Key Insights

- Crypto news, Core inflation data remained steady for December, as the CPI came in slightly lower than expected.

- The odds of a rate cut remain very low, despite the inflation data and President Trump’s repeated calls for a cut.

- The crypto market sees slight gains as BTC returns to $93,000 amid debate on the CLARITY Act.

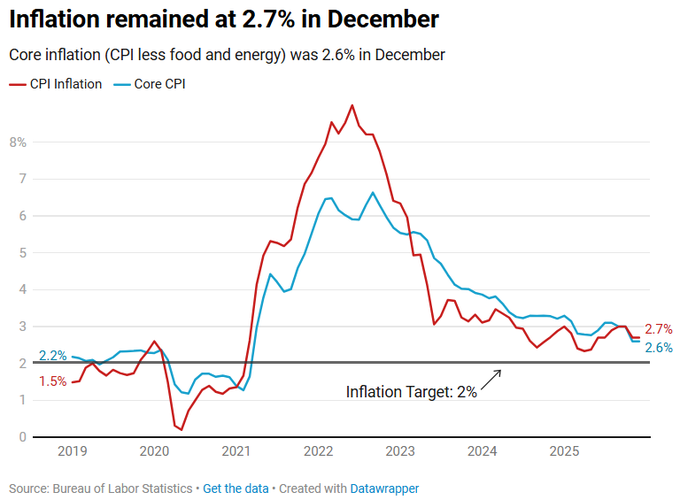

US inflation data for December has finally dropped, revealing numbers that are slightly below expectations. According to the data, the core consumer price index (CPI), excluding food and energy prices, increased by only 0.2% compared to November.

The CPI also increased by 2.6% annually according to the National Bureau of Statistics (NBS). This meant monthly and annual changes were 0.1% below expectations.

Crypto News; Inflation Stays Steady as Odds of Rate Cuts in January

Interestingly, the inclusion of food and energy prices had little impact on the CPI. It only increased by 0.3% monthly and 2.7% annually, in line with expectations.

While this was still above the 2% inflation target by the Federal Reserve, the slowdown in price increase suggests that inflation is cooling. This is positive news for many investors, evidenced by a brief rise in Stock market futures after the report.

The biggest reason for the increase in December was Shelter, which rose by 0.4% month-on-month (MoM). With this category accounting for over one-third of the CPI weighting, its increase, which is now at 3.2% YoY, had a major impact.

Food prices also increased by 0.7%, while energy prices rose by 0.3%. However, the price of used cars dropped by 1.1% while household furnishings declined by 0.5%.

Despite inflation seeming to hold steady, experts do not expect any interest rate cut in January. Following the three rate cuts in 2025, experts expect the Fed to hold steady for some time. There may be no cuts until June.

However, that would not have happened if President Donald Trump had his way. The president posted on Truth Social that the Fed chair Jerome Powell should cut the interest rate now.

He wrote:

“JUST OUT: Great (LOW!) Inflation numbers for the USA. That means that Jerome “Too Late” Powell should cut interest rates, MEANINGFULLY!!! If he doesn’t, he will continue to be “TOO LATE!” ALSO OUT, GREAT GROWTH NUMBERS. Thank you MISTER TARIFF! President DJT”

With Powell expected to leave office by May, all eyes are on who the next Fed chair would be. Given President Trump’s persistent call for interest rate cuts, it is likely the next chair would be someone who supports the same opinion.

Crypto Market Soars Amidst Steady Inflation Data

Meanwhile, the cryptocurrency market has reacted positively to the CPI data, with the sector’s market cap rising by almost 2% in the past 24 hours. Bitcoin has now surpassed $93,000 again, with other assets, including Ethereum, Solana, XRP, and BNB, also experiencing slight gains.

The positive performance represents a rebound for the market, which plunged after massive gains in the early part of the year. However, it remains unclear whether the market will be able to sustain the current rally.

Interestingly, the gains have also been influenced by the Crypto Market Structure Bill, also known as the CLARITY Act. The bill, which is scheduled for Senate Banking Committee markup by January 15, could fundamentally change how cryptocurrency is regulated in the US.

Although it is still under debate, the growing likelihood of bipartisan support is generating positive momentum for the cryptocurrency sector.

The post Crypto News: December CPI Cools on Core as Inflation Holds appeared first on The Market Periodical.