On January 15, JustLend DAO, a core DeFi lending protocol in the TRON ecosystem, announced significant positive news, declaring the completion of the second large-scale JST token buyback and burn, accelerating the release of token deflationary benefits.

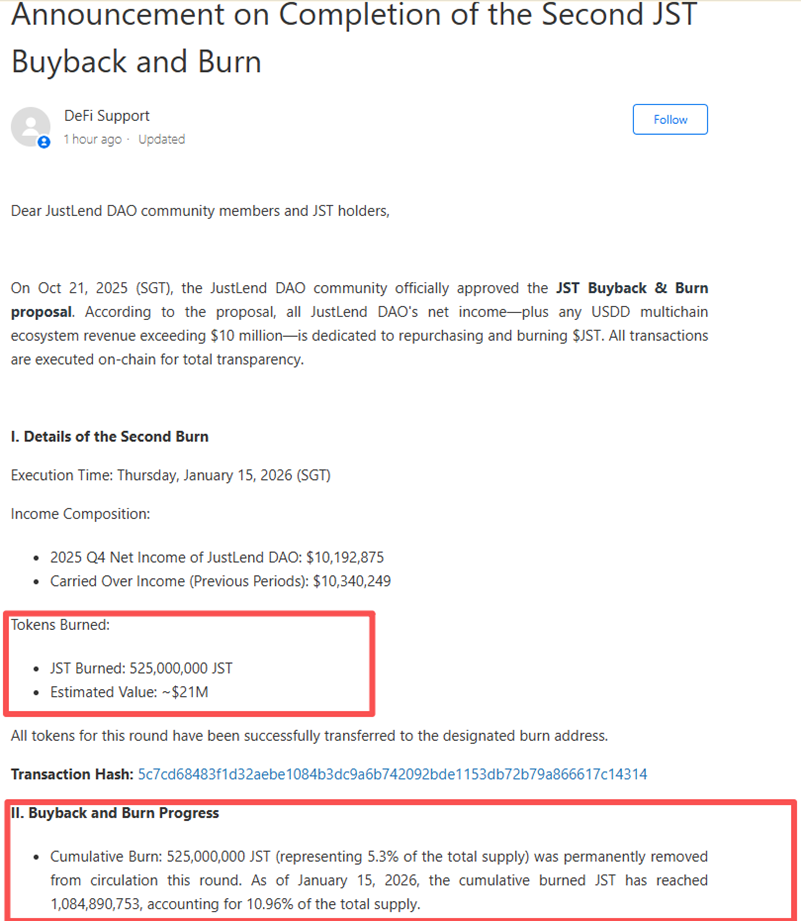

According to the official announcement, the number of JST tokens repurchased and burned in this round reached 525 million, with a value exceeding $21 million, accounting for approximately 5.3% of the total JST token supply. The token's rigid deflationary foundation continues to be reinforced.

If the quantities destroyed in the first round are added together, since the JST buyback and burn program was launched in October last year, the total amount of JST repurchased and burned has strongly exceeded 100 million tokens, accounting for approximately 11% of the total supply. In just under three months, the program has achieved a burn volume of over 100 million tokens. Its deflationary strength and execution efficiency are rare in the industry, injecting strong confidence into the relatively stagnant market recently.

The successful completion of this JST buyback and burn not only ensures the continuous and effective implementation of the JST burn plan, but also accelerates the release of the token deflationary effect's benefits. More importantly, it fundamentally validates that JustLend DAO possesses strong and sustainable real ecological profitability.

Exceeding expectations: Two rounds of cumulative burning have exceeded 100 million JST tokens, accelerating the deflationary process.

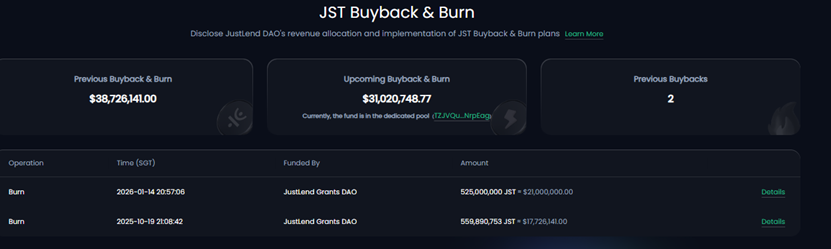

As of January 15, 2026, JST tokens have completed two large-scale buyback and burn rounds, with a cumulative total of over 1.08 billion tokens burned (specifically 1,084,890,753 tokens), representing 10.96% of the total token supply. The value of the funds involved exceeds $38.7 million. In terms of both the scale of deflation and execution efficiency, JST leads the DeFi industry.

