More than a decade ago, a single PC was sufficient for mining cryptocurrency at home. Today, the industry has undergone profound transformations in both breadth and depth—changes that would have been almost unimaginable just a few years ago.

Looking back at 2025, the industry experienced a historic high in October when Bitcoin surged to $126,000, but also faced a cold spell in December as hash price dropped to a record low. A wave of hot money poured into the sector, with even the Trump family completing an IPO through American Bitcoin. The total computing power increased by 30% for the year, and the competition in the Bitcoin mining industry intensified significantly.

At the beginning of 2026, the following are key trend predictions for the industry in the coming year.

Relaxed macroeconomic policies and a friendly regulatory environment

Compared to the past few years, the macroeconomic environment for Bitcoin mining has fundamentally changed. The monetary policies of major global economies are becoming more accommodative, and the regulatory framework is increasingly friendly, creating a favorable environment for Bitcoin price movements.

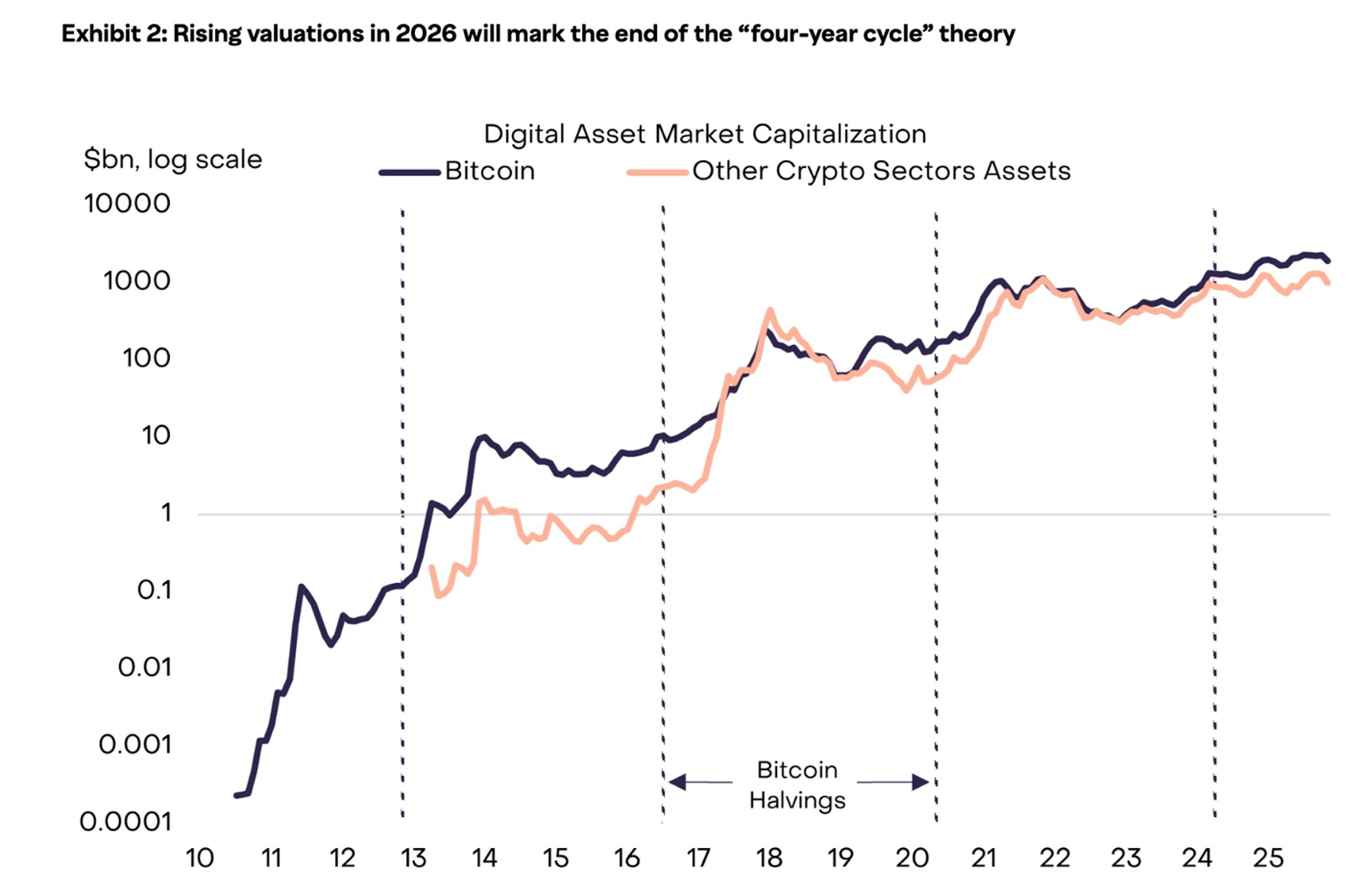

According to Grayscale, a well-known U.S. digital asset management company, in its 2026 outlook, the Federal Reserve is expected to cut interest rates at least twice in 2026, with a probability of 74%. This accommodative monetary environment will directly boost value-storage assets such as gold and silver. Meanwhile, as a "portable, transferable, and scarce" digital gold, Bitcoin is also becoming an increasingly important allocation anchor for institutional capital.

