Key Insights

- Ethereum price has moved sideways in the past few days.

- The network has continued growing its total value locked (TVL) in the decentralized finance (DeFi) industry.

- Its market share in the RWA industry has continued to grow in the past few weeks.

Ethereum price remains in a tight range on Monday, Jan. 1, as market participants waited for key events this week. It was trading at $3,3110, a few points below this month’s high of $3,301. This article provides the ETH price prediction as its Decentralized Finance (DeFi) and Real-World Asset (RWA) tokenization dominance continues.

Ethereum Dominance in DeFi and RWA Industries is Soaring

Data shows that Ethereum has become the biggest blockchain in some of the biggest areas in the financial services industry despite the recent growth of layer-1 and layer-2 networks.

According to DeFi Llama, the total value locked (TVL) in its decentralized finance ecosystem has increased by 3% over the last 30 days to exceed $146 billion.

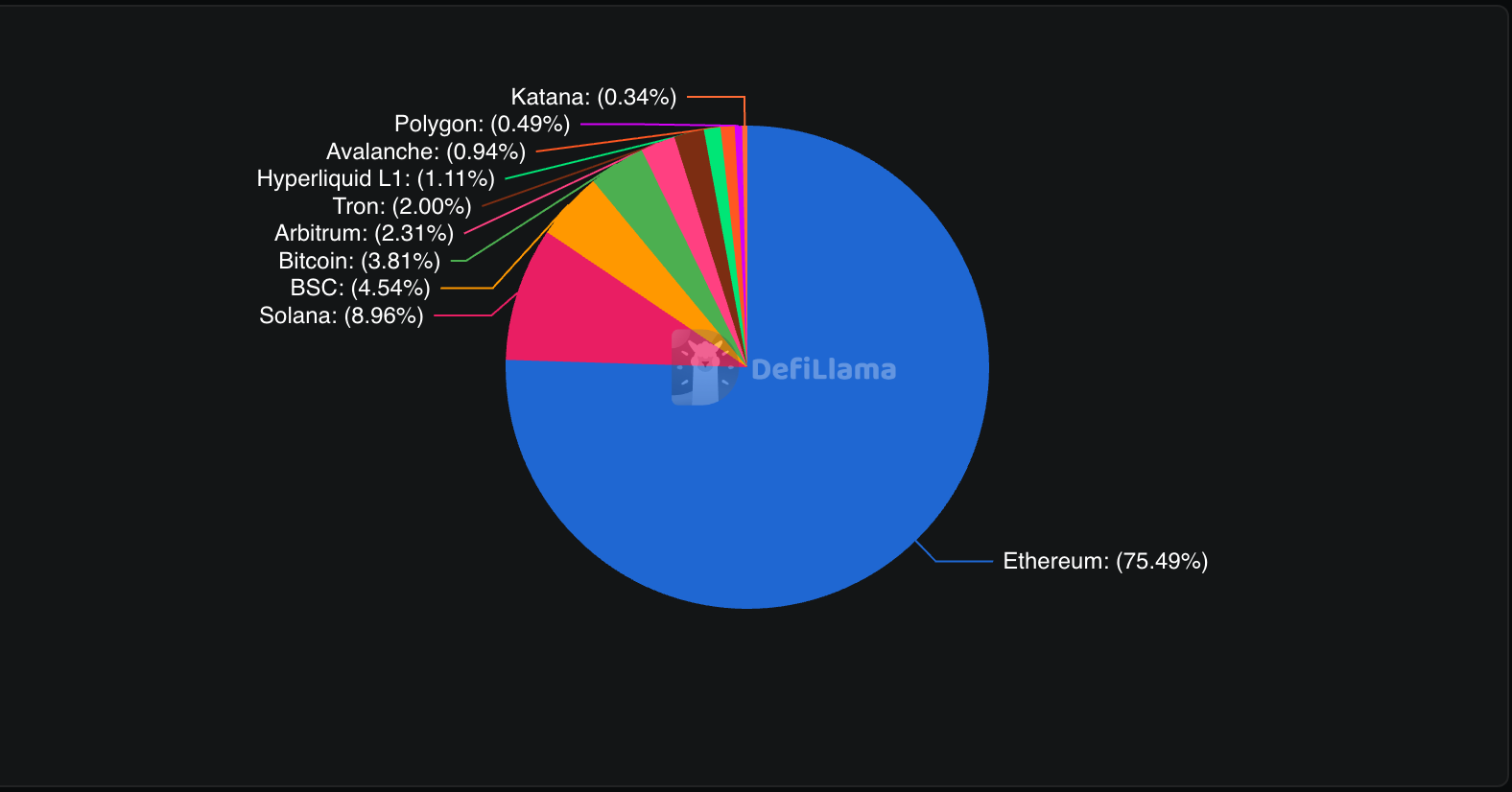

In contrast, Solana and BSC have a TVL of over $20 billion and $9 billion, respectively. Ethereum has a market dominance of 75.5%. This growth happened as the number of layer-1 and layer-2 chains launched. Some of the most notable chains launched recently were Plasma, Katana, Berachain, Ink, Monad, and Scroll.

More data shows that the bridged TVL in Ethereum has jumped to $463 billion, much higher than Solana’s $38 billion and BSC’s $44 billion.

