Key insights

- Bitcoin rose 4.65% to about 95,190, driven mainly by spot buying, according to Will Clemente.

- Short sellers lost about 269 million dollars as liquidations accelerated, per CoinGlass data.

- On-chain data showed limited retail activity, with larger investors positioning amid U.S. market structure clarity.

Bitcoin price surged above 95,000 on Tuesday, driven by aggressive spot market demand. The move triggered heavy short liquidations and revived talk of a return to six figures. Data and analyst commentary showed buyers, not leverage, controlled the rally.

The Bitcoin price move mattered because it reflected real capital inflows. Spot-led rallies often prove more durable than derivatives-driven spikes. Traders and long-term holders now watched whether demand could sustain pressure toward 100,000.

Spot Demand Replaced Leverage as Bitcoin Price Driver

Crypto analyst Will Clemente said spot buying led the Bitcoin price rally. He noted that buyers accumulated Bitcoin directly rather than through futures contracts. That distinction suggested genuine demand instead of leverage-driven price distortion.

Bitcoin price rose 4.65% in 24 hours, trading near 95,190 at publication. Market data showed limited retail frenzy during the advance. Price strength emerged without widespread fear-of-missing-out behavior.

Liquidation data reinforced the spot-driven narrative. Short sellers lost about 269 million dollars as the price moved higher. CoinGlass reported most liquidations clustered near the breakout zone.

Short covering added momentum but did not start the move. Forced exits followed spot accumulation rather than initiating it. That sequencing reduced the risk of a rapid reversal.

Analysts Split Between Breakout and Rejection Risk

Some analysts argued that the Bitcoin price momentum favored a direct push to $100,000. Michaël van de Poppe said the structure pointed to an imminent run toward six figures. He added that recent dips represented buying opportunities, not trend failure.

Bitcoin last lost the 100,000 level in mid-November. The asset has failed to reclaim it since that breakdown. Traders, therefore, viewed the level as psychological resistance rather than technical support.

Others urged caution despite bullish momentum. CrypNuevo warned that the price could run out of liquidity before facing rejection. He flagged the weekly 50 exponential moving average as a potential ceiling.

CrypNuevo said a clean break above 100,000 would invalidate his cautious outlook. Until then, he framed the move as a possible liquidity sweep. His view highlighted uncertainty around short-term follow-through.

Sentiment Remained Weak Despite Bitcoin Price Recovery

Market sentiment indicators showed little optimism during the rally. Santiment said retail enthusiasm remained muted. The platform warned that renewed excitement would likely appear only if Bitcoin price convincingly teased 100,000.

The Crypto Fear and Greed Index reflected that caution. The index stayed in fear territory for over two months. On Wednesday, it printed a score of 26.

Negative sentiment followed a large October liquidation event. Roughly $ 19 billion exited the crypto market on October 10. Since then, price gains have failed to restore broad confidence.

Historically, January produced modest Bitcoin returns. Average gains since 2013 stood near 4.18%. February typically performed better, averaging about 13.12%.

On-chain Data to Institutional Positioning

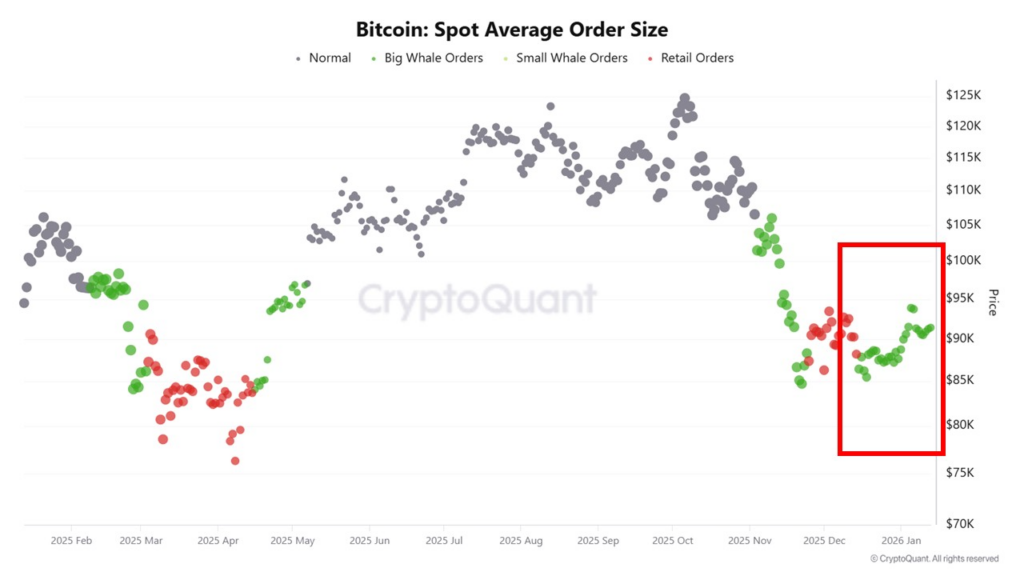

On-chain metrics supported the idea of strategic accumulation. CryptoQuant data showed larger average spot order sizes near 90,000. Retail-sized orders remained relatively scarce.

