Key Insights

- In a recent Ethereum news, new Ethereum addresses jumped from about 4 million to 8 million in 30 days, Glassnode reported.

- Daily active addresses rose past 1 million on Jan. 15, up from roughly 410,000 a year earlier.

- Daily transactions reached a record 2.8 million, up 125% year over year, according to Etherscan data.

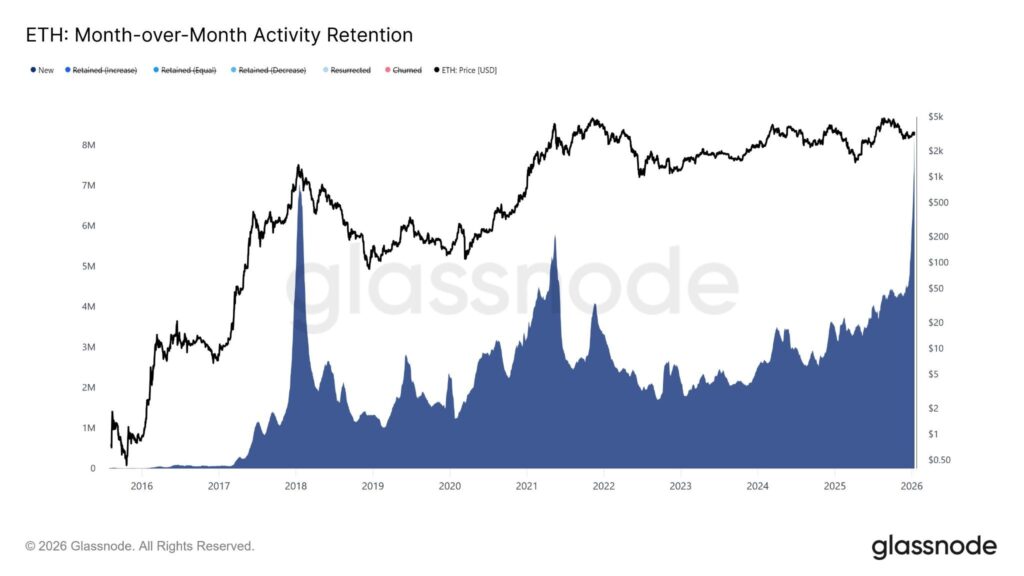

Ethereum network activity surged in January as new user participation nearly doubled month over month, on-chain data showed. The number of interacting addresses rose from just over 4 million to nearly 8 million in 30 days, according to Glassnode. The analytics firm said activity retention spiked sharply among new cohorts, suggesting first-time users rather than recycled demand.

The shift mattered because Ethereum network activity often preceded liquidity expansion and price compression phases. Rising retention suggested users stayed active beyond one-off transactions. Glassnode said the trend reflected structural usage growth rather than speculative churn. That distinction shaped near-term expectations for Ethereum’s on-chain strength.

Ethereum News: New Addresses Drove the Latest Usage Surge

Glassnode reported that activity retention almost doubled over the past month, as new wallets entered the Ethereum network. The firm said first-time interacting addresses accounted for most of the increase. Existing users did not dominate the flow, reducing concerns about internal wash activity. The data pointed to broader participation across the network.

New address growth aligned with longer-term address expansion metrics. Etherscan data showed that daily active addresses exceeded 1 million on Jan. 15, up from roughly 410,000 during the same period last year. The increase marked more than 140% growth year on year.

Transaction throughput followed the same trajectory. Daily Ethereum transactions climbed to a record 2.8 million on Thursday, Etherscan data showed. That level represented a 125% increase from one year earlier. Network usage expanded despite muted price momentum.