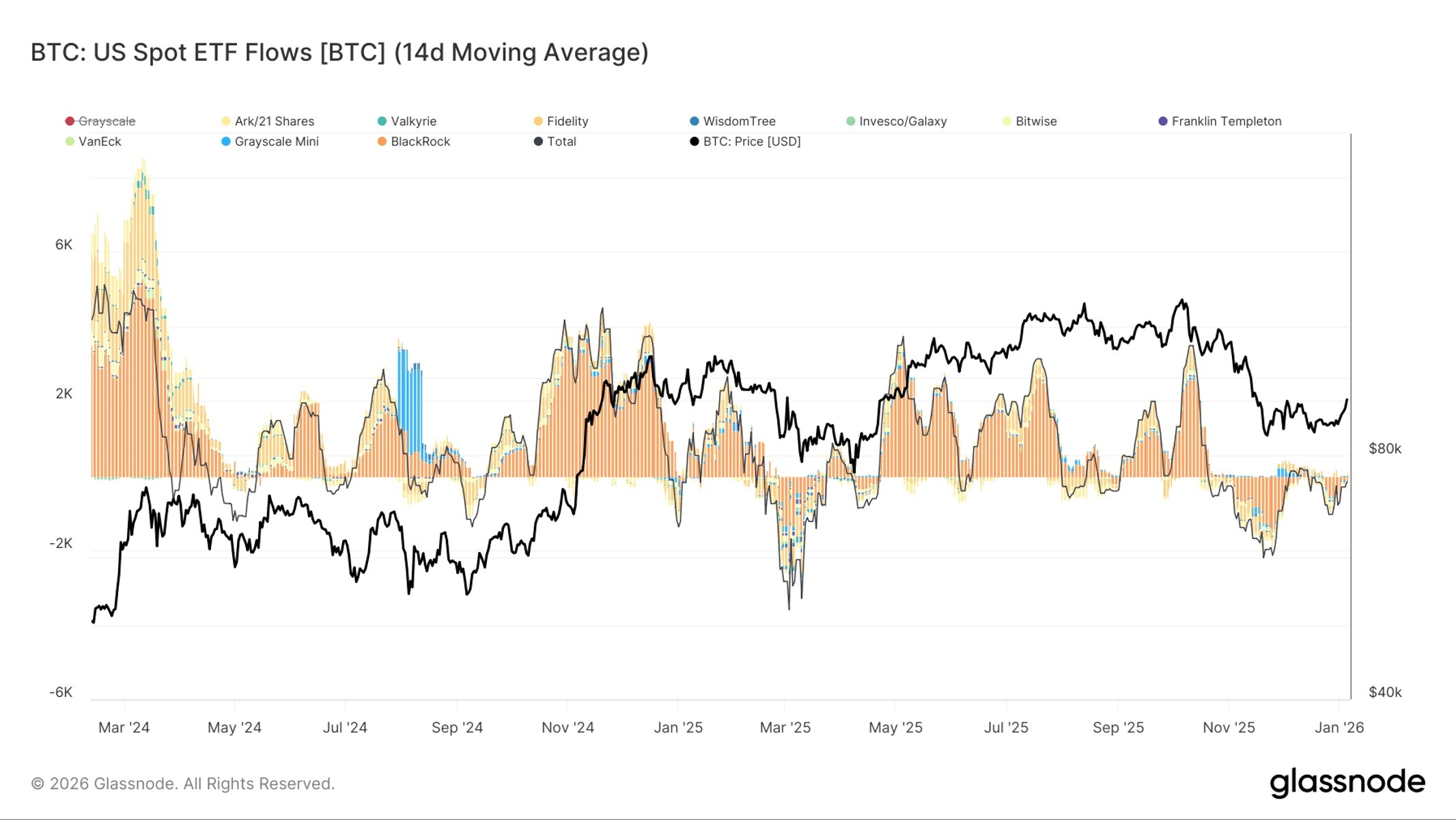

The current price of Bitcoin has fallen 44% from its peak in October 2025 and 24% from the day of Trump's inauguration. According to the crypto research firm K33 Research, the main causes of the decline are imbalances in leverage and localized bubbles, rather than a deterioration in fundamentals. The divergence between price and fundamentals has instead created an excellent opportunity to accumulate positions, and institutional investors are showing strong interest in returning. According to Bloomberg, net inflows of approximately $1.2 billion were achieved in just two days at the beginning of this year.

From a regulatory perspective, the United States has already set a pro-cryptocurrency direction ahead of the 2025 election. The most important bill this year, the "Clarity for Digital Assets Markets Act" (CLARITY Act), is expected to be voted on in the Senate by the end of January. If passed, this bill will clearly define Bitcoin and Ethereum as "digital commodities" under the jurisdiction of the CFTC (Commodity Futures Trading Commission). This would mark Bitcoin's formal entry into the mainstream financial system. As a result, banks will be able to custody Bitcoin more safely, institutions will be free to trade Bitcoin more freely, crypto companies including miners will likely gain access to lower-cost financing, and participation from pension funds and long-term capital is expected to increase significantly.

Meanwhile, sovereign governments that once harbored doubts about cryptocurrencies are now actively building institutional frameworks to embrace them. For mining companies, this regulatory certainty directly translates into confidence for long-term capital investment. When you're deploying infrastructure worth tens or even hundreds of millions of dollars, knowing that the policy foundation beneath you won't suddenly collapse is invaluable.

