Key Insights

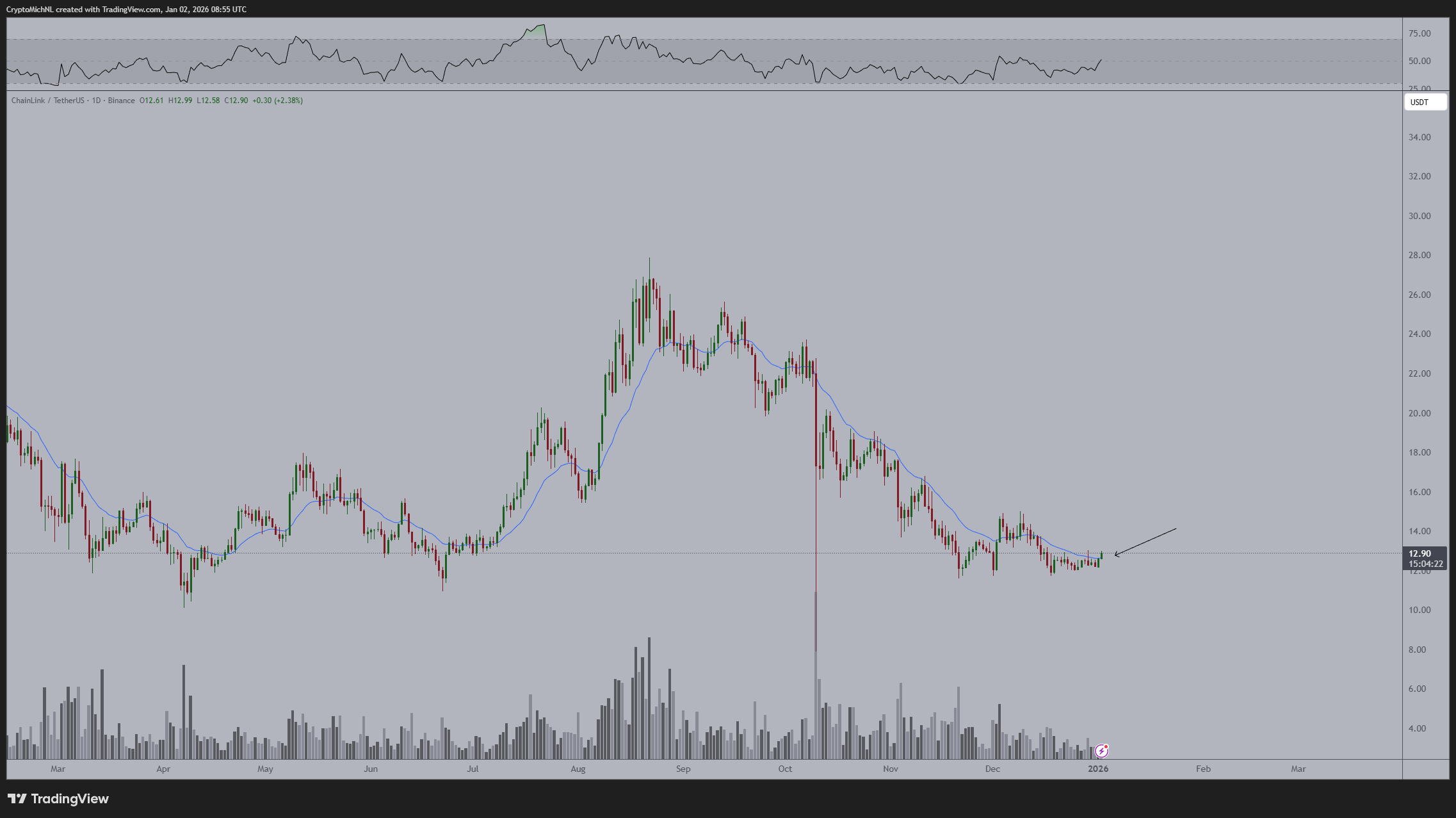

- Chainlink price is breaking the 21-day MA for the first time since the summer. Many altcoins have been correcting all the way down to their wick of the 10th of October.

- LINK crypto saw over $8.54 million in inflows.

- It ranks among the top 10 AI & Big Data projects by development.

Chainlink followed other altcoins on the charts. Chainlink price action declined toward the lows seen in October, though the structure was shifting gradually.

The capital inflow and developments in the crypto sector suggested that Chainlink could shape the trajectory of other altcoins. That said, what do the metrics say about this?

Chainlink Price Shaping Altcoin Sector

Chainlink price was showing signs of a breakout, which could affect the altcoin market as a whole. LINK broke through its 21-day moving average for the first time since the summer of 2025. This happened after falling to its lowest point in October.

This change could mean that prices will go up over the next two to three months. As prices traded around $12.90, the market cap was at $7.5 billion.

Chainlink is the largest oracle network, and its recovery could help DeFi and data-dependent protocols. Thus, it could make people more confident in altcoins that were linked to each other.

If LINK price maintains the breakout, it could mean that the whole sector is turning around from recent downturns. That could make investors move their capital into utilities like LINK.

However, the market is still volatile. Whether or not this leads to a broader altcoin uptrend will depend on the overall trends in the crypto market. Traders are seeing similar patterns in other altcoins, but they are still cautious.

