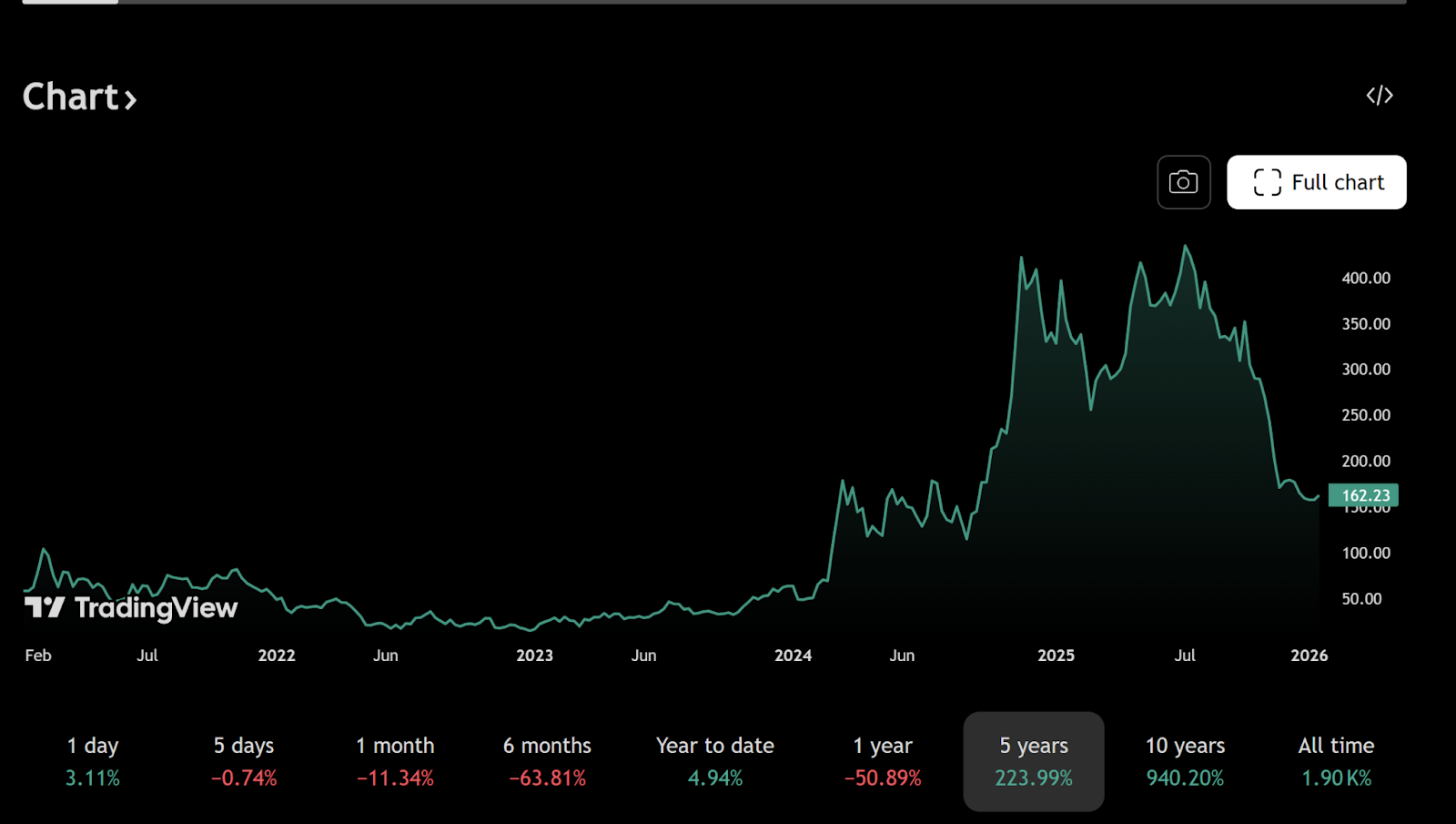

When Bitwise released its 2026 Outlook report, one of its conclusions immediately sparked widespread discussion: native cryptocurrency stocks and listed mining companies, such as Coinbase and MicroStrategy, could significantly outperform traditional Nasdaq technology stocks. The reasoning is simple yet controversial. Bitwise argues that these companies possess an inherent leverage effect tied to cryptocurrency cycles, which traditional tech companies do not have.

Among these, MicroStrategy is the most polarizing example. In private discussions, it is often described as a ticking time bomb—an over-leveraged alternative to Bitcoin doomed to collapse if prices remain depressed for an extended period. Yet, it is precisely this widespread skepticism that makes the case so intriguing. Historically, outsized returns rarely come from consensus; they often emerge from areas where opinions are most divided.

Before determining whether MicroStrategy represents systemic vulnerability or financial complexity, it is necessary to go beyond superficial comparisons and carefully examine the actual workings of its strategy.

MicroStrategy's Bitcoin leverage is not traditional debt financing.

At first glance, this criticism seems reasonable. MicroStrategy borrowed money to purchase Bitcoin, and thus faces downside risk if the price falls below its average acquisition cost. From this perspective, failure seems inevitable during a prolonged bear market.

However, this framework implicitly assumes the traditional leverage model—short-term loans, high interest rates, and forced liquidation. MicroStrategy's balance sheet structure is fundamentally different from this.