Against this macroeconomic backdrop, even if the pace of monetary easing is temporarily slowed in the future due to recurring inflation, supply-constrained assets such as gold, Bitcoin, and certain commodities are still likely to receive structural support. This suggests that Bitcoin's long-term investment rationale is no longer highly dependent on a single monetary policy path, but is gradually being built on a more solid value foundation as a "scarce asset."

Vertical integration, mastering every step of the value chain

An important trend within the mining industry itself is the acceleration of vertical integration. By 2026, the most successful mining companies will no longer simply compete on computational power, but will instead be enterprises that control the entire chain of energy, hardware, and operations, thereby reducing the production cost per Bitcoin.

Back in the day, mining companies were merely data center operators, relying on the power grid for electricity and ASIC mining machine manufacturers for equipment. However, today, leading mining companies are simultaneously becoming energy companies, hardware developers, and infrastructure operators.

Energy is the largest operating cost for mining companies, typically accounting for 60%–70% of total expenses. Therefore, controlling their own power generation sources can significantly reduce long-term costs and improve predictability (without being affected by fluctuations in grid electricity prices).

Many mining companies have started to invest in or collaborate on energy infrastructure projects. For example, they build off-grid power systems such as wind power, solar energy, and battery storage, or partner with renewable energy developers. In some cases, mining operations are established near large solar or wind farms, sharing the power supply and sometimes using cryptocurrency mining as a solution for "curtailed energy consumption," helping to improve the economic viability of renewable energy assets. Alternatively, some companies directly operate natural gas power plants to explore self-generated power for mining.

