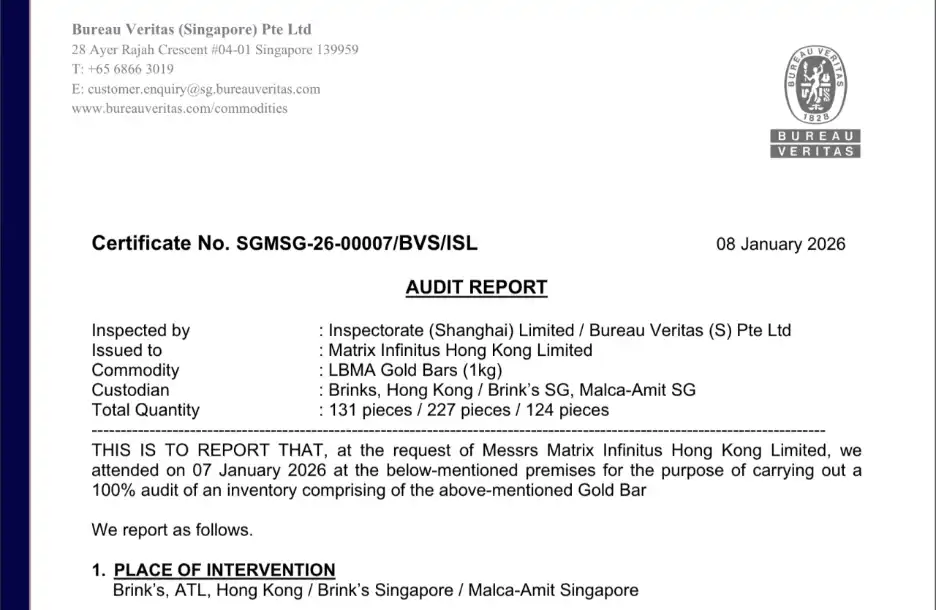

Recently, Matrixport's RWA platform, Matrixdock, released its semi-annual physical gold audit report for the second half (H2) of 2025. The report discloses the status of physical gold reserves corresponding to the XAUm token, demonstrating Matrixdock's ongoing commitment to physical asset verification and information transparency.

This audit was conducted by an independent third-party professional organization according to institutional-level standards, and carried out a comprehensive examination of the physical gold reserves corresponding to the XAUm tokens. The audit strictly followed the leading gold ETF audit standards within the industry, covering all elements including weight, purity, serial numbers, and vault custody information, achieving individual verification of each physical gold bar.

The XAUm gold token launched by Matrixdock employs a "dual-verification" mechanism: on one hand, it relies on independent physical audit processes, and on the other hand, it integrates on-chain real-time verification tools, enabling investors to transparently and continuously observe the mapping relationship between token supply and the corresponding gold reserves.

Audit Coverage and Key Data

● Audit Execution Date: January 7, 2026

● Physical gold reserves: 482 one-kilogram gold bars recognized by the LBMA

● Total weight: 482 kg (approximately 15,595.336 ounces)

● Hosted Vault: Brink's Hong Kong, Brink's Singapore, Malca-Amit Singapore

● Based on the gold price at the time of the audit, the market valuation of the relevant physical gold is approximately 7.175 million U.S. dollars.

● The audit results showed no discrepancies between the physical gold and the related records.

In addition, compared to the audit in the first half of 2025, this audit covers 61 more physical gold bars.

Enhancing the Verifiability of Tokenized Gold Through On-Chain Tools

In addition, the gold allocation query tool provided by Matrixdock allows XAUm holders to view the specific gold bar information corresponding to their tokens via a Web3 wallet. For example, a standard 1-kilogram gold bar corresponds to approximately 32.148 XAUm tokens, providing a more intuitive asset mapping for tokenized gold.

As tokenized assets transition from innovation to infrastructure, investor trust will increasingly rely on verifiable facts rather than verbal promises. Matrixdock states that it will continue to advance reserve transparency and institutional operational standards, committed to providing global investors with a more trustworthy and secure digital gold asset solution.

Click to learn about BlockBeats' job openings.

Welcome to join the official Lulin BlockBeats community:

Telegram Subscription Group:https://t.me/theblockbeats

Telegram discussion group:https://t.me/BlockBeats_App

Official Twitter account:https://twitter.com/BlockBeatsAsia