Author: Jae, PANews

On January 14, the DFINITY Foundation officially released a new token economics white paper titled "Mission 70," proposing an extremely aggressive deflationary plan: by the end of 2026, it aims to reduce the ICP inflation rate by 70%.

After the announcement, ICP's price showed strong performance, with intraday gains once exceeding 30%, leading the market. This is not merely emotional hype, but rather a repricing of the Internet Computer's fundamentals.

For DFINITY, which aspires to "reimagine the internet," this is not merely an adjustment to its economic model but could mark a turning point in its ecosystem development. It is attempting a high-stakes "economic surgery" to make a daring leap—from "infrastructure that burns money" to a "self-sustaining value engine."

Shifting from a period of subsidy expansion to a deflationary era, aiming to reduce the inflation rate by more than 70%.

This brand new white paper, authored personally by founder Dominic Williams, is not just an ordinary project update—it reads more like a "fiscal austerity bill" addressed to all token holders.

The core objective of this plan is to reduce the new issuance of ICP tokens—i.e., the nominal inflation rate—by 70% or more by 2026, through a dual approach of "reducing supply" and "increasing demand," guiding ICP toward deflation.

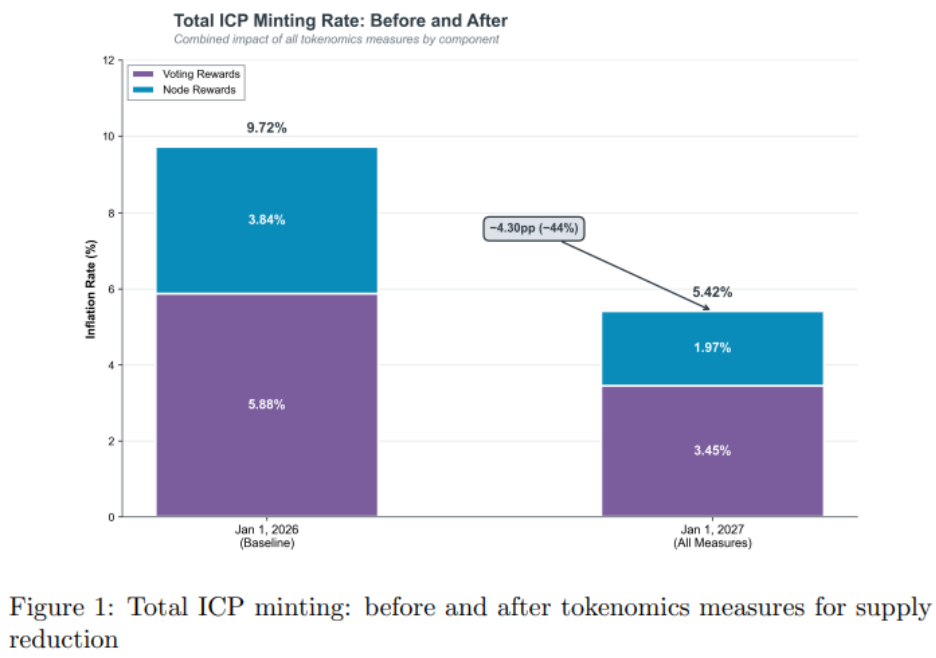

The current annualized inflation rate of ICP is approximately 9.72%, primarily stemming from two major "leakage points" on the supply side: governance voting rewards (5.88%) and node provider incentives (3.84%). This is akin to a machine continuously printing money, constantly diluting the asset value for early participants.

Mission 70 proposes first "stopping the bleeding" on the supply side by adjusting the incentive parameters of the NNS (Neural Network System), aiming to achieve a 44% "absolute token reduction." The logic behind this model lies in,By sacrificing some nominal rate of return in exchange for lower inflation and higher asset scarcity, thereby enhancing the long-term scarcity of the token, this essentially represents a deep-level value game.

The white paper points out that although reducing voting rewards lowers stakers' nominal returns in the short term, it can optimize risk-adjusted returns for long-term holders by increasing token value and reducing circulating sell pressure, thus improving returns as liquidity risk decreases.

