On January 14, a bill aimed at regulating the U.S. cryptocurrency market, the "CLARITY Act," is about to face a crucial vote in the Senate Banking Committee. On the eve of this pivotal moment for the industry, Brian Armstrong, founder and CEO of Coinbase, announced that the company will completely withdraw its support for the bill, citing the reason that "a bad bill is worse than no bill at all."

The announcement immediately caused a major stir in the industry. But what was truly surprising was that on the opposite side of Coinbase stood almost all the other major players in the industry.

Chris Dixon, a partner at the venture capital giant a16z, believes "now is the time to move forward." Brad Garlinghouse, CEO of payment giant Ripple, stated that "clarity clearly beats confusion." Arjun Sethi, co-CEO of rival exchange Kraken, went even further, saying directly "this is a test of political will." Even Coin Center, a nonprofit organization known for its advocacy of decentralization principles, stated that the bill is "basically right in terms of protecting developers."

On one side is the undisputed leader of the industry, and on the other side is a once-important ally of that leader. This is no longer the tired story of the crypto industry clashing with Washington regulators, but rather a civil war taking place within the industry itself.

Isolated Coinbase

Why has Coinbase been isolated by others?

The answer is simple: because almost all other major players have judged this imperfect bill to be the best option currently available, based on their respective commercial interests and philosophies of survival.

First is a16z. As one of the most renowned crypto investment firms in Silicon Valley, a16z's portfolio spans nearly every sector of the crypto industry. For them, the most damaging factor isn't the strictness of any specific regulation, but rather the ongoing regulatory uncertainty.

A clear legal framework, even if imperfect, can provide fertile ground for the entire ecosystem of their investments to grow. Chris Dixon's position represents the consensus among investors, who view regulatory certainty as more important than a perfect law.

Second is the exchange Kraken. As one of Coinbase's most direct competitors, Kraken is actively preparing for an IPO.

A regulatory endorsement from Congress would significantly boost its valuation in the public market. In comparison, the restrictions on stablecoin earnings in the bill would have a much smaller financial impact on Kraken than on Coinbase. For Kraken, exchanging manageable short-term business losses for substantial long-term benefits from going public is an obvious choice that requires little deliberation.

Looking at payment giant Ripple, its CEO Brad Garlinghouse summarized the company's stance with just six words: "Clarity beats chaos." Behind this statement lies a multi-year, multi-hundred-million-dollar legal battle between Ripple and the SEC.

For a company exhausted by regulatory pressures, any form of peace is a victory. Even an imperfect bill is far better than endless consumption in court.

Finally, there is the advocacy organization Coin Center. As a non-profit, their position is least driven by commercial interests. Their core demand over the years has been to ensure that software developers are not misclassified as "money transmitters" and subjected to excessive regulation.

This bill fully incorporates their advocated "Blockchain Regulatory Certainty Act" (BRCA), legally protecting developers. With the core objectives achieved, compromises on other details are acceptable. Their support represents recognition from the industry's "originalists."

When venture capital firms, exchanges, payment companies, and advocacy organizations all line up on one side, Coinbase's position stands out starkly.

So the question arises: if the entire industry has seen the path forward, what exactly has Coinbase seen that has led it to risk causing a rift within the industry just to block this progress?

Business models determine positions.

The answer is hidden in Coinbase's financial statements, revealing a $1.4 billion hole.

To understand Armstrong's table-flipping behavior, one must first understand Coinbase's survival anxiety. For a long time, a significant portion of Coinbase's revenue has relied on cryptocurrency trading fees.

The fragility of this model has been fully exposed during the crypto winter—generating substantial profits during bull markets, but sharply reducing income, or even incurring quarterly losses during bear markets. Companies must find new, more stable sources of revenue.

Stablecoin earnings are the second growth curve that Coinbase has discovered.

Its business model is not complicated. Users hold USDC, a stablecoin pegged 1:1 to the U.S. dollar, on the Coinbase platform. Coinbase then lends out these deposited funds through DeFi protocols (such as Morpho) to earn interest, and in turn, returns part of the earnings to users as rewards. According to data from Coinbase's official website, ordinary users can earn an annualized return of 3.5%, while paid members can receive up to 4.5%.