The JST Burn Plan began in October 2025, when the JustLend DAO community officially passed a relevant proposal. The community decided to use existing earnings of the JustLend DAO protocol, future net income, and any amount exceeding $10 million USD from the USDD multi-chain ecosystem revenue for full JST buybacks. All repurchase transactions are executed transparently on-chain, ensuring the fund flow is traceable and verifiable.

From the structure of funding sources, the core support for the JST buyback and burn program is divided into two major components: existing and future net profits from the JustLend DAO, and over $10 million in excess income from the multi-chain USDD ecosystem. In the initial phase of this plan, the JustLend DAO allocated more than 59.08 million USDT from its existing profits and adopted a tiered execution strategy: 30% of the amount was immediately burned, while the remaining 70% was interest-accrued on a quarterly basis before being burned. This approach aims to balance the short-term deflationary impact with long-term value accumulation.

The first round of token burning was completed in October 2025. In this round, 30% of the funds were used to burn 560 million JST tokens, accounting for 5.6% of the total supply. The remaining 70% was deposited into the JustLend DAO's SBM USDT lending market for appreciation, to be carried out over four quarters.

On January 15 of this year, JustLend DAO released an announcement titled "Announcement on the Completion of the Second JST Token Buyback and Burn," marking the successful conclusion of the second large-scale JST buyback and burn campaign. A total of 525 million JST tokens were repurchased and burned in this round, accounting for 5.3% of the total token supply, with a corresponding token value of approximately $21 million.

As of now, the two rounds of JST buyback and burn have been fully completed:

First round (October 2025):Burn approximately 556 million JST tokens, equivalent to about 17.72 million USD, accounting for 5.66% of the total supply.

Second round (January 2026):Burn 525 million JST tokens, equivalent to approximately $21 million, accounting for 5.3% of the total supply.

Of particular note is the impressive performance of the second round of JST buybacks and burns, which exceeded expectations. Compared to the first round, the amount of capital invested in this round did not decrease due to market volatility or other factors, but instead achieved a counter-cyclical increase, far surpassing the initial market expectations. This strong move has generated a significant response among community users, who are greatly surprised and delighted.

As of now, the total cumulative JST burn amount has exceeded 108 million tokens, accounting for 10.96% of the total token supply. The total funding invested in the two burning rounds has surpassed $38.7 million. This strong deflationary force and large-scale capital investment rank among the top in the global DeFi sector.

In addition, all JST buyback and burn operations are executed in a decentralized manner on-chain by the community autonomous organization, Grants DAO. Every fund transfer and token burning record is fully preserved on-chain, ensuring openness and transparency. All activities are fully traceable on-chain, with characteristics of immutability and public visibility. Users can access core data and the entire execution process, including burn batches and on-chain transactions, at any time through the dedicated Grants DAO page and the "Financial Transparency Operational Metrics (Transparency)" dashboard on the JustLend DAO official website. This truly realizes information transparency, earning user trust and support for the development of the JST ecosystem.

JustLend DAO's Profitability Verified Again, Net Earnings Exceed $1,000 in Q4 2025

The successful implementation of this round of JST buyback and burn not only demonstrates the routine fulfillment of the burning plan, but also vividly highlights JustLend DAO's strong ecosystem operation capabilities and sustainable profitability through an unexpectedly large capital investment. This provides core support for the long-term effectiveness of the JST deflationary mechanism.

According to the initial data of the burn plan, JustLend DAO had previously allocated 70% of its existing income for repurchases over four quarters, with an approximate burn amount of $1.034 million per quarter. However, the actual amount invested in repurchases and burns in this round exceeded $21 million, more than doubling the preset amount.

Under the regular rhythm of quarterly burn, the total capital volume has not decreased but instead increased significantly, far exceeding the expectations of the community and the market. This is fundamentally supported by JustLend DAO's inherent and robust profit-generating capabilities, setting it apart from the "pseudo-deflationary" practices in the market that rely on external financing and token inflation.

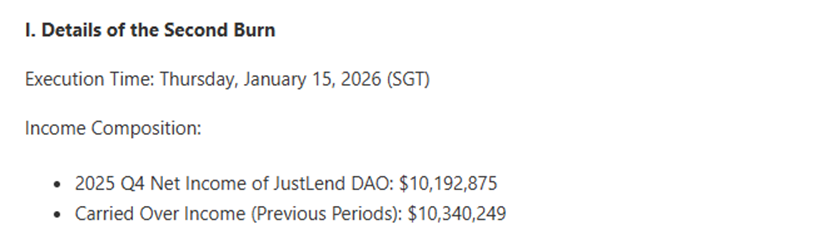

According to the funding composition disclosed in this round's burn announcement, 100% of the JST second-round burn funds come from the JustLend DAO platform's earnings. This includes approximately $10.34 million in existing earnings originally scheduled for execution this quarter, as well as an additional $10.19 million in net earnings generated in the fourth quarter of 2025.

The dual-funding model of "existing gains as a foundation + incremental net gains for acceleration" not only significantly accelerates the JST buyback and burn process, but also substantiates the protocol's financial health and liquidity through solid cash flow data, completely alleviating market concerns about "potential shortfalls in future burn funding."

The over $10 million in new net profit generated in Q4 2025 undoubtedly demonstrates JustLend DAO's strong profitability once again. This clearly shows that JST buybacks and burns are not just theoretical concepts detached from the ecosystem, but value-driven actions deeply rooted in the growth of the protocol's business. JustLend DAO's resilient profitability ensures the long-term effectiveness of its deflationary mechanism.

It is worth noting that,Currently, JustLend DAO still has approximately $31.02 million in accumulated earnings.Repurchases and burnings will be gradually implemented in subsequent quarters. "More than $30 million in existing earnings as a foundation + continuously growing protocol net income" will provide solid support for future JST burns.

This means that the JST buyback and burn program is by no means a short-term, one-time marketing stunt, but rather a regular, long-term value-adding initiative tied to protocol earnings. It establishes a clear and solid long-term deflationary feedback loop for JST, fundamentally different from the short-lived, "one-time wind" buyback tactics commonly seen in the crypto market. This provides strong support for the long-term stable development of JST.

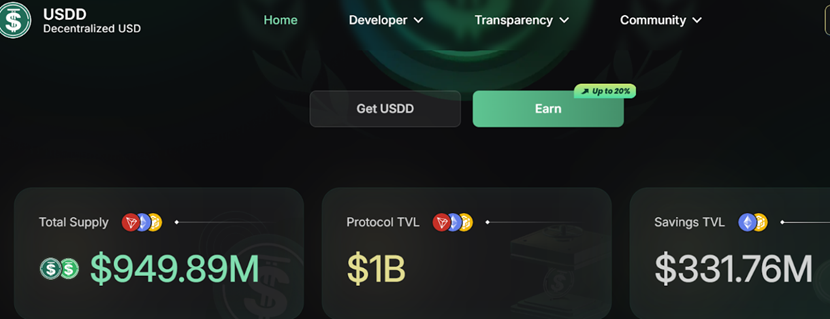

As another potential core funding source for JST buybacks and burn, the stablecoin USDD ecosystem is now entering a golden period of rapid growth, providing ample momentum for the continuous strengthening of the deflationary mechanism. USDD has already successfully achieved cross-chain deployment, covering major public blockchain networks such as Ethereum and BNB Chain. As of January 15, the total supply of USDD has risen to $960 million, while the total value locked (TVL) on related platforms has surpassed $1 billion. With the continued expansion of the USDD ecosystem, the excess profits it generates in the future will become an important incremental funding source for JST buybacks and burn, further enhancing the deflationary effect and continuously driving up the value of JST.

