This article comes from:Ambcrypto is a company that provides cryptocurrency security solutions & Cointelegraph

Compiler | Odaily Planet Daily (@OdailyChina); Translator | Moni

After a "grueling" fourth quarter of 2025, the cryptocurrency market finally showed signs of recovery in early 2026.

Surprisingly, it was not Bitcoin or Ethereum that ignited the cryptocurrency market at the beginning of the new year, but Meme coins. After a period of quiet holidays and sluggish market activity, Meme coins are making a strong comeback.

Is the capital rotation cycle repeating itself?

Frankly speaking, this round of Meme coin market movement is not surprising. By the end of 2025, market liquidity had dried up, FUD (fear, uncertainty, and doubt) sentiment was widespread, and retail investors' risk tolerance had dropped to the lowest level of the year. The Meme coin market cap fell by more than 65%, hitting a yearly low of $35 billion on December 19. As traders' risk tolerance declined, after Christmas, Bitcoin remained in consolidation, and mainstream assets lacked clear direction. Naturally, capital flowed into higher-beta, more elastic assets, and Meme coins just happened to fill this void.

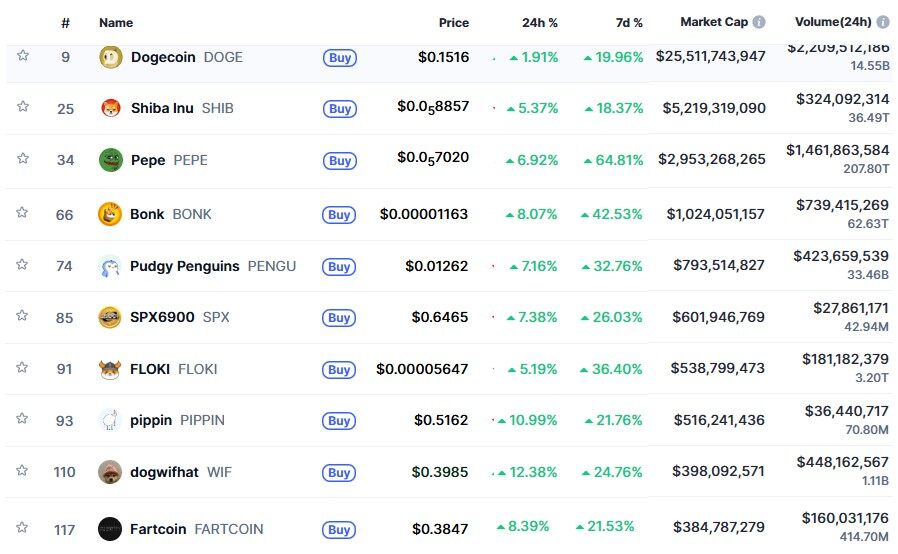

According to CoinMarketCap data, the overall market capitalization of the Meme coin sector has surpassed $47.7 billion, an increase of nearly $10 billion compared to the $38 billion recorded on December 29, 2025. Among them, the top three Meme coins by market capitalization saw significant gains: DOGE rose nearly 20% in a week, SHIB increased by 18.37%, and PEPE surged by 64.81%.

At the same time, the trading volume of meme coins has also surged along with their market value, jumping from $2.17 billion on December 29, 2025, to $8.7 billion on Monday of this week, an increase of 300%.

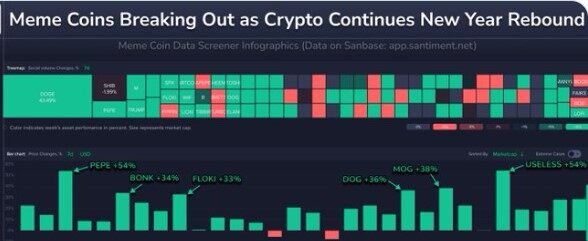

From a data perspective, this recent rise in Meme coins is not just a "hype-driven rally" of a single token, but rather a broad-based recovery across the sector. At the same time, the surge in social media discussion and on-chain trading volume indicates that attention and liquidity are returning, rather than merely a price push.

Technical Analysis Support: Meme Coins' Rebound Is Not Without Basis

Meme coins are among the riskiest assets in the cryptocurrency market, and a price rebound may indicate that investors are willing to take on higher risks again. From a macro technical perspective, the TOTAL3 indicator (the total market capitalization of cryptocurrencies excluding BTC) shown in the chart below indicates that the crypto market has transitioned from a downtrend into a recovery phase. This suggests that market behavior has shifted from "selling on rebounds" to "accumulating on dips."