Selective Crypto Inflows Highlight Chainlink Price Strength

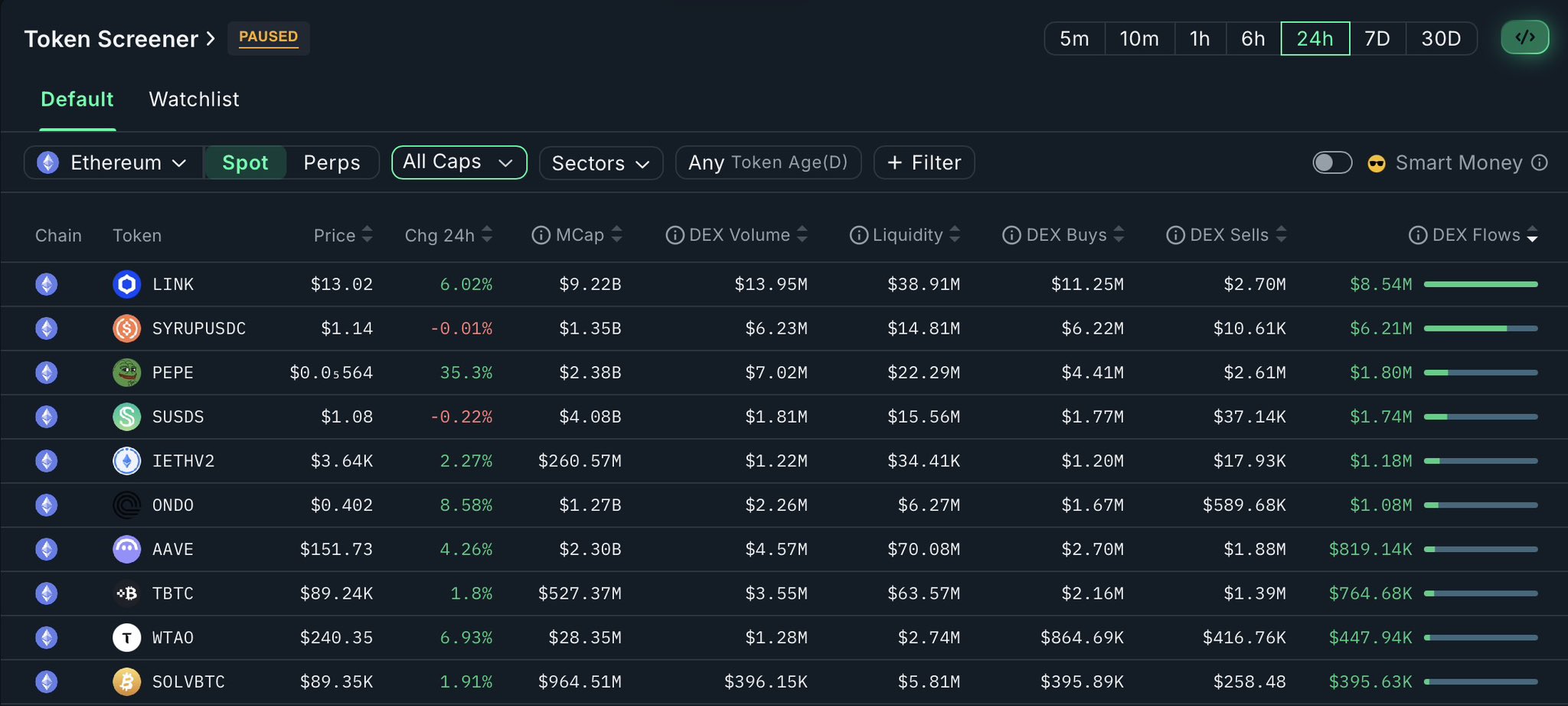

Nansen data showed that massive capital had flowed into tokens on the Ethereum and Chainlink chains in the last 24 hours. Chainlink was the best performer. LINK had the highest net inflow of $8.54 million among majors. Chainlink price went up by about 6.02%.

This buy pressure showed that people were still interested in the Oracle Network token. Its DEX volume was also looking good with a record of $13.95 million.

Other altcoins had different outcomes. PEPE had a strong price rise of 35.3% to $0.00000564, with $1.80 million coming in. The increase made it a momentum play, especially for memecoins. SYRUP came next with a net flow of $6.21 million, but its price declined by 0.01%.

ONDO rose by 8.58% with $1.08 million in capital inflow. AAVE saw $819K in inflows, and its price followed. However, some altcoins went down even though they got more than $1.74 million in new money. Overall, inflows were still selective, and there was not yet a strong conviction.

Top AI & Big Data Projects by Development

Chainlink ranked among AI and Big Data crypto projects. The ranking was based on GitHub events in the last 30 days. Chainlink price continues to draw attention alongside its development activity.

LINK came in second with about 211.03 development activity points. This showed that its Oracle network was making steady progress.

Filecoin (FIL) was in first place with 348.03 points, up 3.11% to $1.44 and a $1.05 billion capitalization. This showed that decentralized storage was becoming a key focus in the blockchain.

Third place went to Internet Computer (ICP), which had 200.03 points. NEAR Protocol (NEAR) was in fourth place with a score of 70.23 and a slight increase to around $1.63.

There were mixed results in the lower ranks. For instance, Oasis (ROSE) rose 4.3% even though there was not much activity. Bittensor (TAO) spiked up by 8.91% to $241 as Injective (INJ) surged by 7.26%. Development metrics showed selective innovation, not growth that was the same for everyone.

Altogether, the market showed a potential resurgence in the altcoin sector on different fronts. However, the confirmations were missing.

The post Chainlink Price Breakout and Inflows Signal Altcoin Sector Shift appeared first on The Market Periodical.