Author:Darren Terminator

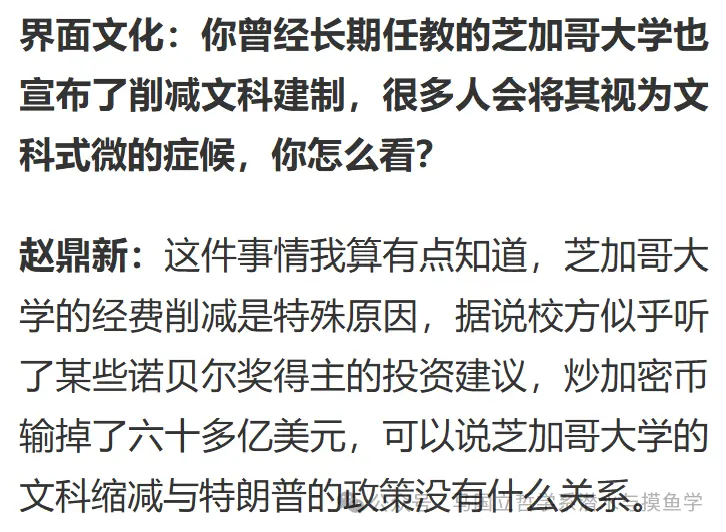

Recently, the Interface News took the opportunity of the release of the third edition of Professor Zhao Dingxin's "Lectures on Social and Political Movements" (the second edition of this book is truly an excellent work) to interview Professor Zhao. In the interview, Professor Zhao stated that the recent series of budget cuts at the University of Chicago are due to the fact that "it is said that the university administration apparently followed investment advice from certain Nobel Prize winners, lost over sixty billion U.S. dollars by trading in cryptocurrencies, and therefore the reduction in humanities programs at the University of Chicago has little to do with Trump's policies."

So, did the University of Chicago really lose over 6 billion U.S. dollars in cryptocurrency trading?

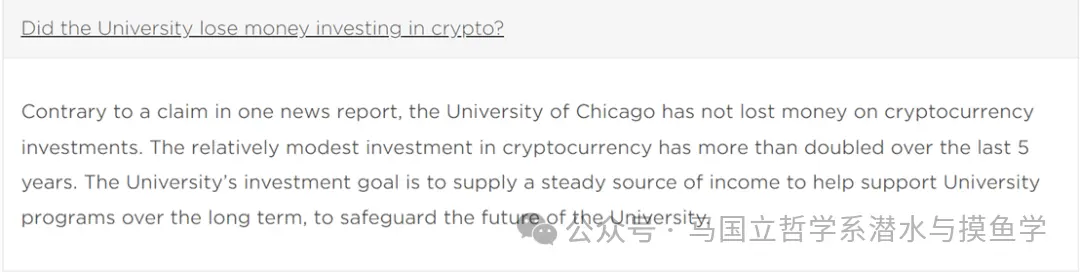

Coincidentally, in its frequently asked questions (FAQ) updated in December 2025, the University of Chicago [1] also addressed the issue of cryptocurrency trading. According to the official website: "Contrary to the claims in a certain news report, the University of Chicago has not incurred losses from investments in cryptocurrencies. Our investment in cryptocurrencies is relatively small in scale, but it has more than doubled over the past five years. Our investment objective is to provide a stable source of income to support our various programs in the long term and to secure the university's future."

So, does that mean the Provost of the University of Chicago must tell the truth?

It's hard to say for certain. However, judging intuitively, the total endowment of the University of Chicago over the past five years has been roughly around $100 billion (about $11.6 billion in fiscal year 2021; approximately $10.9 billion in fiscal year 2025 [2]). Unless the University of Chicago has gone completely crazy and used at least 60% of its endowment to speculate in cryptocurrencies (which would clearly violate various regulations), or misappropriated a large portion of its operating funds for cryptocurrency speculation and lost them all, otherwise...It shouldn't be as much as a 6 billion loss..

So, how much was actually lost?Or is it really true, as the official Q&A says, that they made a killing?

