Author:Michel Athayde

Warning: This is a "report" to wake you up.

Have you ever had this illusion too:

"Four hours is too slow. I want to do 5-minute short-term trading. With a 1% compound interest per day, I would become the richest person in the world in a year."

"Making money through spot trading is too slow. I use 3x, 5x leverage. As long as the direction is right, the money I make is several times more than others."

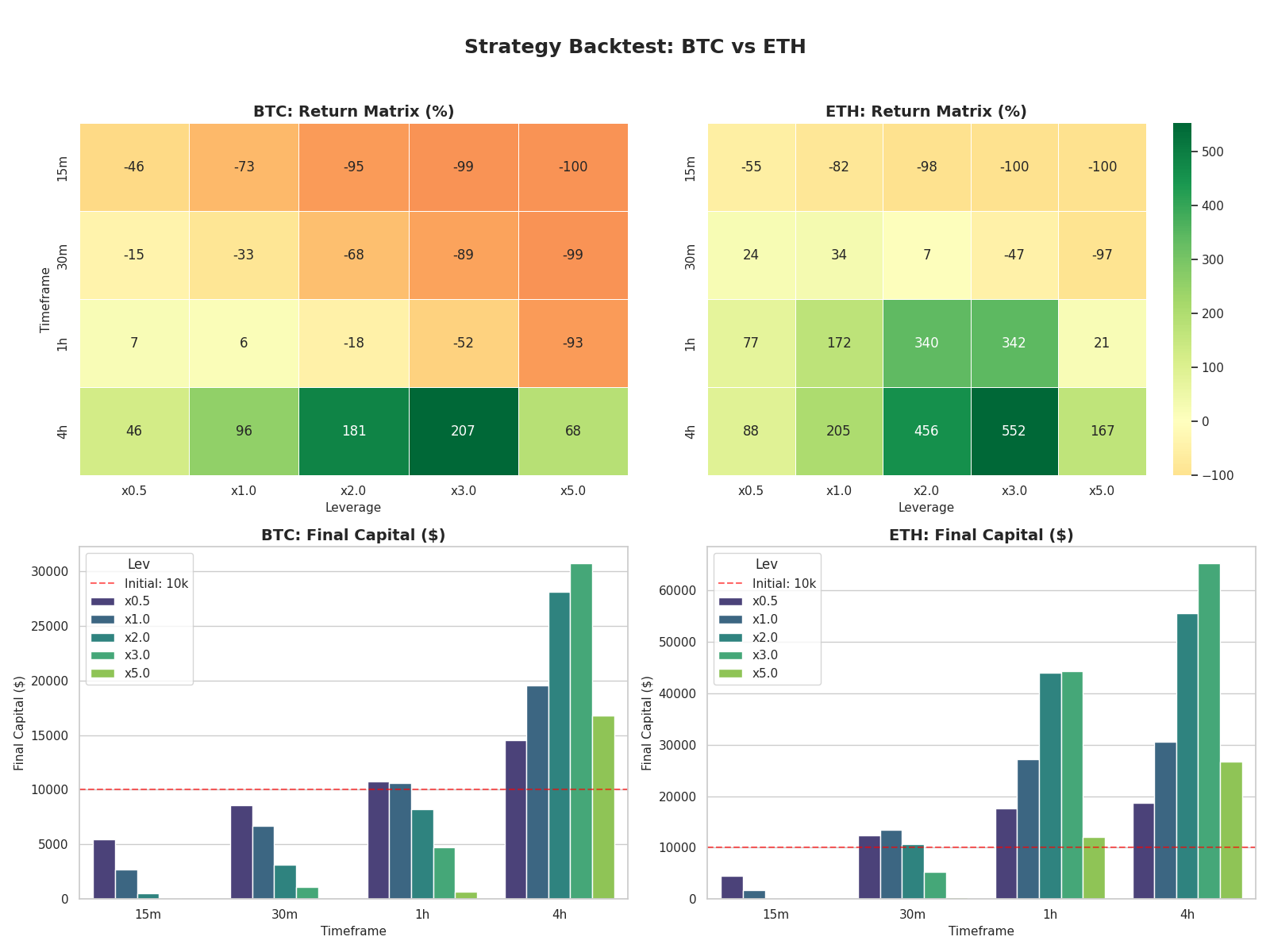

To verify these "get-rich-quick fantasies," we not only backtested for 4 hours, but also dragged out the 15-minute (15m), 30-minute (30m), and 1-hour (1H) timeframes for thorough "torture testing";

We not only examined the spot positions, but also simulated the real outcomes of 200% (2x), 300% (3x), and 500% (5x) leveraged positions under extreme market conditions.

The conclusion is extremely harsh:Without leverage, over these past five years of random attempts, 90% of people couldn't even outperform the "set-and-forget" coin-holding strategy.