Ethereum News: Stablecoin Transfers and Layer Two Scaling Took Center Stage

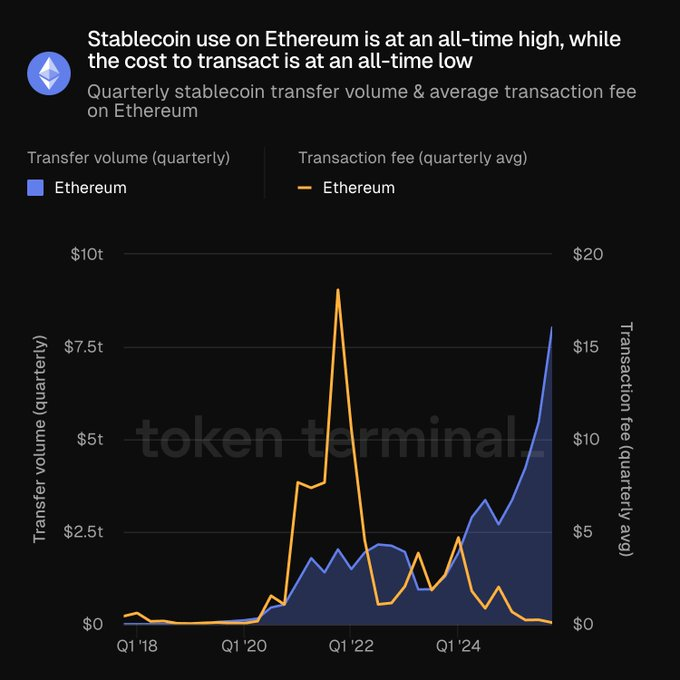

Analysts attributed much of the transaction growth to stablecoin usage. Macroeconomics outlet Milk Road said Ethereum benefited from rising stablecoin transfers while gas fees compressed. The outlet said execution moved toward layer two networks while Ethereum retained settlement security. That design reduced user costs without weakening base-layer trust.

Fee compression supported higher transaction counts without congestion. Data from Token Terminal showed stablecoin activity reached all-time highs as fees fell. The trend suggested functional demand rather than speculative bursts. Lower costs appeared to attract new wallets into regular usage.

Ethereum’s scaling roadmap played a central role. Layer two adoption allowed applications to process volume without burdening the base layer. That structure preserved Ethereum’s settlement role while improving throughput. Milk Road said the model resembled scalable financial infrastructure rather than short-term optimization.

Analysts Pointed to Improving On-Chain Signals

Market observers said improving Ethereum network activity aligned with stronger sentiment. Justin d’Anethan, head of research at Arctic Digital, said indicators that had previously been pushed into oversold territory turned higher. He said renewed capital inflows into exchange-traded funds and stablecoins supported the shift. The comment reflected growing confidence rather than price-based enthusiasm.

Nick Ruck, director at LVRG Research, noted that daily transactions exceeded two million as staking climbed. He said nearly 36 million Ether remained locked in staking contracts. That balance limited the liquid supply while usage expanded. Ruck said scaling upgrades improved speed and lowered gas fees.

He added that sustained inflows into exchange-traded funds strengthened the backdrop. Institutional participation appeared steadier than previous cycles. On-chain fundamentals supported tighter liquidity conditions. The combination shaped a constructive but cautious outlook.

Compression Built as Market Structure Tightened

Some analysts focused on price structure rather than raw activity. MN Fund founder Michaël van de Poppe said Ethereum showed visible compression. He said tightening ranges often preceded directional moves. Van de Poppe said the setup could be resolved within days rather than months.

Compression reflected conflicting forces across spot and derivatives markets. Network usage rose while price remained range-bound. That divergence often tested a trader’s conviction. Market participants watched whether demand translated into sustained bid pressure.

Ethereum traded near $3,300 during the period as volatility narrowed. Resistance levels capped upside attempts throughout December and early January. Support held above the $2,900 zone despite repeated tests. Traders monitored whether on-chain demand forced a range exit.

What Comes Next for Ethereum Network Activity

Ethereum network activity now faced a short-term test of durability. Analysts watched whether new addresses remained active beyond initial interactions. Retention trends over the next few weeks mattered more than raw sign-ups. Glassnode said sustained engagement would validate the recent spike.

Transaction volumes also required consistency to confirm structural growth. Stablecoin usage needed to remain elevated without fee pressure returning. Layer two execution trends would indicate whether scaling gains persisted. Any reversal could challenge the current narrative.

From a market perspective, Ethereum remained compressed below key resistance. A break above the $3,500 area could confirm follow-through if liquidity tightened. Failure to hold current support risked another consolidation phase. For now, Ethereum news network activity provided measurable support, not guarantees.

The post Ethereum News: ETH Network Activity Surged as New Users Doubled in 30 Days appeared first on The Market Periodical.