Original Title: "Does Dollar-Cost Averaging in BTC with Leverage Really Make More Money?"

Original Author: CryptoPunk

A five-year backtest tells you: 3x leverage offers almost no cost-effectiveness.

Conclusion first:

In the backtest over the past five years, the final return of BTC with a triple leveraged regular investment was only 3.5% higher than that with a double leveraged investment, yet it came at the cost ofThe cost of risk approaching zero.

If we consider the risk, return, and feasibility comprehensively—Spot dollar-cost averaging is actually the optimal long-term solution; 2x is the extreme; 3x is not worth it.

Five-Year Regular Investment Net Value Curve: 3x Does Not "Create a Gap"

From the net asset value (NAV) trend, we can intuitively see that:

· Spot (1x):The curve smoothly rises with controllable drawdowns.

· 2x Leverage:Significantly increase returns during the bull market phase.

· 3x Leverage:Multiple instances of "crawling close to the ground," and long-term wear and tear from fluctuations.

Although in the rebound of 2025–2026, the 3x ultimately slightly outperformed the 2x,

ButFor years, the net asset value of 3x has consistently lagged behind that of 2x.

Note: In this backtest, the leverage part uses a daily rebalancing approach, which may result in volatility drag.

This means:

The ultimate success of 3x heavily relies on the "final stretch of the market movement."

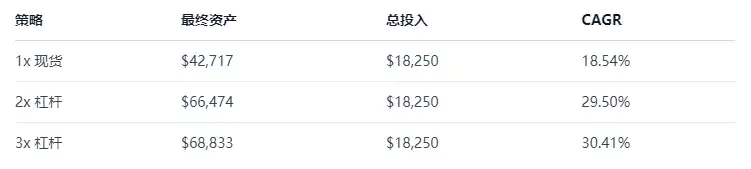

II. Final Profit Comparison: The Marginal Returns of Leverage Decline Rapidly

The key is not "who benefits the most," but rather...How much extra is there?

· 1x → 2x:Earn an additional ≈ $23,700

· 2x → 3x:Just a bit more ≈ $2,300

The returns have almost stopped growing, but the risks are increasing exponentially.

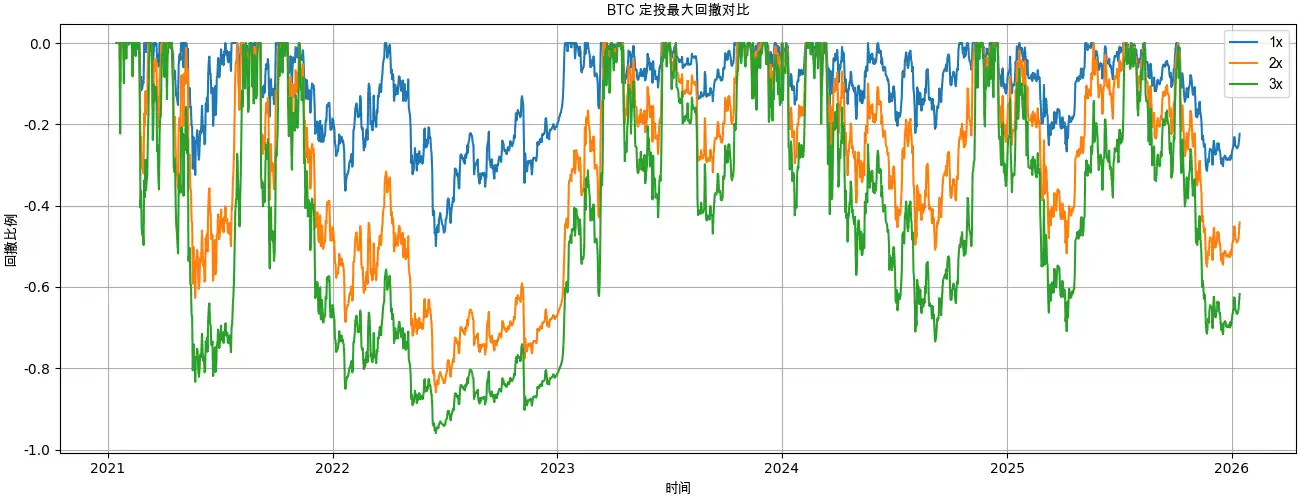

III. Maximum Drawdown: 3X is Approaching "Structural Failure"

There is a very critical practical issue here:

· -50%:Mentally bearable

· -86%:Need +614% to break even

· -96%:Need +2400% to break even

3x leverage was essentially "mathematically bankrupt" during the 2022 bear market.