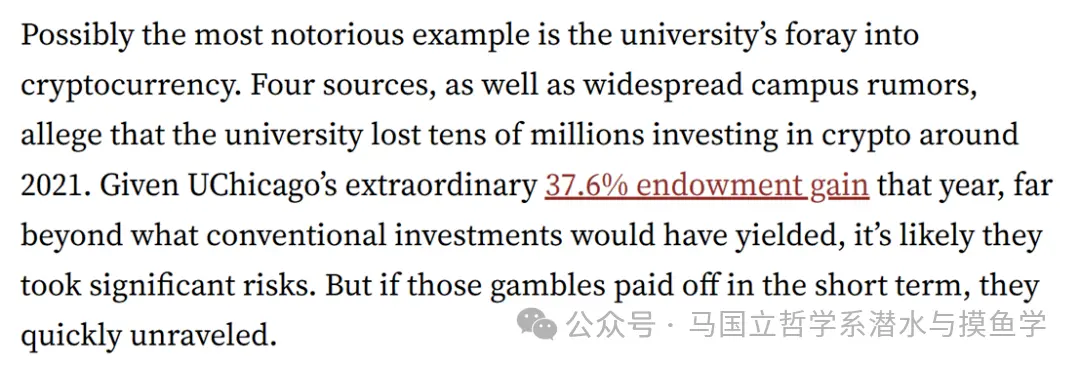

The Stanford Daily [3], the Financial Times [4], and Investopedia [5] reported on this matter last year. According to the Stanford Daily, their four sources indicated that "the University of Chicago lost tens of millions of dollars in cryptocurrency investments around 2021."

Then the financial report of the University of Chicago [6]How to say it?

Unfortunately, the financial report does not directly tell us exactly how much money was lost from trading cryptocurrencies. However, in the 2022 fiscal year financial report, the University of Chicago disclosed the fair market value of its cryptocurrency investments:As of2021Year6At the end of the month, it was approximately 64 million U.S. dollars, and as of...2022Year6At the end of the month, it would be approximately 45 million U.S. dollars (a difference of about 19 million U.S. dollars).Later, in subsequent financial reports, perhaps because they had made substantial profits or suffered heavy losses, the University of Chicago changed its statistical methods and no longer disclosed its investments in cryptocurrencies. However, according to a Q&A session in 2025, the University of Chicago still maintained a relatively cautious approach to investing in cryptocurrencies.

It is worth noting that the 2022 financial report shows that,As of the end of June that year,The total loss from investments in the University of Chicago endowment fund is astonishingly as high as fifteen hundred million dollars.The 2023 financial report showed that the University of Chicago's investment only suffered a small loss. In the following two years, the university's finances turned positive.

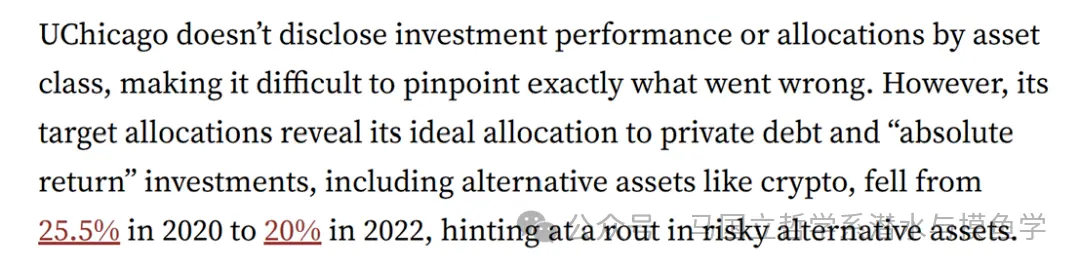

However, we don't know exactly which of these losses and gains stem from cryptocurrency trading. The Stanford Daily newspaper provided a somewhat unreliable clue: "[The University of Chicago's] target asset allocation shows that the university's ideal allocation to private debt and 'absolute return' investments (which include alternative assets such as cryptocurrencies) has decreased from 25.5% in 2020 to 20% in 2022, suggesting a noticeable withdrawal (or decline) in high-risk alternative assets."