In addition, the reduction in node incentives is based on the improvement of provider operational efficiency and the multiplier effect caused by the increase in ICP prices: when the ICP price rises, the number of new ICP tokens that need to be issued to pay node fees with the same fiat currency value will be reduced.

Relying solely on "cost-cutting" from the supply side would make it difficult to achieve the overall emission reduction target of 70%. To bridge the remaining 26% of the emission reduction goal, DFINITY has placed its bet on the AI sector, formulating a demand expansion strategy centered around the "Caffeine AI" platform.

Caffeine is positioned as the world's first commercial "self-written internet" platform. Its technical foundation lies in utilizing on-chain large language models (LLMs) to enable natural language programming (NLP), allowing non-technical users to directly develop, deploy, and run full-stack applications on the ICP through textual descriptions. It is committed to transforming internet users from mere consumers into active builders.

In the economic model, all computational, storage, and network activities driven by Caffeine consume "Cycles." Cycles are the unit used in the ICP ecosystem to quantify and calculate storage resources, representing the cost of executing a single instruction. Cycles are created by burning ICP tokens.

DFINITY plans to attract more AI models and enterprise-grade cloud engines to run directly on the ICP, enabling these high-computing-power and high-storage-demand applications to consume Cycles on a large scale. This will create a sustainable deflationary effect on ICP.

This also means that the value capture of ICP will no longer rely on speculation, but will instead be directly tied to the real demand for decentralized AI computing on a global scale.

Related Reading:The DFINITY Foundation Bets on AI: What Makes Caffeine Drive the Surge in ICP?

The underlying logic of this economic operation is DFINITY's accurate assessment of its own development stage: the period of subsidies and expansion has ended, and it must now enter the phase of value capture.It attempts to address the most criticized issue of value dilution since ICP's inception, shifting market attention from inflation to actual on-chain resource consumption.

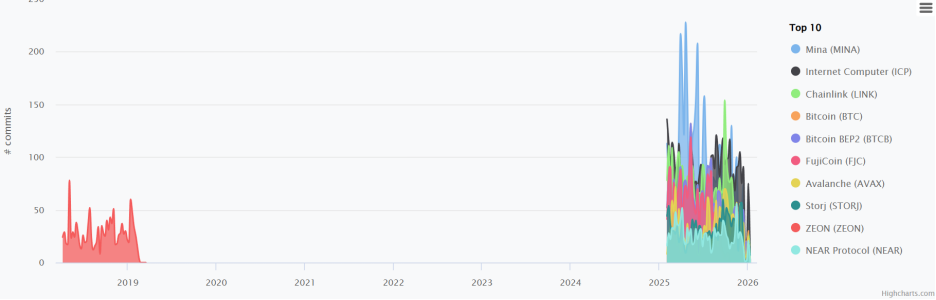

It ranks second globally in development activity and has built three major competitive barriers.

Markets are often easily confused by price fluctuations. DFINITY's economic overhaul is built upon a solid technical foundation.

The activity level of a code repository is usually the most objective and explicit indicator of a project's long-term vitality.

According to CryptoMiso's data, over the past 12 months, the Internet Computer had a total of 4,185 GitHub commits, ranking it second among all blockchain projects globally, surpassing established public chains such as Bitcoin, Ethereum, and Solana.

This high-intensity development pace mainly stems from the DFINITY Foundation's large-scale development team. Moreover, this active development is not blindly accumulated; it focuses primarily on the following areas:

- Subnet Expansion: A series of upgrades in 2025 will increase the subnet's storage capacity to 2 TiB and introduce dynamic load balancing, significantly enhancing the network's ability to handle massive amounts of data.

- Wasm Performance Optimization: Continuously pushing the performance limits of WebAssembly to enable ICP to execute complex smart contract computations at near-native speeds.

- Threshold Cryptography Iteration: Continuously enhancing Chain Fusion technology to enable ICP contracts to directly manage native assets from external blockchains such as Bitcoin, Ethereum, and Solana, without relying on high-risk cross-chain bridges.

