Author: imToken

2026 will undoubtedly be a landmark year for the mass adoption of Ethereum.

With the completion of multiple foundational upgrades in 2025 and the finalization and advancement of the Interop roadmap, the Ethereum ecosystem is gradually entering the "Era of Large-Scale Interoperability." Against this backdrop, the Ethereum Interoperability Layer (EIL) is beginning to step into the spotlight from behind the scenes. (For further reading, see...)Ethereum Interoperability Roadmap: How to Unlock the "Last Mile" for Mass Adoption)。

If early technical discussions were still at the stage of "proof of concept," then EIL is now undeniably entering the deep waters of standard implementation and engineering realization. This has sparked a series of heated debates within the community. For example, when we strive for a smooth cross-chain experience comparable to Web2, are we subtly altering the trust boundaries that Ethereum has long upheld?

Objectively speaking, when any technological vision moves toward engineering implementation, trade-offs between efficiency and safety are inevitable. This paper attempts to go beyond technical slogans and analyze the real trade-offs made between efficiency, standards, and safety assumptions by examining the specific design details of EIL.

I. What Exactly Is EIL "Stitching" Together?

First, we need to clarify the essence of EIL once again—it is not a new blockchain, nor a new consensus layer, but rather a set of interoperability communication frameworks and standard protocols.

In short, the core logic of EIL lies inStandardizing the "state proofs" and "message passing" of L2s without rewriting Ethereum's underlying security model enables different L2s to have composability and interactivity similar to single chains, without altering their own security assumptions.(For further reading, see "Ethereum Island Isolation Ends: How Does EIL Reconstruct Fragmented L2s into a "Supercomputer"?)。

As is well known, in the current Ethereum ecosystem, each L2 is like an isolated island. For example, your account (EOA) on Optimism and your account on Arbitrum may have the same address, but their states are completely isolated:

- Signature Isolation:Your signature on chain A cannot be directly verified by chain B;

- Asset Isolation:Your assets on chain A are also invisible to chain B;

- Interaction barriers:Cross-chain operations require repeated authorization, switching of gas, waiting for settlement, and so on.

EIL combines the capabilities of "Account Abstraction (ERC-4337)" and a "Minimally Trusted Messaging Layer" to create a unified execution environment for the account layer and messaging layer, aiming to eliminate these artificial divisions:

In a previous article, I gave an intuitive example: previously, cross-chain operations were like traveling abroad, where you needed to exchange currency (cross-chain assets), obtain a visa (reauthorization), and also follow local traffic rules (purchase gas for the target chain). Entering the EIL era, cross-chain operations are more like using a Visa card globally for consumption:

No matter which country you are in, with just one swipe (and a signature), the underlying banking network (EIL) automatically handles the exchange rate, settlement, and verification, making you oblivious to the existence of national borders.

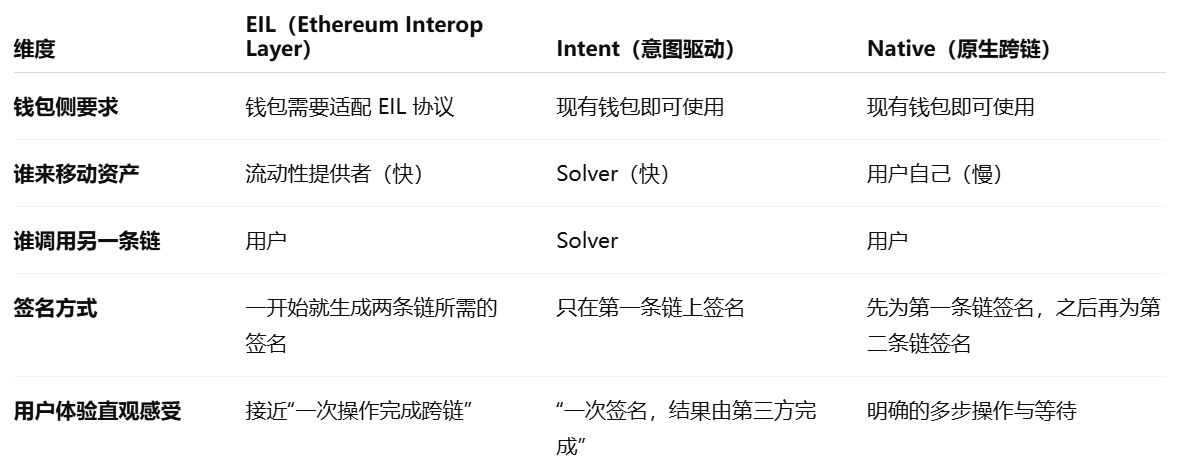

Compared to traditional cross-chain bridges, relayers, and intent/solver models, the advantage of this design is also intuitive ——The Native route is the safest and most transparent, but it is slow and provides a fragmented user experience. The Intent route offers the best user experience, but it introduces trust and coordination challenges with Solvers. EIL aims to bring the user experience closer to that of Intents without involving Solvers, but it requires deep collaboration between wallets and the protocol layer.

Source: Based on @MarcinM02, image created by myself

The EIL proposal put forward by the Ethereum Foundation's account abstraction team envisions a future in which users can complete cross-chain transactions with just a single signature, without relying on centralized relayers or introducing new trust assumptions. Transactions can be initiated directly from the wallet and seamlessly settled across different L2s.

II. EIL's Engineering Path: Account Abstraction + Minimally Trusted Messaging Layer

Of course, this also brings up a more practical question: whether the implementation details and ecosystem compatibility of EIL can truly achieve "theory equals practice" remains an open issue.

We can break down the engineering implementation path of EIL in more detail. As mentioned above, it does not attempt to introduce a brand-new inter-chain consensus, but instead builds upon two existing building blocks:ERC-4337 Account Abstraction (AA) + Minimally Trusted Cross-Chain Messaging and Liquidity Mechanism.

First is account abstraction based on ERC-4337, which decouples accounts from private keys, allowing user accounts to become smart contract accounts. These accounts can have customizable validation logic and cross-chain execution logic, no longer limited by the traditional EOA key-based model.

The significance of this for EIL is that cross-chain operations no longer need to rely on external executors (Solvers) to perform them on your behalf. Instead, they can be expressed at the account layer as a standardized user operation object (UserOp), which is uniformly constructed and managed by the wallet.

These features were previously impossible to implement directly with EOA (Externally Owned Accounts) and required complex external contract wrappers. With account abstraction based on ERC-4337, user accounts can evolve from rigid "key pairs" into programmable code. More directly, users can express cross-chain intentions with just a single signature (UserOp). (For further reading, see...)From Externally Owned Accounts (EOA) to Account Abstraction: Will the Next Leap in Web3 Occur in the "Account System"?):

Account contracts can embed more complex validation and execution rules, enabling a single signature to trigger a series of cross-chain instructions. Combined with mechanisms like Paymaster, they can even achieve gas abstraction—for example, paying transaction fees on the destination chain using assets from the source chain, eliminating the awkwardness of having to buy a few dollars' worth of native gas tokens before cross-chain transactions.

This is also why EIL's narrative is often tied to wallet experiences, as what it truly aims to change is the form of entry points through which users interact with the multichain world.

The second is a message-passing mechanism centered around minimal trust—XLP (Cross-Chain Liquidity Provider), which addresses the efficiency issues in cross-chain message passing.

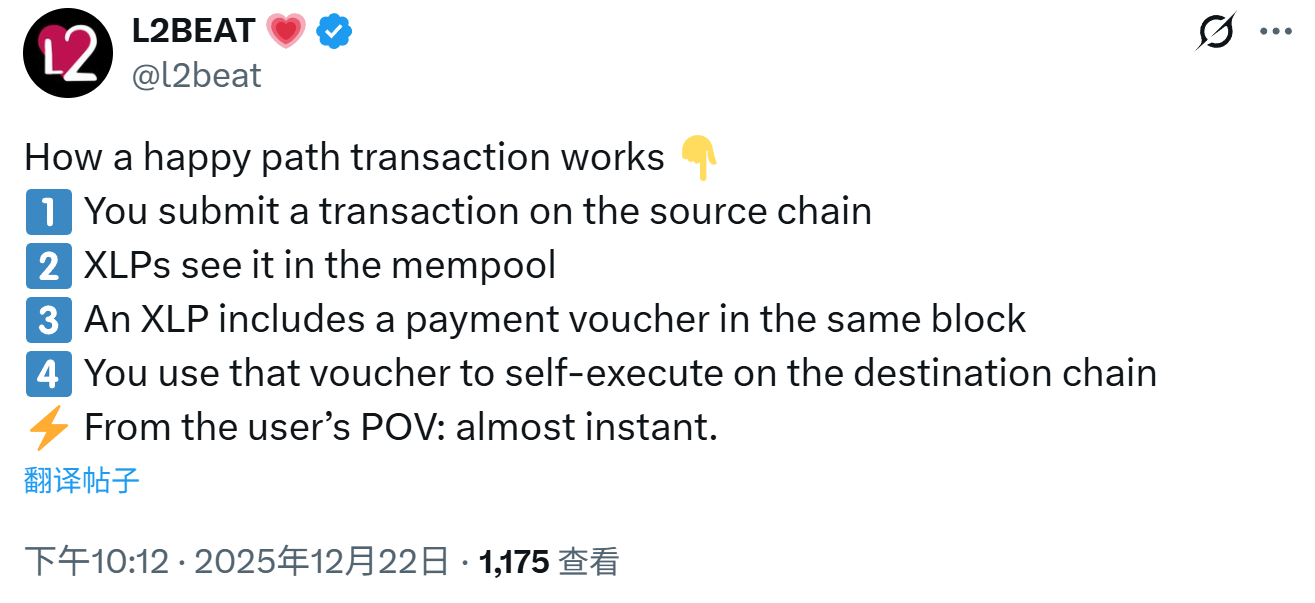

Since traditional cross-chain solutions rely on relayers or centralized bridges, EIL introduces XLP. Based on this, a theoretically efficient and ideal path that minimizes the sacrifice of security can be built:

- The user submits a cross-chain transaction on the source chain;

- XLP observes this intent in the memory pool, pre-pays the funds/Gas on the target chain, and provides a "payment voucher (Voucher)";

- The user utilizes credentials to complete self-execution on the target chain;

From the user's perspective, this process is almost instantly credited, eliminating the need to wait for the lengthy settlement of an official bridge.

