If payment is the entry point for user traffic on Polygon, then tokenization is the foundation of its institutional-grade infrastructure.

In the RWA (Real-World Assets) distribution field, Polygon has become the testing ground and platform of choice for top global asset management institutions. Its low transaction costs and seamless compatibility with the Ethereum ecosystem give Polygon a significant advantage in the migration of traditional financial assets onto the blockchain.

In October 2025, the world's largest asset management firm, BlackRock, deployed approximately $500 million in assets in a single transaction on the Polygon network through its BUIDL tokenized fund.

This action represents the highest-level endorsement of the security of the Polygon 2.0 architecture.With the large-scale inflow of institutional funds, Polygon's TVL (Total Value Locked) and liquidity depth are likely to be further enhanced.

AlloyX's Real Yield Token (RYT) launched on Polygon is a typical example of the integration of traditional finance and DeFi.This fund invests in short-term, low-risk instruments such as U.S. Treasury bonds, with its unique feature being support for a looping (reinvestment) strategy. Investors can use RYT as collateral in DeFi protocols to borrow funds and reinvest them back into the fund, repeatedly amplifying returns.

The issuance of digital bonds by Germany's NRW.BANK on Polygon represents a significant breakthrough for regulated capital markets in Europe.This bond operates under the framework of Germany's Electronic Securities Act (eWpG), demonstrating that Polygon is not only capable of issuing regular crypto tokens but also able to support compliance assets with strict regulatory requirements.

POL exhibits strong deflationary characteristics, token value capture restarts

Looking back at the asset itself, the transition from MATIC to POL is not merely a change in token symbols, but also a restructuring of the economic logic.

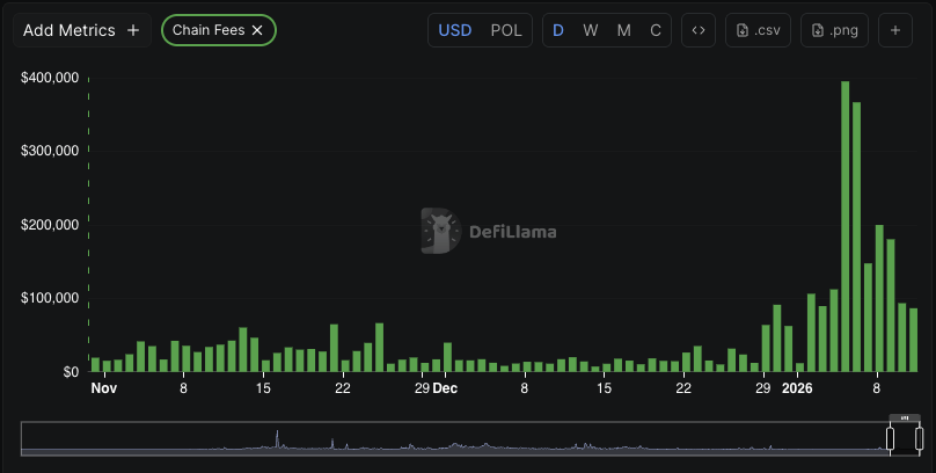

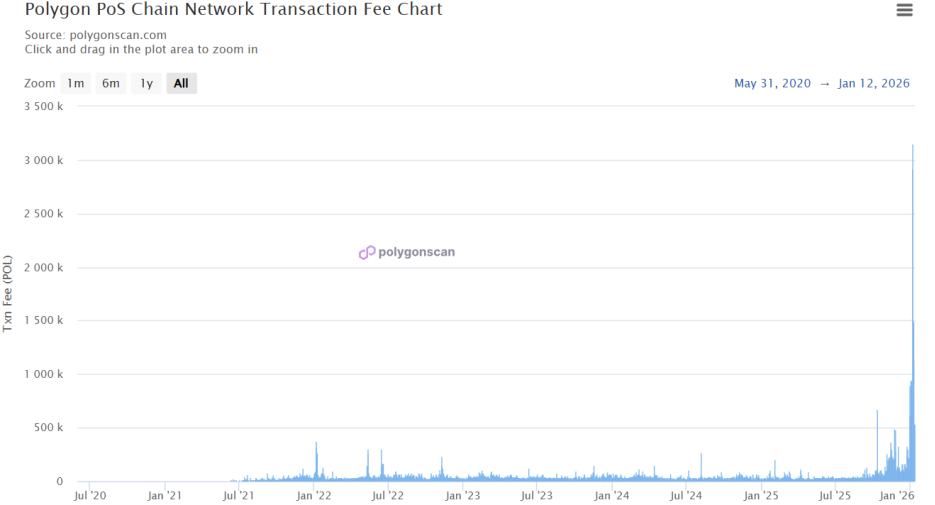

Since early 2026, Polygon has generated over $1.7 million in transaction fees and burned more than 12.5 million POL tokens (approximately $1.5 million).

