Dogecoin shows intraday volatility with fluctuations between support and resistance levels, as traders monitor key indicators for a breakout.

The Dogecoin (DOGE) market has recently displayed a series of fluctuations, with the meme coin trading at around $0.1255 after a 0.9% decline in the past 24 hours. The daily range shows Dogecoin dipping to $0.1231, while making a brief recovery to $0.127, indicating intraday volatility.

On the positive side, Dogecoin has seen some institutional progress, gaining a regulated investment product through 21Shares. Yet, this achievement has not been enough to shift the downward trend in price action.

Over the past 7 days, Dogecoin has decreased by 10.3%, and a closer look at the chart shows a failed attempt to maintain upward momentum. Traders will now be watching closely to see if Dogecoin can stabilize above key support levels.

Dogecoin Price Analysis

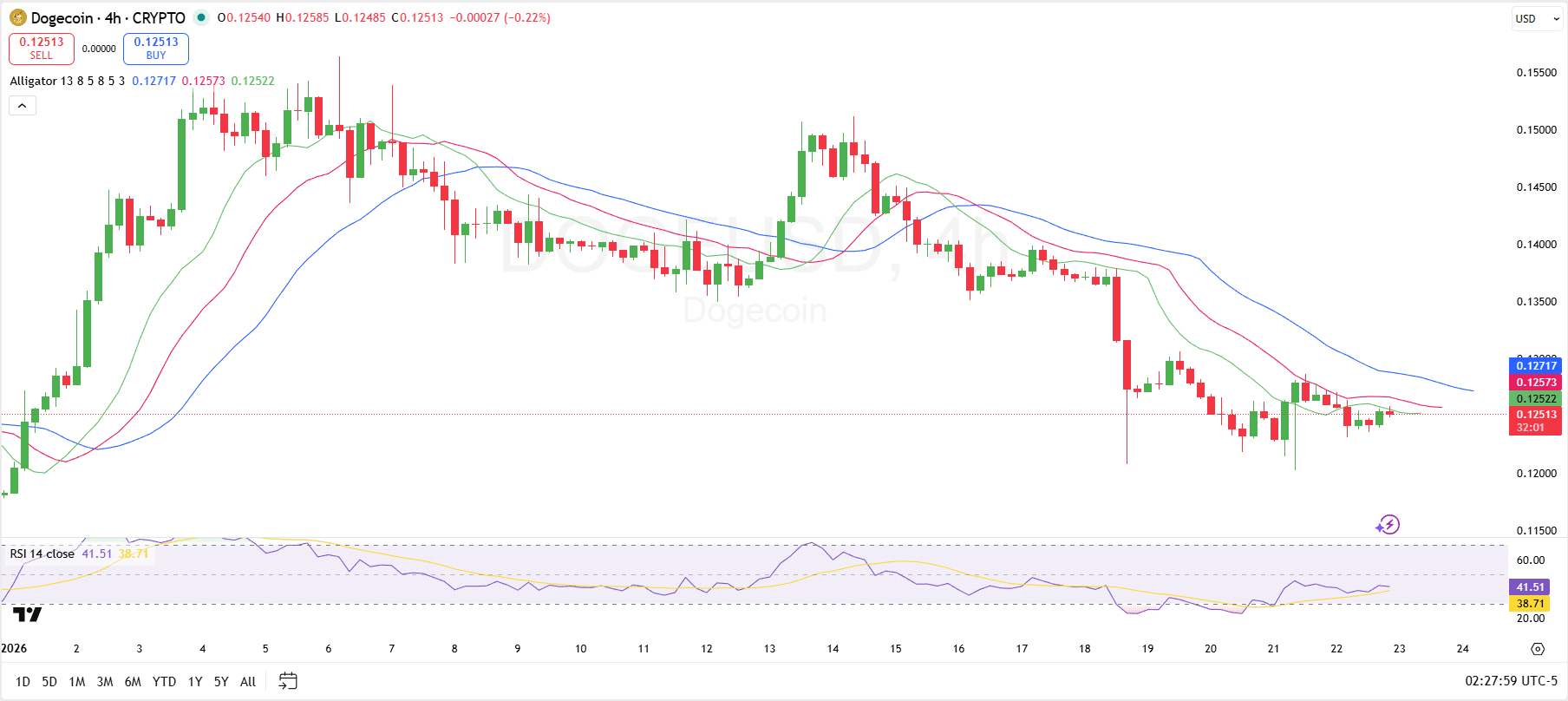

The 4-hour chart for Dogecoin indicates that the price is currently navigating between key support and resistance levels. For instance, the Alligator Indicator remains in a neutral to bearish state, as the green line is still below the red and blue lines, which suggests a lack of bullish momentum. For the price to turn bullish, the green line would need to cross above both the red and blue lines, setting up for a potential uptrend.

Additionally, the Relative Strength Index sits at 41.51, which indicates that Dogecoin is neither overbought nor oversold, but leaning to the negative side. This is a crucial area to watch, as a move above the 50 level in RSI would provide further confirmation of upward momentum.

On the downside, the immediate support is at $0.1242, with a possible breakdown leading to further tests near the $0.1200 range. Meanwhile, on the upside, resistance exists near the $0.1279 level, with further resistance around the $0.1300 range, where price action has previously faced rejection.

Can DOGE Reach $1.10?

Elsewhere, Veteran analyst Ali Martinez highlights that Dogecoin has historically respected falling wedge structures. Notably, if the crypto breaks out from its current wedge, the price movement could be significant.

According to Martinez, this potential breakout could lead to a substantial upward momentum, aligning with the bullish technical pattern observed in the chart. Notably, if it breaks out this time, it could see Dogecoin surge to the $1.10 level, a 777% surge from the current price of $0.1255.

DisClamier: This content is informational and should not be considered financial advice. The views expressed in this article may include the author's personal opinions and do not reflect The Crypto Basic opinion. Readers are encouraged to do thorough research before making any investment decisions. The Crypto Basic is not responsible for any financial losses.