In summary, JST's deflationary mechanism is by no means a simple linear logic of "token burning - supply contraction." Instead, it is built upon the real and sustainable earnings of the dual ecosystems of JustLend DAO and USDD. The deflationary strength is deeply tied to the profitability of the ecosystem, completely overcoming the industry's dilemma that "deflation without revenue support is meaningless." This lays a solid and irreversible logical foundation for the long-term value appreciation of JST.

JustLend DAO ecosystem continues to enhance its deflationary effects, driving the value growth of JST tokens.

JustLend DAO takes real ecosystem revenue as its core engine and continues to increase the JST token buyback and burn efforts, promoting a deepening deflationary effect. This has successfully established a virtuous value cycle of "enhanced ecosystem activity → increased protocol profitability → intensified buybacks and burns → improved token scarcity → stronger ecosystem attractiveness," forming a self-reinforcing growth flywheel.

As the JST buyback and burn program continues to be implemented regularly, the substantial reserve fund will continuously release deflationary benefits. Supported by the steady expansion of the JustLend DAO ecosystem, the value proposition of the JST token is becoming increasingly solid, and its market performance is gradually realizing its long-term potential.

In terms of deflationary effects, 1.08 billion JST tokens have already been burned, accounting for 10.96% of the total supply. Large-scale token burns directly and rigidly reduce the circulating supply. With a fixed total supply, each round of burning continuously reduces the amount of tokens in circulation. The ongoing deflationary mechanism keeps enhancing the token's scarcity, driving JST's value into a long-term upward trend.

The potential value of JST has also been widely recognized by the market. According to CoinMarketCap data on January 8, the market capitalization of JST tokens successfully broke through the $400 million mark, with a 24-hour trading volume surge of 21.92%. The price has increased by 10.82% over the past month. The synchronized expansion of trading volume and market capitalization clearly reflects the market's strong confidence in the development prospects of the JustLend DAO ecosystem.

With the orderly implementation of the buyback program, the circulating supply of JST tokens will further decrease, continuously highlighting their scarcity value, which is expected to drive a new surge in the value of JST tokens. More importantly, the dual-ecosystem profitability of JustLend DAO and USDD continues to strengthen, and the deflationary pressure on JST will be further intensified, making the fundamental momentum for its value growth increasingly robust.

As a sustained driving force for the JST deflationary mechanism, JustLend DAO continuously injects real revenue support into buybacks through the ongoing improvement of its product matrix and the healthy growth of its operational data.

As a core financial infrastructure within the TRON ecosystem, JustLend DAO has evolved from a single lending protocol into a comprehensive DeFi solution covering asset lending, liquidity staking, bandwidth leasing, and gas optimization through continuous integration and upgrades. It has built a complete product matrix, providing diverse driving forces for ecosystem revenue growth:

- SBM Lending Market:As a fundamental ecological service, it supports users in depositing assets to earn interest or collateralizing them for loans, thereby achieving efficient asset allocation;

- sTRX Liquid Staking:The preferred TRX staking entry in the TRON ecosystem, users can stake TRX to obtain liquidity tokens sTRX.

- Energy Rental Service:Offer flexible energy leasing with "rent as you go, return as you go," significantly lowering the threshold for user on-chain operations.

- Gas-Free Smart Wallet:Support direct deduction of transaction fees from the transferred tokens. With the support of platform subsidies, users only need to pay about 1 USDT in fees for each USDT transfer, greatly enhancing the usability of on-chain transactions.

Driven by its diverse product matrix, JustLend DAO has achieved significant growth across all key metrics, including core operations such as the dynamic staking market and lending demand. According to DeFiLlama data, JustLend DAO has firmly established itself as the third-largest lending protocol globally, following multi-chain lending platforms Aave and Morpho, which operate across more than 30 chains. Notably, JustLend DAO is a single-chain deployed protocol, and its ability to stand out in a multi-chain competitive landscape highlights its leading position and strong user recognition within the TRON ecosystem.