Many Ethereum DeFi networks have continued growing in the past few months. For example, Aave has accumulated over $28 billion in assets, while Lido has $28 billion. Some of the other notable dApps in its ecosystem are Ether.fi, Ethena, Spark, Sky, and Maple Finance.

Meanwhile, the network has continued growing in the fast-growing real-world asset (RWA) tokenization industry, where its total value locked jumped to $12 billion, a notable amount in an industry with over $20 billion in assets.

More large companies have continued to select Ethereum as their preferred chains for their RWA assets. For example, JPMorgan announced that it would use it to launch its first on-chain fund. Other companies using the network for the RWA industry are WisdomTree, BlackRock, and Janus Henderson.

Most importantly, the RWA industry is still in its infancy and has considerable room for growth. For example, data shows that less than 1% or $2.8 billion of the US equity market has been tokenized. A 10% increase in tokenized equities would mean trillions in assets.

Most of the tokenized stocks, worth over $1.28 billion, are in Ethereum, while $1.21 billion are in Solana. Therefore, Ethereum will likely continue to gain market share in this industry in the future.

The same is happening in the stablecoin industry, which is benefiting from the approval of the GENIUS Act. Data shows that the market cap of all stablecoins has jumped to $308 billion, with Ethereum accounting for over $160 billion of them. Ethereum handled over $8 trillion in volume in the last quarter.

Ethereum Upgrades to Contribute to Its Growth

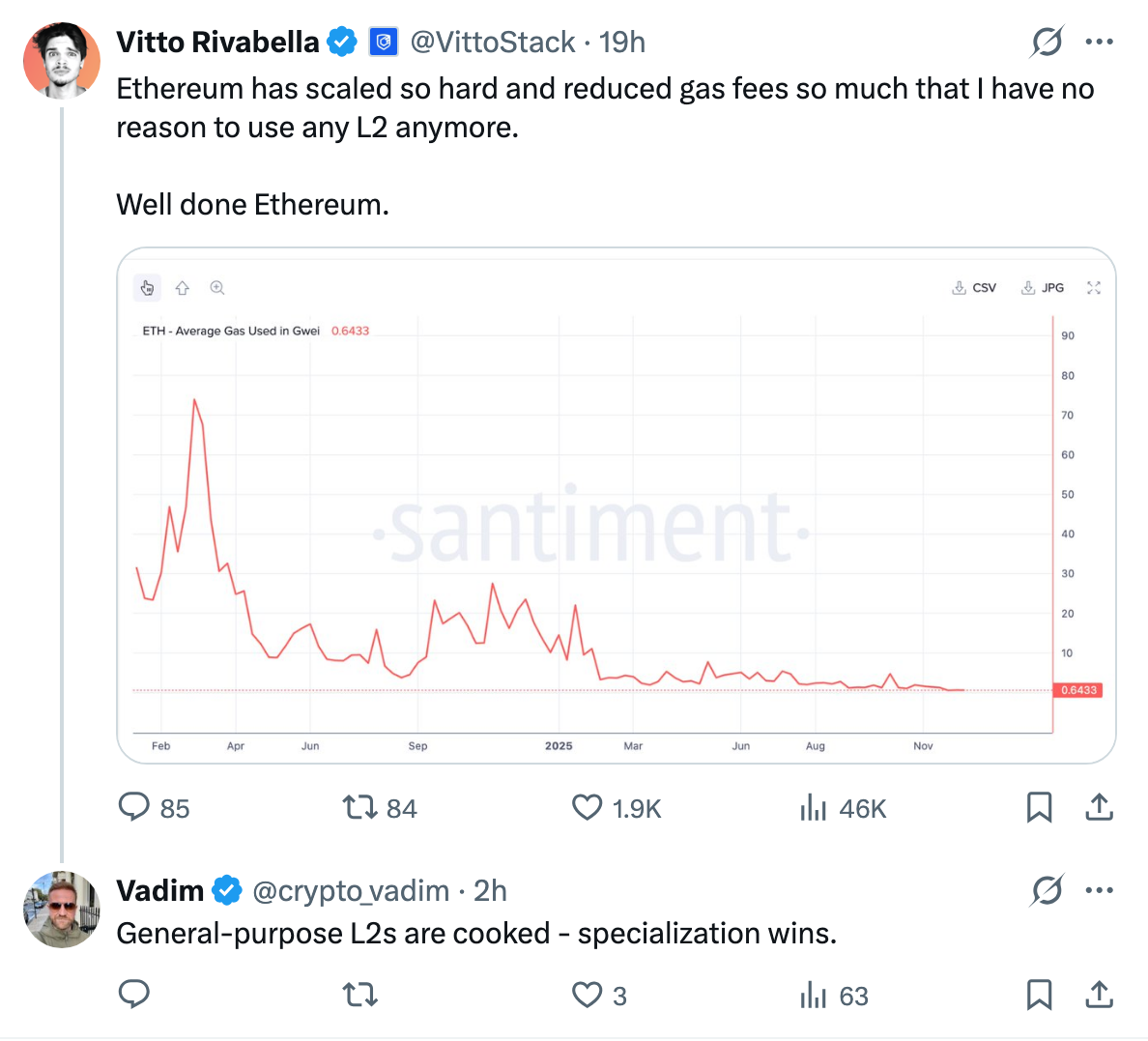

Ethereum is likely to continue gaining market share in key industries in the future due to its regular upgrades. The developers launched the Fusaka upgrade in December last year.

Fusaka introduced the peerDAS feature, which allows validators to verify blob data by checking small samples rather than downloading the entire data. It also increased the block gas limit and improved its EVM tools.

Ethereum will launch the Glamsterdam and Hegota upgrades later this year. These updates have made it a faster and cheaper chain, with some analysts arguing that there will be no need for layer-2 networks.

Ethereum Price Technical Analysis

While Ethereum has some of the best fundamentals, technicals suggest that it has more downside in the near term before bouncing back later this year.

It has formed a large bearish flag pattern, a common continuation sign in technical analysis. Also, the coin has remained below the 50-day and 200-day Exponential Moving Averages (EMA) and the Supertrend indicator.

Ethereum price chart | Source: TradingView

Therefore, it will likely continue to fall, potentially to the key support level at $2,593, its lowest level since November 20th. A move below that price will point to more downside to $2,500. It will then bounce back later this year.

The post Ethereum Price Prediction as its DeFi and RWA Dominance Grows appeared first on The Market Periodical.