The company primarily finances its Bitcoin purchases through convertible bonds and senior unsecured bonds. These bonds mostly carry zero or very low interest rates and are largely set to mature between 2027 and 2032. Crucially, these bonds do not include margin calls or price-based forced liquidation mechanisms. As long as the company can pay the minimal interest required, it will not be forced to sell its held Bitcoin at a discount.

This distinction is crucial. Leverage that carries the risk of forced liquidation behaves very differently from leverage designed around time and options.

MicroStrategy's cash flow supports long-term Bitcoin investment.

Another common misconception is that MicroStrategy has abandoned its operating business and now relies entirely on the appreciation of Bitcoin. In reality, the company remains a profitable enterprise software provider.

Its core analytics and software business generates approximately $120 million in revenue each quarter, providing stable cash flow that helps cover interest expenses. Although this business represents only a small portion of the company's total market value, it plays a crucial role from a credit perspective. It provides the liquidity needed to maintain the capital structure during prolonged periods of market stress.

Time is the second structural advantage. Since the debt matures in several years, MicroStrategy does not need an immediate rise in its stock price. The company will only face real pressure if the price of Bitcoin plummets significantly below its average price and remains there for years.

As of December 30, 2025, MicroStrategy holds approximately 672,500 bitcoins, with an average purchase cost close to $74,997. This figure is often cited as a basis for bearish arguments, but focusing solely on the spot price overlooks the asymmetric gains embedded in the company's liabilities.

MicroStrategy's convertible bonds created an asymmetric option for Bitcoin.

Convertible bonds introduce a repayment structure that is often misunderstood. If MicroStrategy's stock price rises significantly—often due to an increase in the price of bitcoin—bondholders can choose to convert the bonds into equity rather than demanding repayment of the principal.

For example, some 2030 bonds to be issued in 2025 have a conversion price of about $433 per share, which is much higher than the current trading price of about $155. Converting at the current price would not be rational, so the company only pays a minimal amount of interest.

If Bitcoin's price rises significantly, the equity value will expand accordingly, and part of the debt can be effectively eliminated through conversion. If Bitcoin's price stagnates but does not crash, MicroStrategy can continue its operations while paying very low actual interest. Only if Bitcoin's price drops to around $30,000 and remains there until the end of the 2020s would forced deleveraging become a significant concern.

This situation is possible, but far more extreme than many casual comments suggest.

MicroStrategy's Bitcoin strategy is a macro monetary game.

On a deeper level, MicroStrategy is not merely speculating on the price of Bitcoin. It is expressing a view on the future of the global monetary system, particularly the long-term purchasing power of the U.S. dollar.

By issuing long-term, low-interest bonds denominated in U.S. dollars, the company is effectively shorting the fiat currency. If monetary expansion continues and inflation remains high, the real value of its liabilities will decrease over time. Bitcoin, with a fixed supply of 21 million coins, serves as a hedge against this transaction.

This is why comparing MicroStrategy to a reckless leveraged trader misses the point. The strategy is more akin to a long-term macro investment rather than short-term speculation. In an environment where debt can be inflation-eroded, borrowing a depreciating currency to acquire scarce digital assets is a classic approach.

In short, if the value of the dollar in the future is lower than its value today, repaying nominal debt becomes easier over time. The longer the debt maturity and the lower the interest rate, the more pronounced this effect becomes.

Why Retail Investors Misinterpret MicroStrategy's Bitcoin Leverage Strategy

Retail investors typically assess leverage from the perspective of personal finance. Loans must be repaid, losses become apparent quickly, and leverage itself is inherently risky. However, large-scale corporate financing follows a different set of rules.

MicroStrategy can refinance, extend its debt, issue stocks, or restructure its debt—options that are not available to individuals. As long as the capital markets remain accessible and the company's creditworthiness is maintained, time will become an asset rather than a liability.

This difference in perspective explains why Michael Saylor's strategy often appears reckless to outsiders. In reality, as long as one accepts its core assumptions—long-term currency devaluation and the continued existence of Bitcoin as a global store of value—the strategy is internally logical and coherent.

Bitwise, Crypto Stocks, and Bitcoin's Leverage-Driven Upside Potential

From this perspective, Bitwise's optimism about cryptocurrency stocks becomes easier to understand. Companies like MicroStrategy and Coinbase are not just participants in the cryptocurrency ecosystem; they are structurally intertwined with it.

When the cryptocurrency cycle turns upward, their profitability, balance sheets, and equity valuations can expand at a faster pace than those of traditional technology companies. This leverage amplifies downside risks, but during speculative expansions, markets rarely reward linear exposure; instead, they reward convexity.

Conclusion: MicroStrategy is more like a Bitcoin call option than a time bomb.

MicroStrategy is neither a sure winner nor on the verge of collapse. Describing it as a "time bomb" is overly simplistic and overlooks both its capital structure and strategic intent. In reality, it is more like a large, publicly traded call option on Bitcoin—financed by long-term, low-cost debt and supported by an operating company capable of generating cash flow.

Whether this ultimately proves visionary or disastrous depends on the long-term development trajectory of Bitcoin and the credibility of the fiat currency system over the next decade. However, it is clearly not a reckless gamble, but rather a carefully planned macro investment utilizing institutional tools.

In financial markets, it is often precisely these unsettling, highly questioned structures that produce the most asymmetric outcomes.

Recommended Reading: