Key Insights

- Eric Adams is already embroiled in controversy less than 24 hours after endorsing the NYC token.

- Addresses linked to the former NYC Mayor reportedly removed over $3 million from the memecoin liquidity pool.

- NYC Token team claims it is liquidity pool rebalancing as the token rebounds.

Former New York City Mayor Eric Adams is caught in controversy after the alleged rug pull of a memecoin linked to him. Adams, who recently left office, endorsed the NYC token in a conference held in Times Square on Monday.

The endorsement was not entirely unexpected, given Adams’ support for crypto during his administration. In the press conference, he said the revenue from the project would be spent addressing antisemitism and anti-Americanism. However, the hype was short-lived.

NYC Token Plunges After Alleged Rug Pull

According to reports, addresses linked to Adams removed liquidity from the NYC token at its price peak. This led to panic selling among several traders, causing the token’s value to plunge.

The reports of liquidity removal first came from RuneCrypto on X. He noted that Adams removed a total of $3,43 million in USDC from the liquidity pool. Lookonchain noted that the removed liquidity was around $3.18 million.

There were varying claims about how much was removed. The clear impact was that several holders suffered losses as the token’s value fell. One trader, Dr6s2o, lost over $470,000 after panic-selling the token due to the drop in value.

Bubblemaps also observed irregular liquidity activity, which started with an address 9Ty4M. This removed around $2.5 million USDC at the market peak. It later added $1.5 million after the token had fallen by more than 60%.

Interestingly, there were earlier concerns about the concentration of the token supply. 70% of the supply is controlled by one wallet, while the top 10% of holders control over 98% of the supply.

Scammers have also launched several other memecoins with similar names simultaneously, further confusing traders.

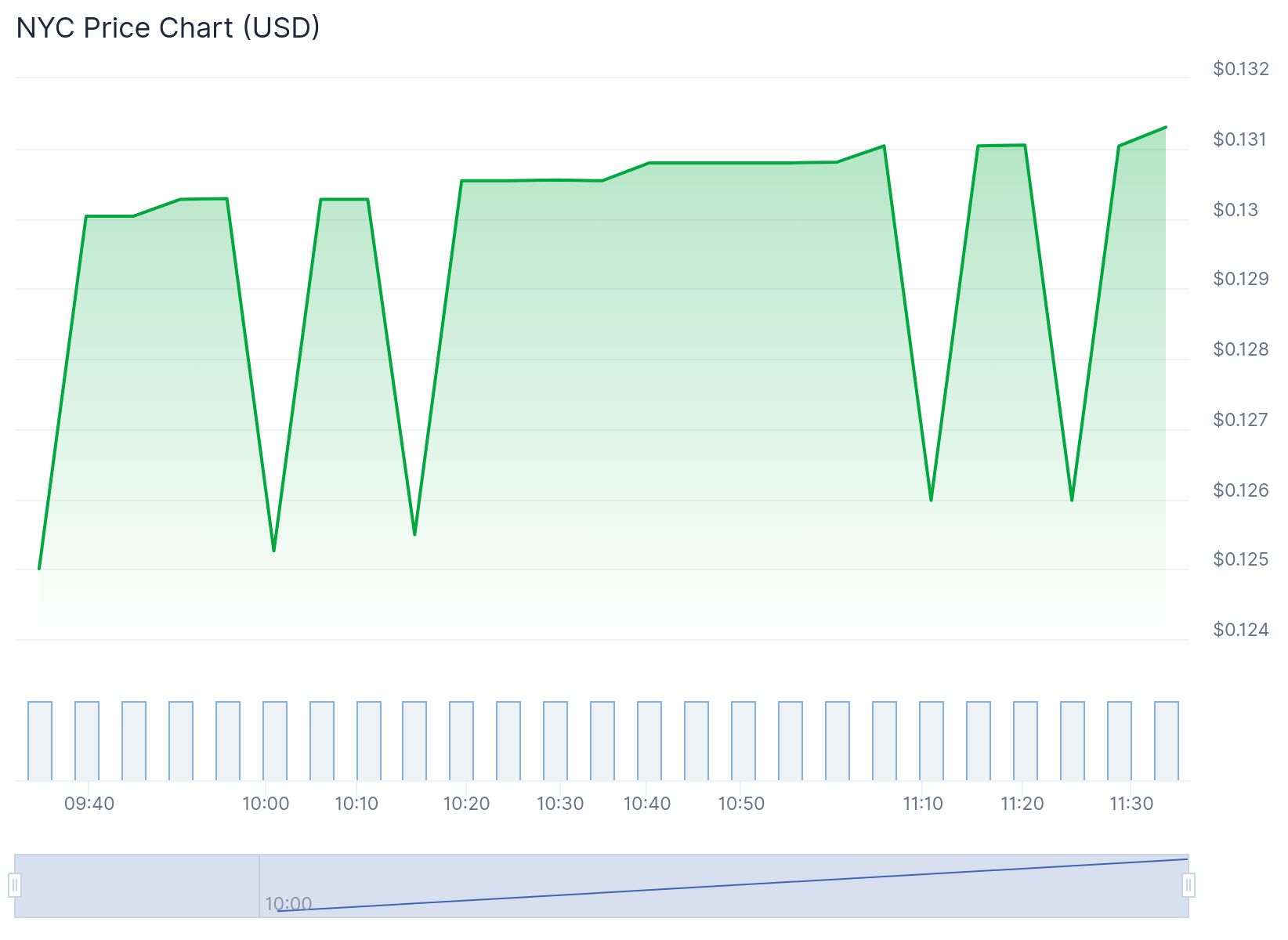

NYC Token on Rebound as Team Claims It was Liquidity Rebalancing

Meanwhile, the memcoin looks to have rebounded after initially dropping by more than 60%. CoinGecko data indicates a 4% increase in the last 24 hours, with a market capitalization of $39 million.

Its fully diluted valuation is over $131 million. The token is based on Solana with a total supply of 1 billion. Its circulating supply stands at 300 million tokens.

Interestingly, the official page for the NYC Token has claimed that what happened was simply a rebalancing of liquidity. It claimed that more liquidity has now been added.

It said:

The announcement added, “We’re in it for the long haul.” However, it is unlikely to calm nerves given the performance of previous memecoin linked to Politicians.

Tokens such as TRUMP, MELANIA, and LIBRA are all down by at least 92% from their peak value. Many believe NYC Token will follow the same trend.

The post Eric Adams Faces NYC Token Controversy After Alleged Liquidity Pull appeared first on The Market Periodical.