The high level of developer activity and continuous technical delivery indicates that, despite the unpredictable nature of market cycles, the ICP developer community has not dwindled. Instead, it is steadily progressing toward the goals set by the DFINITY Foundation.

And it is precisely these technological accumulations that give DFINITY the confidence to perform an "economic operation."

With the evolution of its technical architecture, the Internet Computer has now evolved from a single L1 chain into a sovereign computing cloud platform. In the competitive market, its main advantages are reflected in three dimensions:

First, consolidate the practical capabilities of on-chain AI. Internet Computer is currently one of the few public blockchains capable of natively running AI inference models.Unlike other projects that run AI off-chain and return results through zero-knowledge proofs (ZKPs), this approach can directly load neural network models. Against the backdrop of the explosive growth of AI + Web3, this advantage is difficult to replace.

- End-to-end encryption and privacy: The Internet Computer enables encrypted storage of sensitive on-chain data, ensuring that when AI models process user private data, even node providers cannot access its contents.

- Cost-effectiveness: The comprehensive cost of running AI inference on the Internet Computer is more than 20% lower than that of traditional SaaS giants like Palantir, giving it a strong commercial competitive edge in the field of decentralized machine learning (DeML).

Second, to build a seamless interoperable future, ICP canisters can operate as native addresses on other chains.Against the backdrop of frequent cross-chain bridge security incidents, the "Chain Fusion" technology provided by the Internet Computer may represent the future direction of interoperability.

- Native Integration of BTC and SOL: The Internet Computer now enables direct handling of native on-chain assets from Bitcoin (such as Ordinals and Runes) and Solana assets, without involving any wrapped tokens or centralized custodians, significantly enhancing the security of multi-chain asset management.

- Full-chain DeFi hub: This capability could make the Internet Computer the "glue" connecting the fragmented public blockchain ecosystem, allowing developers to build DeFi applications that seamlessly deploy across multiple chains.

Finally, to eliminate barriers to widespread adoption, ICP's "Reverse Gas Model" serves as a powerful tool to attract mainstream developers.Under this model, users can use DApps without purchasing tokens or installing plugin wallets, significantly lowering the entry threshold for Web3 and providing an experience comparable to Web2. Combined with Internet Identity 2.0, users can achieve seamless login through fingerprint or facial recognition on their smartphones, a feature that far surpasses that of established public blockchains.

Cryptocurrency Price Plummets 99%: Centralized Legacy Issues Lead to Market Trust Deficit

Although the technological vision is grand, DFINITY's path toward the "World Computer" remains full of challenges. It currently faces multiple obstacles from market biases, ecosystem scale, and execution risks.

On one hand, after the mainnet launch in 2021, the ICP token price plummeted from a peak of over $400 to single digits, wiping out countless investors' capital.Although DFINITY insists this is due to market manipulation, long-term investor lawsuits and allegations of foundation dumping remain unresolved.

Although DFINITY has repeatedly requested the court to dismiss the related cases, the legal investigation into alleged market manipulation has remained a Damocles' sword hanging over the project's head.

This stereotype of a "centralized doomed project" may, to some extent, limit the willingness of new capital to participate.

On the other hand, ICPs are facing a phenomenon where technology and applications are out of balance.

