Key Insights

- Ethereum ETFs record $13.82 million in inflows on February 10, 2026

- Weekly Ethereum ETF flows turn positive at $70.87 million after prior week’s $165.82 million outflow

- Whale addresses accumulate Ethereum below realized price

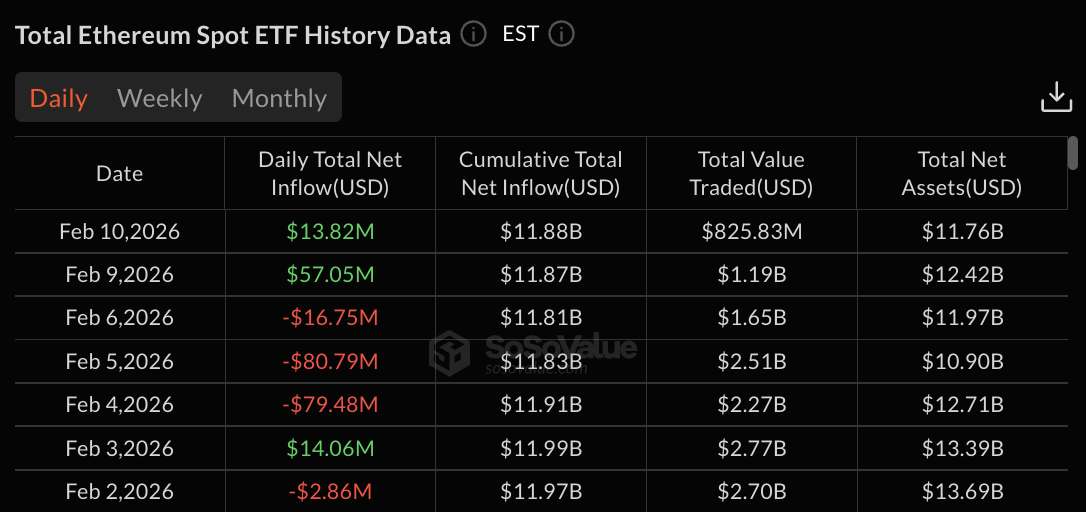

Ethereum ETFs recorded inflows of $13.82 million on February 10, 2026. This ended a three-day outflow streak, according to SoSoValue data.

Grayscale’s ETH product led positive flows with $13.32 million, while Fidelity’s FETH attracted $501,130.

February 10 inflows followed three straight days of Ethereum ETF outflows totaling $177.02M between February 4 and February 6. This shift highlights a rotation of institutional interest from Ethereum products back into Bitcoin ETFs.

Weekly data shows the products recorded $70.87 million in positive flows for the period ending February 10, reversing the prior week’s $165.82 million in withdrawals.

Grayscale ETH Leads Ethereum ETF Inflows

Grayscale’s ETH product recorded $13.32 million in inflows on February 10. This accounted for 96% of total Ethereum ETF positive flows.

Fidelity’s FETH attracted $501,130, or approximately $0.50 million. That makes it the only other product with inflows during the session.

Seven Ethereum ETF products reported zero activity on February 10. BlackRock’s ETHA showed no flows. Grayscale’s ETHE also recorded none. Bitwise’s ETHW, VanEck’s ETHV, Franklin’s EZET, Invesco’s QETH, and 21Shares’ TETH all reported zero activity.

Cumulative total net inflows for Ethereum ETFs reached $11.88 billion, up from $11.87 billion on February 9.

Total net assets stood at $11.76 billion, down from $12.42 billion. Total value traded across Ethereum ETFs reached $825.83 million during the session.

The February 10 positive flows came after Ethereum ETFs recorded their largest single-day inflow on February 9 at $57.05M.

The two consecutive days of positive flows added up to $70.87 million. This provided some relief after the extended selling pressure earlier in February.

Weekly Ethereum ETF Flows Turn Positive at $70.87 Million

Weekly data shows Ethereum ETFs recorded $70.87 million in inflows for the period ending February 10.

The positive weekly performance reversed the prior week’s $165.82 million in outflows through February 6.

Total value traded on a weekly basis reached $2.02 billion for Ethereum ETFs ending February 10. This compared to $11.90 billion in the prior week, showing substantially reduced trading activity.

The week ending February 6 saw Ethereum ETFs post $165.82 million in outflows. These losses followed several weeks of persistent negative flows. The trend underscored sustained selling pressure across Ethereum products.

The asset base has declined from $20.42 billion on January 16 to $11.76 billion on February 10. The $8.66B decrease over 25 days came from both sustained outflows and Ethereum price movements.

Cumulative flows dropped from $12.91 billion at the January peak to $11.88 billion. That showed $1.03 billion in net withdrawals during the period.

Whale Accumulation Ramps Up Below Realized Price

CryptoQuant data shows that Ethereum whale addresses have stepped up accumulation. They increased buying as the price dipped below the realized price of accumulation addresses.

The full-scale accumulation by whale addresses began in June 2025. The current price trades below the level where whales initiated their buying program.

Whale accumulation has proceeded more aggressively as prices dropped. The current price levels appear attractive to Ethereum whale addresses based on their continued buying activity.

Altcoin ETFs Maintain Positive Flows

Solana spot ETFs recorded $8.43 million in inflows on February 10. XRP spot ETFs attracted $3.26 million during the same session. The combined $11.69 million in inflows came as both alternative products maintained institutional interest.

Solana ETFs have experienced mixed flows in early February. The products saw $2.82 million in inflows on February 5.

They then faced $6.71 million in outflows on February 4 and $11.86 million on February 6. This swing reflected sharp shifts in investor sentiment within just three days. The February 10 positive flows show a return to institutional buying.

XRP ETFs have maintained more consistent positive flows. The products drew $19.46 million on February 3. They then attracted $4.83 million on February 4 and $15.16 million on February 6. On February 9, they added another $6.31 million.

The post Ethereum ETFs Turn Green With $13.8M Inflows Led by Grayscale appeared first on The Market Periodical.