Key Insights

- Yield protocol, also known as YO, lost $3.7 million due to slippage during a routine swap.

- The DeFi protocol swapped $3.84 million GHO stablecoin for just $112,000 USDC.

- It has now sent an onchain message to the liquidity pools and addresses that captured the surplus, asking for a refund.

The decentralized finance protocol Yield, also known as YO (yield optimizer), has suffered a loss of approximately $3.73 million.

The platform, which is an index that brings together the best yield-generating pools from over 50 protocols across various blockchains, experienced a loss during a Vault operation.

Extreme Slippage Caused the Loss, Highlighting Human Error as a Risk for DeFi

According to Peckshield, which reported on the incident, the protocol was swapping staked Aave stablecoin stkGHO into Circle USDC at the time. Due to extreme slippage, 3.84 million GHO was exchanged for just $112,000 USDC.

This represents a major loss for the protocol and a particularly unique one, as it did not involve any bad actor. Slippage typically occurs in trading when the expected price and the actual price do not align, primarily due to volatility resulting from low liquidity.

The incident highlights how DeFi losses could come from multiple fronts beyond the regular losses due to exploits. Many believe that it is a result of human negligence, with some users even noting that there are tools to prevent such incidents.

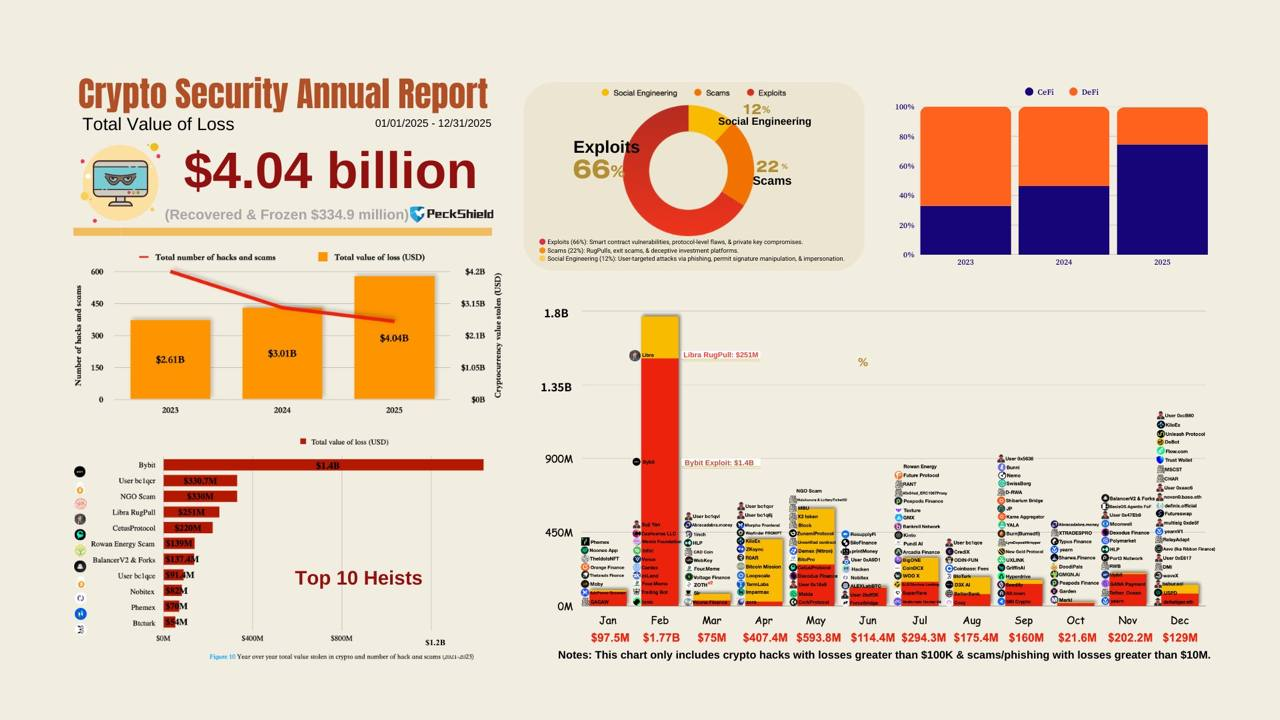

Meanwhile, losses due to human errors, such as this, are relatively uncommon in DeFi, with exploits and scams remaining the primary attack vectors. According to a recent report from Peckshield, over $4 billion worth of crypto was stolen in 2025, representing a record year with a 34% increase compared to 2024.

Crypto hacks account for $2.67 billion of the stolen funds, while $1.37 billion is attributed to scams, representing a 64.2% year-over-year increase in losses. Interestingly, only $334.9 million was recovered in 2025, compared to $488.5 million in 2024.

YO Sends Onchain Message in Efforts to Recover Lost Funds

Interestingly, a Uniswap V4 liquidity pool (LP) captured the $3.7 million lost due to the incident. However, the YO protocol has already reached out to the Uniswap LP onchain with a message requesting a private resolution of the issue and a refund of the loss, with 10% kept as a bug bounty.

The onchain message reads:

“This message is regarding an unintended swap that routed through your Uniswap v4 position today. We want to resolve this matter cooperatively and privately. We propose that you retain 10% of the net proceeds as a bug bounty and return the remainder to an address we provide. Please reply here or on X to @0scaronchain to coordinate.”

However, it is unclear if the Uniswap LP has reached out to the YO protocol team to facilitate the refund.

While the effort is ongoing, the DeFi protocol has, through its multisig wallet, bought back $3.71 million GHO from CoW Swap and redeposited the stKGHO into the vault. This has allowed it to re-enable the YoUSD market on Pendle, which was temporarily paused due to the incident.

The post DeFi Protocol Yield Suffers Almost $4 Million Loss appeared first on The Market Periodical.