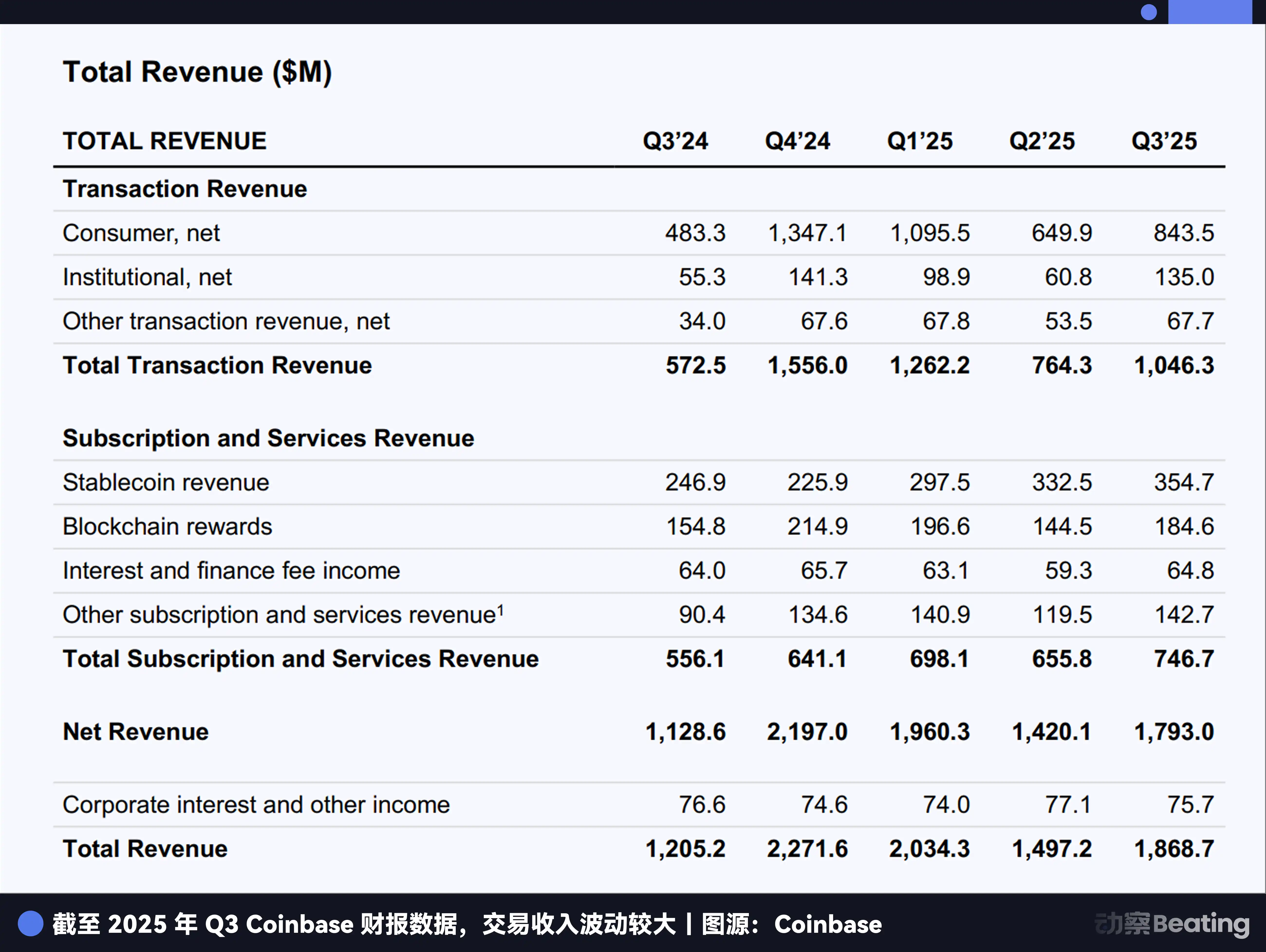

According to Coinbase's Q3 2025 financial report, its "interest and financing income" reached $355 million, with the majority coming from stablecoin operations. Based on this, it is estimated that this business contributed approximately $1.4 billion in revenue to Coinbase in 2025, representing an increasingly significant portion of its total income. In a bear market marked by sluggish trading volumes, this stable and substantial cash flow has become a lifeline for Coinbase.

A newly added provision in the CLARITY Act precisely targets Coinbase's critical vulnerability. This provision stipulates that stablecoin issuers or their affiliated parties cannot offer returns on users' "static holdings," but they are allowed to provide returns on "activities and transactions."

This means that users earning interest by simply holding USDC in their Coinbase accounts will be prohibited. This would be a fatal blow to Coinbase, and if the bill passes, this $1.4 billion in revenue could be significantly reduced or even eliminated entirely.

In addition, Armstrong's various issues listed on social media seem more like a competition at the market structure level: the draft would indirectly block the path for tokenized stocks/securities, set even higher barriers for DeFi to overcome, make it easier for regulators to access user financial data, and simultaneously weaken the role of the CFTC in the spot market.

The stablecoin revenue ban is just the most obvious and immediate blow to Coinbase.

Different interests lead to different choices.

Kraken's stablecoin business is much smaller than Coinbase's, allowing it to trade short-term losses for long-term value in an IPO. Ripple's core is payments, and regulatory clarity is its top priority. a16z's chessboard is the entire ecosystem; the gains or losses of individual projects don't affect the bigger picture. While Coinbase sees a cliff, other companies see a bridge.

However, there is a third party in this game: traditional banking.

The American Bankers Association (ABA) and the Bank Policy Institute (BPI) argue that allowing stablecoins to pay interest would lead to trillions of dollars in deposits shifting away from the traditional banking system, posing a survival threat to thousands of community banks.

