H100’s Health Tech Stock Jumps 280% with Bitcoin Focus

Key Insights:

- H100 stock jumped 45% in one day after raising $10.6 Million to accelerate its Bitcoin treasury strategy. This pushed its total gain to 280% since May 22.

- Bitcoin cypherpunk Adam Back and UTXO Management supported the funding round. H100 is set to increase its Bitcoin holdings to 81.85 BTC.

- Institutional and sovereign Bitcoin holdings have surpassed 6.1 million BTC. Centralized entities now control 30.9% of the total supply, according to Gemini and Glassnode.

H100 Group AB surged 45% after raising $10.6 Million to expand its Bitcoin treasury strategy. The health tech firm’s stock has surged 280% after shifting its focus to Bitcoin. Cypherpunk Adam Back and Nordic investors supported the move.

H100 Stock Explodes as $10M Bitcoin Raise Ignites Rally

H100 Group AB’s stock surged 45% on June 11 after announcing a 101 million krona ($10.6 Million) funding round. The raise aims to speed up the company’s Bitcoin strategy.

The stock closed at 4.64 krona ($0.49) on the Nordic Growth Market exchange. According to MarketWatch, that marks a 280% gain since H100 first announced its Bitcoin treasury pivot on May 22.

The company said it would use the new capital to expand its Bitcoin holdings. H100 plans to purchase roughly 67.1 BTC, boosting its total reserves to 81.85 BTC.

Cypherpunk-Backed Raise Surpasses Expectations

The raise included a 69.65 million krona ($7.31 Million) share issue. An additional 31.35 million krona ($3.29 Million) came from convertible loans. Originally planned as a 21 million krona offering, Tranche 1 was later upsized by nearly 50% to meet demand.

Key participants included Bitcoin cypherpunk Adam Back, crypto fund UTXO Management, and Nordic investors like Race Ventures Scandinavia and Crafoord Capital Partners.

The convertible notes have no interest. They mature in five years. Investors can convert them to equity at 1.75 krona per share, according to H100.

CEO Sander Andersen said H100’s health approach aligns with the Bitcoin community’s values.

“The values of individual sovereignty highly present in the Bitcoin community aligns well with, and will appeal to, the customers and communities we are building the H100 platform for,” Andersen said during the company’s May 22 announcement.

Bitcoin Balance Sheets Are Going Global

H100’s move adds to a broader wave of public companies adding BTC to their balance sheets. According to BitcoinTreasuries.NET, 126 public firms currently hold Bitcoin. Fourteen new firms joined in the last three weeks alone.

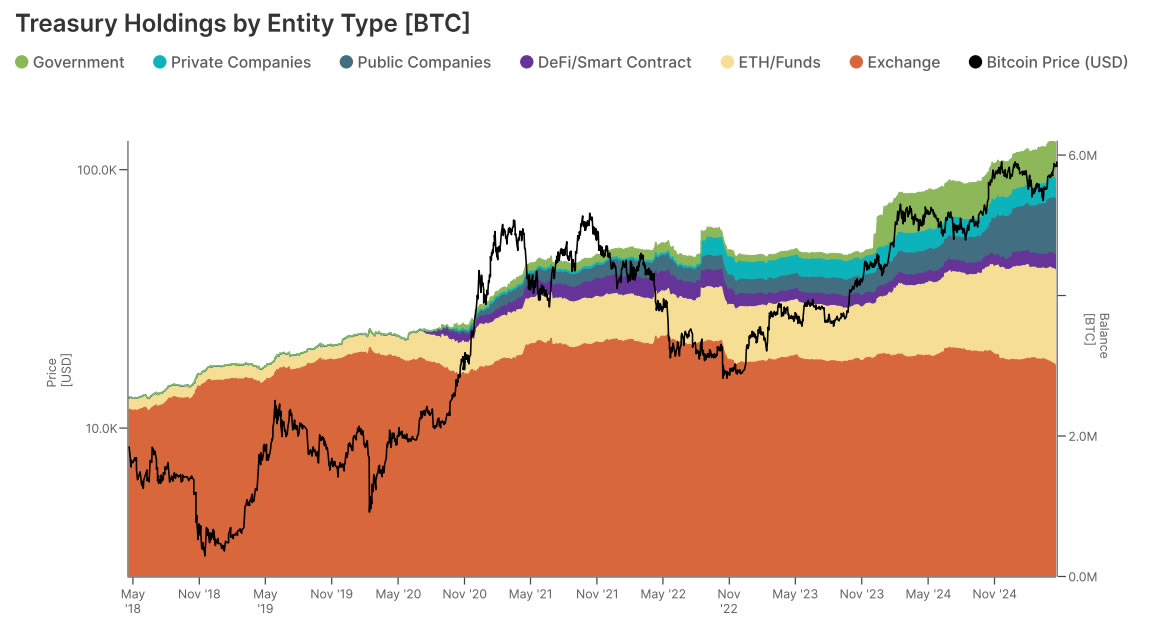

Gemini and Glassnode’s joint report, published June 12, revealed that centralized entities now control 30.9% of all circulating Bitcoin. That amounts to 6.1 million BTC—or approximately $668 Billion at current prices.

The report categorized these holders into sovereign treasuries, ETFs, public companies, and centralized exchanges.

Exchanges hold a significant portion of Bitcoin, often managing assets for customers. Researchers note that early institutional adopters continue to lead the market.

This concentration is most visible in public companies, funds, and ETFs. This suggests early entrants continue to shape the institutional structure of the Bitcoin market.

Institutions Tighten Grip, But Sovereign Holdings Stay Dormant

The report also highlighted the unique role of government treasuries. Though their holdings are largely dormant, they remain capable of moving markets.

Researchers cited examples like the United States, China, Germany, and the United Kingdom. There, governments acquired BTC through enforcement actions, not market activity.

Unlike sovereign wallets, private company holdings appear more distributed. This trend reflects a broader retail and institutional participation base, especially in smaller public firms like H100.

Institutional Bitcoin holdings have surged 924% over the past decade. This growth mirrors the BTC price increase, from under $1,000 to over $100,000. Researchers said the trend signals a structural transformation toward institutional maturity.

“Although Bitcoin remains a risk-on asset, its integration into traditional finance has made price action more reliable and less driven by speculative extremes,” the report concluded.

Bitcoin Strategy Now Core to Corporate Growth

H100’s Bitcoin bet positions it among many companies intertwining corporate strategy with crypto adoption. Companies like Tesla and MicroStrategy are steadily increasing their Bitcoin holdings. Rather than using BTC as a hedge, they treat it as a primary treasury asset.

With a 280% stock surge since May 22 and fresh backing from crypto-native investors, H100’s pivot is drawing attention beyond health tech.

Whether it proves sustainable may depend on Bitcoin’s broader market cycle. But for now, one thing is clear: Bitcoin has entered the corporate DNA far beyond traditional finance.

The post H100’s Health Tech Stock Jumps 280% With Bitcoin Focus appeared first on The Market Periodical.