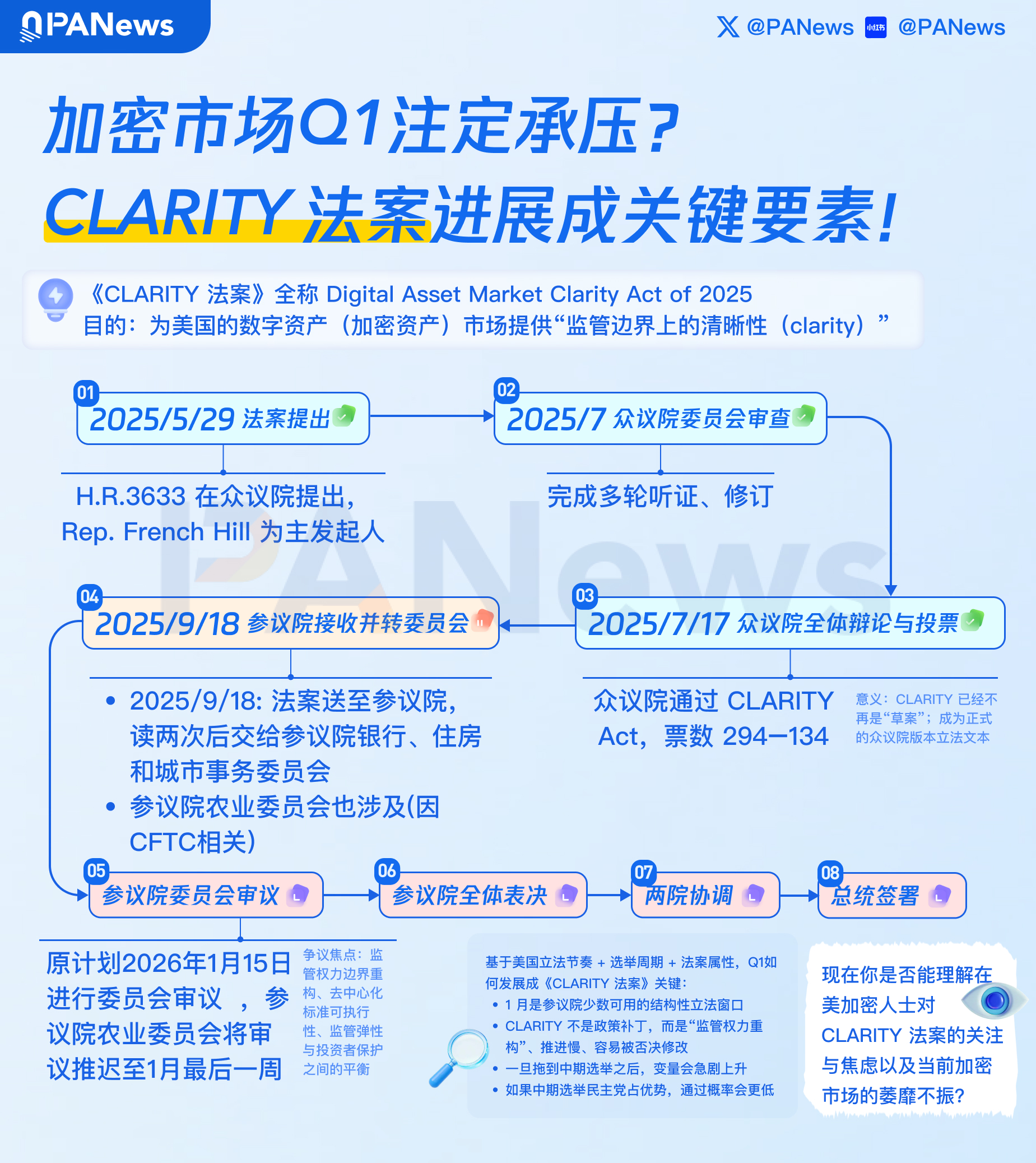

The purpose of the "Clarity Act" is to provide "regulatory clarity" for the digital asset (crypto-asset) market in the United States. It was introduced in the House of Representatives on May 29, 2025, by Rep. French Hill as the primary sponsor. Currently, it is stuck in the stage of "Senate receipt and referral to committee." The market is increasingly concerned that if the Clarity Act does not make significant progress in Q1, the longer it is delayed, the more adverse the consequences will be.

The reasons are multiple:

January is one of the few structural legislative windows available in the Senate.

January to March each year is the primary timeframe for the Senate to handle high-complexity, non-urgent bills. CLARITY is a market structure bill categorized as "high-complexity + high-controversy + non-urgent," which naturally places it at a lower priority. Once it fails to make substantive progress in January (such as clear actions at the committee level), it is easily "naturally pushed out" by the overall legislative schedule.

CLARITY is not a policy patch, but a "restructuring of regulatory authority."

The characteristics of such bills are: slow progress, frequent requests for revisions, and a high likelihood of being postponed rather than rejected.

Once it drags into the period after the midterm elections, the variables will rise sharply.

Midterm elections = a reset of the congressional power structure, partially advanced but unfinished legislation, and a reshuffling of priorities. Bills like CLARITY, which are not yet enacted, lack strong bipartisan consensus, and heavily rely on the support of current committees, are very likely to be "re-evaluated" after the power structure changes, and even be completely redrafted.

If the Democratic Party has an advantage in the midterm elections, the probability of passage will be lower.The mainstream position of the Democratic Party tends more toward: strengthening the scope of securities law, preserving regulatory agencies' interpretive flexibility, and being highly cautious about "limiting enforcement agencies' discretion through legislation."

The core effect of CLARITY is to predefine certain regulatory boundaries, limit "regulation by enforcement," and reduce the SEC's discretion in gray areas. Therefore, in a Senate environment dominated by Democrats, CLARITY is more likely to be: required to undergo significant revisions (substantially rewritten), broken down into multiple sub-bills, or indefinitely postponed.

Yes, I can understand the concerns and anxieties of crypto enthusiasts in the U.S. regarding the CLARITY Act, as well as the current sluggishness of the crypto market. The CLARITY Act (Crypto Asset Regulatory Clarity Act) is a legislative proposal aimed at providing regulatory clarity for the cryptocurrency industry in the United States. However, many in the crypto community are concerned that the bill may not go far enough in supporting innovation or may introduce unintended regulatory burdens. At the same time, the broader crypto market has been experiencing a period of stagnation or decline, driven by factors such as macroeconomic conditions, regulatory uncertainty, and market sentiment. These factors together contribute to the current mood of