The same applies to hardware. ASIC (Application-Specific Integrated Circuit) mining machines were originally sold to miners, mining farms, and data centers. However, during 2024–2025, many mining machine manufacturers began to shift toward self-mining. When demand for new mining machines slowed down (for example, due to increased mining difficulty, higher electricity costs, or falling prices), manufacturers might end up holding large inventories. To avoid price cuts that could hurt profits, they began using these machines themselves for mining, effectively converting inventory into Bitcoin rewards. This strategy was particularly notable during Bitcoin bull markets.

This integration not only improves gross profits but also brings strategic flexibility. Controlling energy resources allows for optimal global deployment, while controlling hardware enables calculated upgrades in computing power. This has now become the dividing line between industry leaders and struggling companies.

AI Transformation Wave

The most noteworthy trend to watch in 2025 will be the strategic shift of mining companies toward AI and high-performance computing (HPC), a trend that will intensify further in 2026.

The AI boom in the United States has created a voracious demand for energy. A report from Morgan Stanley indicates that by 2028, the U.S. could face a 20% electricity shortfall due to AI data centers, equivalent to the power consumption of 33 million households. Meanwhile, mining companies already possess ready-made infrastructure and electricity contracts, giving them a natural advantage in supply. These data centers, which often require tens of megawatts to several gigawatts of power, can be retrofitted to host AI GPU clusters. When bear markets or halving events compress mining profits, shifting data center operations to AI workloads becomes a crucial strategy for revenue diversification.

For grid stability, Bitcoin mining companies can help by quickly adjusting their electricity usage, whereas traditional AI data centers cannot offer such flexibility.

Of course, the transition is not without challenges. Our VP of Investor Relations, Charley Brady, explained to media outlet Seeking Alpha that a data center may require hundreds of millions of dollars to support AI workloads, which require GPUs and AI chips—equipment that is more expensive than ASIC miners used for Bitcoin mining. However, mining companies already own land, have permits, and are connected to the power grid, so retrofitting data centers for AI is much faster than building from scratch, giving them a structural advantage.

In addition, AI data centers require significant investment to upgrade existing cooling systems and network infrastructure, which is why mining companies transitioning to AI/HPC all need to take on substantial debt. Media outlet CCN estimates that numerous listed mining companies have raised over $4.6 billion in funding through debt or convertible bonds for growth purposes.

The Era of Energy Efficiency Reigns Supreme

The technological arms race in mining hardware has reached a critical point, and 2026 will be the year where efficiency reigns supreme.

Three years ago, 20 J/TH was considered top-tier performance. However, today, ASIC manufacturers have already launched machines with energy efficiencies below 10 joules per terahash (J/TH). Currently, leading mining companies in the industry have average mining efficiencies that are already below 20 J/TH.

The harsh reality is that if miners are still using equipment from several years ago, mining is no longer economically viable unless electricity prices drop below 3 cents per kilowatt-hour, or even lower.

2026 will see a surge in the accelerated retirement of older equipment. This will undoubtedly be painful for small miners who cannot afford the capital expenditures required for upgrading and replacing their mining machines. However, it is an inevitable result of technological progress. Of course, these older devices are not entirely worthless. There will still be regions with lower or even free electricity, and currently, some mining companies have developed operating systems (OS) that can reduce the power consumption of mining machines by lowering their frequency. In the U.S. market, by 2026, U.S. tax law will allow for full depreciation of mining machines, which will significantly improve the after-tax cash flow for mining operations.

Sovereign states entering the mining industry

The most noteworthy trend at the geopolitical level is that sovereign states are deeply getting involved in Bitcoin mining.

For countries rich in energy resources, mining is an effective way to monetize their energy or surplus electricity: stranded natural gas that cannot be burned, hydropower during the flood season, associated gas flared off, and renewable energy exceeding the grid's capacity can all be converted into Bitcoin.

At the beginning of 2026, Turkmenistan, a Central Asian country, enacted its "Virtual Assets Law." Through this legislation, the government established clear regulations for cryptocurrency mining, the issuance of digital assets, and the operation of digital asset trading platforms, bringing order to an industry that previously lacked clear oversight. As of January 1st, mining and trading activities have officially moved into the open.