As of January 15, the total value locked (TVL) in the JustLend DAO platform has risen to approximately $703.8 million. The platform has cumulatively distributed over $19.2 million in incentives to the community and has provided secure and efficient DeFi services to more than 480,000 users globally. Among these, the SBM lending market has a supply asset size exceeding $420 million, with a borrowing asset size reaching $20 million, maintaining a leading position in terms of capital activity and volume within the industry.

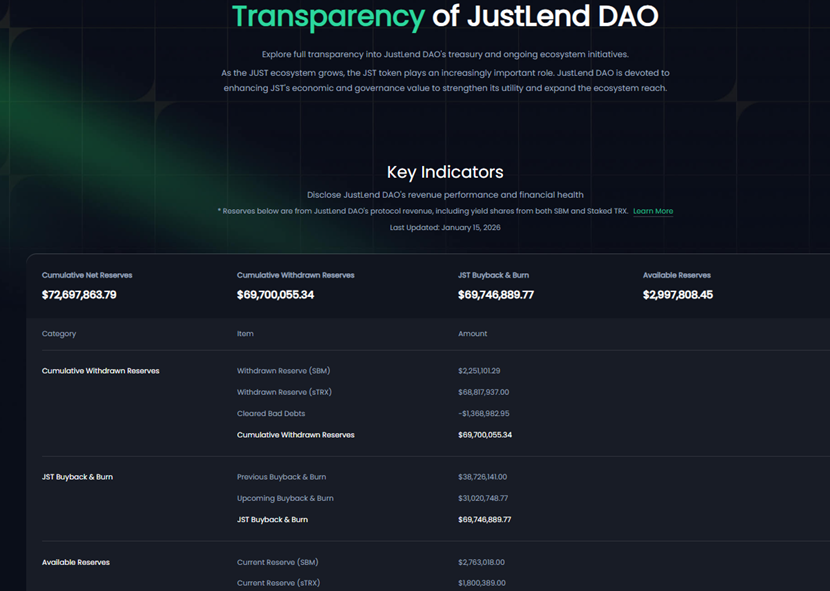

Regarding protocol revenue, according to the Transparency financial metrics dashboard, as of January 15, the platform's cumulative net earnings have exceeded $72.69 million, of which $69.70 million has been withdrawn, and $2.99 million remains as retained earnings on the books. The overall financial structure is healthy and stable, providing solid financial support for buybacks and burn operations.

In terms of revenue structure, JustLend DAO's current net income is derived solely from two business lines: the SBM lending market and sTRX liquidity staking. Among these, sTRX is the absolute core source of revenue. Out of the $69.7 million in total revenue extracted, sTRX contributed a net income of $68.81 million, while the SBM lending market contributed approximately $2.25 million in net income.

As the staked volume of sTRX continues to grow, its revenue contribution is expected to further increase. According to the latest data, the amount of TRX staked as sTRX has exceeded 9.3 billion tokens, with the number of participating addresses surpassing 13,500. The current annualized yield is 7.23%, and both the staked amount and the number of participants have been steadily increasing. The SBM lending market has also performed remarkably. According to DeFiLlama data, the interest fees captured in the fourth quarter of 2025 amounted to approximately $2.2 million (only borrower-paid interest is counted), setting a new historical record and reflecting the continued expansion of the lending business scale.

At the same time, two high-frequency essential services—Energy Leasing and GasFree Smart Wallet—are becoming new growth engines for the JustLend DAO ecosystem. The base rate for energy leasing was significantly reduced from 15% to 8% on January 9. Currently, leasing 100,000 units of energy per day costs approximately 6.21 TRX (equivalent to the energy obtained by staking 10,674 TRX, which can cover 2 contract transactions). The number of addresses participating in energy leasing has increased to 73,000. Meanwhile, the GasFree Smart Wallet has processed cumulative fund transactions exceeding $46.3 billion, serving over 2.5 million accounts and saving users $3.64 million in transaction fees.

In the future, the profits from services such as energy leasing and GasFree will also be gradually incorporated into the JustLend DAO platform's revenue statistics, becoming a new growth driver for the ecosystem's income and further broadening the sources of funds for JST buybacks. As the profits from diverse business operations are continuously injected into the buyback and burn mechanism, the deflationary pressure and value appreciation of JST will grow in tandem, continuously raising the ceiling for long-term token value growth.