Castle Labs pointed out that the main reason for the surge in transaction fees was that Polymarket activated its 15-minute prediction market fee feature, which directly brought over $100,000 in daily revenue to Polygon.

Previously, the Polygon PoS network also set a historical record by burning 3 million POL tokens in a single day, equivalent to approximately 0.03% of the total supply. This was not coincidental, but a natural outcome as the ecosystem entered a phase of high-frequency usage.

According to the EIP-1559 mechanism, when block utilization remains consistently above 50%, gas fees will enter a rapid upward trajectory. Currently, Polygon's daily token burn has stabilized around 1 million POL, with an annualized burn rate of approximately 3.5%, which is more than twice the annual staking yield (around 1.5%).This means that, based solely on on-chain activity, the circulating supply of POL is being "physically removed" at a significant rate.

This high-density value capture may support the "token renaissance" mentioned by Sandeep Nailwal.

The moat coexists with fourfold risks.

Although the current form of Polygon appears to be thriving, it still faces four major challenges:

- The Double-Edged Sword of Regulatory Policies: While acquiring Coinme provides a license, it also directly exposes Polygon to regulation across U.S. states. If compliance issues in Coinme's history escalate, they could potentially impact Polygon's "renewal" plan for the POL token in 2026.

- Challenges of a fragmented technical architecture: Polygon 2.0 includes multiple complex modules such as PoS, zkEVM, AggLayer, and Miden. While a multi-component architecture offers enhanced functionality, maintaining such a large and diverse technical ecosystem presents extremely high engineering complexity and security risks. In particular, any vulnerability in AggLayer's cross-chain interactions could potentially trigger a systemic disaster.

- Fierce competition in the public blockchain market:

- The Rise of Base: Backed by Coinbase, Base has experienced a significant increase in users, gradually eroding Polygon's market share in areas such as social media and payments.

- Pressure from high-performance public blockchains: High-performance L1s like Solana still hold a leading advantage in transaction speed and developer experience, while Polygon's goal of 100,000 TPS will require more time to be validated.

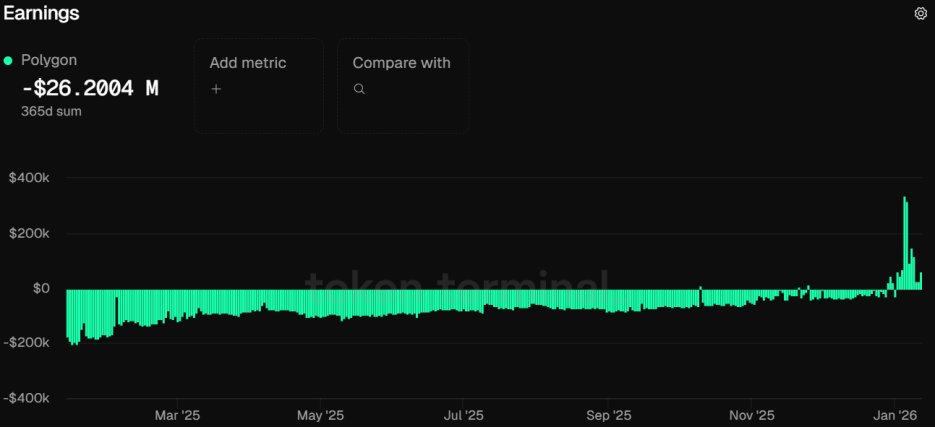

- Concerns about financial sustainability: According to Token Terminal data, Polygon reported a net loss of over $26 million in the past year, with its transaction fee revenue failing to cover validator costs. This reliance on ecosystem incentives indicates that it is still in a stage of "spending money to gain market share." Even if Polygon turns profitable by 2026, the sustainability of its revenue-generating capability remains to be seen.

Clearly, Polygon is no longer content with merely serving as a "plug-in" for Ethereum. Its transformation strategy is worth careful consideration: breaking through performance bottlenecks through technological scalability, lowering entry barriers through investments and acquisitions, gaining credibility through top-tier institutions, and finally reinforcing user stickiness through high-frequency use cases.

Clearly, Polygon is no longer content with merely serving as a "plug-in" for Ethereum. Its transformation strategy is worth careful consideration: breaking through performance bottlenecks through technological scalability, lowering entry barriers through investments and acquisitions, gaining credibility through top-tier institutions, and finally reinforcing user stickiness through high-frequency use cases.

2026, as a "year of rebirth," will be marked not only by fluctuations in the price of the POL token but also by Polygon's deep resonance with the global financial landscape as an infrastructure provider. For investors, tracking the progress of Polygon 2.0's technical implementation, the inflow and turnover rate of capital, and its financial performance will be key to determining whether Polygon can successfully reinvent itself.