However, the Stanford Daily also made an interesting observation: "From 2013 to 2023, the University of Chicago's endowment fund achieved an annualized return rate of only 7.48%, while the stock market's annualized return rate during the same period was 12.8%, and the average for Ivy League institutions was 10.8%."If the University of Chicago's endowment fund had simply followed market performance initially, it would now have an additional 64.5 billion U.S. dollars. AndThis (dream) money would be more than enough to pay off all the school's debts.Of course, universities cannot simply replicate market indices, as they must hedge against downturns to maintain financial stability. However, even if the University of Chicago only matched the average performance of its Ivy League peer group, its endowment would still be $3.69 billion larger than it is today. This amount would be sufficient to cover the school's current budget deficit for the next 15 years.

However, apart from losses from trading and investing in cryptocurrencies,What other reasons could explain the University of Chicago's budget cuts?

A common argument, besides the claim that Trump is a rogue, also frequently emphasizes the University of Chicago's own strategic miscalculations:Borrowing to increase leverage, vigorously developing infrastructure, and aggressively expanding.[7][8] As of the end of June 2025, the University of Chicago had approximately $9.2 billion in debt, [9] which is about 90% of its endowment fund. Although the financing costs for this debt are relatively low, different from those across the ocean, the interest payments required for this fiscal year still amount to more than $200 million.

Such a high level of debt, of course, did not come out of nowhere. Since the new century, the University of Chicago has spent heavily on new laboratories, libraries, dormitories, and technology in order to enhance its reputation, attract more students, and compete with various established prestigious universities. Much of this expansion has been financed through substantial borrowing. However, the new infrastructure brings ongoing operational costs, and the university has not yet figured out how to sustain these expenses in the long term.

According to the University of Chicago's student newspaper [10], citing Professor Clifford Ando, any parent who wants to send their child to the University of Chicago should consider carefully: the tuition you painstakingly pay—does it go toward your child's education, or are you actually paying off the university's debt? The reckless expansion and the resulting debt problems are clearly the responsibility of the university's leadership, whose actions reflect impulsive decision-making and excessive ambition.More ironically, 2006–2022 The base salary of the principal increased over the years.285%Now, facing some financial problems, the administration has shifted the difficulties onto students and regular faculty: even in years when assets are sold, layoffs occur, and enrollment is suspended, the salaries of top executives continue to rise.

What should the University of Chicago do next?

Of course, besides further cost-cutting, they need to find new sources of revenue. Obviously, a common tactic used by American universities to increase income is to admit more undergraduate students. The University of Chicago is going to do the same, though the reasons they give will surely sound lofty and respectable.

[1] https://provost.uchicago.edu/actions-budget

[2] In this article, the University of Chicago's budget, endowment, and liabilities are combined figures for the main campus, the Medical Center, and the Marine Biological Laboratory. Common news reports (especially the University's own promotional materials) typically combine these figures for the endowment, but report liabilities only for the main campus.

[3] https://stanfordreview.org/uchicago-lost-money-on-crypto-then-froze-research-when-federal-funding-was-cut/

[4] https://www.ft.com/content/4501240f-58b7-4433-9a3f-77eff18d0898?utm_source=chatgpt.com

[5] https://www.msn.com/en-us/money/careersandeducation/university-s-investment-losses-spark-outrage-resulting-in-drastic-program-cuts/ar-AA1Nxhgx

[6] https://intranet.uchicago.edu/en/tools-and-resources/financial-resources/accounting-and-financial-reporting/financial-statements

[7] https://www.wsj.com/us-news/education/colleges-face-a-financial-reckoning-the-university-of-chicago-is-exhibit-a-8918b2b0

[8]https://www.ft.com/barrier/corporate/d5c7c0f4-abf1-4469-8dca-87ff01cbebf6

[9] The main campus of the university has a debt of about six billion U.S. dollars. Perhaps this is the source of Professor Zhao's six billion U.S. dollars.

[10] https://chicagomaroon.com/40486/news/uchicago-professor-sounds-alarm-over-troubling-university-finances/