However, you might have noticed a potential issue: what if the XLP takes the funds but fails to perform the service? The elegant design of EIL addresses this by allowing users to submit proofs on Ethereum L1 to permissionlessly slash (penalize) the XLP's staked assets if they breach the contract.

The official bridge is only used for settlement and recourse after bad debts, which means the system operates extremely quickly under normal circumstances; in extreme cases, security is still guaranteed by Ethereum L1.

This structure implies moving slow and expensive security mechanisms out of the default path, instead concentrating the trust pressure on failure handling.

Of course, this is also one of the sources of controversy: when security increasingly relies on the "executability of failure paths" and the "effectiveness of economic penalties," does EIL truly introduce no new trust assumptions? Or does it merely shift trust from explicit relays to a more hidden, more engineered set of conditions?

This will also lead to a more critical discussion below: it may appear sufficiently elegant in theory, but what centralization issues and economic frictions might it still face in a real-world ecosystem, and why does the community remain cautious about it?

III. Between Vision and Engineering: Is EIL Truly "Minimizing Trust"?

Up to this point, EIL's ambitions are clear: it aims to minimize explicit relay trust in its design and attempts to consolidate cross-chain operations into a single signature and a single user action at the wallet layer.

The problem is that——Trust does not vanish into thin air; it simply transfers.

This is also why platforms like L2BEAT, which have long focused on the risk boundaries of Layer 2 solutions, remain particularly cautious about the engineering implementation of EIL. After all, if the interoperability layer becomes the default general-purpose pathway, any hidden assumptions, incentive failures, or governance single points within it could be amplified into systemic risks.

Specifically, the efficiency of EIL comes from two aspects: first, AA bundles actions into a single signature, and second, XLP's advance payment allows users to bypass waiting. The first aspect is relatively straightforward—it is an efficiency improvement resulting from the integration of AA. However,The latter's prepayment implies that certain security no longer comes from immediately verifiable finality, but rather from "economically-backed guarantees that can be traced and penalized."

This would undoubtedly shift the risk exposure to a few more engineering-related issues:

- How are the default probability, funding cost, and risk hedging of XLP priced under real market volatility?

- Are the "fines and confiscations" timely and enforceable enough to cover losses in extreme situations?

- When the amount increases and the path becomes more complex (multi-hop / multi-chain), does the difficulty of failure scenarios increase exponentially?

Ultimately, the foundation of trust here is no longer mathematical proof, but the staked collateral of validators. If the cost of an attack is lower than the potential gains, the system still faces a risk of rollback.

Furthermore, objectively speaking, EIL attempts to address liquidity fragmentation through technical means. However, liquidity itself is a market-driven behavior. If significant cost and trust differentials still exist between different chains, a mere communication standard (EIL) cannot truly enable liquidity to flow.After all, a mere communication protocol standard cannot resolve the fundamental economic issue of "liquidity being unwilling to flow."

Furthermore, if there is no supporting economic incentive design, EIL might face a dilemma where the pipeline becomes standardized, but lacks implementers due to lack of profitability.

Overall, EIL is one of the most important infrastructure concepts proposed by the Ethereum community in response to the fragmented L2 experience. It aims to simplify UX while maintaining Ethereum's core values (self-custody, censorship resistance, and decentralization), which is commendable in itself. (Further reading:Piercing Through the Noise of Ethereum's "Degeneration": Why the "Ethereum Values" Form the Widest Moat?)。

For ordinary users, there is no need to hastily praise or criticize EIL; instead, it is more important to understand its trade-offs and boundary assumptions in protocol design.

After all, for the current Ethereum, EIL is not merely an incremental upgrade to existing cross-chain pain points, but rather a deep technical and value-driven attempt to integrate experience, economics, and security trust boundaries. It could potentially push Ethereum toward truly seamless interoperability, but it may also expose new boundary effects and trade-offs during the implementation process.

Final Words

As of today in 2026, EIL is not a plug-and-play ultimate solution, but rather more like a systematic test of the boundaries of trust, engineering feasibility, and the limits of user experience.

If it succeeds, Ethereum's L2 world will truly look like a single chain; if it is less successful, it will certainly leave clear lessons for the next generation of interoperability design.

Everything is still experimental before 2026.

And this, perhaps, is exactly where Ethereum is most genuine and also most deserving of respect.