That pattern suggested institutional or high-net-worth participation. Large buyers appeared to adjust exposure cautiously rather than chase price. The absence of panic selling also stood out.

Analysts linked this behavior to regulatory expectations. A draft U.S. Senate market structure bill outlined clearer crypto asset classifications. The proposal separated commodities from securities and defined oversight roles.

The bill treated decentralized networks differently from centralized intermediaries. Developers and validators avoided automatic classification as regulated entities. Exchanges and custodians faced stricter registration and disclosure rules.

Bitcoin, Ethereum, stablecoins, and spot exchange-traded funds remained integrated into the U.S. financial system. Observers said clarity, not price reaction, represented the bill’s real impact.

Betting Markets and Near-term Levels to Watch

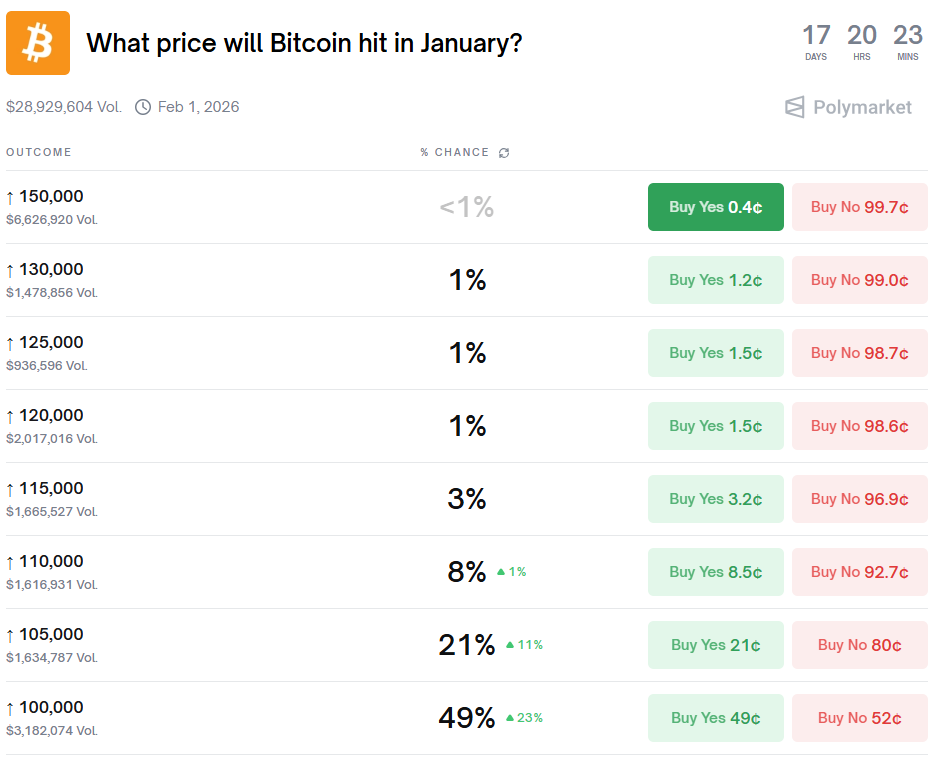

Prediction markets reflected divided expectations. Polymarket showed a 51% chance of Bitcoin reclaiming $ 100,000 by February 1. The odds of reaching $ 105,000 stood at nearly 23%.

Those probabilities implied cautious optimism rather than certainty. Traders priced upside potential without dismissing the risk of rejection. Volatility expectations, therefore, remained balanced.

Immediate focus stayed on whether the Bitcoin price could hold above 95,000. Sustained spot demand near that level would strengthen the bullish case. Failure could expose the price to another liquidity sweep.

For now, data suggested accumulation rather than exhaustion. Spot buyers drove the move, sentiment lagged, and leverage unwound. The next decisive signal likely arrived at the 100,000 threshold.

The post Bitcoin price eyes 100,000 as spot buying squeezes shorts appeared first on The Market Periodical.