Baseline Data: The "Passing Line" You Must Beat

Before evaluating any strategy, we must first see how much "lying flat" (i.e., doing nothing) can earn us. Based on the past 5 years of spot data:

BTC pure spot:+48.86%

ETH pure spot: +53.00%

(Note: This means that if you had bought and uninstalled the app 5 years ago, you would now have approximately a 50% profit. This is the "passing line" that the strategy must beat.)

MACD Strategy Data Summary

I backtested the performance of MACD on BTC/ETH over the past 5 years across different timeframes and leverage levels:

| English Label (Chart Label) | The Chinese term "中文含义" translates to "Chinese meaning" in English. If you are referring to the meaning of a specific Chinese word or phrase |

| Strategy Backtest | Strategy Backtesting Analysis |

| Return Matrix (%) | Return Heatmap (The redder the color, the more loss; the greener the color, the more profit) |

| Final Capital ($) | Final capital (principal is 10,000 U) |

| Timeframe (TF) | Time Period (15m, 30m, 1h, 4h) |

| Leverage (Lev) | Leverage (x0.5, x1.0, x2.0, x3.0, x5.0) |

| Initial: 10k | Initial principal (red dashed baseline) |

Top Left & Top Right (Heatmap - Yield):

Danger Zone (Red/Deep Orange): Focus on 15 minutes and 30 minutes This short cycle, especially when combined with high leverage (x3.0, x5.0), almost wiped out the capital (-99%, -100%).

Gold District (Dark Green): Focus on 4 hours Cycle.ETH refers to Ethereum, The performance under the 4-hour cycle was particularly outstanding, with almost all the blocks being green.

Lower Left & Lower Right (Bar Chart - Final Funds):

Red dashed line (10k): This is the break-even line. Bars below the red line indicate a loss, while bars above the red line indicate a profit.

BTC vs ETH: Pay attention to the lower right corner. ETH's 4-hour candlestickWhen you use x2.0 or x3.0 When using leverage, the capital column is extremely tall, far outperforming BTC, which verifies that ETH's volatility brings higher excess returns during trending market conditions.

I. A Painful Lesson: 90% of Short-Term Trading Is "Negative Optimization"

The data reveals a harsh reality: on medium- and small-time cycles (15m, 30m, 1h), the MACD strategy not only fails to generate excess returns (Alpha), but in fact significantly underperforms the "dumb" strategy of simply holding coins, due to excessive trading and transaction costs.

1. "Frenetic Activity" in the BTC 1-Hour Timeframe

Strategy PerformanceBTC 1h x1.0 return rate is +6%.

Baseline PerformanceThe BTC spot coin-holding yield is +48.86%.

In-depth analysis:

At the 1-hour time frame, you've spent five years diligently watching the charts, executing thousands of trades based on MACD crossovers, paying huge trading fees to the exchange, and in the end, you only earned 6%. However, if you had simply done nothing, you could have earned 49%.

Conclusion: Running the MACD strategy on the 1H time frame essentially destroys value. Your aggressive moves seem fierce, but in the end, your returns turn from positive to negative (relative to the opportunity cost).

2. Comprehensive Failure of Short-Term Trends (15m / 30m)

All Strategies: Total loss or margin call.

Benchmark comparisonCompared to the +50% positive return from holding coins, the short-term trading strategy is... -100% destructive strike.

Cause of Death Analysis:

NoiseFluctuations at the 15-minute level are mostly meaningless random walks.

Rate WearThe frequent opening positions' commission fees and slippage, like termites, gradually eroded the principal.

Mental breakdownHigh-frequency stop-loss orders lead to distorted operations.

II. The Only Overtake: "Excess Returns" in a 4-Hour Cycle

Only when the cycle is extended to 4 hoursOnly then does the MACD strategy demonstrate its ability to outperform "holding coins." This is the sole significance of quantitative trading.

1. BTC 4h: A Thrilling Victory

MACD x1.0 (Spot): Earnings about +96%.

Coin Hoarding Benchmark:+48.86%.

Winning Logic:

MACD on the 4-hour chart successfully helped BTC avoid the main bearish waves (such as the big crash in 2022). Although it missed out slightly on the early and late gains of the bull market, the advantage of staying out of the market to avoid risks ultimately allowed it to outperform simply holding (HODLing).

2. ETH 4h: Absolute Domination

MACD x1.0 (Spot): Earnings about +205%.

Coin Hoarding Benchmark:+53.00%.

MACD x3.0 (Best Leverage): Profit +552%.

Winning Logic:

ETH has a very strong trend. While HODLers enjoyed the price increase, they also fully endured an 80% drawdown. In contrast, the MACD strategy preserved profits by staying out of the market during the bear phase and compounded returns during the next bull cycle. The 4x higher return (205% vs 53%) demonstrates the significant value of timing in ETH trading.