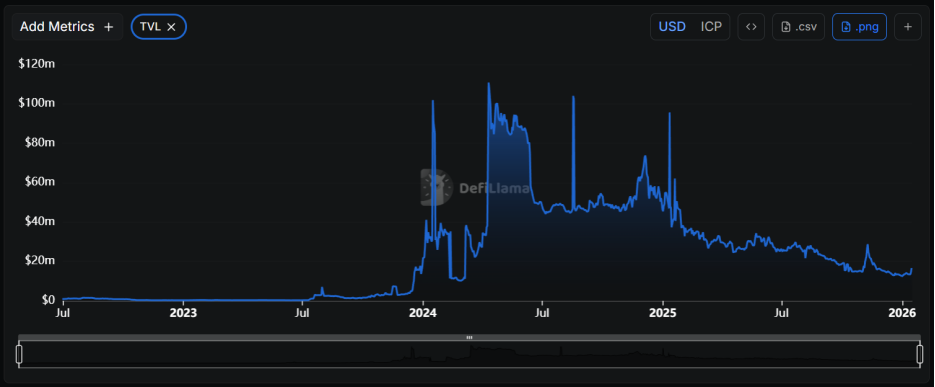

First, DeFi scale lags behind. Compared to Ethereum or Solana, the DeFi ecosystem on the Internet Computer is still significantly smaller. As of January 16, its on-chain TVL was only around $16 million.

Second, there is insufficient liquidity depth. Although the protocol has strong cross-chain technology, the liquidity depth of native on-chain assets such as ckBTC and ckETH is inadequate, leading to high slippage risks for large transactions.

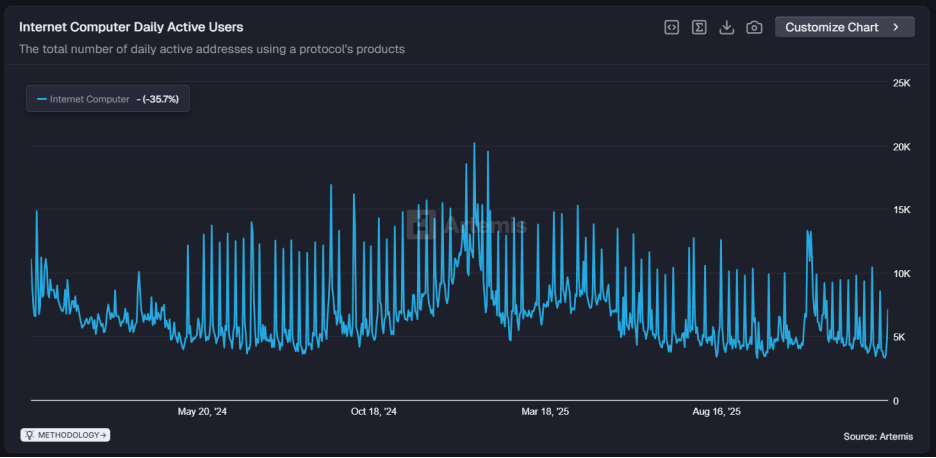

Third, it has a weak user base. The number of daily active addresses on the Internet Computer is only about 7,000, which is significantly lower in magnitude compared to the top ten public blockchains by market capitalization. How to transform the vision of a "self-written internet" into real user traffic will be its top priority.

Third, it has a weak user base. The number of daily active addresses on the Internet Computer is only about 7,000, which is significantly lower in magnitude compared to the top ten public blockchains by market capitalization. How to transform the vision of a "self-written internet" into real user traffic will be its top priority.

The place with the highest uncertainty is the effectiveness of the "inflation surgery."Mission 70 is a sophisticated economic experiment, the success of which primarily depends on the simultaneous fulfillment of two prerequisites: first, reducing rewards will not lead to a significant exodus of node providers; second, Caffeine AI can generate exponential growth in Cycles consumption. If the implementation of the AI platform falls short of expectations, a simple reduction in rewards could turn into a blow to the ecosystem's vitality, potentially leading to a vicious cycle of "price decline—increased inflation."

DFINITY is attempting to make a comeback through a new token economic model. If ICP gained popularity in 2021 based on the vision of the "world computer," then ICP in 2026 plans to prove its ability to create and capture value to the market by relying on a sophisticated deflationary model and verifiable real data.

For investors, the underlying logic for judging the ICP price has changed. It is no longer about the vague concept of ecosystem prosperity, but instead focuses on two quantifiable and trackable hard metrics: the rate of Cycles burning and the frequency of on-chain AI inference calls.

The short-term price increase of the token may merely reflect a release of market sentiment. The actual implementation effectiveness of the new token economic model, Mission 70, and whether it can break the curse of "strong technology, weak ecosystem," will become key factors in determining whether ICP can return to the ranks of top public blockchains.