Countries that benefited earlier from the Bitcoin mining boom include Bhutan, where the government used surplus hydropower through state-owned investment institutions to mine Bitcoin, starting in 2019 and accumulating Bitcoin reserves since then. Kazakhstan, a neighbor of Turkmenistan, once became the world's second-largest Bitcoin mining country, accounting for 18% of the global hash rate, second only to the United States. Some Japanese electric power companies (partially state-owned or state-controlled) also launched Bitcoin mining pilot projects last year. El Salvador in Africa has also attempted to use geothermal energy from volcanoes for mining.

More strategically, Bitcoin is being viewed as a strategic reserve asset similar to gold. For countries seeking to reduce their reliance on the U.S. dollar or hedge against the depreciation of their local currency, domestic mining provides a way to accumulate Bitcoin without having to purchase it in the open market.

Cloud Computing Power: Entry Points for Individual Participation

Finally, let's discuss how individuals can participate in mining. The reality is that mining with a single ASIC in one's home garage is becoming increasingly impractical. Rising mining difficulty, high household electricity costs, and the low online reliability of individual operations—factors that industrial-scale mining efficiency demands—are pushing small investors out of the direct mining sector.

But this does not mean that individuals are excluded; it's just that the ways of participation are evolving. Models such as cloud mining and online computing power trading platforms are growing further, and this trend will accelerate by 2026.

These platforms allow users to purchase computing power shares without worrying about hardware, electricity, cooling, or maintenance, enabling them to enjoy the efficiency benefits of large-scale mining operations while avoiding operational complexities.

The industry itself is no longer as chaotic as it was a few years ago. Leading platforms are becoming increasingly mature, with improved transparency, clear pricing structures, and more flexible contracts, making cloud computing power a viable and legitimate option for individual investors. Although there have been cases of fraud in the past, reputable operators have established trustworthy records.

I believe this is a natural evolution of industry maturity. Just as investing in gold doesn't require owning a gold mine, participating in the Bitcoin mining economy no longer necessitates building your own mining facility. This "democratization through intermediation" expands industry accessibility while allowing professional mining companies to focus on optimizing efficiency.

Financialization of mining

As we move into 2026, Bitcoin mining is gradually transitioning from a single model of computational power operations to a more capital-intensive, financialized phase. Hash power, mining hardware, and mining facilities are no longer just production tools; they are evolving into financial assets that can be priced, financed, and traded. This transformation is not without precedent: in traditional mining, Barrick Gold has achieved financialization of its cash flows by hedging future gold production, while Franco-Nevada has securitized future mine revenues through royalty and streaming agreements.

A similar logic is being replayed in the Bitcoin mining industry. Mining companies are beginning to treat future Bitcoin production as a discountable cash flow, using hashing power contracts, mining equipment leasing, hosting agreements, and more complex structured arrangements to separate and repackage operational and price risks. As RWA (Real-World Assets) structures mature and Bitcoin derivatives tools continue to improve, the pricing and financing efficiency of mining assets have significantly increased.

This trend also helps gradually de-Beta the Bitcoin mining market, where mining companies no longer bear the high volatility of Bitcoin prices entirely. Instead, they actively manage risks and smooth earnings through financial instruments, enabling the mining industry to evolve from a high-leverage, high-volatility model into a hybrid form combining infrastructure and financial assets.

Looking ahead

Bitcoin mining in 2026 has evolved from a niche experiment into a global industry integrating institutional capital, national strategies, and cutting-edge technology. Seven trends—macroeconomic easing, vertical integration, AI transformation, efficiency competition, sovereign participation, cloud mining adoption, and the financialization of mining—all point in the same direction: Bitcoin mining is maturing and becoming increasingly professional, deeply embedding itself into the global economic structure and emerging as foundational infrastructure within the global energy and financial landscape.

The foundation built today will support Bitcoin for the next several decades. And 2026 is destined to be a pivotal year on this journey.