III. The True Meaning of Leverage: Amplifying "Winning Probability" or Amplifying "Gambling Tendencies"?

Based on the benchmark data, we can redefine the role of leverage.

1. x2.0 - x3.0: The Secret of the Golden Range

BTC 4h x3.0 (+207%) vs BTC HODL (+48.86%):

With a 3x leverage, the strategy amplified its returns by 4 times. This is a healthy amplification ratio, indicating that the strategy captured genuine trends, and the leverage played a role of "adding momentum to an existing trend."

ETH 4h x3.0 (+552%) vs ETH HODL (+53.00%):

The returns were amplified 10 times! This is the peak performance of quantitative trading—by combining high-volatility assets with appropriate leverage and the correct market cycle, it achieved income growth that represents a leap in financial status.

2. x5.0: The "Inversion" of Yield Rates

ETH 4h x5.0 (+167%):

Note! Although it outperformed coin hoarding (+53%), it was far outperformed by the low-leverage strategy (+552%).

WarningWhen you increase your leverage to 5 times, you're essentially working for the exchange (paying high funding fees) and giving money to the market (incurring high volatility losses). You take on the risk of blowing up your account and losing everything, yet you only receive mediocre returns.

Four, your "Death Matrix" report (The Death Matrix)

To convince you otherwise, we have listed the final outcomes under different configurations.

| Subject | cycle | Leverage Ratio | Status | Final Yield | Outcome Evaluation |

| BTC stands for Bitcoin, | 15 minutes | x5.0 | 💥 Margin Call | -100% | It's a sure death. Pure gambling; the fees alone can drain you dry. |

| BTC stands for Bitcoin, | 15 minutes | x1.0 | -73% | Chronic suicide. It's even worse than keeping it in the bank. | |

| BTC stands for Bitcoin, | 1 hour | x1.0 | +6% | Working in vain. Running and losing in coin hoarding (+49%), wasting five years of youth. | |

| BTC stands for Bitcoin, | 4 hours | x1.0 | ✅ | +96% | Excellent. Outperformed a one-time coin hoarding strategy with a steady mindset. |

| BTC stands for Bitcoin, | 4 hours | x3.0 | ✅ | +207% | Outstanding. Maximize returns with controllable risks. |

| Sure! Please provide the | Sure! Please provide the | Sure! Please provide the | Sure! Please provide the | Sure! Please provide the | Sure! Please provide the |

| ETH refers to Ethereum, | 15 minutes | x5.0 | 💥 Margin Call | -100% | Certain death. A victim of noise trading. |

| ETH refers to Ethereum, | 1 hour | x1.0 | ✅ | +172% | It's okay. ETH is volatile, so you can make a bit in the short term, but it's tiring. |

| ETH refers to Ethereum, | 4 hours | x1.0 | ✅ | +205% | Great. 4 times the profit of holding coins, and no need to stay up late. |

| ETH refers to Ethereum, | 4 hours | x3.0 | ✅ | +552% | King. This is the holy grail range for quantitative trading. |

| ETH refers to Ethereum, | 4 hours | x5.0 | ✅ | +167% | A waste of resources. The risks have increased significantly, while the returns have actually decreased (including funding costs and wear and tear). |

V. Final Decision Guide: What Should You Do?

Based on Hodl coins (+50%) Regarding this passing threshold, we provide the following final strategic recommendations:

If you don't want to go through the hassle / don't have time / or are in a bad mood:

Strategy: Pure coin hoarding (Buy & Hold) or MACD 4h x1.0 (spot).

Expectation: ~50% - 100% return.

Cost: You need to endure asset drawdowns, but this is ten thousand times better than losing money through reckless operations.

If you want to outperform the market (BTC):

Strategy: MACD 4h (x1.5 - x2.0)

Expectation: ~150% - 200% return.

Key: Must strictly cut losses, only trade on the 4H higher time frame, never look at the 15m.

If you are pursuing excess returns (ETH):

StrategyMACD 4h (x2.0 - x3.0)

Expectation: ~400% - 550% return.

Key: This is the optimal dessert zone. Take advantage of ETH's high volatility + moderate leverage.Remember not to exceed 3 times..

If you are a gambler / day trader:

StrategyMACD 15m/1h + x5.0 or higher.

Expectation:-100% (Reset to zero).

WarningData shows that this method can't outperform holding coins, and it's even worse than just donating the money.

Key Conclusions

"Due to only about 50% returns from holding spot coins for 5 years, this actually demonstrates the value of an excellent quantitative strategy."

However, this value is limited to the 4-hour timeframe.

For cycles shorter than 1 hour, all your efforts are counterproductive; it's better to just give up and do nothing.

Only by standing at the golden crossover point of 4H + 3x can you truly mock those who "hold on for dear life."

(The data in this article is based on historical backtesting and does not represent future returns. The market involves risks, and leverage should be used with caution.)