Key Insights

- NVIDIA stock price has trailed the broader market this year.

- Jefferies analysts expect the stock to jump to $275.

- RBC analysts expect the AI semiconductor market to jump to $550 billion by 2028.

NVIDIA stock price has underperformed the broader stock market this year. It has remained in a correction after falling by 11% from its 2025 high, even as the Nasdaq 100 and S&P 500 indices are hovering at all-time highs. Still, Jeffries believes the NVDA stock is cheap and will eventually rise by 45% to $275.

Jefferies Upgrades NVIDIA Stock Price

Analysts at Jefferies delivered a highly bullish NVIDIA stock, which has remained in a narrow range this year. In a note, these analysts raised the price target to $275 from $240. The rating implies a 45% upside from the current $187, bringing its market capitalization to over $6.7 trillion.

Jefferies highlighted the company’s strengths in the artificial intelligence (AI) data center industry and noted that it is fairly undervalued given its estimated growth metrics. Additionally, the analysts highlighted the potential for its Chinese sales.

The Trump administration allowed the company to sell its H200 chips to China, and reports indicate strong demand. Reuters noted that the company had received 2 million orders, far higher than the 700k in its inventory.

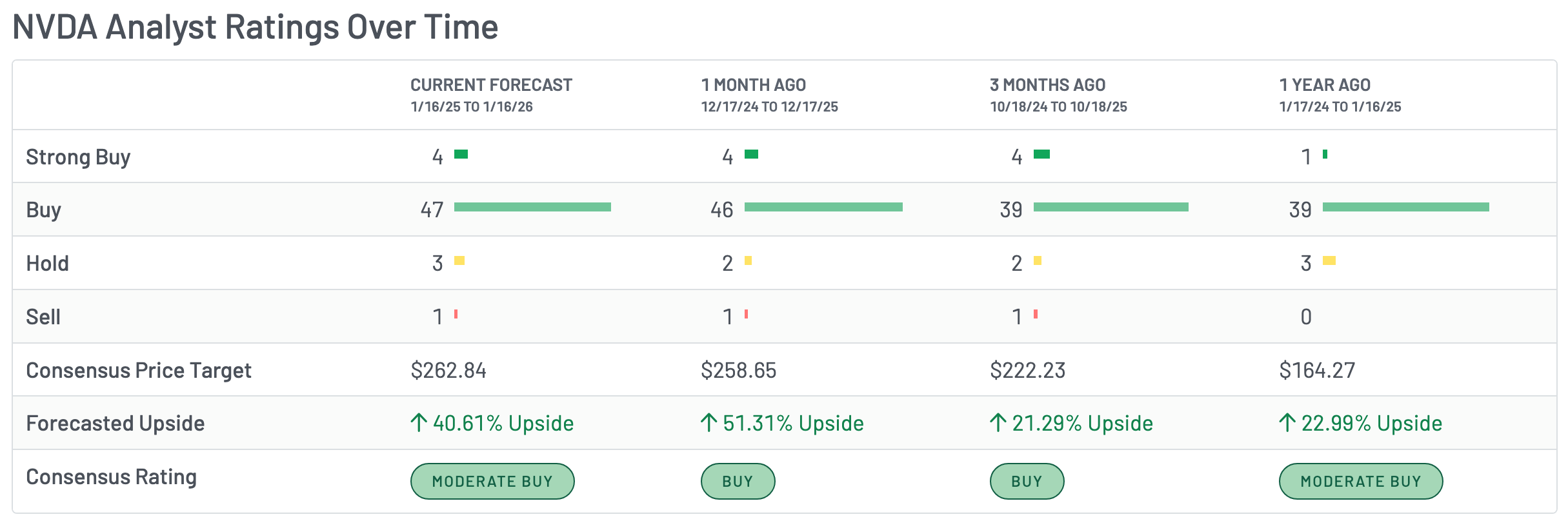

Other Wall Street analysts are highly bullish on Nvidia stock, with an average price target of $262, up 40% from the current level. The most bullish analysts are from Tigress and Loop Capital, who expect that it will jump to $350.

Jefferies’ upgrade came a few days after RBC predicted that the AI semiconductor market will continue doing well in the coming years. The report predicted that it will get to $550 billion by 2028 from $220 billion in 2025.

The analysts pointed to ongoing tight supply in the industry, which is leading to a substantial backlog, and to the massive planned data centers in the United States and other countries.

Analysts Expect NVIDIA’s Growth to Continue Despite Competition

Wall Street analysts believe that Nvidia can overcome the growing threat of competition from companies like AMD and Google, as well as Chinese giants like Huawei, Moore Threads, and MetaX.

Nvidia’s main advantage is that its chips are much more advanced than those of its competitors. As such, hyperscalers and other data center companies are more comfortable using their products. That’s why it has continued to thrive even though AMD’s chips offer good value.

At the same time, it has a software advantage because of its Compute Unified Device Architecture (CUDA), which enables developers to harness the power of its GPUs for general-purpose computing.

Therefore, analysts expect the company to continue growing at double digits for many years to come. The average estimate is that its revenue rose by 63% in 2024 and that it will grow by 50% this year to $321 billion.

This growth is fairly undervalued, as it has a Rule of 40 multiple of over 115%. This metric is derived by adding its revenue growth and its profit margin. A company with a figure of 40 or higher is considered undervalued.

Nvidia also has a forward PE ratio of less than 50. While this multiple is high, it is much smaller than those of other companies like AMD, Palantir, and Shopify.

NVIDIA Share Price Technical Analysis

The daily chart shows that NVDA’s stock price has traded sideways over the past few months. As a result, it has formed a symmetrical triangle pattern, with its two lines about to converge.

This triangle pattern formed after the stock experienced a significant surge from April to October. As such, there are signs that the stock has formed a bullish pennant pattern, which could lead to more upside, especially after the recent TSMC earnings.

If this happens, it may rally to the all-time high of $212. A move above that level will lead to more gains, potentially to $275, which Jefferies predicts. The bullish NVIDIA forecast will become invalid if it drops below the key support level at $170.

The post Can NVIDIA Stock Jump 45% to $275 as Jefferies Predicts? appeared first on The Market Periodical.