Data released by the U.S. Treasury confirms that China’s holdings of U.S. debt fell by $6.1 billion, reaching its lowest exposure levels since 2008. While China remains one of the largest international holders of U.S. debt, it has sold 10% of its holdings since January 2025.

Derisking? China Sold $6.1 Billion In US Treasuries During November

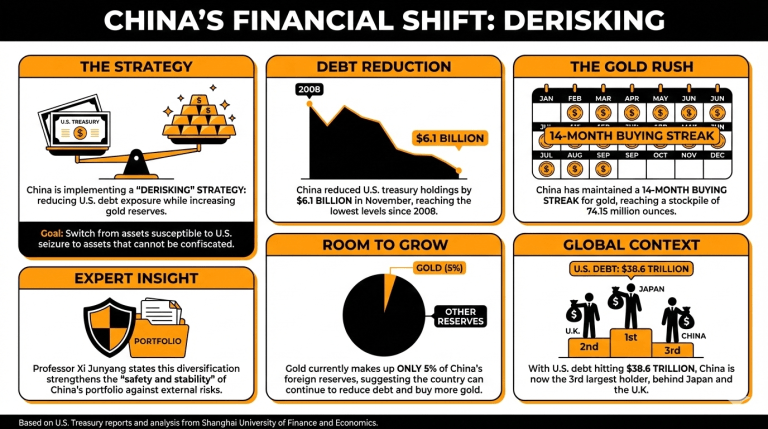

China’s “derisking” strategy seems to be in full implementation, at least when it comes to U.S. debt.

According to official reports from the U.S. Treasury, China continued its persistent sales of U.S. debt, having reduced its treasury holdings by $6.1 billion during November. China now owns $682.6 billion in U.S. treasuries, the lowest registered since 2008. This move is part of a reserve diversification policy that intensified since the start of the so-called “trade war” with the U.S.

Xi Junyang, a professor at Shanghai University of Finance and Economics, declared that this decrease was a result of “increased optimization and diversification of holdings of foreign assets seen in recent years, which helps strengthen the overall safety and stability of the portfolio.”

In contrast, China’s gold rush has reached a 14-month buying streak, as the country switches from assets controlled by the U.S. government and susceptible to seizures to assets that cannot be controlled or confiscated by third parties.

China’s gold stockpile, with 74.15 million ounces, still reaches only 5% of the nation’s foreign reserve. This means that China can continue to reduce its U.S. debt exposure and purchase even more gold.

Junyang believes that China will be allocating more of its reserves into gold in the future, as it can enhance “the stability of reserve assets” and strengthen “the ability to withstand external risks.”

China has also criticized the growth of the U.S. debt, which has recently reached $38.6 trillion, showing no signs of stopping at least in the short term.

With these movements, China is still the third-largest international holder of U.S. debt, behind Japan and the U.K.

Read more: China Steadies US Treasury Exposure as Debt Balloons Over $38 Trillion

FAQ

What recent actions has China taken regarding U.S. debt? In November, China sold $6.1 billion in U.S. Treasuries, reaching its lowest exposure since 2008, indicating a shift in its investment strategy.

What reasons does China give for decreasing its U.S. debt holdings? Officials cite a focus on optimizing and diversifying foreign asset portfolios to enhance safety and stability.

How is China increasing its gold reserves? China has entered a 14-month buying streak in gold, aiming to reduce exposure to U.S. assets and acquire unconfiscatable investments.

What is the current state of China’s gold stockpile? China’s gold holdings total 74.15 million ounces, which constitutes only 5% of its foreign reserves, suggesting a potential for further purchases as it diversifies from U.S. debt.