Bitcoin surged on Tuesday, briefly reaching a two-month high as traders unwound bearish positions and rotated capital into other cryptocurrencies.

The rally gained momentum after Bitcoin pushed through the $95,000 resistance, a price that had capped multiple rallies in recent months. Consequently, the breakout forced heavily leveraged traders to exit short positions, accelerating the advance and reinforcing bullish conviction.

Key Data Points

- Bitcoin reached $96,450 on Tuesday, its highest level in two months

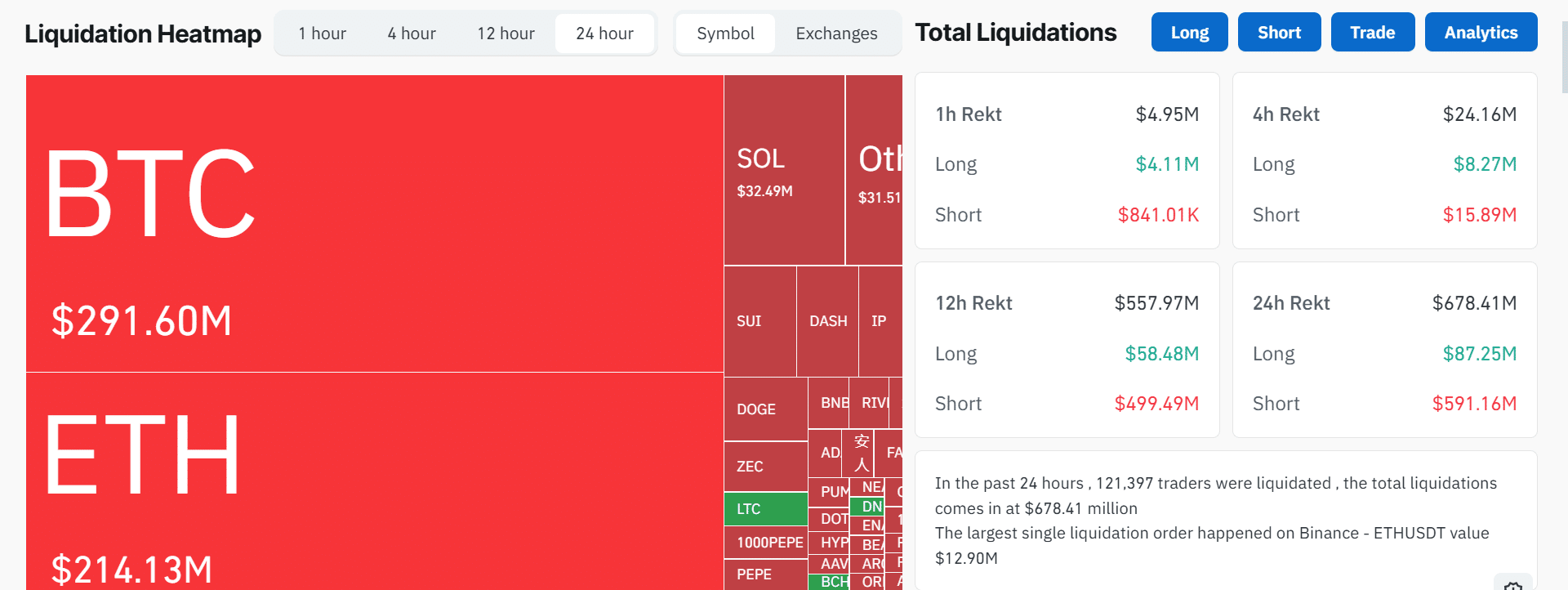

- More than $678 million in futures positions were liquidated over the past 24 hours

- Bitcoin crossed $96,000 for the first time since November

- Futures open interest fell from $31.5 billion to $30.6 billion in one day

- DASH climbed to its highest level since 2021

Break Above $95,000 Reshapes Market Structure

The move above $95,000 marked a clear inflection point for Bitcoin’s short-term market structure. Traders had been closely monitoring this level after several failed breakout attempts earlier in the cycle.

Bitcoin was rejected near the same price on December 3, December 10, and January 5. However, this time, sustained buying pressure proved sufficient to overwhelm sellers and push prices decisively higher.

As the level gave way, approximately $591.16 million in short positions were liquidated. Futures open interest dropped sharply, indicating a reduction in leverage and a shift toward spot-driven demand.

Altcoins Rally as Confidence Spreads

The renewed momentum quickly spilled into the broader market. Following Bitcoin’s breakout, capital rotated into altcoins, driving widespread gains after a prolonged corrective phase.

Ethereum rose 6.52% over 24 hours to $3,327. Optimism (OP) advanced 13%, while Celestia (TIA) and Pudgy Penguins (PENGU) gained roughly 10% each.

DASH stood out earlier in the session, climbing to a multi-year high on strong volume. As of press time, the token is trading at $59.74, representing a 33% increase over the past 24 hours.

As altcoins outperformed, Bitcoin’s dominance slipped from 59.3% on December 24 to 58%, according to CoinMarketCap. The decline suggests traders are increasingly diversifying exposure beyond Bitcoin as confidence improves.

Sentiment Recovers After Extended Weakness

The rally follows months of cautious positioning across the crypto market. Bitcoin had been widely perceived as lacking strong bullish catalysts when it entered 2026.

A major $19 billion liquidation event in October 2025 left markets deeply oversold. In response, many investors reduced crypto exposure and redirected capital toward assets such as gold, silver, and AI-related equities.

During that period, the crypto fear and greed index repeatedly fell into “extreme fear” territory, a condition that has historically coincided with market stabilization and eventual recoveries.

Traders Focus on Key Levels Ahead

With momentum rebuilding, attention has shifted to whether Bitcoin can maintain $94,500 as a new support level. A sustained hold could open the door to a move toward $99,000, an area that acted as support between June and November and may now serve as resistance.

Conversely, a failure to defend $94,500 could see Bitcoin fall back into its previous range between $85,000 and $94,500. As a result, short-term price action around this level is likely to play a decisive role in determining near-term market direction.

DisClamier: This content is informational and should not be considered financial advice. The views expressed in this article may include the author's personal opinions and do not reflect The Crypto Basic opinion. Readers are encouraged to do thorough research before making any investment decisions. The Crypto Basic is not responsible for any financial losses.