As early as July 2025, the Stablecoin Genius Act was passed, explicitly allowing stablecoins' "third parties and affiliated parties" to pay interest, leaving legal room for Coinbase's model. However, in the seven months following that, the banking industry launched a strong lobbying campaign and ultimately succeeded in adding a "static holding" ban to the CLARITY Act.

Banks are not afraid of a 3.5% yield rate, but rather the loss of control over deposit pricing. When users can freely choose to place their funds in banks or cryptocurrency platforms, the decades-long low-interest monopoly held by banks comes to an end. This is the essence of the conflict.

So, given such a complex game of interests, why did Armstrong alone choose the most resolute approach?

Two Philosophies of Survival

This is not merely a conflict of commercial interests, but rather a collision of two fundamentally different philosophies of survival. One is the idealism and uncompromising nature of Silicon Valley, while the other is the pragmatism and incremental reform of Washington.

Brian Armstrong represents the former perspective. This is not the first time he has publicly confronted regulators. As early as 2023, when the SEC sued Coinbase for operating an illegal securities exchange, Armstrong openly criticized the SEC for being "inconsistent" and revealed that Coinbase had held over 30 meetings with regulators, repeatedly requesting clear rules but receiving no response.

His position has always been consistent: he supports regulation, but firmly opposes "bad regulation." In his view, accepting a bill with fundamental flaws is even more dangerous than having no bill for the time being. Once a law is enacted, it will be extremely difficult to amend it in the future. Accepting a bill that stifles a core business model for short-term certainty is akin to drinking poison to quench thirst.

Armstrong's logic is that it is worth fighting with all efforts now, even if it is painful, because it preserves the possibility of securing better rules in the future. If they compromise now, it would mean permanently giving up the ground of stablecoin earnings. In this battle that determines the company's future, compromise is equivalent to surrender.

Meanwhile, other leaders in the cryptocurrency industry have demonstrated a starkly different pragmatic philosophy. They understand the rules of the game in Washington, where legislation is an art of compromise, and perfection is the enemy of progress.

Kraken's CEO, Jesse Powell, believes that it is important to first establish a legal framework that grants the industry a legitimate social status, and then gradually improve it in practice through continuous lobbying and participation. First ensure survival, then pursue growth.

Ripple's CEO, Garlinghouse, places certainty above everything else. Years of litigation have taught him that struggling in the quagmire of legal battles is a huge drain on the company. An imperfect peace is far better than a perfect war.

Dixon from a16z, from the strategic perspective of global competition, argues that if the U.S. delays legislation due to internal disputes, it will simply cede its central position in global financial innovation to Singapore, Dubai, or Hong Kong.

Armstrong is still fighting Washington's battles in the style of Silicon Valley, while others have already learned Washington's language.

One is the principle of "Better to be shattered as jade than to remain intact as a mere tile," representing steadfastness; the other is the pragmatic consideration of "As long as the green hills remain, there will never be a lack of firewood," representing practicality. Which is wiser? Before time provides the answer, no one can make a definitive judgment. However, one thing is certain: both choices carry heavy costs.

The Cost of Civil War

What is the true cost of this civil war ignited by Coinbase?

First, it has caused political divisions within the cryptocurrency industry.

According to a report by Politico, the decision by Senate Banking Committee Chairman Tim Scott to postpone the vote was made at a time when Coinbase had withdrawn its support and the bill had yet to secure a clear bipartisan majority among lawmakers. While Coinbase's move was not the sole reason, it was undoubtedly a key factor that pushed the entire effort into disarray.

If the bill ultimately fails as a result, other companies might blame part of the responsibility on Coinbase, believing that it prioritized its own interests and hindered the progress of the entire industry.

More seriously, this public infighting has significantly weakened the collective bargaining power of the cryptocurrency industry in Washington.

When legislators see that an industry cannot even form a unified voice internally, they become confused and frustrated. A divided industry would be helpless in the face of powerful traditional financial lobbying groups.

Second, it reveals the dilemma of regulation in the digital age.

The CLARITY Act attempts to walk a tightrope between encouraging innovation and mitigating risks, but this balance is nearly impossible to satisfy everyone. For Coinbase, the bill is too restrictive; for traditional banks, it is too lenient; and for other crypto companies, it might just be right.

The dilemma of regulation lies in its attempt to set boundaries for insatiable desires. Every implemented rule merely marks the beginning of the next round of strategic maneuvering.

But the most significant cost is that this civil war has shaken the foundation of the cryptocurrency industry.

What exactly is the cryptocurrency industry? Is it a social experiment about decentralization and individual freedom, or a business focused on asset appreciation and wealth creation? Is it a revolution against the existing financial system, or merely a complement and improvement to it?

Armstrong's determination, contrasted with the compromises made by others in the industry, together outline the current reality of the field: a contradictory entity constantly swaying between ideals and reality, between revolution and commerce.

Click to learn about BlockBeats' job openings.

Welcome to join the official Lulin BlockBeats community:

Telegram Subscription Group:https://t.me/theblockbeats

Telegram discussion group:https://t.me/BlockBeats_App

Official Twitter account:https://twitter.com/BlockBeatsAsia