Key Insights

- Companies bought over 73,000 Bitcoin and 1 million Ethereum in Q4 of 2025.

- Corporate Bitcoin holdings have climbed to 1.1 million BTC. The number of public companies holding Bitcoin has risen to 191.

- 11 new companies purchased ETH in Q4 of 2025, as the supply held by corporations reached 6 million ETH.

Companies increased their accumulation of digital assets in late 2025. A new Bitwise report confirms this trend. The investment firm reported that companies bought over 70,000 Bitcoin and 1 million Ethereum in Q4 alone.

The massive acquisition by corporate buyers happened despite the volatile performance within that period.

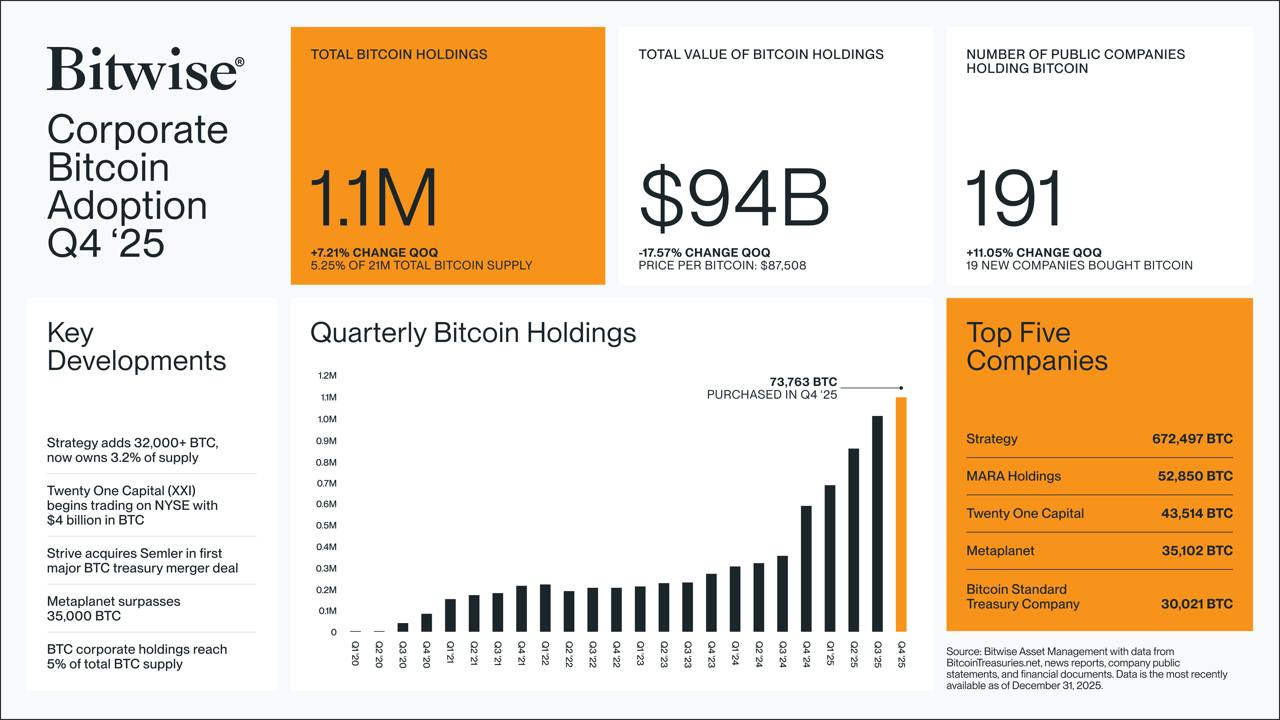

Corporate Bitcoin Holdings Reached 1.1 Million BTC in Q4 2025

According to Bitwise, companies bought a total of 73,763 BTC in Q4 of last year. Strategy (formerly MicroStrategy) led with 32,000 BTC. However, other buyers, such as Tokyo-listed Metaplanet, saw their holdings surpass 35,000 BTC.

Overall, the amount of BTC held by corporate holders reached 1.1 million BTC. It was worth around $94 billion, with a 7.21% quarter-on-quarter increase. Companies now account for 5.25% of Bitcoin’s total supply.

Strategy alone accounts for 3.2% of all Bitcoin supply, with 672,497 BTC. MARA Holdings comes second with 52,850 BTC, while Twenty One Capital, which began trading in Q4, also has 43,514 BTC.

Metaplanet is finally in the top 5 corporate bitcoin holders with 35,105 BTC, and Bitcoin Standard Treasury Company completes the list.

Interestingly, the number of public companies holding Bitcoin also increased, with 19 new companies buying BTC during the quarter. This represents an 11% increase, taking the number of public companies holding BTC to 191.

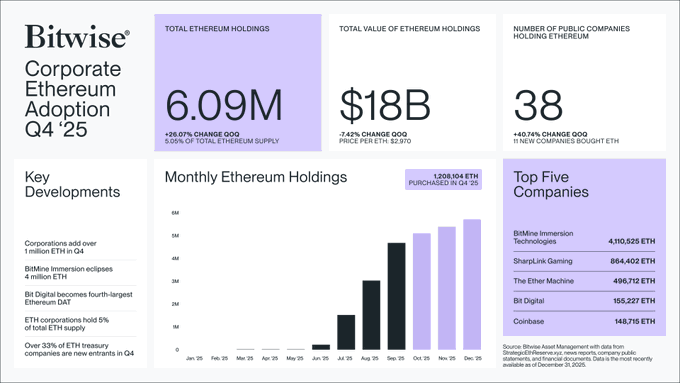

Ethereum Holding by Companies Increased over 20% in Q4 2025

Meanwhile, corporate interest in Bitcoin also extended to Ethereum, showing how both assets have gained institutional confidence. According to Bitwise data, total Ethereum holdings increased by 26% quarter on quarter, rising to 6.09 million.

With this, companies now hold more than 5% of Ethereum’s total supply, having added over 1 million ETH during the period. BitMine Immersion alone holds 4.1 million ETH, showing its dominance in the sector. The next closest is SharpLink Gaming, which has 864,402 ETH.

The company has been particularly bullish on Ethereum, with the chairman, Tom Lee, predicting it could reach $7,000 this year. BitMine has been staking its ETH holdings and now has over 2 million ETH staked.

However, BitMine is not the only one seeing the potential upside for ETH. The number of public companies holding Ethereum increased to 38 in Q4, with 11 new companies buying ETH. This represents an over 40% rise, with more than 33% of ETH treasury companies making their first purchase in Q4.

ETH purchases rose by more than 26% in Q4 2025. The value of ETH holdings grew only 7.42%. Total ETH holdings reached $18 billion. This is a direct result of the decline in ETH’s value, which saw it fall from above $4,000 to around $2,700.

Interestingly, the leading altcoin is now back above $3,000 after rising almost 4% in the past 24 hours. However, its price remains volatile, struggling to maintain the $3,000 level over the past month.

The post Bitcoin & Ethereum Acquisitions Surge in Q4 2025 Despite Weak Gains appeared first on The Market Periodical.