Subsequent profits have almost entirely come from new capital invested after the bottom of the bear market.

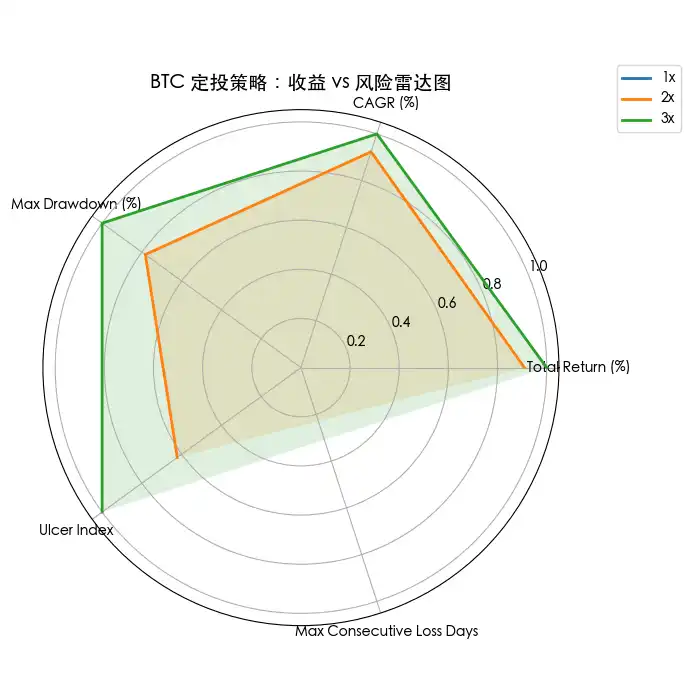

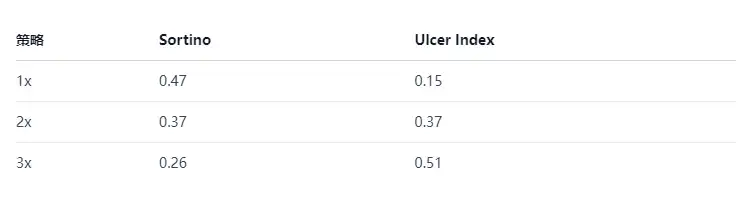

IV. Risk-Adjusted Returns: Cash Is Actually the Best

This set of data indicates three things:

1. The spot unit risk return is the highest.

2. The higher the leverage, the worse the "cost-effectiveness" of downside risk becomes.

3. 3x has been in a deep drawdown zone for a long time, causing immense psychological pressure.

The "Ulcer Index" is a technical indicator used in financial markets to measure the magnitude and duration of drawdowns in an investment or portfolio. It helps assess the emotional stress or "ulcer" that an investor might experience during a period of declining value. An Ulcer Index value of 0.51 indicates a relatively low level of drawdown risk or emotional stress. Here's a

The account has been "underwater" for a long time, giving you almost no positive feedback.

Why does the 3x leveraged product perform so poorly in the long term?

The reason is just one sentence:

"Daily Rebalancing + High Volatility = Continuous Loss"

In a volatile market:

· Rise → Add position

· Fall → Reduce position

· No rise or fall → The account continues to shrink

This is a typical example.Volatility Drag.

And its destructive power is related to the leverage multiple.squareProportional.

In high-volatility assets like BTC,

Using 3x leverage incurs a 9x volatility penalty.

Final conclusion: BTC itself is already a "high-risk asset."

The answer from this five-year backtest is very clear:

· Spot Market Regular Investment:The risk-return ratio is optimal, and it can be implemented in the long term.

· 2x Leverage:Radical upper limit, suitable only for a few people

· 3x Leverage:Long-term cost-effectiveness is very low, making it unsuitable as a regular investment tool.

If you believe in the long-term value of BTC,

Therefore, the most rational choice is often not "adding another layer of leverage,"

But ratherLet time be on your side, not your enemy.

Click to learn about BlockBeats' job openings.

Welcome to join the official Lulin BlockBeats community:

Telegram Subscription Group:https://t.me/theblockbeats

Telegram discussion group:https://t.me/BlockBeats_App

Official Twitter account:https://twitter.com/BlockBeatsAsia