Key Insights

- HBAR price continued its strong downward trend this week.

- Technical analysis suggests that the token will likely continue falling.

- HBAR ETF inflows have stalled, a sign of weak institutional demand.

HBAR price dropped for seven consecutive days, erasing most of the gains made earlier this week. Hedera was trading at $0.1150 on Monday, down nearly 15% from its year-to-date high and 62% below its highest point in July 2021. This article examines some of the key reasons why the token is expected to continue falling in the near term.

HBAR Price Technical Analysis Hints to More Downside

The daily timeframe chart shows that the HBAR price has been in a strong downward trend since July last year, when it peaked at $0.3042. This chart indicates that the coin has continued to form a series of lower lows and lower highs.

The recent rebound found substantial resistance at $0.1350, which coincided with the descending trendline that connects the highest swings since July last year. It has always retreated by double digits whenever it retested this resistance level.

Hedera price also remains below all moving averages. In particular, it has resisted moving above the 50-day Exponential Moving Average (EMA) since October last year.

The Average Directional Index (ADX) has dropped to 19, its lowest level since September last year, a sign that the recent rebound has lost momentum.

Therefore, the most likely HBAR price forecast is bearish as long as it remains below the 50-day moving average and the descending trendline.

The next level to watch will be at the key support level at $0.1023, its lowest level in December and October 10th.

A move below that level means that Hedera will continue falling as sellers target the psychological level at $0.1.

On the other hand, a move above the descending trendline and the 50-day Exponential Moving Average will invalidate the bearish outlook and signal more gains, potentially reaching the psychological level at $0.20.

HBAR price chart | Source: TradingView

HBAR ETF Demand Has Flopped

Meanwhile, third-party data shows the recently launched spot Canary Hedera ETF (HBR) has largely flopped as demand waned.

Data shows that the fund added $812,000 on Friday, bringing the cumulative total inflow to $84.5 million. It has $57 million in net assets.

Friday’s inflows marked the first time the fund had recorded any activity this year. Before that, the last time it experienced inflows was on December 24, when it added $898,000.

Its performance differs from that of other altcoin ETFs recently. For example, the spot XRP ETFs have added $1.22 billion in inflows since their launch in November, while Solana funds have added $816 million.

Hedera Ecosystem Woes Remain

Another reason the HBAR price may continue to fall is that, unlike other layer-1 networks, Hedera’s growth has stalled over the past few months.

Hedera has a minute market share in the decentralized finance (DeFi) industry, where its total value locked (TVL) has dropped by 7.55% in the last 30 days to $122 million. Its ecosystem is comprised of 24 dApps, with ten of them having no assets.

Its biggest DeFi protocol is Stader, a liquid staking platform that lets users earn rewards by holding HBAR tokens.

In contrast, the TVL in the DeFi industry stands at over $227 billion, with Ethereum, Solana, and BSC Chain having the biggest market share.

Hedera, which launched a stablecoin studio platform in 2024, has a negligible market share in the industry. The total stablecoins in the network dropped to $58 million on Monday.

HBAR Demand Has Waned

Additionally, there are signs that the demand for Hedera tokens has waned in the past few months. Data compiled by CoinMarketCap shows that HBAR’s volume in the last 24 hours stood at $158 million, lower than that of other smaller tokens, such as WLFI, Pepe, and Render.

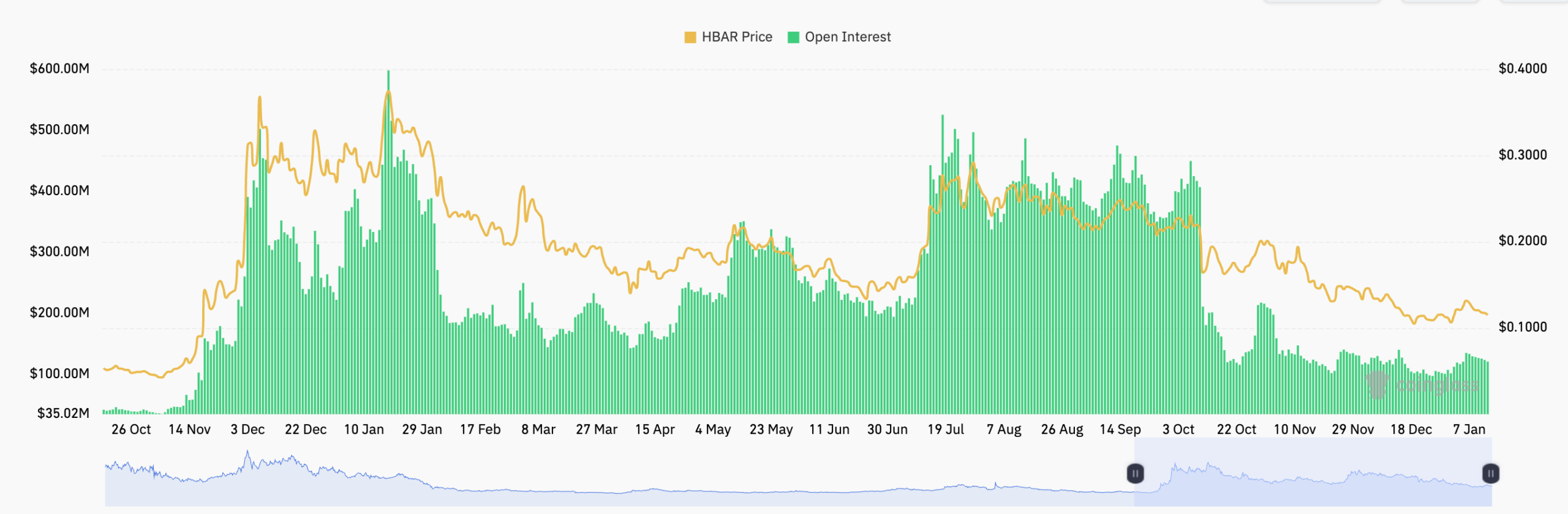

Additional data indicates that HBAR’s futures open interest has decreased to $125 million, down from over $500 million a few months ago. That is a sign that its demand has continued to fall because it lacks a clear catalyst.

The post Top 4 Reasons HBAR Price Crash May Accelerate Soon appeared first on The Market Periodical.