Currently, TOTAL3 is testing a key resistance level of approximately $848 billion, which coincides with the 200-day moving average and a medium-term trendline. If it subsequently breaks out with increased volume and holds above this level, the technical target could rise to $900 billion, providing room for the continuation of a rebound in altcoins and Meme coins.

From the perspective of internal sector structure, Meme coins are showing clear signs of systematic strength. The recent price increase is not concentrated in a single asset, but has spread across multiple projects such as PEPE, BONK, DOGE, FLOKI, and MOG, spanning both the Ethereum and Solana ecosystems. This broad participation typically indicates that capital is being allocated at a sector level, rather than short-term speculation on individual assets. Historical cycles also show that during Bitcoin consolidation phases, high-beta assets often rebound first, serving as a test of the market's risk appetite.

Leverage and Sentiment: Long Positions Enter, but Leverage Risks Accumulate in Tandem

The derivatives market for meme coins has also heated up rapidly. According to Coinglass data, DOGE's open interest trading volume increased by 45.41% in the past 24 hours, with a total open interest of $1.941 billion. PEPE's open interest rose by 33.32%, reaching $514 million. SHIB increased by 93.66%, WIF by 123.39%, and PENGU by 69.04%.

Outstanding contracts are typically a key indicator for judging whether "real money" has entered the market, as this metric reflects the total volume of unsettled derivative contracts, where each seller transaction is matched with a buyer. The recent price rebound in Meme coins has been simultaneously validated by rising outstanding contracts and trading volumes. Taking PEPE and DOGE as examples, multiple Meme coins have seen a significant increase in derivative trading volumes as their prices rise. This synchronization usually indicates a strong bullish momentum in the market, as leveraged traders open more contracts expecting further price increases, showing genuine long-position building rather than just short-covering.

Of course, the rapid expansion of open contracts also means that leveraged exposure is accumulating simultaneously. Considering that Meme coins themselves have limited fundamental support and their pricing is highly dependent on market sentiment, the increased activity on high-leverage platforms could significantly amplify short-term volatility. Historically, Meme coins often act as the "canary in the coal mine" for market trends: they are the first to reflect changes in risk appetite, but they are also the most vulnerable to sharp declines when sentiment reverses. Once market sentiment turns or external shocks emerge, overly concentrated long positions could trigger rapid deleveraging and a chain reaction of liquidations. Therefore, while derivatives data currently provides positive validation for the ongoing rebound, its structure also highlights that the risk of short-term pullbacks cannot be ignored.

The rise in altcoins may follow the steps of Meme coins, potentially benefiting SOL.

On-chain analytics platform Santiment previously posted on X.AnalysisIt is said that this round of Meme coin rebound began a few days after Christmas, when FUD sentiment among retail traders reached its peak. In the crypto market, the assets that are often the most undervalued by retail investors are usually the first to rebound.

As market capital begins to diversify into "other" areas such as meme coins, altcoins may also soon experience a price surge. Historically, the altcoin that has benefited the most from the meme coin craze is SOL.

Meme coins have always been one of Solana's key growth engines, driving user engagement and cultural influence over the past few years. This activity has helped attract developers and traders to the network, playing a significant role in the revival of Solana's decentralized finance ecosystem. At the same time, the dominance of meme coin trading has influenced the perception of the network among investors and financial institutions, often linking Solana's growth to speculative cycles.

Igor Stadnyk, co-founder and head of AI at True Trading, stated that Meme coins have become part of Solana's cultural identity and serve as a liquidity engine for attracting users. However, the next phase of Solana's growth may come from applications that rely less on viral speculation and more on sustained execution, such as on-chain perpetual futures and AI-native trading agents.

Is it a prelude to a recovery, or a classic bull market trap?

Given that the current crypto market has not yet fully recovered from its downturn, this Meme coin craze has also sparked some skepticism within the community: is this a prelude to a comprehensive recovery, or merely an emotion-driven short-lived rebound?

Optimists believe that the strong rebound of meme coins indicates a return of risk appetite in the crypto market, suggesting that altcoins, and even major assets, may follow with further gains. However, on the other hand, features such as social media-driven hype, leverage amplification, and prices still far below historical highs seem highly similar to past "bull trap" scenarios. For traders, this is not a signal to blindly chase higher prices, but rather a phase that demands high discipline, quick responses, and strict risk management.

But one thing is certain: Meme coins have kicked off the first wave of the 2026 crypto market. Whether they will light up a new bull market or burn too hot and backfire on the market remains to be seen. The answer may be revealed very soon.