Key Insights

- There are signs that a crypto market rally will happen soon.

- The Senate will consider the Crypto Market Structure Bill next week.

- The Federal Reserve will likely continue cutting interest rates this year.

The crypto market remains in a bear market, with Bitcoin being 28% below its all-time high of $126,275. Still, some potential catalysts will lead to a cryptocurrency rally, at least in the meantime.

Market Structure Bill to Trigger a Crypto Market Rally

The upcoming Senate markup vote on the Market Structure Bill may drive a crypto market rally. Lawmakers will decide its future soon. Senator Rick Scott, the Chairman of the Senate Banking Committee, announced that it will have a markup vote next week.

He said the bill will make it easier for companies in the crypto industry to succeed. He believes it will help them do well in the US. He also expects that the bill will lead to more job creation in the country.

The CLARITY Bill has already passed in the House of Representatives. It will now need all Republicans and eight Democrats to pass in the Senate. Polymarket traders believe that the Senate will pass it and that Donald Trump will sign it into law.

The act will be the second most important bill passed by Washington politicians after the GENIUS Act. It focused on the stablecoin industry.

Bitcoin Price Has Formed a Bullish Pattern

Meanwhile, the crypto market rally will be triggered by a potential Bitcoin price rebound since it has formed a highly bullish chart pattern.

The chart below shows that the coin has formed an ascending triangle pattern. Horizontal resistance and a diagonal trendline characterized it.

This resistance is at $94,468, while the diagonal line connects the lowest swings since November last year. The recent Bitcoin retreat is happening as bears attempt to retest the diagonal line.

Therefore, the Bitcoin price will likely rebound and move above $100,000 in the near term. This will boost the performance of other altcoins.

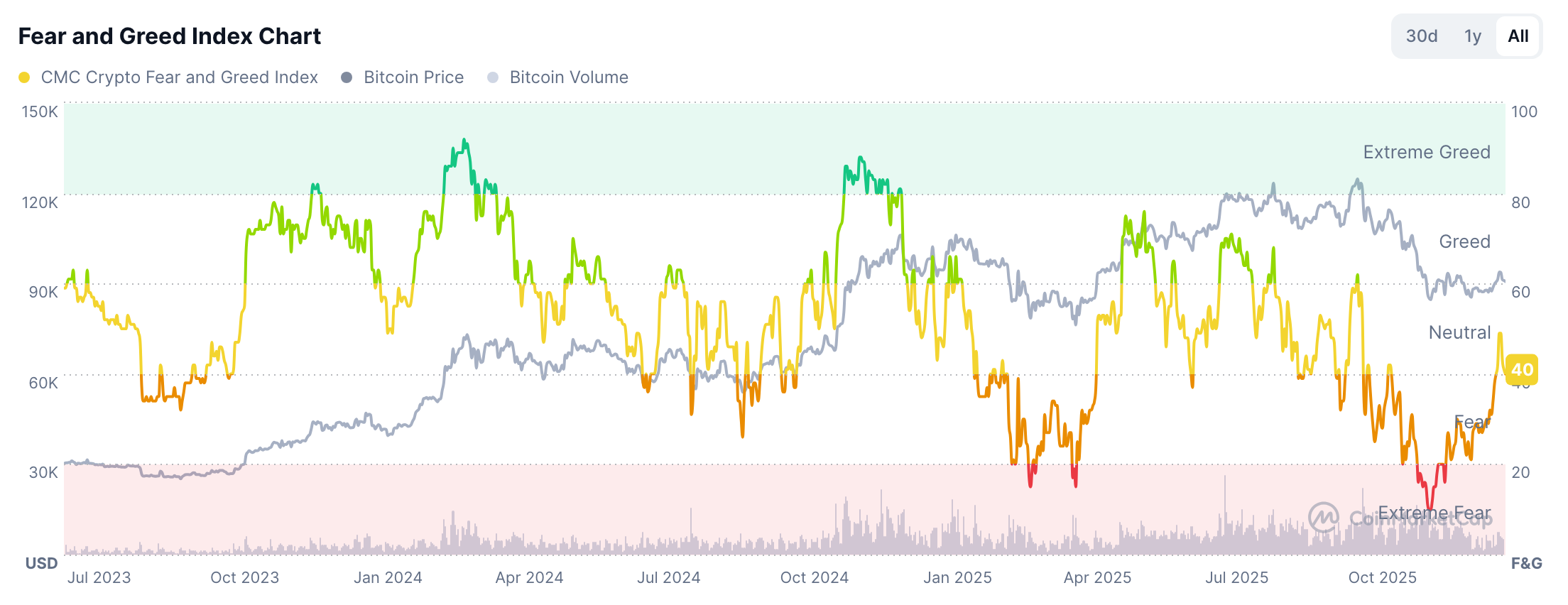

Crypto Fear and Greed Index is Rising

Market participants have shifted from extreme fear to neutral. This change is another key catalyst for a crypto rally.

Data shows that the Crypto Fear and Greed Index has moved from the extreme fear zone of 10 to the neutral point at 40. This means that the gauge will move to the green zone soon.

In most cases, crypto prices tend to rally when the gauge moves to the greed zone. They then drop when the index moves to the extreme greed zone.

Therefore, a move to the greed area will likely lead to a risk-on sentiment among investors. This will push it higher in the long term.

Federal Reserve Interest Rate Cuts and Soaring M2 Money Supply

The crypto market rally will gain strength as the chance of Federal Reserve interest rate cuts increases. Rising probability fuels optimism.

Odds of more cuts rose after the US published a mixed labor market report. This report showed that the economy created 55k jobs in December, much lower than the median estimate of 70,000. The unemployment rate came in at 4.4%, much higher than where it was a year ago.

Meanwhile, more data has shown that the US consumer inflation is moving downwards and that Donald Trump has not had a major impact on pushing inflation higher. Also, Trump will replace Jerome Powell with a more friendly official later this year.

Fed cuts will coincide with more US stimulus measures, including those in the Big Beautiful Bill and tax refunds. Some of these funds will move to the crypto market.

Additionally, the global M2 money supply is expected to continue rising this year. Bitcoin and other altcoins do well when the money supply is in a strong uptrend.

Futures open interest is bottoming. Stablecoin outflows from exchanges are also bottoming. Both signals show strong market support. These signs are highly bullish for a crypto rally.

The post Crypto Market Rally: Top Reasons to Bet on a Cryptocurrency Bull Run appeared first on The Market Periodical.